The option interface can be a little overwhelming to new users as there is a considerable amount of information displayed on one page. It doesn’t take long before it all clicks into place though.

The option chain

When clicking any of the options pages in the menu, you will be taken to the option chain page. It’s possible to display all the expirations at once, or just the expiration you are interested in.

Once looking at the option chain you will see a table displaying many different options. Each row represents one strike price. The strike price is displayed in the middle column, with call options to the left, and put options to the right.

You will notice that there is both a bid and an ask column for each option. Deribit is a peer to peer exchange and every market participant is able to take either side of each market.

Selecting an option

Clicking anywhere in the row to the left of the strike price will bring up the order form for the call option at that strike price. Clicking anywhere in the row to the right of the strike price will bring up the order form for the put option at that strike price.

For this example we’ve selected BTC-27DEC19-10000-C, the Bitcoin $10,000 call option that expires on 27th December 2019.

The option order form

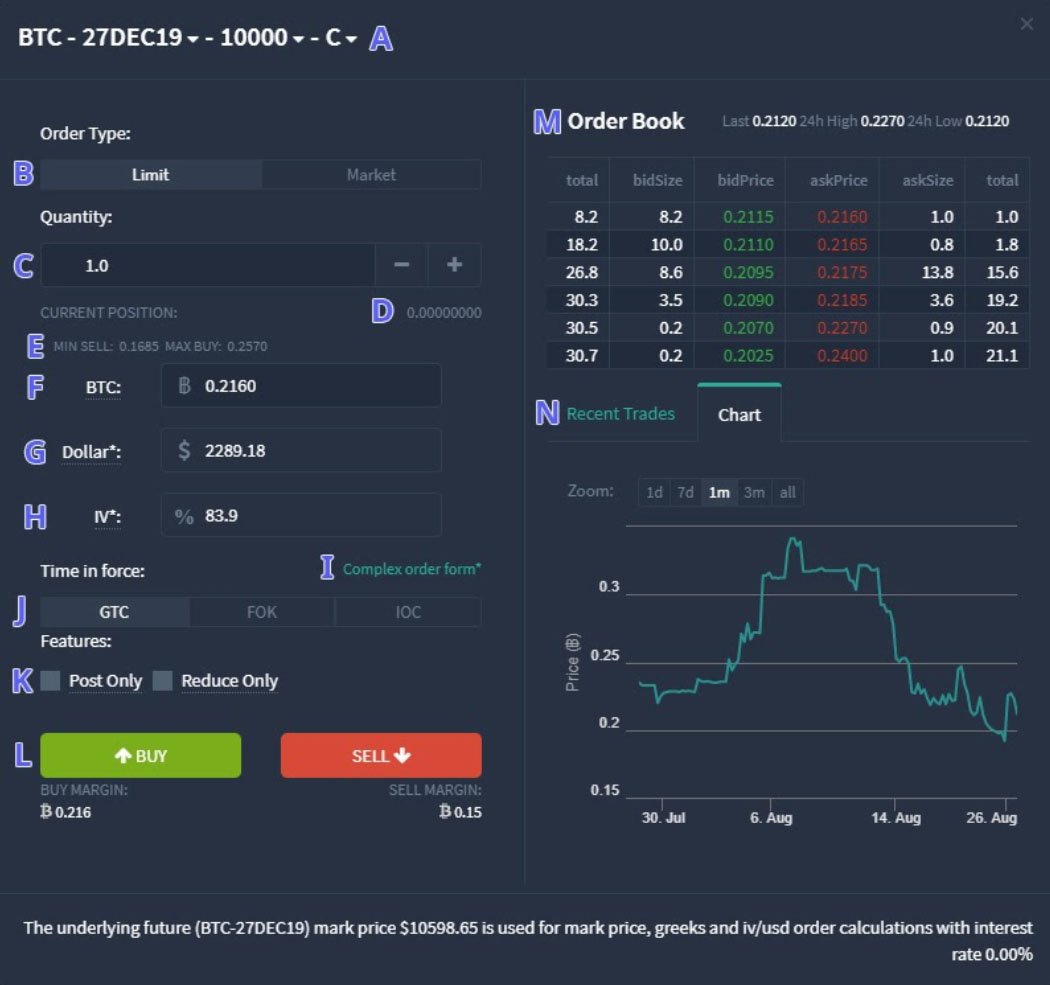

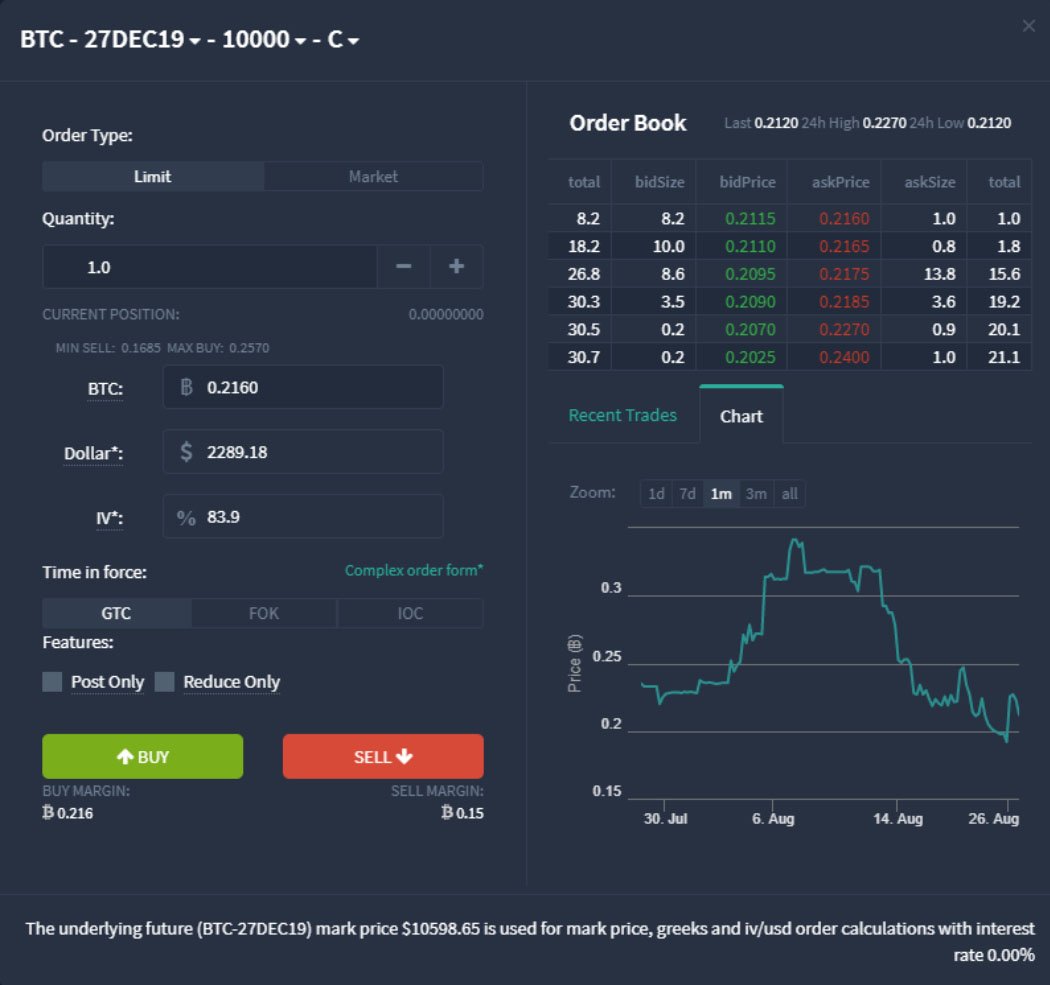

Once we’ve clicked to make our selection it will bring up the order form for that option. First let’s go through this order form and it’s features, then we’ll place a trade.

A. These are the details of the option that is selected. It is possible to use the small arrows to change which option is populating the order form.

B. Order Type – Here you can choose either limit order or market order. Given the wider spreads in options it is advisable to stick to limit orders to better control the price you are getting for your orders.

C. Quantity – This is the quantity in number of contracts. For example a quantity of 1 contract is to control 1 Bitcoin.

D. Your current open position on this option contract.

E. The trading bandwidths. These are levels outside of which orders will not currently execute. The bandwidths are covered in more detail in a separate lesson.

F. Here you enter the price in BTC of the order you wish to place.

G. The equivalent dollar price of the order.

H. The equivalent implied volatility (IV) of the order.

I. This button enables the complex order form. The complex order form is covered in a separate lesson.

J. Time in force:

- GTC – Good Til Cancelled. This order will stay open until it is either filled or cancelled.

- FOK – Fill Or Kill. This order must be filled completely or cancelled.

- IOC – Immediate Or Cancel. This order must be filled immediately or cancelled. The difference here being that a partial fill is acceptable.

K. Additional optional settings for the limit order:

- Post Only – A post only order will only act as a maker order i.e. it will not execute against an existing order in the orderbook. If the limit price selected would otherwise cause it to execute immediately, the price is adjusted to one tick away from the price that would cause instant execution. For example, if the current best ask is 0.216 BTC and you place a limit order to buy at 0.22 BTC with post only selected, the order will be placed at 0.2155 BTC so as not to execute immediately.

- Reduce Only – A reduce only order will only be used to make a position smaller. It will never make a position larger or open a new position.

L. The BUY and SELL buttons, used to place the order. Underneath each button you can see the initial margin required to execute the order.

M. This is the orderbook for the option. On the left in green are the bids, these are orders you can sell into. On the right in red are the asks, these are orders you can buy into.

N. Here you can select either ‘Recent Trades’, which shows the most recent trades for this options, or ‘Chart’ which shows a chart of the price of this option over time.

Placing an option order

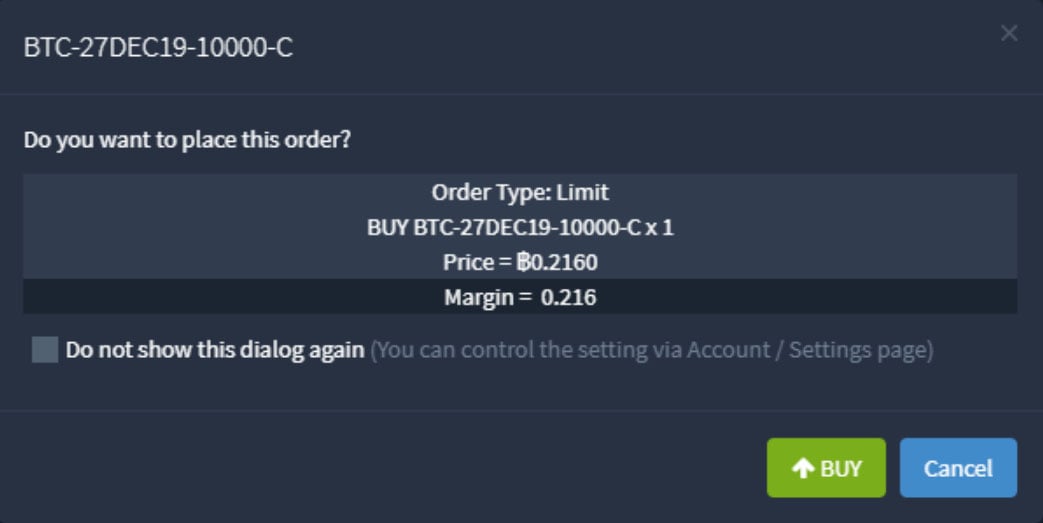

Now you’re familiar with the order form, let’s place an option trade. For this example we’ll buy one of the call options already discussed, the BTC-27DEC19-10000-C.

To do this we first enter the quantity of 1 and then the price we want to pay. For this example we would like it to execute immediately so we can enter the best ask price of 0.216 in the ‘BTC’ field. Or we can click on the ask in the orderbook, which will populate the price into the field for us.

Once we have done this we simply click the buy button in the bottom left. This will bring up a confirmation dialog for you to check the details.

Confirm this by clicking ‘BUY’, and the order will be placed.

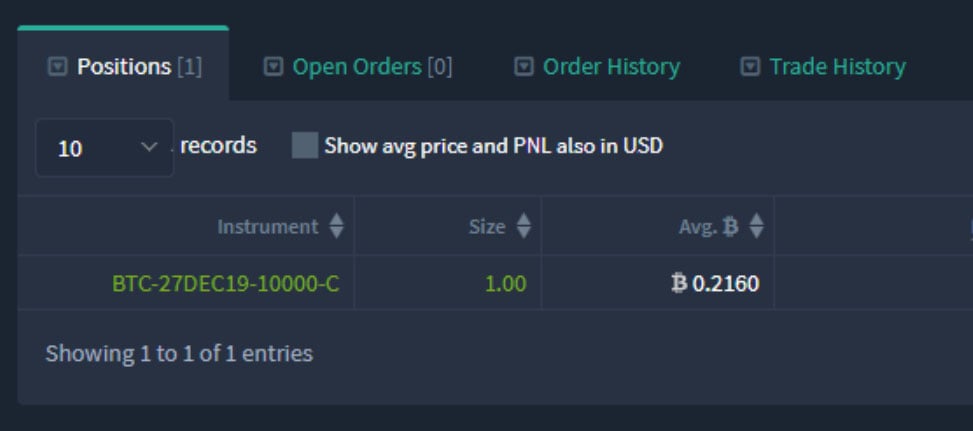

Once executed the open position will be displayed underneath the options chain in the ‘Positions’ tab like so:

Long positions are displayed in green and have a positive value in the ‘Size’ column. Short positions are displayed in red and have a negative value in the ‘Size’ column.

That’s it, we’re now long 1 Bitcoin $10,000 call option in the December expiry. The value of this option will vary as the underlying price moves and as time passes, so the only thing to decide is when to sell it. Alternatively of course the option can be held until expiry. The profit and loss calculations for both scenarios (selling early and holding to expiry) will be covered in a separate lesson.

As these are european style options, you cannot exercise an option before expiry, however you can close your position by performing an equal order in the opposite direction. For our 1 contract bought call, this would be selling 1 contract of the same call.

AUTHOR(S)