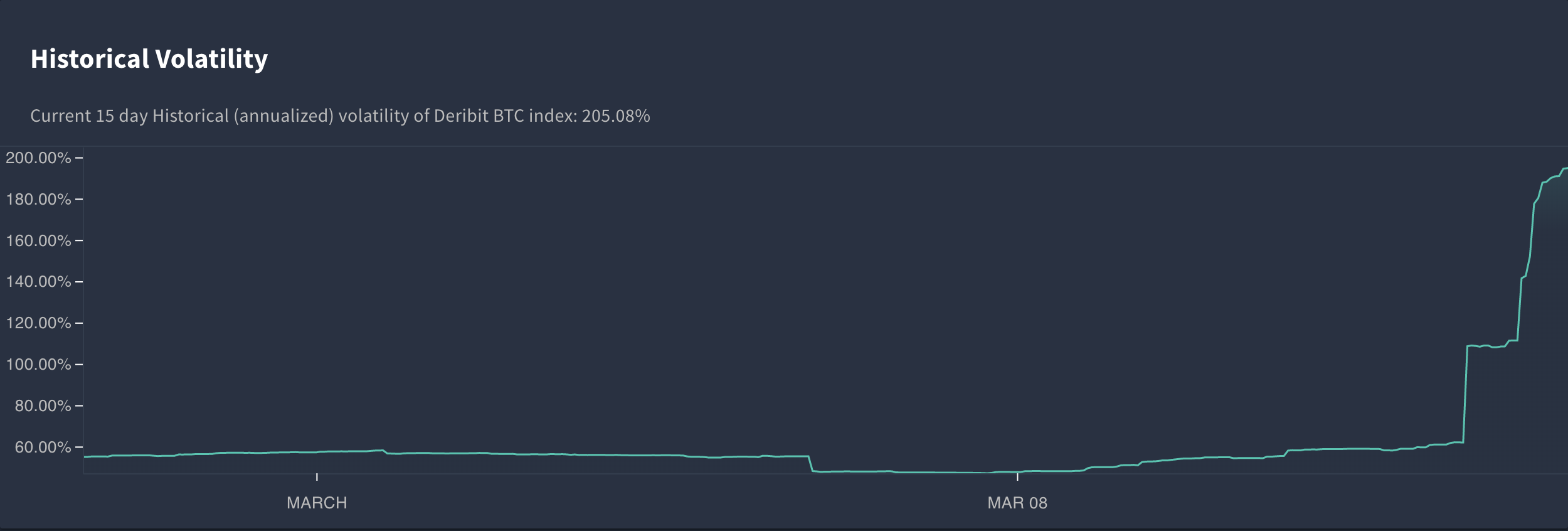

On March 12, BTC experienced a price drop of almost 40%. The fall continued into overnight trading when BTC reached its lowest value since March 2019 – USD 3,850.00. Even though crypto assets are known for their extremely volatile trading, bitcoin had not suffered such large daily loss in almost 7 years. This has been a test for the crypto derivatives market, which had not experienced a market situation like this before.

The last two days have been demanding for traders and exchanges alike. However, we are glad to say that Deribit was up to the task even though we did experience some issues. In the 24 hours, following the price drop, almost USD 3 billion volume was traded. Moreover, a new option record was reached, as 40k BTC contracts have been traded.

Crypto derivatives exchanges have been pioneering a new way of trading, and only at times like these, we can stress test the systems and risk models in place. Due to the increased volatility, some of the parameters got adjusted, and we would like to address these in more detail below:

Price Deviations

During highly volatile periods, Index Price, Mark Price, and Last Price can differ considerably, therefore, it is important to understand the differences between them.

Index Price is directly derived from a number of selected and trusted spot exchanges, and shows the current value of the underlying asset. The constituents and weight can be seen here.

Mark Price is used to value the derivatives contracts during trading hours. It is derived from the Index Price and is adjusted for the market activity. See the exact calculation in the example below.

Last Price is the last price at which a trade occurred for the given instrument.

Any rapid price move causes a mounting price pressure, however, derivatives prices are affected by this even more than spot market, as derivatives markets allow for far higher leverage. Therefore, during volatile periods more traders are unable to meet their margin calls and get liquidated. This is also what happened during this price drop. The market experienced overwhelming selling pressure, which was further intensified by liquidations on multiple markets, thus significantly decreasing the perpetual price.

However, due to risk management limits in place, Mark Price did not follow the market closely enough.

On Deribit Mark Price is calculated as:

1. The Index Price + 30 seconds EMA of (Perpetual Fair Price – Index Price).

2. Perpetual Fair Price is the Mid-Price 1BTC deep in the order book.

Additionally, the Mark Price was hard limited by Deribit Index +/- 0.5%, so under no circumstances, the Mark Price could divert more than 0.5% from the Deribit Index.

This hard limit was implemented to avoid market manipulation, and under normal market conditions, it is a measure that protects market participants, as it would limit unnecessary liquidations.

Additionally, the funding rate ensures that the perpetual is not trading too far from the index, keeping both prices in line with each other.

However, this was not the case during the last price drop, as the selling pressure was too large. Due to this, the perpetual was trading at a substantial discount to the BTC Index while Mark Price could not adjust appropriately due to the hard limit. This caused the margining approach to be sub-optimal. For this reason, we have now adjusted the calculation of the Mark Price and removed the hard limit. This change will remain in place until further notice. The funding rate limits remain unchanged.

Platform Lockdown

In the past, multiple derivatives exchanges have experienced flash crashes that have caused a cascade of liquidations and massive sell-offs. Reasons have been various – an external market manipulation, an internal error, etc. To avoid this from happening, Deribit introduced a form of circuit breaker. A measure often used in traditional finance, as seen in NYSE this week. A circuit breaker is a trading halt, that gets triggered by a certain price change, as set by the exchange. This is done to avoid massive sell-offs, and allow market participants to get up to speed with the market during highly volatile periods. At Deribit this price change was set at +/-1.5% Index Price move per second. It got triggered a few times during the night of March 13.

Given the extreme circumstances, we decided to temporarily widen the circuit breaker to +/-4.0% Index Price move per second. This was done to allow for as much continuous trading as possible, while maintaining some degree of safety.

Our risk management is monitoring the market and will adjust the settings accordingly.

Insurance Fund

The main function of an insurance fund is to ensure traders that they will receive a pay-out even if their counterparty goes bankrupt. This certainty is crucial for the efficiency of the market and traders’ trust in the exchange. Therefore, a sizable insurance fund is needed to add a layer of safety. However, too large insurance fund can signal an inefficient or too aggressive liquidation mechanism. At Deribit we have always tried to find the balance between efficiency and fairness. Our liquidation system ensured a slow and steady growth of our insurance fund, no socialized losses, and fair treatment to our clients. However, yesterday’s extreme volatility had a significant impact on our BTC insurance fund. The suboptimal Mark Price limitations contributed significantly to the drop in the insurance fund.

We are confident that the changes outlined above will prevent this from occurring again.

However, to maintain the trust of our clients and avoid socialised losses, we decided to strengthen the fund by adding 500 BTC from the company funds.

Market Liquidity

During extreme market conditions, it can be difficult for market makers to adjust their quotes instantly or to even maintain their quotes at all. Therefore, the quality of the books is always temporarily affected by price moves like this. It is the same for every exchange, market and instrument class traded – for crypto and traditional markets alike. Market makers need to continuously control their market exposure, and with such high volatility, it can be a highly challenging task. We would like to stress that these are normal effects of such events, and should be considered when trading high-risk instruments. To protect yourself from unnecessary losses, it is important to evaluate your risk profile and consider possible volatility when developing your strategy.

For more questions, feel free to turn to our community managers or follow our notification group. Our support management is looking into all the tickets received and is doing their best to answer and help you as soon as possible.

Moreover, we are very happy to see the increasing customer interest, as we believe that this is the best testament to our performance.

Thank you for choosing Deribit

AUTHOR(S)