In this article, we will cover some examples of how to trade the volatility of an asset, rather than the price of the asset. To help us, we will use several different products that are available on Deribit, including but not limited to the options. We will as much as possible remove our exposure to the direction of the underlying price, while retaining our exposure to the magnitude and frequency of price movements (the volatility).

Please note: It is assumed that the reader is already familiar with the details of calls and puts, and has some familiarity with both realised and implied volatility. For more information on these subjects see our option course here. No opinion is offered on when or if any of the mentioned strategies are appropriate for each trader. That is for the individual trader to decide.

The prices of option contracts are significantly affected by the volatility of the underlying asset, and more specifically by the market’s expectation of volatility. This makes them very useful for traders who want to speculate on volatility.

Straddles (long and short)

Most option trades are taking some sort of position on volatility, even if it’s not the primary focus of the trade, but let’s first look at a structure that is commonly used to bet specifically on volatility, a straddle.

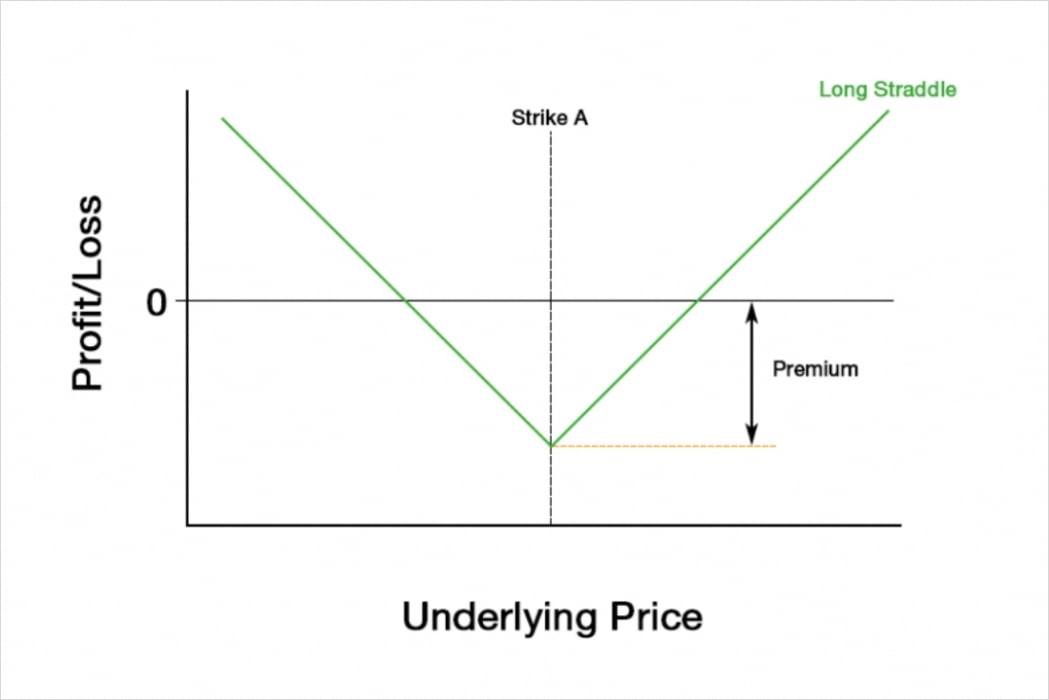

A long straddle involves purchasing both a call and a put option at the same strike price and with the same expiry date. The strike price will typically be close to the current underlying price when the position is opened. When simply held until expiry with no further adjustments, the long straddle makes a profit when the underlying price moves far away from the strike price. The further the price moves, the more the long straddle makes. If the price stays close to the strike price, the long straddle will of course make a loss.

Even without knowing any of the maths or theory behind options or implied volatility, it’s possible to understand intuitively that this position is long volatility. When the underlying price doesn’t move much, a loss will be made, and when the underlying price moves a lot, a profit will be made.

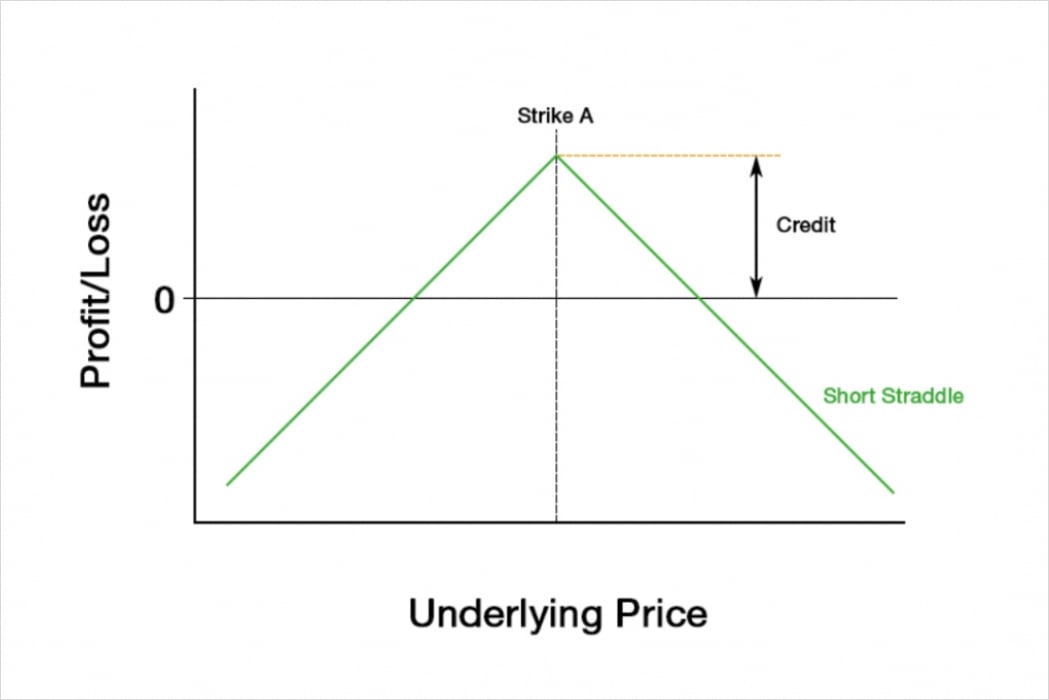

To short volatility instead, the opposite position can be taken. Selling the call and put with the same strike price creates a short straddle, the exact opposite of a long straddle.

When held until expiry, the short straddle makes a profit when the underlying price stays close to the strike price. If the underlying price moves far away from the strike price, a loss will be made.

Moving back to the long straddle, it can achieve a profit if the price moves far in either direction, and at least initially it is neutral with respect to price direction (delta neutral). However, it needs the price to move far away from the strike in order to make a profit. A call and a put have both been purchased, typically at the money, so the cost to buy this position will often be high. As the underlying price moves away from the strike price, the long straddle will start to lose its delta neutrality, becoming an increasingly directional position, and no longer being a bet primarily on volatility. We can fix this problem with delta hedging which we will cover later.

A short straddle collects a large amount of premium up front, however this is only all kept if the price expires exactly at the strike price. The further away from the strike price the underlying price moves, the more the holder of the straddle will have to pay out, and there is no cap on this amount. A short straddle can also be delta hedged, which we will cover later.

Strangles (long and short)

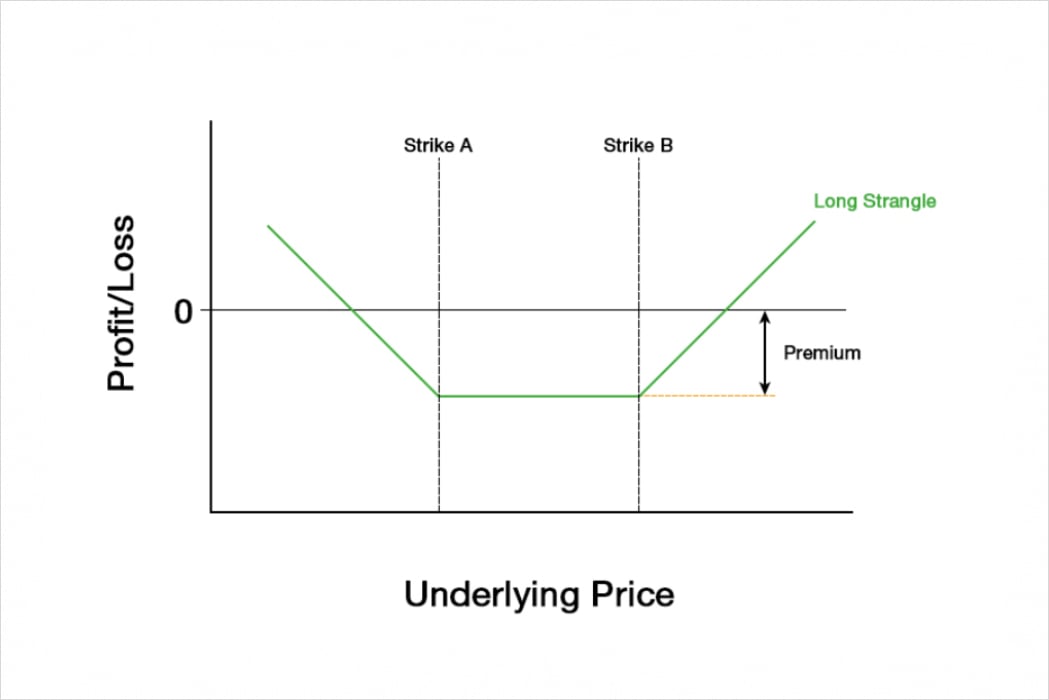

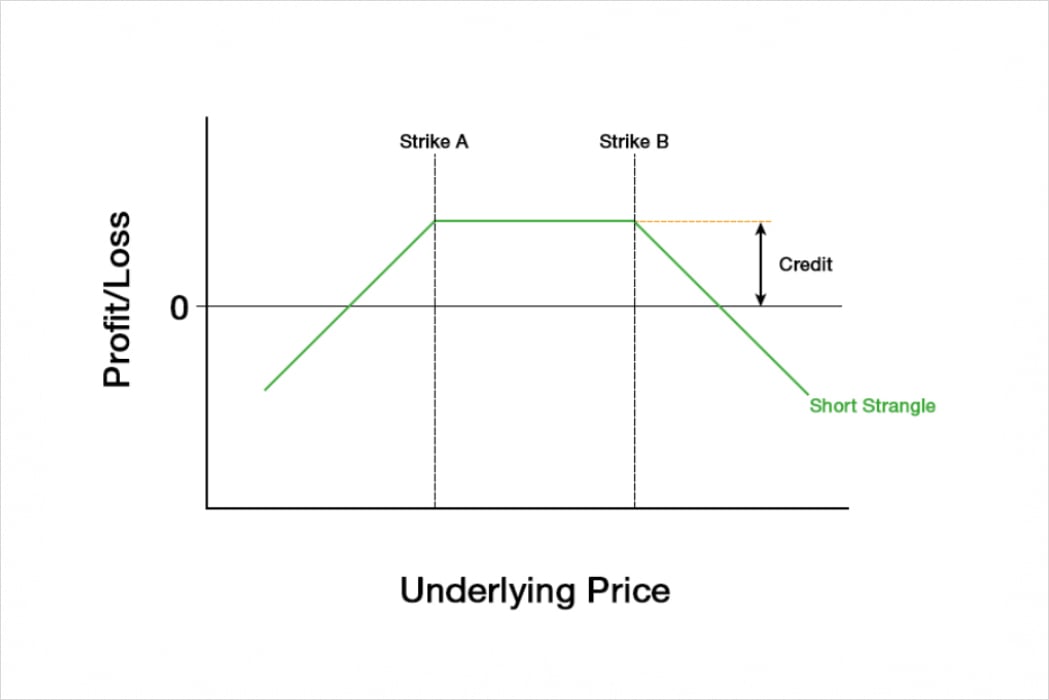

A strangle is similar to a straddle, but involves moving the strike price of both the put and call out of the money. Some traders may be happy with the risk/reward profile of a straddle, but as was just mentioned, there are reasons why both sides of the straddle trade may prefer a strangle instead.

From the point of view of the long strangle, they won’t have to pay as much premium for their position. However, the underlying price also has to move further before one of their options is in the money.

From the point of view of the short strangle, they have a much wider range where the underlying price can end up while they still make a profit. However, their maximum profit will be much less.

Both straddles and strangles offer a simple way to get exposure to the volatility of the underlying asset, both via underlying price movements and via implied volatility (option prices). If implied volatility increases, this means option prices increase. This benefits the long straddles and strangles, and hurts the short straddles and strangles. Conversely, if implied volatility decreases, this means option prices decrease, which benefits shorts and hurts longs.

Dynamic delta hedging

As we touched on already, although both a straddle and a strangle will typically be roughly delta neutral when they are initially entered, as the underlying price moves in one direction, they will lose their delta neutrality.

For example, if we long a straddle which includes a call with a delta of 0.5 and a put with a delta of -0.5, then if we add our deltas together, our total delta is 0. Perfect, we are long volatility, with no preference for price direction.

However, now imagine the underlying price quickly increases several percent. This will be good for our position, but our call is now in the money and the put is now out of the money, so the deltas of our options may have changed to something like 0.6 for the call and -0.4 for the put. Now our total delta is 0.2, so as well as still being long volatility, we are also long the underlying price. If the underlying price then quickly decreases a few percent, completely retracing the previous move, we might be right back where we started. In this circumstance, there has been good volatility, but our supposedly long volatility position has not benefited from it because we just let our deltas run.

To fix this, and help our position benefit from volatility even if price then comes back to the strike price, we can hedge our deltas while the trade is open. To do this, we simply use a futures position to ‘cancel out’ the delta of our option position.

In our example, when we first enter the long straddle, our total delta is 0 so there is nothing we need to do. When the price first increases, our total delta changes to 0.2. To get our total delta back to 0, we should sell futures such that the futures position has a delta of -0.2.

At this point we would then have:

- Delta of 0.2 from our straddle

- Delta of -0.2 from our futures short

When the underlying price then falls back down towards the strike price, the delta of our options will go back to 0.5 for the call and -0.5 for the put.

We would then have:

- Delta of 0 from our straddle

- Delta of -0.2 from our futures short

Which leaves us with a delta of -0.2. To get this back to zero, we buy back our futures position, which in this case completely closes it.

Our options will be worth exactly the same as if we had not done any delta hedging of course, however now we have a profit from our futures short. Remember the underlying price increased, we then sold some futures. The underlying price then decreased and so we bought our futures back at a lower price than we sold them at. This profit from the delta hedge on the future has ensured that even though the underlying price has ended up back at the strike price of our straddle, we have still captured some profit for the volatility in the underlying price that we saw.

This simplified albeit slightly long winded example illustrates how if a trader is willing to be more active and hedge their delta, they can dramatically reduce the price direction exposure of their option position, making it a bet primarily on volatility itself.

Delta hedging won’t always lead to a more profitable outcome though. In our example, the underlying price moved back to the strike price, which is the worst place it could be for our long straddle, so of course any profit from hedging will look superior. However, if price moves strongly in one direction instead with no large pullbacks, the unhedged long straddle position would have been more profitable. Of course there is no way to know this will happen ahead of time, so it is up to the trader to decide what they want exposure to. If it is purely volatility exposure that is desired, then they will need to dynamically delta hedge their options.

DVOL futures

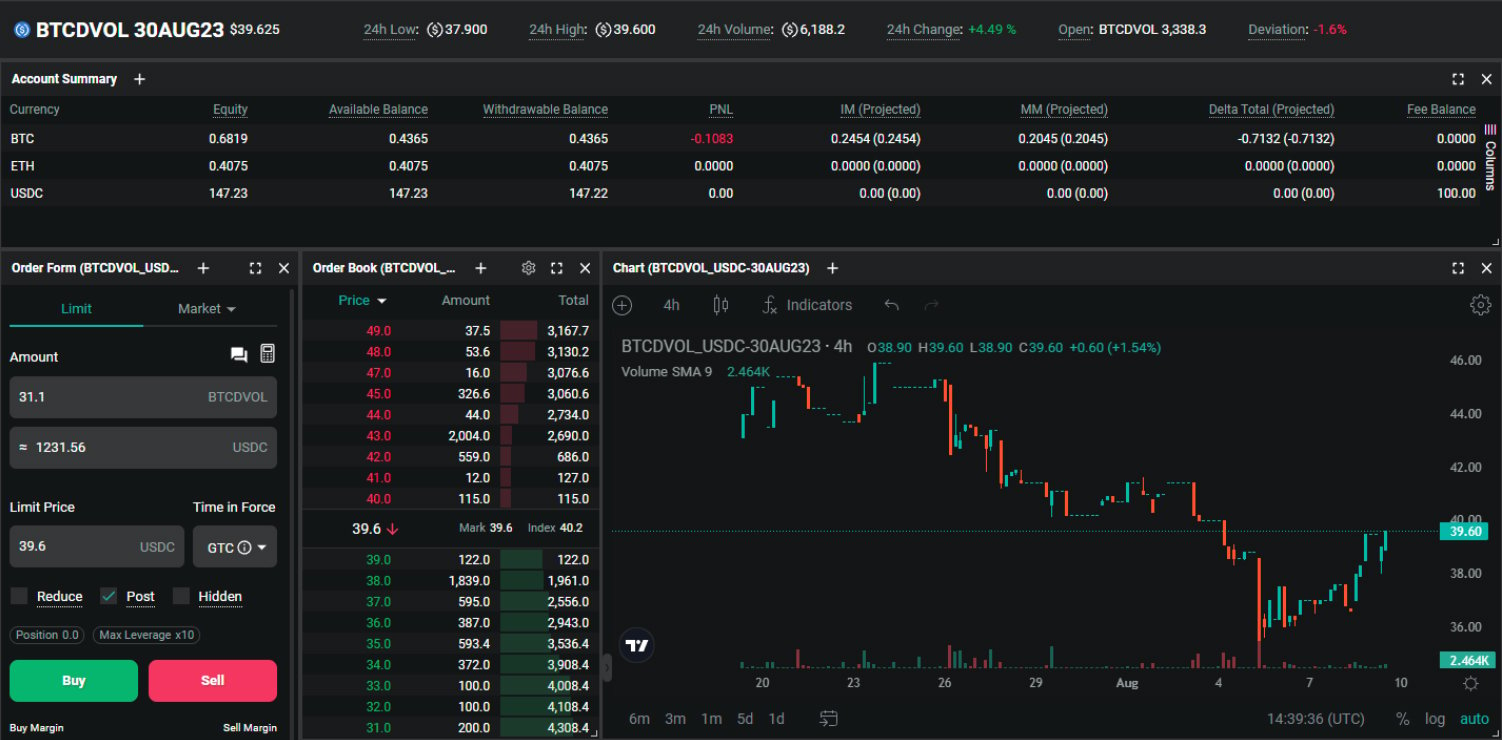

So far we’ve used options, and options in combination with futures to hedge our deltas. There is another product on Deribit though that allows us to trade a futures contract on a volatility index (DVOL, which is the Deribit volatility index).

The DVOL index gives us a single value for rolling 30 day implied volatility that we can trade futures on. For more information on exactly how this index is calculated see here.

The DVOL futures allow us to trade implied volatility more directly, without having to worry about where the underlying price is relative to our strike prices, or about actively hedging our deltas.

These are huge benefits, but there are also disadvantages. While this is a relatively new product, and so this may improve with time, the liquidity on DVOL futures is usually much lower than what is available on the options or the regular futures. There is also currently only one DVOL future available at a time. So there is more choice of expiry dates available with options, which not only gives more choice but also allows for trading relative volatilities between different expiry dates.

Despite these limitations, the DVOL futures offer another very useful way to speculate on volatility.

Summary

Traders wishing to speculate on volatility, can do so by utilising options. The buyer of a put or a call is long volatility, and the seller of a put or a call is short volatility. Some of the most common option structures to bet on volatility are straddles and strangles, because at least initially, they are roughly delta neutral.

However option positions that are initially delta neutral can pick up deltas as the underlying price moves (or as time passes). Delta hedging can be used to make sure the trader’s profit or loss is primarily based on volatility, rather than the direction the underlying price moves. This delta hedging can be done either manually or algorithmically.

Futures on a volatility index offer another way to bet on volatility, without having to worry about price direction or about delta hedging.

AUTHOR(S)