Summary: Bitcoin will likely consolidate within the 40,000 to 45,000 range for the rest of the year. Although we have heard numerous S-1 filing updates, there have yet to be any public comments from the SEC that an approval is likely. Next week, the CPI print on December 12 and the FOMC meeting on December 13 will be pivotal. We would need non-farm payrolls to break below 100,000 to have a meaningful positive effect on the price of Bitcoin. Selling a 45,000 strike call for the end of December expiry and buying a 45,000 strike call for the January expiry (calendar spread) would be a prudent way to keep upside exposure alive for any potential SEC Bitcoin Spot ETF approval (after December).

Analysis

Bitcoin will likely consolidate within the 40,000 to 45,000 range for the rest of the year without credible news that the SEC will approve one or several Bitcoin Spot ETFs in January. There appears to be no urgency for SEC officials to approve an ETF ahead of the low liquidity Christmas period. Although we have heard numerous S-1 filing updates, there have yet to be any public comments from the SEC that an approval is likely.

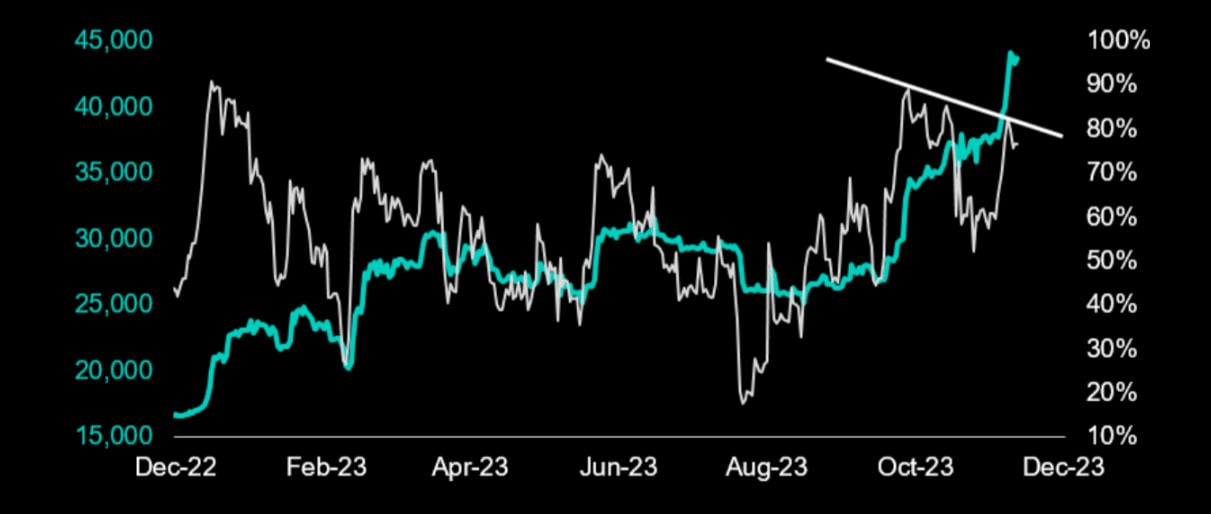

Exhibit 1: Bitcoin (green) vs. RSI (white) – small divergence as technical are weaker than in Oct

Earlier in December, the SEC published that the final deadline for rebuttal comments by Bitcoin Spot ETF applicants would be January 5, 2024, followed by a potential SEC response between January 5 and January 10. We would expect a range-bound Bitcoin price action until then.

Next week, the CPI print on December 12 and the FOMC meeting on December 13 will be pivotal. Still, we assume traders will prematurely head into their Christmas holidays as the year has been successful for tech and crypto investors. While we expect inflation to decline during the next two quarters, we would need to see a fall below 3.0% (last 3.2% YoY) to reawaken the animal spirits and for Bitcoin to rally. Similarly, Fed Chair Powell will likely try to stay neutral instead of repeating his remarks in mid-October that bond yields have done the Fed’s job. Our base case scenario is that volatility will likely decline.

Even for tonight’s employment data, the options market is pricing in a Bitcoin move of only +/-2% over the subsequent 24 hours, a relatively low volatility event. However, while we saw a strong positive reaction on the back of weaker job openings, we would need non-farm payrolls to break below 100,000 to have a meaningful positive effect on the price of Bitcoin.

Of course, a low liquidity environment, such as weekends and Christmas holidays, can always cause adverse effects, and we would, therefore, structure trades where the downside is limited.

Previously, we pointed out that the gamma from the open interest 40,000 strike calls would likely pull markets higher, and once the level was broken, we saw aggressive hedging and a ramp-up in liquidations. Anecdotal evidence suggests that miners had sold 40,000 strike calls, which needed to be hedged once Bitcoin reached that level. But as those positions are now neutralized (delta-hedged), we suspect markets could consolidate.

If this is the most likely scenario, then selling a 45,000 strike call for the end of December expiry and buying a 45,000 strike call for the January expiry (calendar spread) would be a prudent way to keep upside exposure alive for any potential SEC Bitcoin Spot ETF approval (after December) but would of course neutralize our upside if any rally would occur from now until the end of the year.

Financing the January call by selling the December call lowers our call price from $2,950 (for the January 26, 2024 call with a strike level of 45,000) to $1,600 as the December call with the same strike trades at $1,350 (Buy January for $2,950 and Sell December for $1,350).

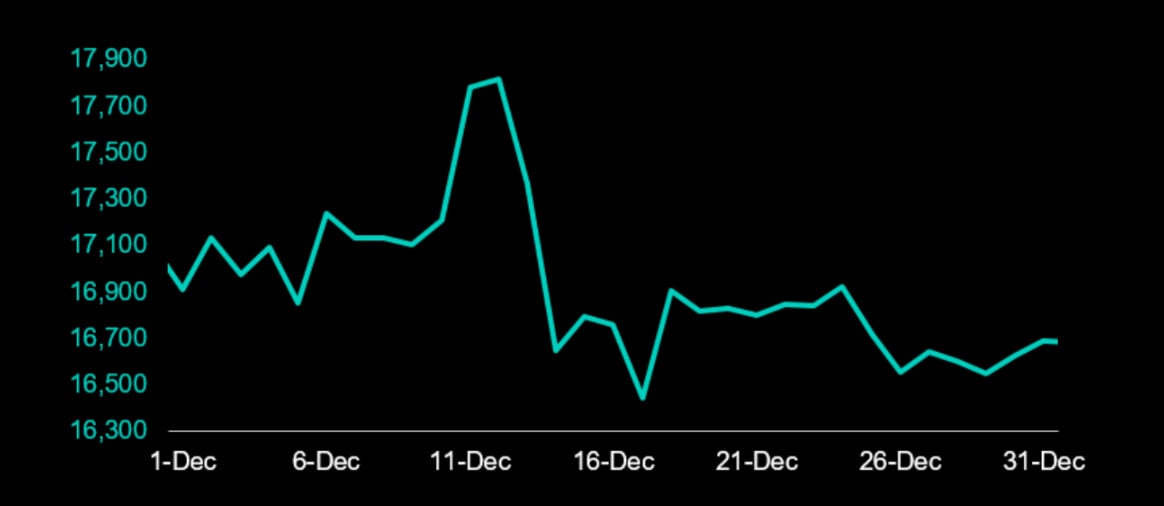

Exhibit 2: Bitcoin (green) – every period is different but Bitcoin consolidated after Dec 12, 2022

We predicted the rally’s start in January as our macro models suggested that inflation had peaked. But it took until mid-October for Fed Chair Powell to acknowledge that inflation had sufficiently declined and that the rise in bond yields had done the Fed’s job of tightening the cost of capital for the economy. Bitcoin took those comments from Fed Chair Powell as a risk-on signal, setting up the market for another potential rally next year. But as traders, we also need to manage our risk in periods of potential consolidation; we believe the next few weeks could prove challenging.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)