COMBOS are now available to trade on Deribit.

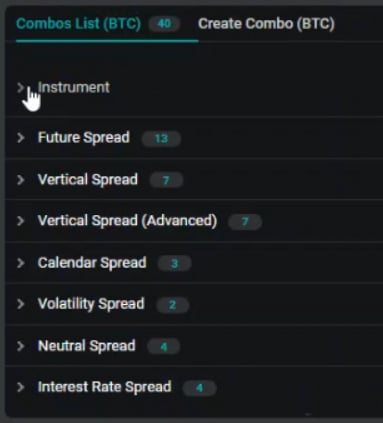

A Combo makes it possible to include a combination of multiple instruments together in a single trade, and in a single order book. It is now possible to request quotes for, and execute, multi-leg strategies as a single order. The available strategies include:

- Vertical spreads

- Butterflies

- Condors

- Ratio spreads

- Calendar spreads

- Straddles

- Strangles, and even

- Futures spreads

The futures Combos make trading the spread between two futures contracts (including the perpetual) much easier. Rolling positions from one future to the next is also now possible to execute directly on the Deribit platform, which includes rolling cash and carry trades. The option Combos also make executing multi-leg option strategies far simpler, and often cheaper!

Combo trade example 1

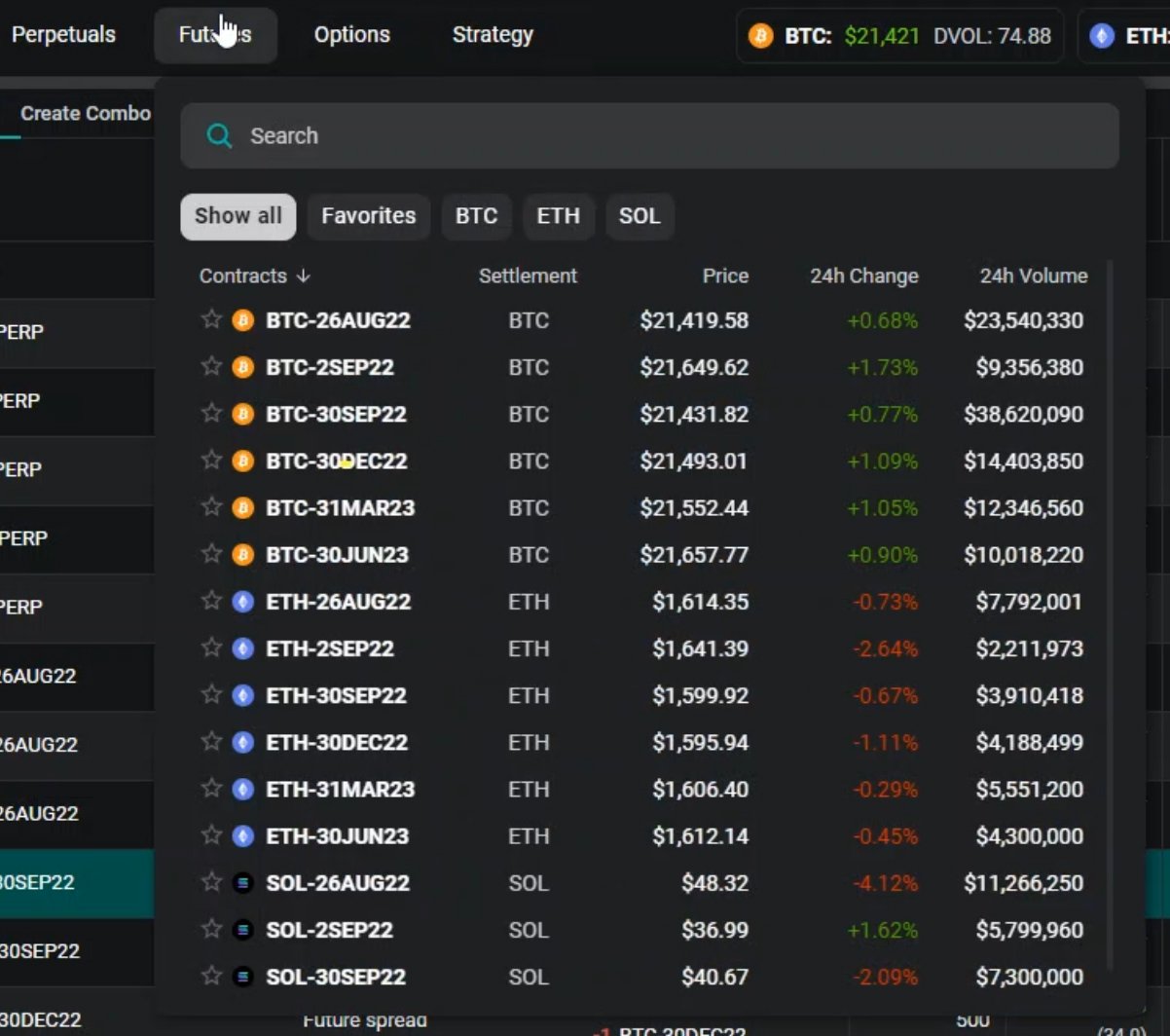

Combos are traded on a separate page that can be accessed via the top menu. To get to the Combo page for bitcoin instruments for example, we go to the:

Top Menu > Strategy Trading > Combo Books > BTC

As the future spreads are listed first, let’s look at how we can use the Combos to execute a futures spread trade with a single order.

We currently have no futures positions open at all, so by executing a futures spread we will be opening a new position on two different futures. With Combos this is done in a single order.

Let’s say that we have a view that the difference between the December future and the September future is currently too large, and we expect it to contract in the near future. One way we could profit from this view if it does turn out to be accurate, is by shorting the December future and longing the September future.

Previously we would have to either execute these two legs separately, or use a block trade, which has a much higher minimum trade size. With a Combo though, we can do everything we need in a single order.

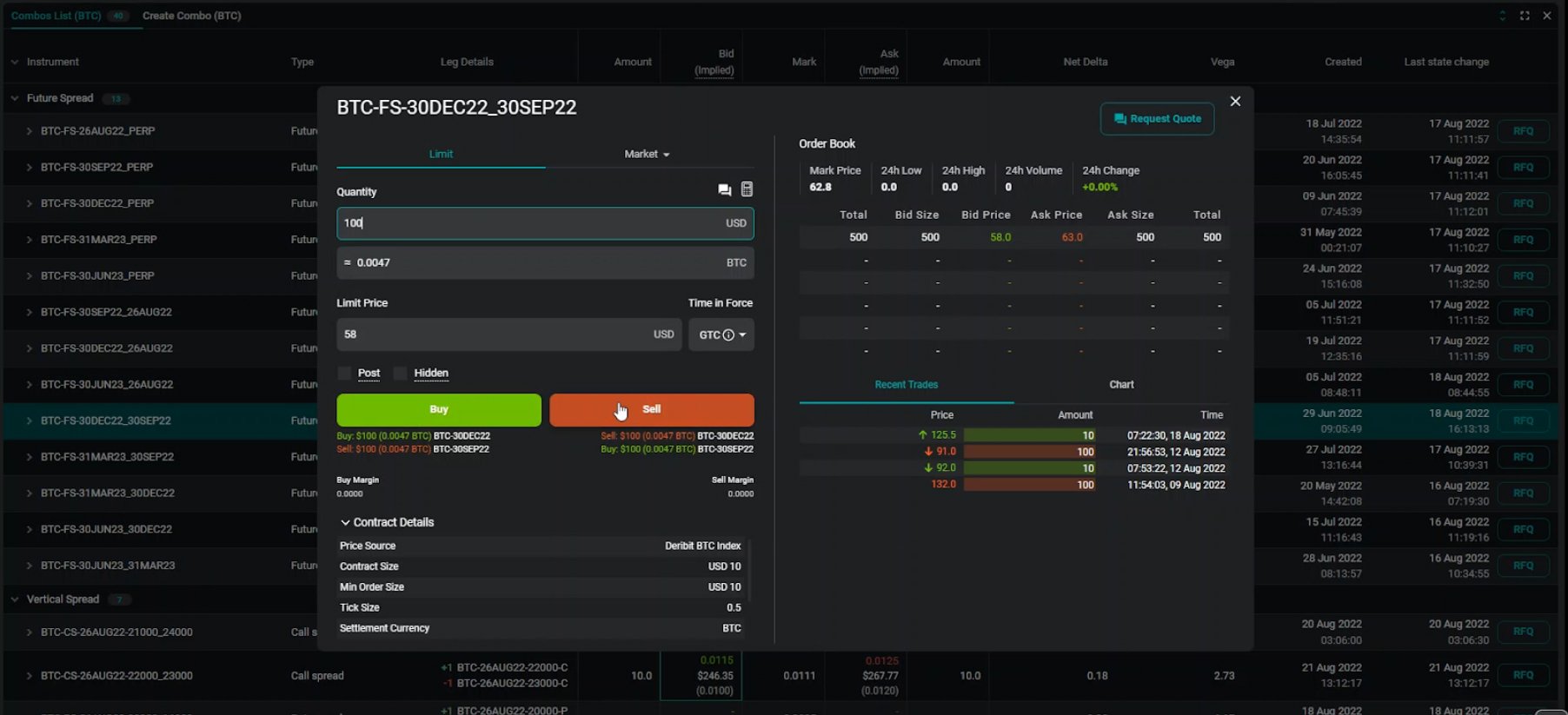

We need a future spread that includes both the December and September futures. This one includes both so will be perfect for our needs.

If we open the order book for this Combo, we see a single price for both legs combined. Here we can see a bid price of 58 and an ask price of 63. As we are trading a future spread, these prices are in dollars.

An important question to ask when trading a Combo is what direction do we want to trade the Combo in. When a strategy contains multiple legs and includes some buys and sells, it can be difficult to be certain which direction the trade should be placed in, and whether we should expect the price for that direction to be a net credit or a net debit. Thankfully the direction and quantity of each leg is displayed underneath the ‘Buy’ and ‘Sell’ buttons in the order form for each Combo. This allows us to be sure which direction we are trading in, and therefore whether we are paying/receiving what we expect for that direction.

Futures spreads are quoted as the furthest date minus the nearest date, meaning they are positive when the futures are in contango. The December future is currently trading at a higher price than the September future meaning the market is in contango. This means that December minus September is a positive number, so we would expect the price of the Combo to be a positive number.

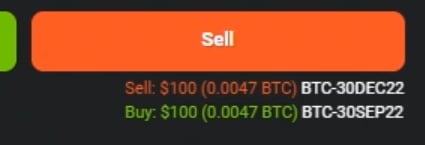

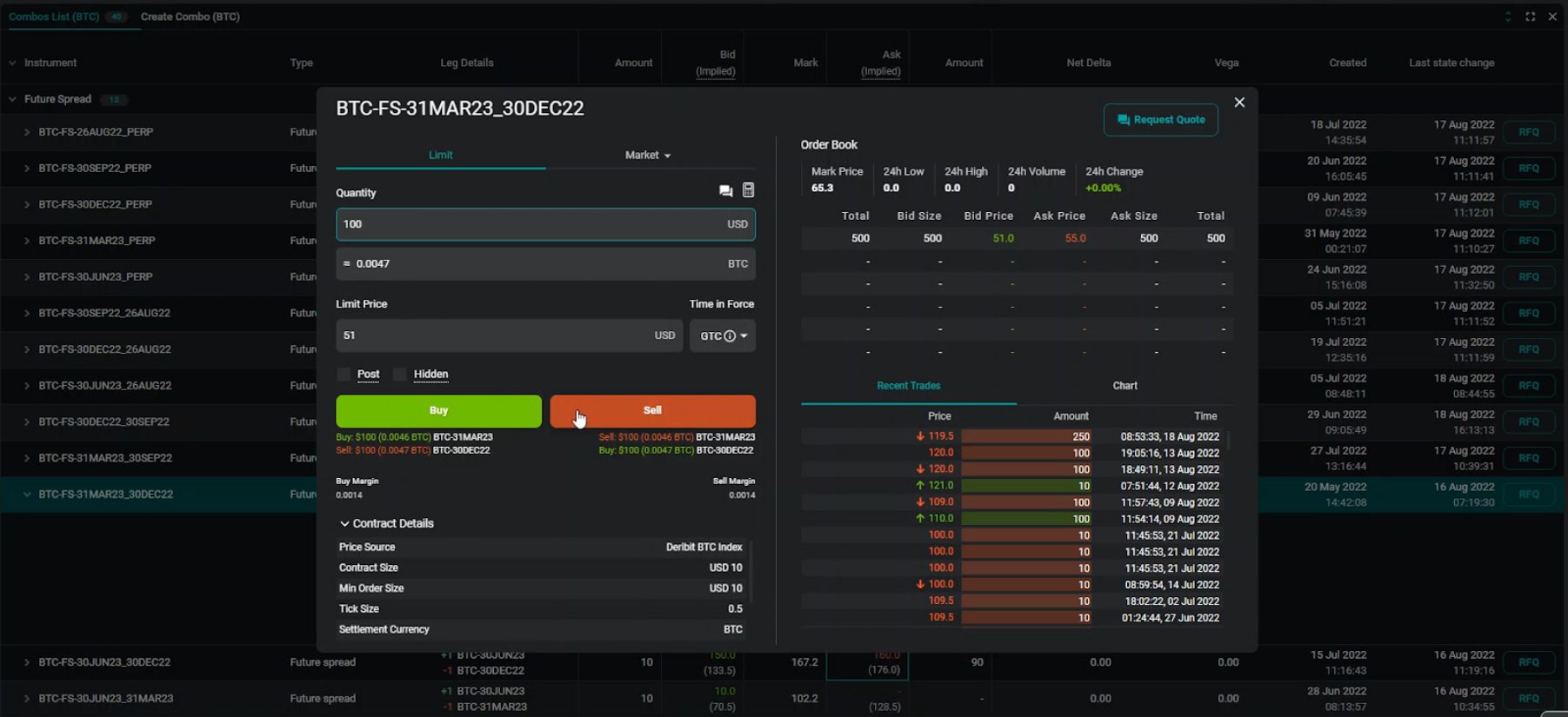

As we are intending to buy the September future and also sell the December future at a slightly higher price, we would expect to be selling this Combo. To double check this is indeed correct, we can look at the legs listed underneath the ‘Sell’ button.

If we enter a quantity of $100 in the order form, we can see the legs listed under the sell button are:

Sell $100 BTC-30DEC22

Buy $100 BTC-30SEP22

This is exactly what we want so lets go ahead and sell $100 of this futures spread as a Combo. If we prefer to wait for a better price, it’s possible to leave a limit order in the order book and wait for it to be filled, however for this example let’s sell directly into the best bid of $58.

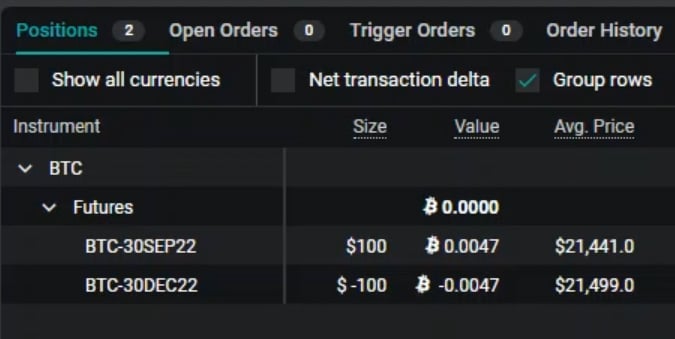

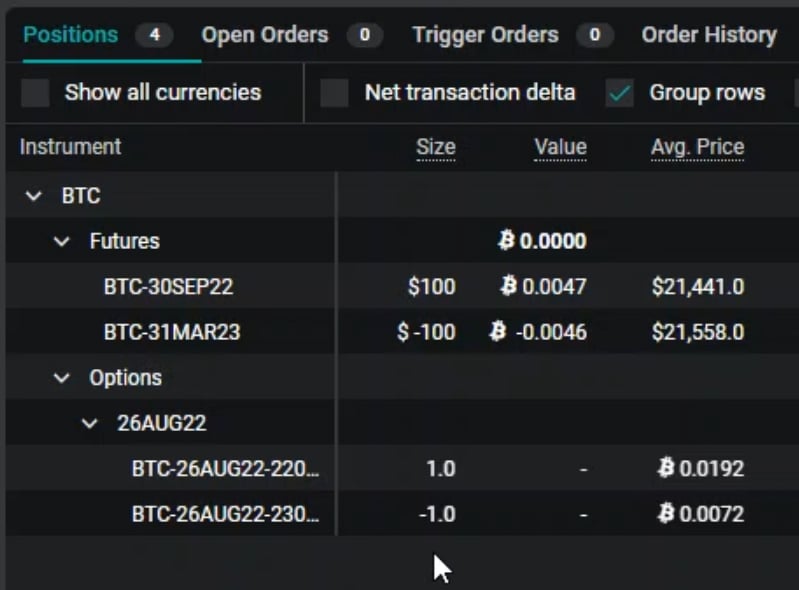

Once we place this order and it is filled, we can see our two new futures legs in the positions table at the bottom of the page.

We are now long $100 worth of the September future and short $100 of the December future as desired. The difference between our average prices is the $58 that we sold the Combo for.

Although we entered both of these legs together as a Combo, they sit separately in our account. It is still possible to trade the legs individually once the position is open. This includes trading the legs in the individual order books for these instruments, or as part of a different Combo.

For example, let’s say that I want to roll the December leg out to March next year. To do that I would need to buy the December future, and sell the March future. This can of course be done via another Combo!

This Combo for the March and December futures will be perfect.

We are currently short $100 of the December future, so we want to buy back the December future and sell the March future. We therefore want to sell $100 of this spread. We can see underneath the sell button that this will sell March and buy December.

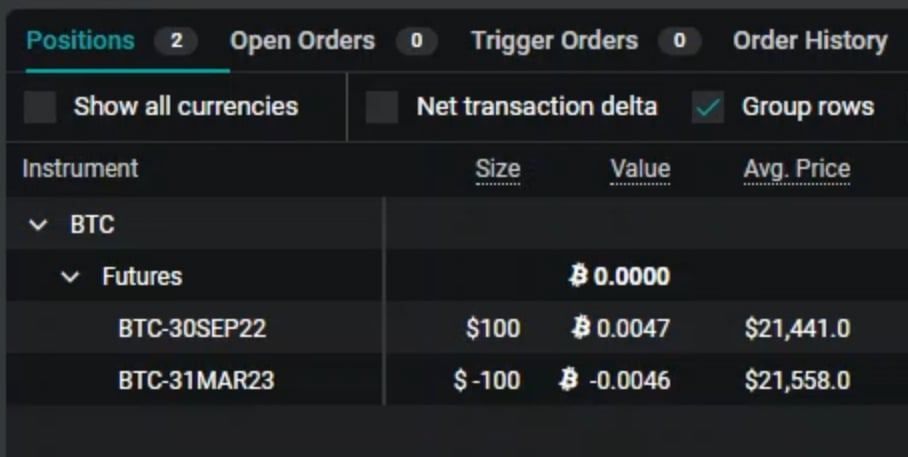

Once we place this order and it is filled, we can see our position has been updated in the positions table.

Our $100 short in the December future has been closed, and this has been replaced by a $100 short in the March future, which is exactly what we wanted.

As you can see, the futures Combos are incredibly useful for either opening spread trades, or for moving a future position from one contract to another. And with a minimum trade size the same as the individual contracts themselves, they are useful for traders of all sizes. Where Combos really shine though is when we start using them for multi-leg option positions.

Previously to open a multi-leg option strategy a trader would need to either:

- Leg into it, with the risk of price moving away before all legs are filled

- Cross the spread multiple times, incurring extra cost, or

- Use a block trade, which has a minimum trade size.

With Combos, traders can enter and exit multi-leg option strategies:

- Directly on the Deribit platform

- In a single order and order book, lowering both the effort and the cost

- At any size that can be traded on the individual instruments.

Combo trade example 2

One of the simplest, and most popular multi-leg option strategies is a vertical spread. A vertical spread involves buying one option, and selling another option of the same type and with the same expiration date.

For example, let’s say we think the price of bitcoin is going to increase this week and we would like to use options to benefit when this view is correct. To do this we may wish to execute a bull call spread. This involves buying one call option, then selling another call option that is further out of the money.

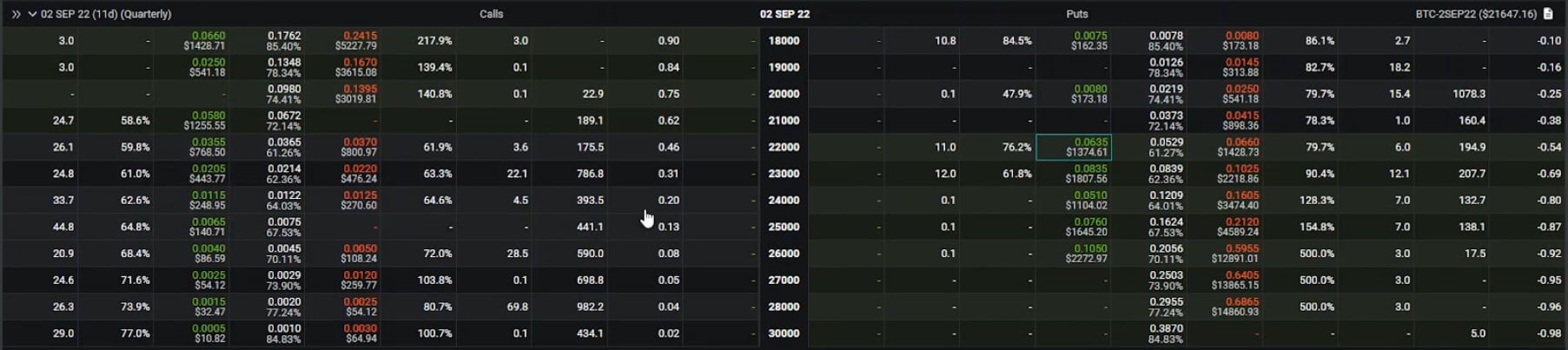

We will use the 26-AUG22 expiry for this example. This is the current option chain for this expiry, with the underlying price currently at around $21,400.

Let’s say we like the look of the $22,000/$23,000 bull call spread. That is, we want to buy the $22,000 call and at the same time sell the $23,000 call.

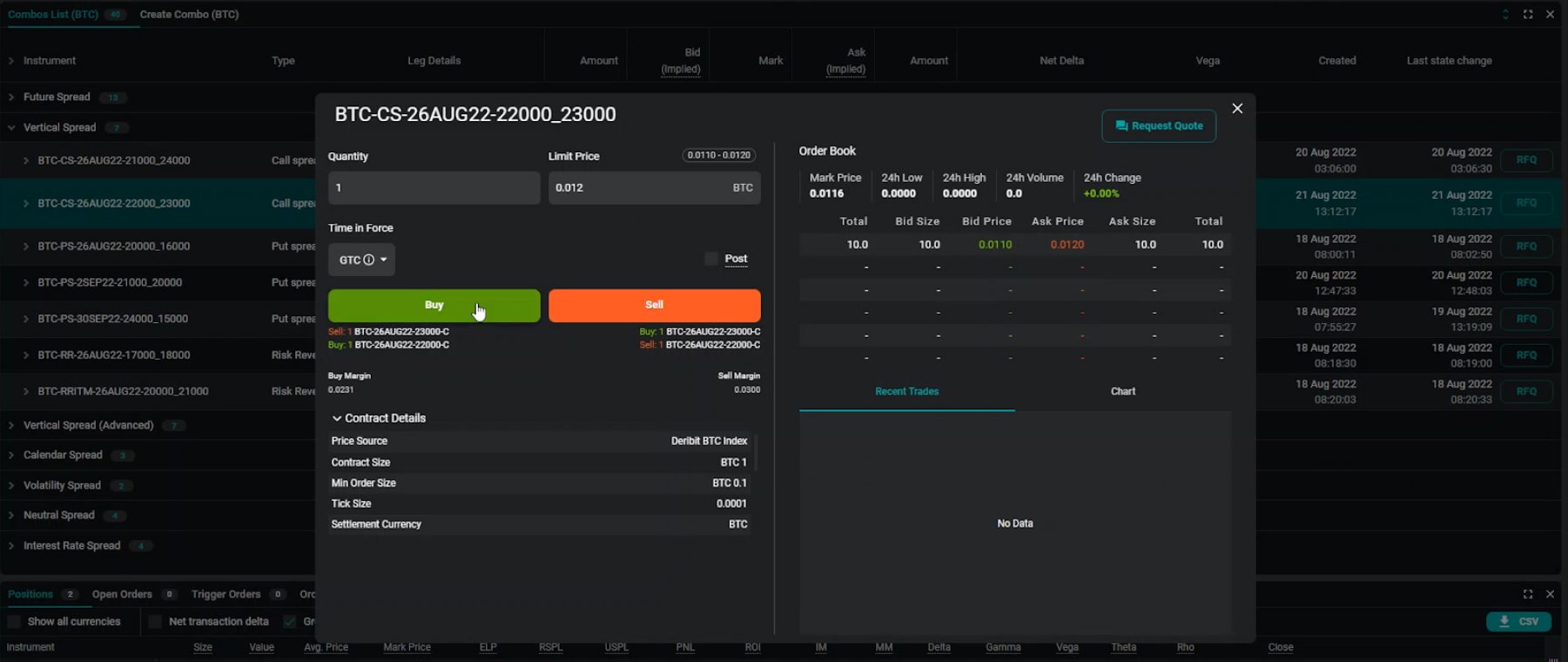

To do this let’s go back to the Combo page via the top menu. What we are looking for is a vertical spread, so we’ll look in the vertical spread section, and we find this vertical call spread for August 19th with strikes of 22000 and 23000, which is exactly what we need.

In the order book for this Combo, we see a single price for both legs combined. Here we can see a bid price of 0.011 and an ask price of 0.012. As we are trading inverse bitcoin options, these prices are in bitcoin. For example, 0.012 BTC is 1.2% of a bitcoin.

We want to buy the $22,000 strike and sell the $23,000 strike. This means we need to buy this spread. To make sure we get an immediate fill let’s buy into the ask of 0.012 BTC.

Once our order has been filled, we can see our two new option legs in the positions table at the bottom of the page.

We are now long one of the $22,000 calls and short one of the $23,000 calls, as desired. The difference between our average prices is the 0.012 BTC that we paid for the Combo.

As with the futures spread, although we entered both of these option legs together as a Combo, they sit separately in our account. It is still possible to trade the legs individually once the position is open. This includes trading the legs in the individual order books for these instruments, or as part of a different Combo.

In both of the examples we have covered so far, the Combo that we wanted to trade already existed. Now let’s look at an example where we create a new Combo that doesn’t yet exist.

Combo trade example 3

Sometimes we will know exactly what strategy we want to use, but the Combo won’t exist yet. For example, let’s say we are looking at this option chain for September 2nd and with the underlying price at around $21,600, we like the look of the $21,000 straddle. This means we would like to purchase both the $21,000 call and the $21,000 put.

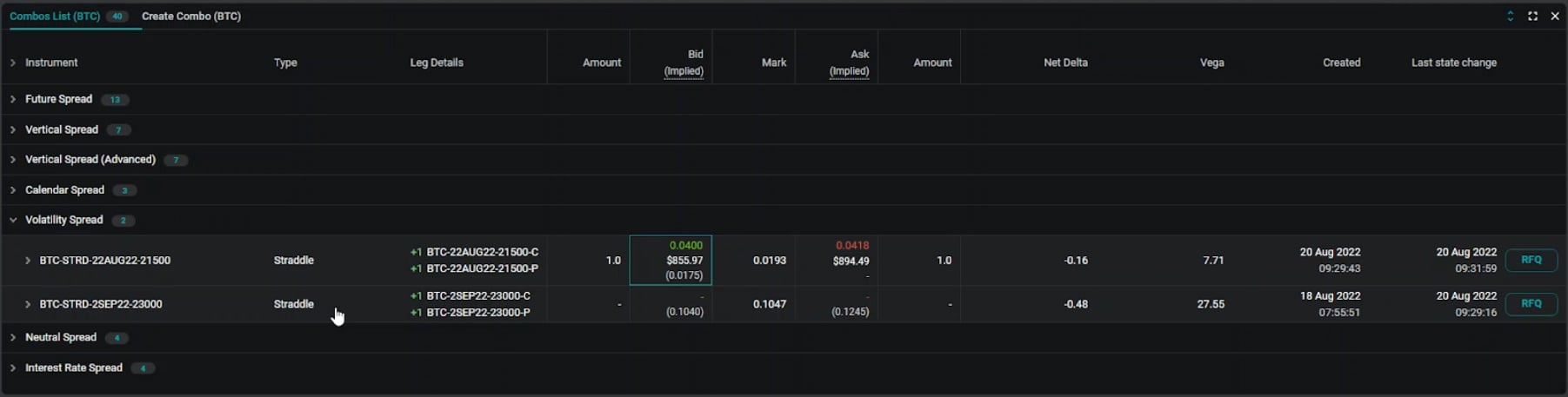

So we head over to the Combo page to find the straddle. When we get there though, we can only see one straddle for the September 2nd expiry, and it’s not the one we want. The only straddle Combo currently active for this expiry is the $23,000 straddle.

This is no cause for concern though as we can simply head over to the ‘Create Combo’ tab, where we are able to enter the details for our desired position.

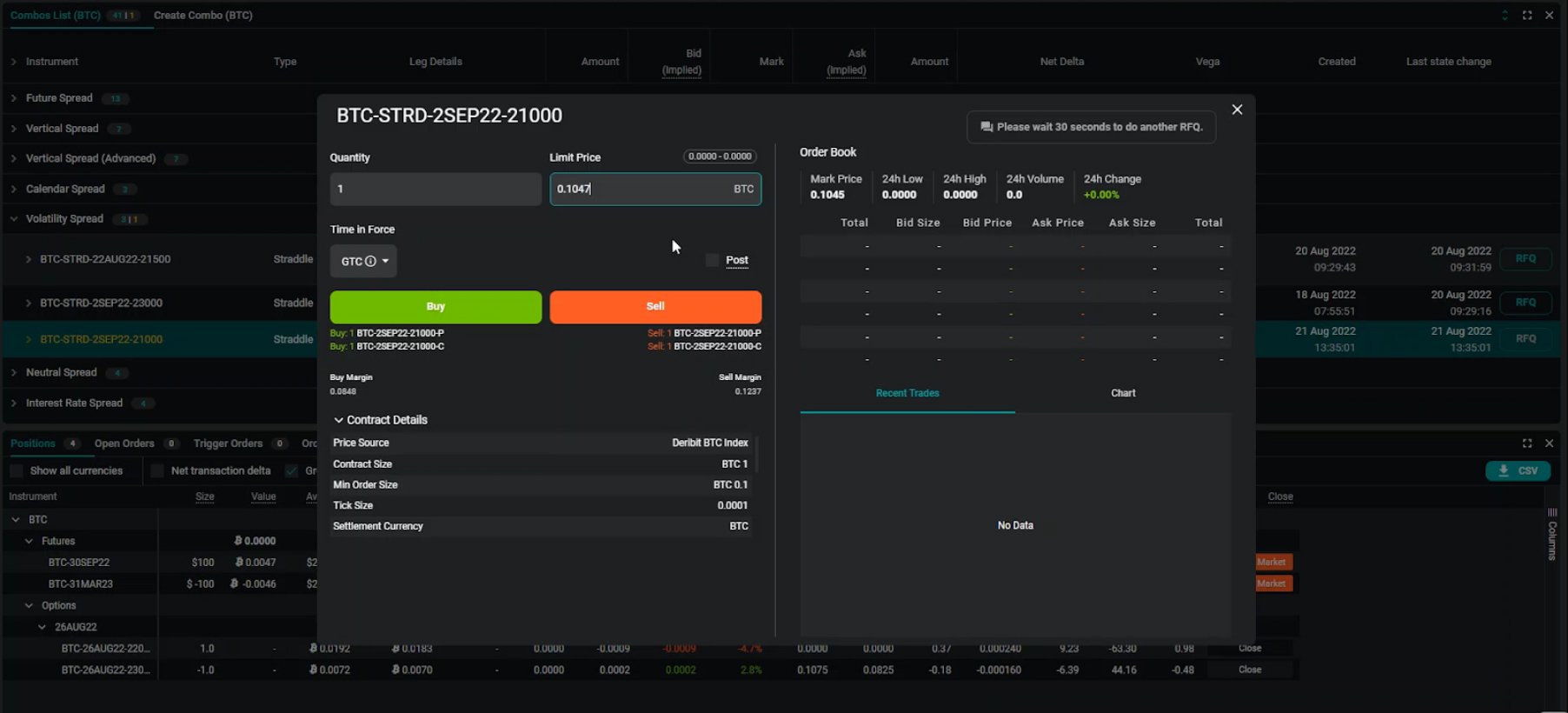

First we select the desired strategy, which in this case is a straddle. Then we select the expiry date, which in this case is 2SEP22. Then finally we select our strike price, which in this case is 21000. Because the strategy we are creating a Combo order book for is a straddle, we only need to enter this single strike. For more complicated strategies we would need to enter the strike price for each leg.

Notice also that we can see a visual representation of what the strategy we are building looks like. The V shape on the chart here being the payoff of a long straddle.

Once we’ve entered all the correct details, we click Create and RFQ. RFQ stands for Request For Quote. Market makers will typically monitor for new RFQs so they know what instruments traders would like a quote for. So after we have created a Combo, we can expect other traders (including market makers) to eventually place orders in the newly created order book.

For this example though, we are not going to wait for other people to place their quotes and then cross the spread. We are going to leave our own limit order in the order book and wait for it to be filled.

Once we have created the Combo for the $21,000 straddle, we can open the order form. There we can see the mark price is currently about 0.1045. Let’s increase our order price a little above this to encourage someone else to give us a fill. We want to buy this straddle so we enter an order to buy 1 straddle for a price of 0.1047 BTC.

Notice here that the price we can enter for the Combo has a tick size of 0.0001, rather than the usual 0.0005 tick size for the individual options. This allows for more precision in the order prices when multiple options are combined.

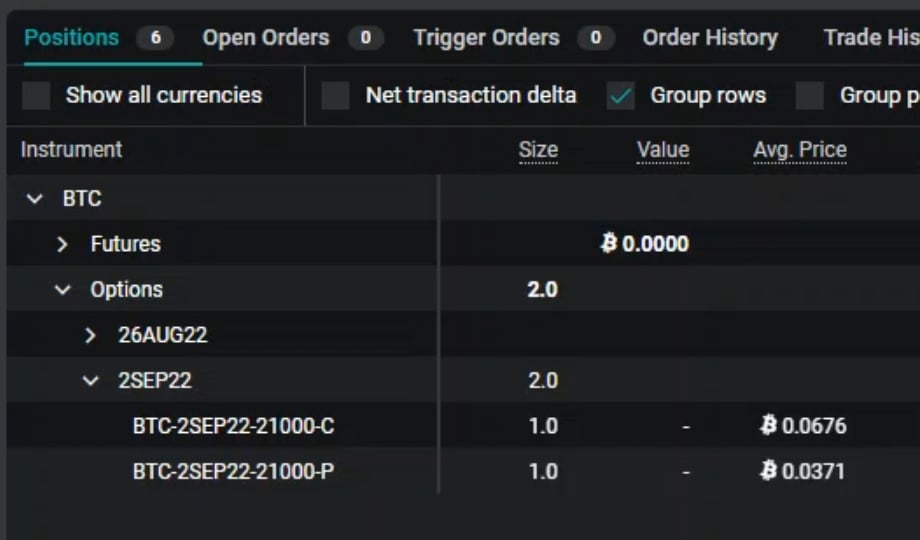

Bear in mind that when we leave a limit order in the books that it is not guaranteed to be filled. In this instance it is filled though, and so we can see our new position in the positions table.

We are now long one of the $21,000 calls and long one of the $21,000 puts, as desired. The sum of our average prices is the 0.1047 BTC that we paid for the straddle Combo.

As we mentioned in the previous example, although we entered both of these legs together as a Combo, they sit separately in our account. It is still possible to trade the legs individually once the position is open.

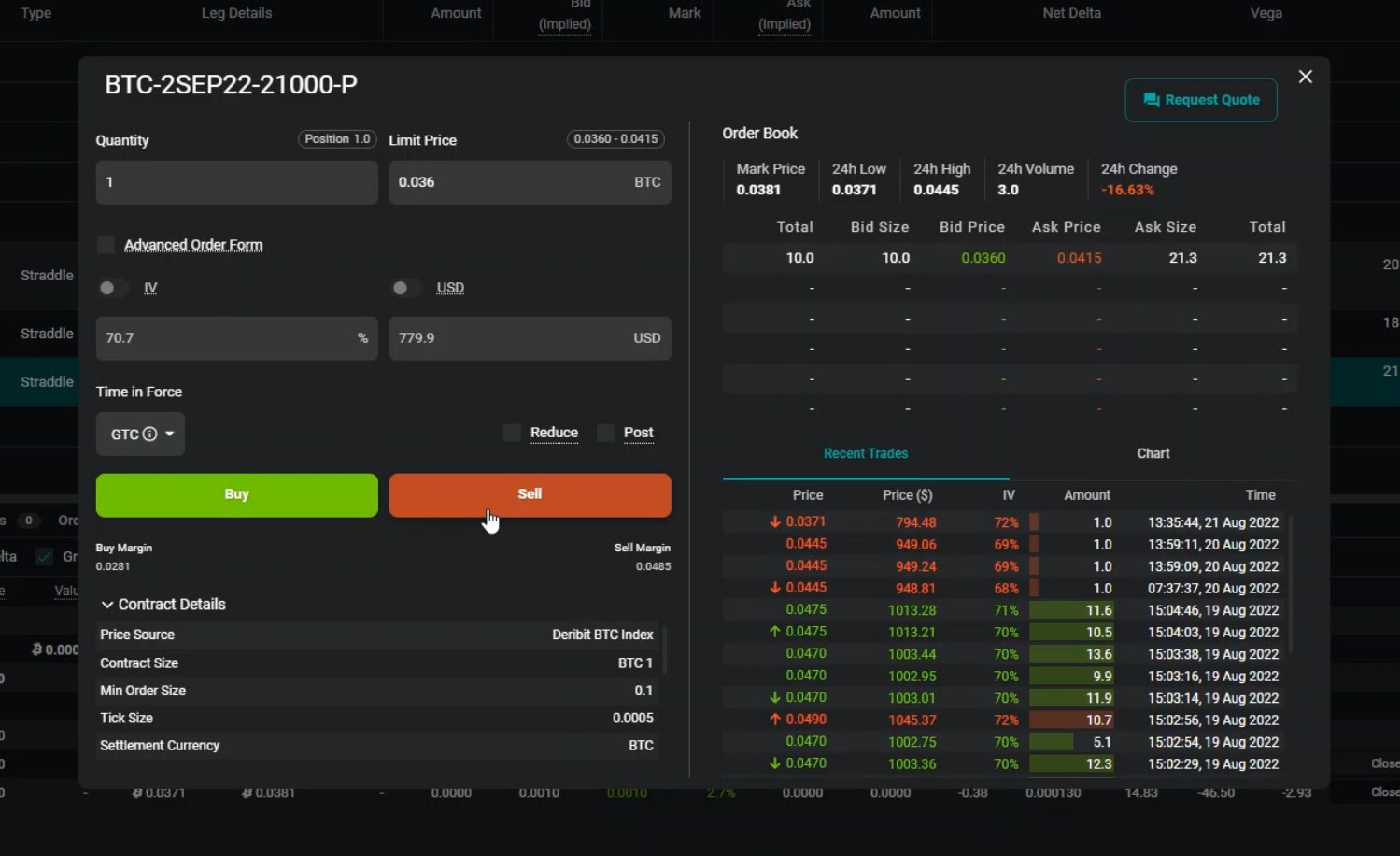

For example, let’s say that we become more bullish on the price of bitcoin, and so we would like to close our put option leg, leaving only the long call. To do this, we can click on the put option in the ‘Instrument’ column in the positions table to bring up the order form for that option.

We are currently long this put with a position size of 1, so we want to sell a quantity of 1. To ensure we get an immediate fill, we will sell into the best bid of 0.036 BTC.

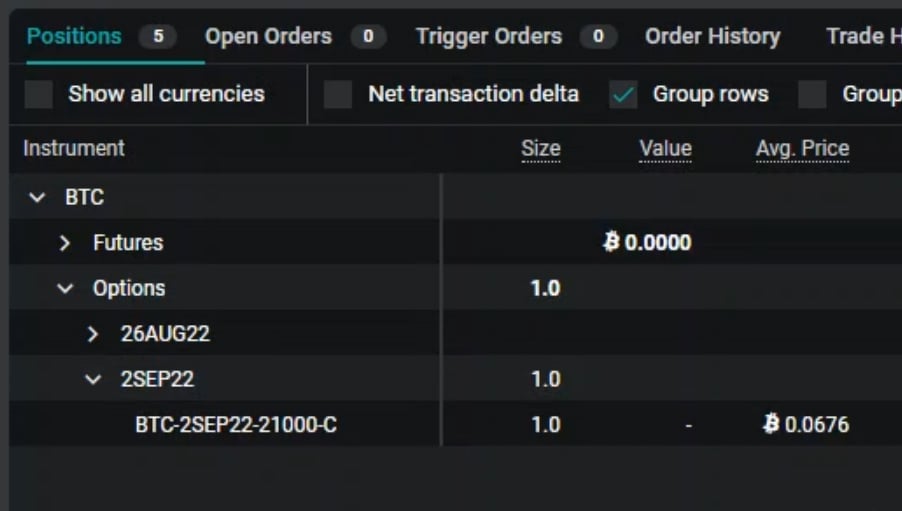

Once this order fills, we can see in the position table that our put option position has been closed, leaving only the long call option, which is exactly what we wanted.

Summary

Hopefully this brief introduction to Combos on Deribit has given you some insight into how powerful combining multiple legs into a single order book can be, and how much easier Combos can make trading multi-leg strategies.

To recap why traders may want to utilise Combos to execute their trades:

- Combos offer much easier execution of multiple legs. It is now possible to execute all legs of a multi-leg option strategy with a single order at a single price. There is no longer a need to manage multiple orders for a single strategy or to cross the spread multiple times.

- Combos eliminate leg risk. No risk of being filled on one leg with price then running away from the other leg.

- Individual legs retain their flexibility. Traders can still trade the legs individually once the position is open. This includes trading each leg in the individual order books, or as part of a different Combo.

- Combos benefit from lower fees! The cheapest direction of a Combo has reduced fees, meaning less fees to pay compared to executing each leg individually.

- More precise prices. It is possible to use tick sizes of 0.0001 for option Combos, allowing for greater precision.

- Minimum trade sizes are small. The minimum trade size for Combos is the same as for the individual instruments they contain, so even smaller traders can take advantage of the benefits of Combos.

AUTHOR(S)