Latest update: 21/08/24

Please note that this article was originally written in 2020, and so refers to the legacy version of portfolio margin. New versions of portfolio margin were released in 2024, the details of which can be found in the margin pages in your account, and the Deribit knowledgebase.

Standard margin recap

First let’s have a quick recap of how a standard margin account works. On a standard margin account, each position has its margin requirements calculated separately. If you have multiple positions, these are simply added together to give you the total margin requirements for the account.

Note: A standard margin account is the default on Deribit. If you haven’t actively changed to portfolio margin you will have a standard margin account.

Initial margin (IM) is how much margin is required to open a position in the first place. Once you have no more spare initial margin (your IM bar is at 100%+), you will no longer be able to open new positions.

Maintenance margin (MM) is how much margin is required to keep the position open. This will always be a lower amount than initial margin. Once there is not enough margin left in your account to satisfy the maintenance margin requirements, your positions will begin to be liquidated.

With standard margin accounts both IM and MM are calculated using fixed formulas, depending on the product.

Note: IM and MM are not added together. If IM is 13 BTC and MM is 10 BTC, you would need 13 BTC to open the position, not 23.

Portfolio margin

Portfolio margin offers a completely different way of calculating margin requirements. Instead of calculating the margin for each of the positions in an account separately, the portfolio margin system looks at how the entire portfolio of positions would perform together with changing market conditions.

The performance of the whole portfolio is tested against changes in several parameters. Whichever of these scenarios would inflict the largest loss to your portfolio, this loss amount is then used to calculate your margin requirements.

Let’s look at each of the parameters that go into the portfolio margin calculation as well as where you can find them on the Deribit website.

The portfolio margin page

When you have portfolio margin enabled on your account you will have access to the portfolio margin page. You can get there by clicking PM at the top of the page:

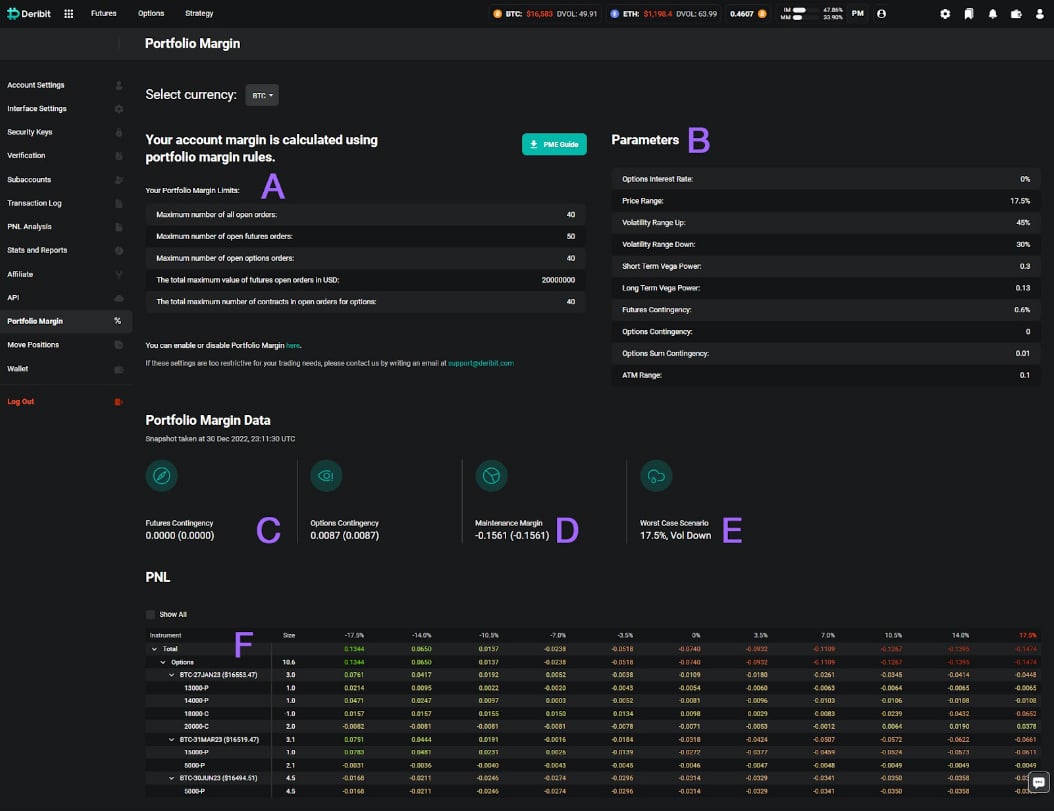

This page displays the current values for each of the parameters used in the calculation, and each of your current positions with the corresponding margin calculations.

A – Order limits for your portfolio margin account.

B – The parameters used in the margin calculations. These parameters can be changed at the discretion of the Deribit risk management department, though any major changes will be announced.

C – The contingency totals based on your positions.

D – The total calculated maintenance margin requirements, including the contingencies.

E – The current worst case scenario for your portfolio. The value from this scenario in the risk matrix is used to calculate your maintenance margin requirements.

F – The risk matrix. This shows the effect each scenario would have on your portfolio. The worst scenario is used for margin calculations

Now let’s go into more detail about each of the parameters used in the calculations.

Underlying price movement (Price Range)

As you might expect the most notable parameter is a change in the underlying price. On the PM page you can see the current value (17.5%) in the parameters list at point B. You can also see it being applied in the calculations below in the risk matrix, with a 17.5% decrease in price to the left and a 17.5% increase in price to the right.

What this means is that the system will look at how your positions as a whole would perform with a 17.5% increase in the underlying price of BTC, and the same for a 17.5% decrease, as well as several points in between. Whichever would result in the largest loss for your account, this amount is then used as your required maintenance margin.

Note: With portfolio margin, initial margin is your maintenance margin plus 30%. So IM = MM x 1.3. With an additional amount of IM required for open orders.

Implied volatility

Although price movement is often the most significant factor it is not the only change the portfolio is tested against. For options, another significant parameter that needs to be accounted for is the implied volatility (IV). After all, if current IV is relatively low and the price moves down 17.5% in a day, IV is likely to increase dramatically. This will greatly increase the mark prices of options and therefore the maintenance margin requirements.

You can see the current range for both an increase and decrease in IV at point B (Volatility Range Up, and Volatility Range Down). These values have been taken into account in the risk matrix, with whichever one would cause the greatest loss being used in the final calculation.

Contingencies

Contingency amounts are added to the calculations for futures positions, and option positions that are net short on a particular strike. You can see the contingency rates at point B, and the actual amounts for the current portfolio either side of point C.

These contingencies create a floor to how much margin certain positions will require, even when they offset each other, avoiding the possibility of a position requiring zero margin.

Is portfolio margin for everyone?

As you can see the portfolio margin calculation is quite a lot more complicated than the relatively simple formulas used for standard margin accounts. While it can lower requirements for some, this complexity means portfolio margin certainly isn’t for everyone.

When is portfolio margin useful?

Portfolio margin has clear advantages for positions that offset each other, as the maintenance margin requirements can be considerably lower. For example option spreads, opposing futures positions or a combination of futures and option positions.

If you wanted to sell a call spread, for example selling BTC-27DEC19-10000-C and buying BTC-27DEC19-12000-C, your margin requirements will be significantly lower in a portfolio margin account because the potential losses from selling the $10,000 call are largely offset by the purchase of the $12,000 call. In a standard margin account, while the profit/loss would still be offset, the margin required would not be offset.

When is portfolio margin not useful?

It’s not always the case that portfolio margin lowers the margin requirements. For example, directional futures positions that are not large enough to significantly increase the required margin in a standard margin account (due to the linear increase in margin requirements in standard margin accounts), will actually have lower requirements with a standard margin account.

If you are only going to be longing options, you may also choose to do this on a standard margin account instead of a portfolio margin account. In a standard margin account when you buy an option you pay the whole premium up front, so there is no chance of getting liquidated. This is one of the biggest benefits to buying options.

If you buy options in a portfolio margin account, the margin system may not need you to tie up the whole premium. This has the effect of building in some extra leverage to your position, and with leverage comes the possibility of liquidation.

Account requirements

To qualify for portfolio margin you need to read through the documentation and confirm that you have an understanding of how portfolio margin works, then confirm you accept the terms and conditions. If you do not already have relevant experience, it is a good idea to do some testing first to make sure you know how things work. To achieve this, it is possible to have portfolio margin on a testnet account first. This allows you to try it out without risking any funds.

To enable portfolio margin, click SM at the top of the screen, then follow the link on the page to portfolio margin.

Order limits

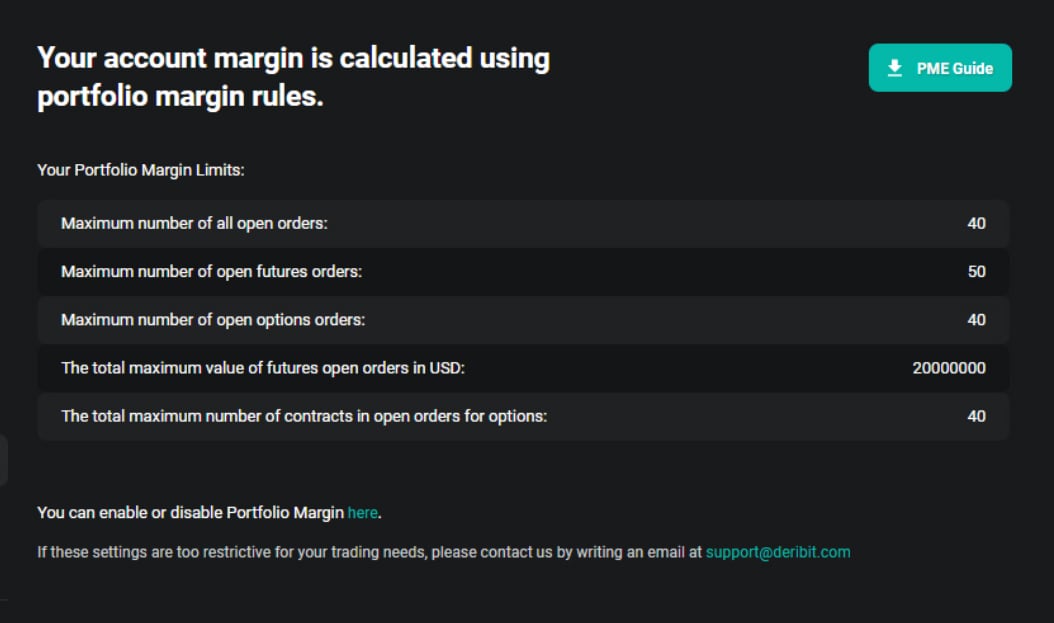

There are separate limits placed on the maximum number of open orders you may leave in the orderbooks. You can see these limits on the portfolio margin page as shown here:

These limits will be related to the size of your account. They limit the possibility that a trader will leave more orders than their account could possibly cope with should they be filled.

Liquidation

The liquidation process also works differently for portfolio margin accounts. The liquidation engine will aim to reduce the risk of your overall portfolio by first trading futures. This could result in opening new futures positions that you did not already have open. The goal of this is not to reduce your position size, but to reduce the risk of your portfolio, which in turn should bring your margin requirements back below your equity.

Options may also be traded during the liquidation process, however these will only reduce your positions.

Whenever maintenance margin requirements are higher than 100%, it is to the discretion of Deribit risk management how to handle your positions in an attempt to reduce the risk of bankruptcy.

Summary

To summarise, you should only enable portfolio margin if it will benefit your positions and you are comfortable with using margin and leverage already.

The two most obvious examples of where portfolio margin is beneficial are:

- Option spreads/portfolios

- Futures positions that are so large that they would require a larger amount of maintenance margin in a standard margin account, due to the linear increase in MM requirements for standard margin accounts.

While it is more complex, if portfolio margin is suitable for you, then it can greatly reduce your margin requirements.

AUTHOR(S)