In, At and Out Of The Money Options (ITM, ATM + OTM)

It is often useful to state where an option’s strike price is in relation to the current price of the underlying asset. You can describe an option as being ‘in the money’ (ITM), ‘at the money’ (ATM) or ‘out of the money’ (OTM).

For call options, when:

Strike Price < Current Asset Price, the option is in the money

Strike Price = Current Asset Price, the option is at the money

Strike Price > Current Asset Price, the option is out of the money

For put options, when:

Strike Price < Current Asset Price, the option is out of the money

Strike Price = Current Asset Price, the option is at the money

Strike Price > Current Asset Price, the option is in the money

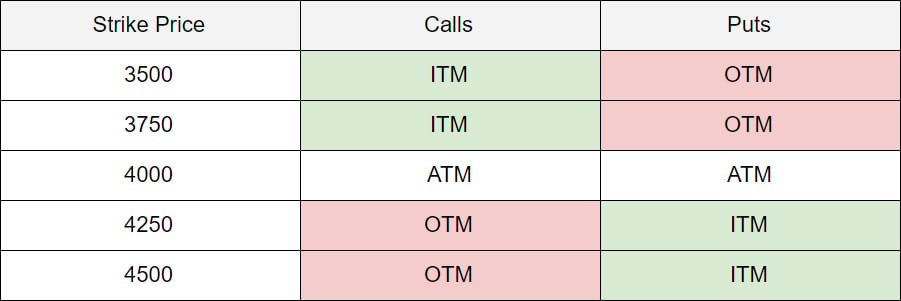

For example assume we are looking at the Bitcoin options on Deribit and the current price of BTC is right around $4000. Then we would describe the options at each strike price according to the following table:

Note that the price is rarely going to be precisely at any of the strike prices, so it is common to describe the options that are close to the current price as ATM. For example if BTC was trading at $4010 you could still describe the $4000 strike options as ATM.

To help judge it easily at a glance the Deribit option screen highlights in the money options with a slight green background as seen below:

AUTHOR(S)