The cryptocurrency market has been developing rapidly, now providing even more new financial instruments and opportunities for speculation. While the glory of the futures market is still intact, a new type of derivative gaining market favour is options, and they are breaking records.

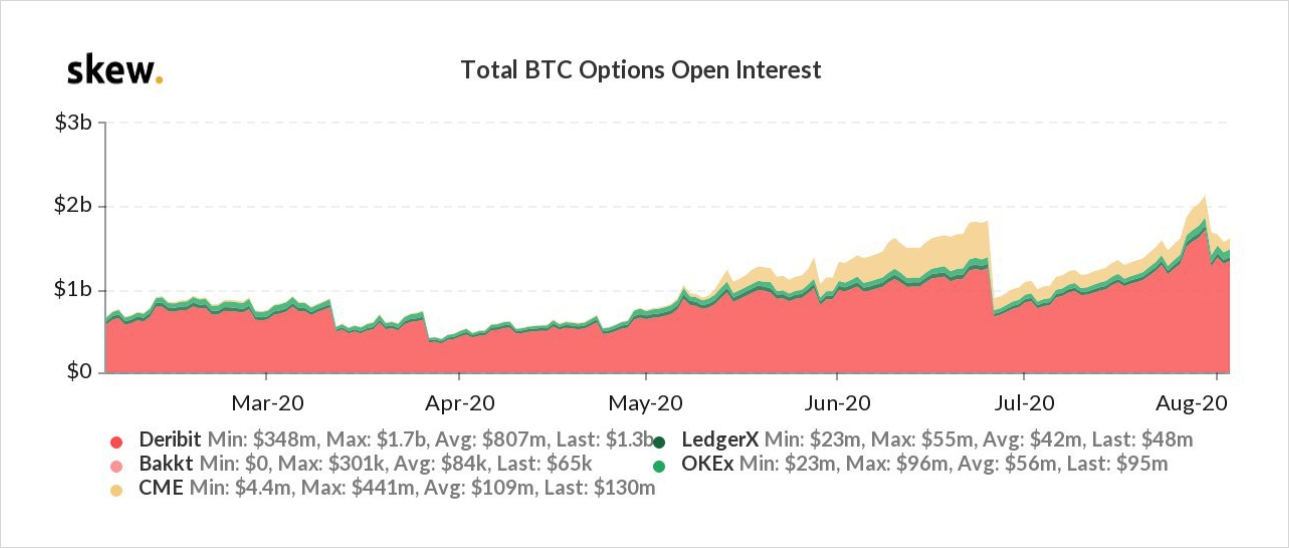

Interest in crypto options increased significantly after the extreme volatility on March 12, 2020. Since then, a continuous growth of open positions in options contracts has been observed on all exchanges supporting this instrument. Open interest has grown tenfold on the Chicago Mercantile Exchange (CME) alone, and in general, the BTC options market has grown by 50% over the past month, reaching a total OI of $2 billion, with more than 80% on Deribit.

Options are a classic derivative that came to the crypto market from traditional financial markets, where such derivatives play a key role due to their versatile nature.

An option is a complex financial instrument and, in this regard, has not yet gained widespread popularity among the retail traders. However, current statistics show that the demand for crypto products from professional traders and institutions is actively growing. Perhaps this rapid rise in interest in BTC options is due to the recent analysis by JPMorgan Chase, stating that the March crash was the first successful stress test for Bitcoin.

What is an Option?

An option is a financial instrument based on an underlying asset, in our case, BTC or ETH; it is a contract between a buyer and a seller, according to which:

- The buyer acquires a right (not an obligation) to buy/sell an asset at a certain point in time at a predetermined price;

- The seller pledges to buy/sell an asset at a buyer’s request.

Types of Options

An option may represent either buying or selling of the underlying asset (BTC or ETH in our case).

Call Option grants the option buyer the right to buy the underlying asset at a predetermined price.

Put Option grants the option buyer the right to sell the underlying asset at a predetermined price.

Accordingly, four types of corresponding transactions are possible:

- Buy a Call Option

- Sell a Call Option

- Buy a Put Option

- Sell a Put Option

All options have a strike price and a premium.

A premium is a price at which one buys an option and a strike price is a price specified in the option contract at which the option buyer must buy/sell the underlying asset at the time of contract expiry.

Such instruments open up new broad opportunities for speculation; however, due to their more complex structure, traders should be aware of their risk profile to find the most suitable strategy for their trading needs.

Options use cases

To better understand the mechanics behind the options contracts, let’s take a look at a simple example: you expect the price of Bitcoin (BTC) to be below $20,000 by the end of the year, while your friend believes that it will be above the mentioned level. The price of Bitcoin is hovering at around $11,000 at the moment. Your friend can go long on futures since according to his strategy, he will profit at any price above $11,000. However, your choices with using futures contracts are limited. However, you can take advantage of options! To implement your strategy, you can buy a put option contract with an expiration date of 12/31/2020 and a strike price of $20,000.

If the Bitcoin price is below $20,000 by the option contract’s expiration date, you will receive a profit, which will depend on the Bitcoin price at the time of expiration minus the premium paid.

And if the price does not meet your expectations, the option will never get exercised. In this case, you will incur a loss only limited to the amount of the premium paid.

Options strategies

Let’s take a closer look at 3 most popular options trading strategies that allow you to profit from various market situations – the bullish (price is rising), bearish (price is falling), and in flat (sideways market movements): Long Call, Bear Call Spread, and Short Condor.

Bull Market – Long Call

The Long Call strategy can be used in a bull market when the trader expects the underlying asset (BTC or ETH) to increase in price. This strategy is one of the simplest and consists of a single option contract – buying a call option.

The chart above showcases the price of the underlying asset on the x-axis and profit/loss on the y-axis. The blue line shows the profit dependence on the price of the underlying asset at the expiry, and the red line represents the same dependence at the current moment.

In this case, the trader’s potential profit is unlimited, however, the loss is limited only by the premium paid for the option.

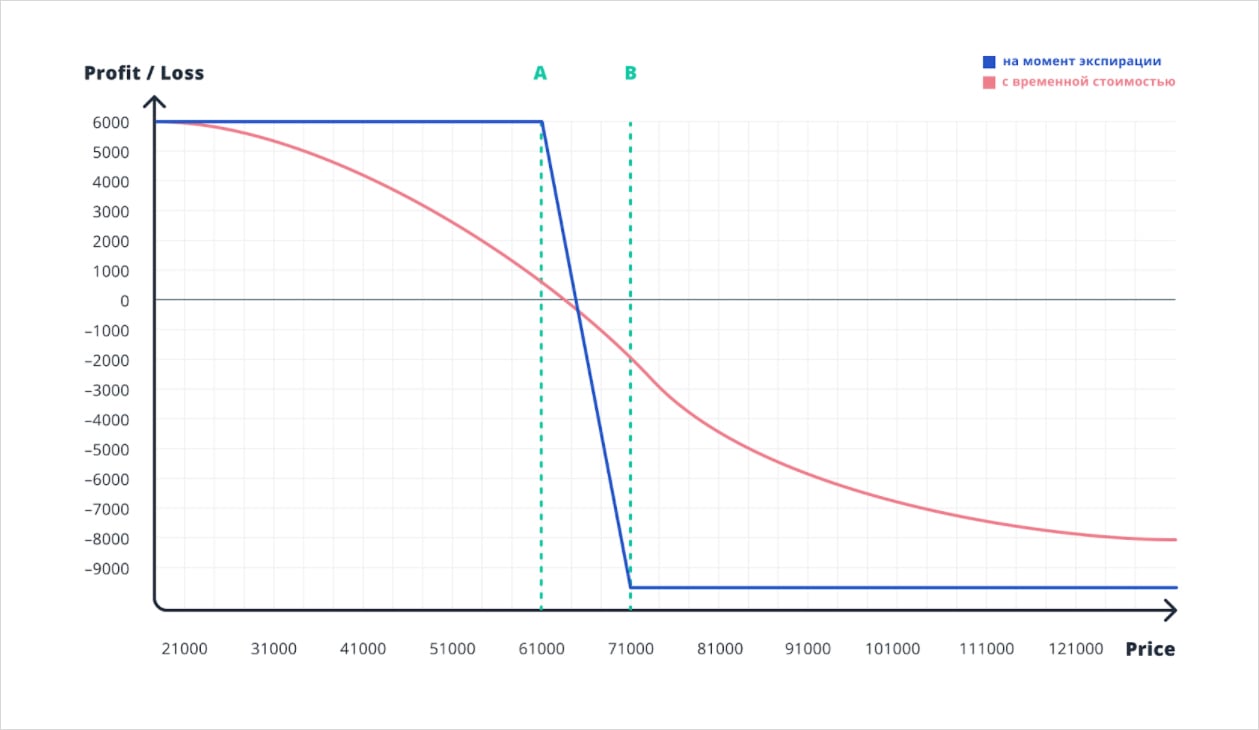

Bear Market – Bear Call Spread

A bear call spread is a useful tool in a bear market when the underlying asset price is expected to fall moderately. This strategy is created by selling and buying call options with the same expiry but different strike prices.

This strategy would be most profitable if executed approximately 30 days before the expiry, as it would allow to best capture the value of accelerating time decay. Moreover, high volatility associated with ETH and BTC would allow the trader to profit from a higher premium, in comparison with lower volatility assets. For this strategy, the premium received from selling the call option is the main profit driver. The long call, however, will mitigate the high risk of selling naked calls.

Importantly, traders should make sure that both legs of the strategy ar the same size, as short calls without the protection of long calls can significantly increase the risk of the strategy.

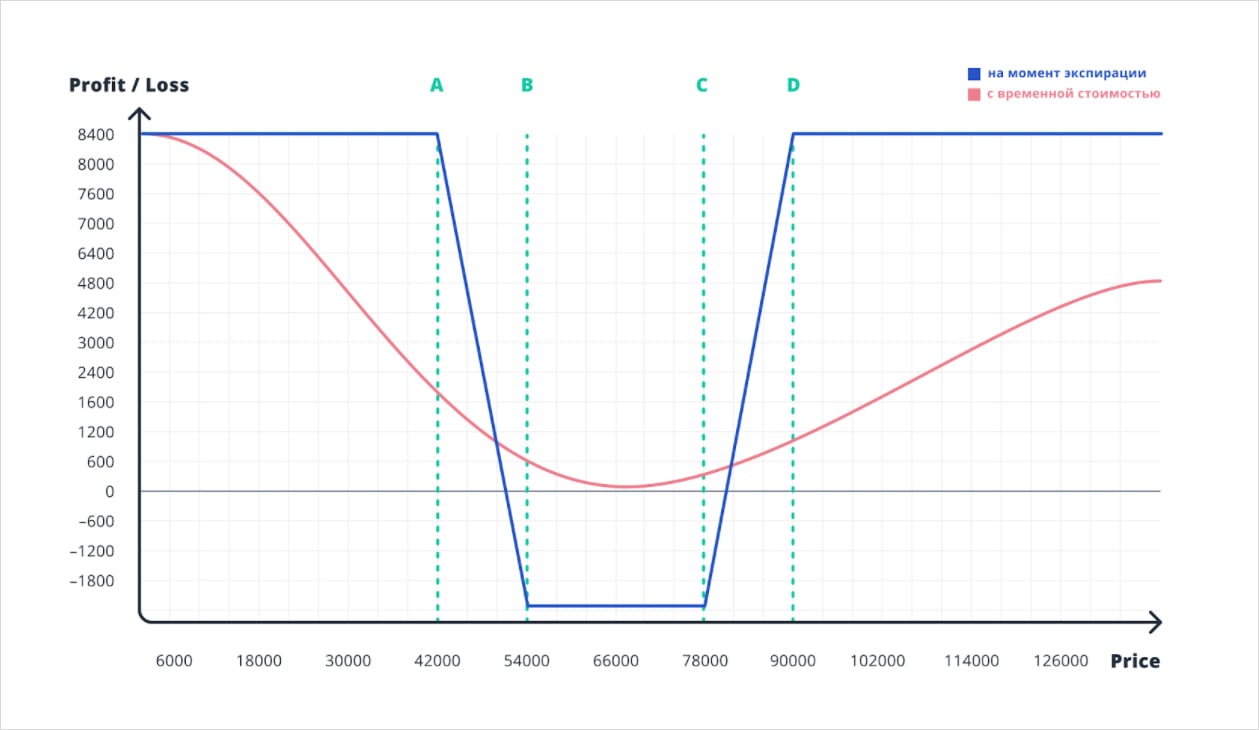

Increased Volatility – Short Condor

This strategy is created using four options contracts with the same expiration date, but increasing strike prices: selling put A, buying put B, buying put C, selling put D.

Selling a put condor allows you to profit from the underlying asset price fluctuations while limiting losses that may be caused by slight price deviations. This is a strategy with a negative vega, so it should be established during a flat market with volatility expected to increase.

The profit is limited by the net premium received and is maximized if, at expiry, the price of the underlying asset is below the point A or above the point D. Losses are limited by the sum of premiums of options B and C, minus the premium of options A and D. This strategy can be used when a trader expects price swings of the underlying asset, however, is not sure of the direction.

However, due to 4 legs in the strategy, it can turn to be quite costly to implement, therefore, traders should determine the most beneficial timing.

These few examples show how using various options strategies can help traders to profit from various market situations, adjusted for their risk profile. However, for traders new at options, this at first can be a confusing and time-consuming process.

Benefits of Automation

3Commas Option Bots allow you to fully automate the implementation of such strategies, monitor the market dynamic, track the results and make necessary adjustments. All you need to do is select the underlying asset, expiration date, ready-made strategy, and the maximum volume of funds to participate in trades. Then, using the sliders, determine the trend and the expected volatility or strike price of the option.

3Commas allows you to implement the most profitable trading strategies on Deribit – quickly and with ease. This allows traders to earn money in situations where other financial instruments fail.

AUTHOR(S)