With a strong commitment to innovation and collaboration in our longstanding partnership with Deribit, Actant is excited to announce immediate support for trading Deribit’s newly introduced linear options on SOL, XRP and MATIC.

Actant’s experienced development team is highly adaptable, enabling us to update our software in line with changes in the trading environment. Our quick addition of linear options for SOL/XRP/XMATIC is a prime example of this flexibility. It highlights our commitment to integrating the newest features from Deribit to enhance the user experience. Notable additions include RFQs, multicast price feeds, and more, solidifying our commitment to providing a state-of-the-art trading environment.

Learn more about how Actant can help Deribit users, whether they are Market Makers or Professional Traders, enhance their Deribit trading experience by leveraging the advanced functionalities provided by Actant’s comprehensive trading suite, notably

Quote Management and Safe Automation

Designed to support options quoting across an unlimited array of instruments using a single station, this system utilizes price and additional data feeds to compute and disseminate options quotes into the market. These quotes rely on standard valuation models, integrating diverse inputs such as volatilities, Greeks, and rates. These inputs update continuously in response to underlying price movements and other market events, all without mentioning Actant’s customizable safety parameters. This allows traders to automate their quoting strategies with the utmost level of security.

Hedging

Managing risk is crucial, and Actant offers autohedging functionality out of the box. Whether hedging individual trades or the entire portfolio, Actant’s product simplifies the process, enabling Deribit traders to leverage underlying or options markets for risk control and to secure their edge.

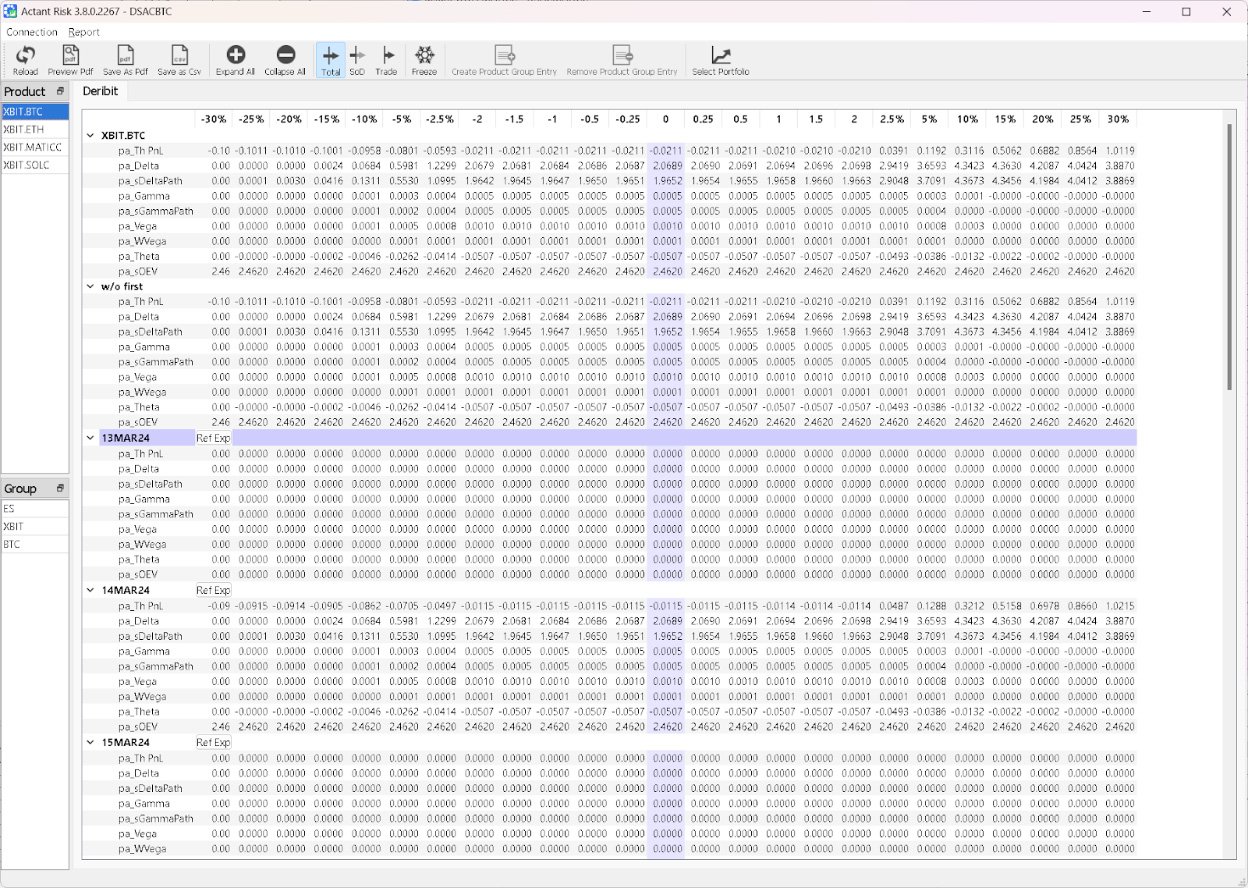

Risk Matrix

A completely customizable tool for risk analysis, Deribit traders using Actant can utilize the basic slide risk analysis package or customize the application to see the risk the way they want.

Volatility Management – Our Volatility Fitter

Our Vol Fitter application adds GUI variable management and optimization tools to a robust Volatility script environment. Utilize our library of volatility scripts, covering splines, polynomials, floating curves, and more, or create your own. Most scripts leverage our VolFitter application for precise graphical control of surfaces. Optimization can be applied to any subset of easily defined variables without parameter constraints. Not to mention our AutoFitter, which allows you to selectively automate the process.

Smart Orders

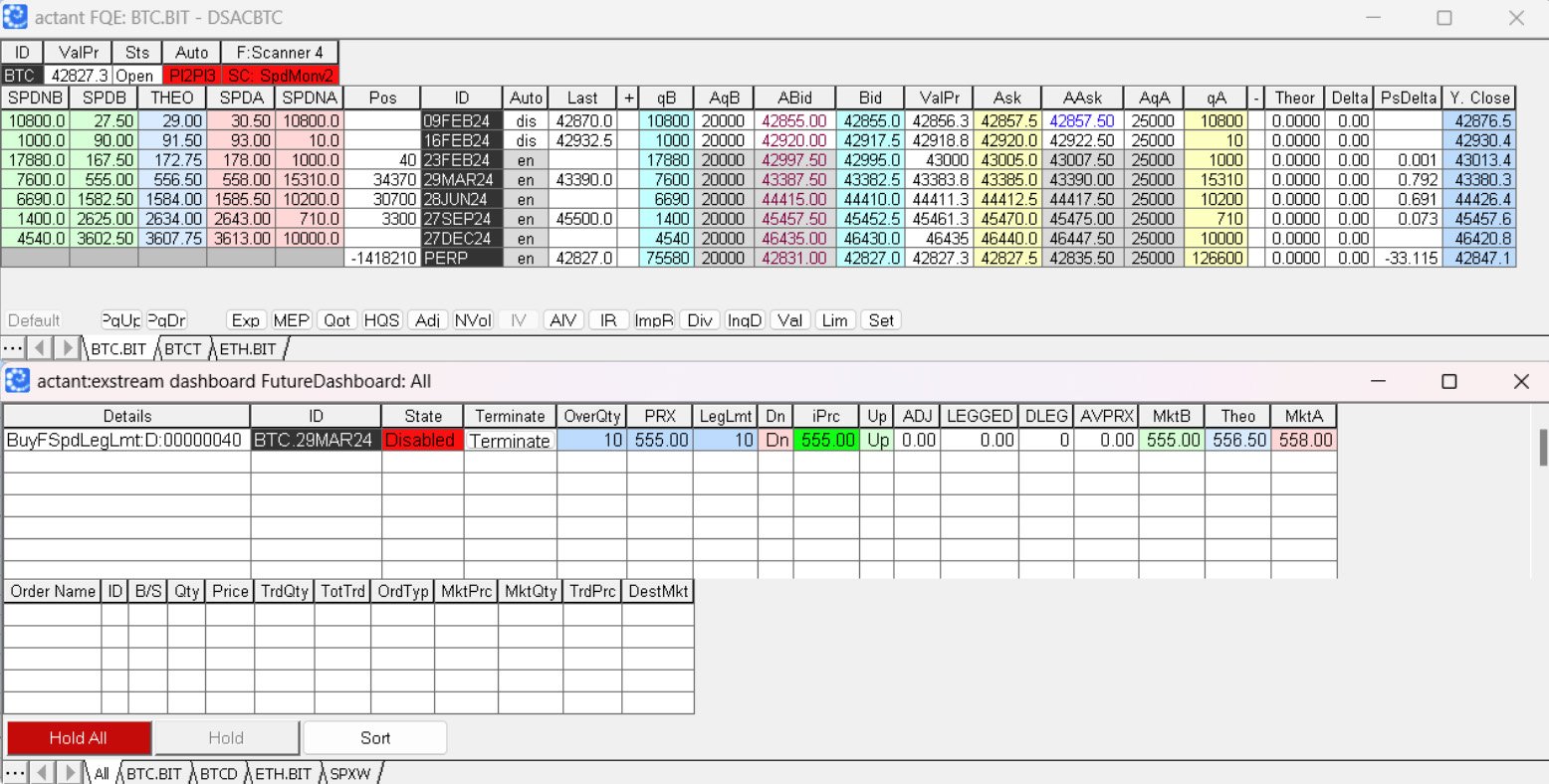

With Actant, you can create automated strategies using advanced algorithms to optimize execution by minimizing market impact, reducing costs, and maximizing favorable prices. Actant adapts to real-time market conditions to enhance execution quality. Smart orders provide Deribit traders with greater control, efficiency, and improved performance in complex market environments.

Delta1 Trading

Our new tool is designed to enhance Delta1 strategies with algorithmic functionality. Users can evaluate and execute perpetuals/futures spreads on Deribit or define them in a multi-asset basket. This not only allows for cross-instrument evaluation but also enables the identification of the best opportunity for execution. Once identified, a dashboard presentation allows for either standard click trading features or automated order initiation.

Are you excited to discover more advanced functionalities?

Contact us referencing Actant/Deribit and receive a discount on the first month of usage. Online demos are free.

Email us at [email protected]

AUTHOR(S)