It is now possible to deposit USDT (a.k.a Tether) into your Deribit account. Along with the existing ability to hold USDC, this addition gives users more choice when they want to keep their funds in stable coins.

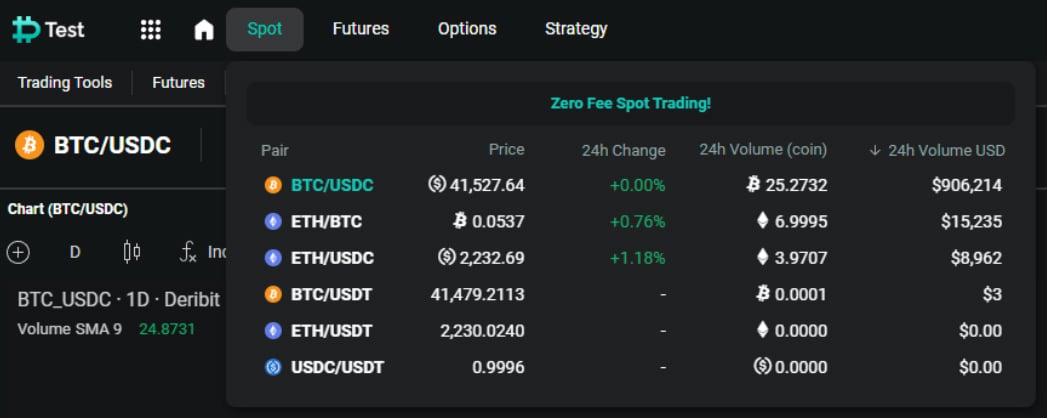

To support the launch of USDT, there are three new USDT spot markets on Deribit. The new markets are BTC/USDT, ETH/USDT, and USDT/USDC. These spot markets will allow Deribit users to move from any of the three existing settlement currencies into USDT, or vice versa. As with the other spot markets on Deribit, these markets have zero fees!

New possibilities

Previously, if you held USDT on another venue, but wanted to trade on Deribit, you would have needed to first convert your USDT to something else before sending your funds to Deribit. Now though, it is possible to deposit your USDT directly into your Deribit account, and then swap it for whichever currency you would like to trade.

To navigate to the new spot markets, just click Spot in the top menu on the Deribit website.

Depositing USDT

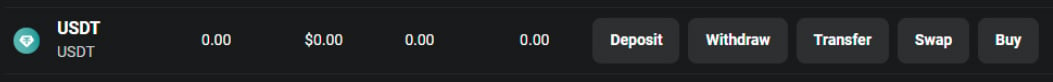

To deposit USDT, you will first need a Deribit USDT deposit address. At time of writing Deribit only supports USDT via ERC20 (Ethereum), so this will be an Ethereum address. To find your deposit address, navigate to the wallet page, find USDT in the list, then click the Deposit button.

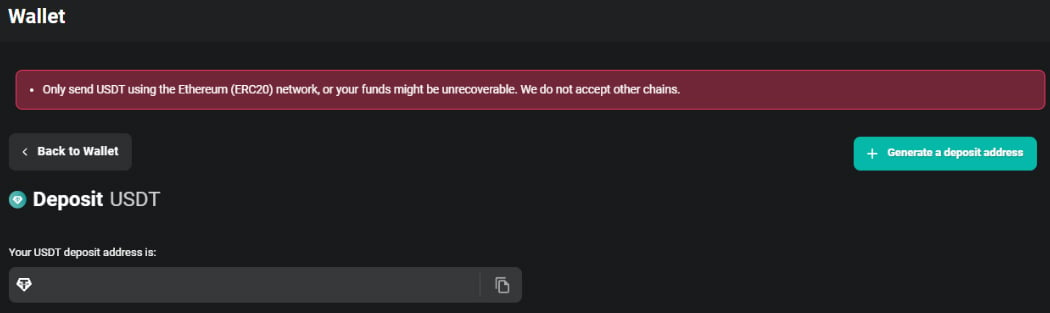

This will take you to the deposit page for USDT. As USDT and USDC are both accepted via an ERC20 address, you may already have a USDT deposit address in your account if you have previously generated a deposit address for ETH or USDC. If you do not have one though, simply click the ‘Generate a deposit address’ button.

Once you have a deposit address, you can use this to deposit USDT into your account from other venues, or from your own wallets. It is important to only send USDT on the correct chain. On Deribit this currently means only sending USDT via the ERC20 (Ethereum) network. Sending funds via any other network could result in the loss of your funds.

Will USDT be included in cross collateral?

When Deribit adds the cross collateral system (coming soon), it will also be possible to use USDT as collateral for positions in instruments with a different settlement currency. In other words you will be able to use your USDT as margin to trade the BTC, ETH, and USDC products.

The cross collateral system will allow traders who enable it to use currencies other than the settlement currency as margin for open positions or orders on derivatives products.

What is USDT?

USDT is a stablecoin that is designed to track the value of the dollar. One USDT is meant to be worth $1. The peg is held in place by the market, and the value of Tether’s reserves (which include US Treasuries).

USDT was launched in 2014, and has since grown to be the largest stablecoin by market cap. It is available across several different blockchains, though at time of writing, Deribit only accepts the ERC20 (Ethereum) version.

You can read more information about Tether the company, and how the USDT currency works on their website here.

AUTHOR(S)