The skyrocketing price of ETH seems to be caused by a gamma squeeze, but judging from the available data, the current price increase still lacks sufficient support.

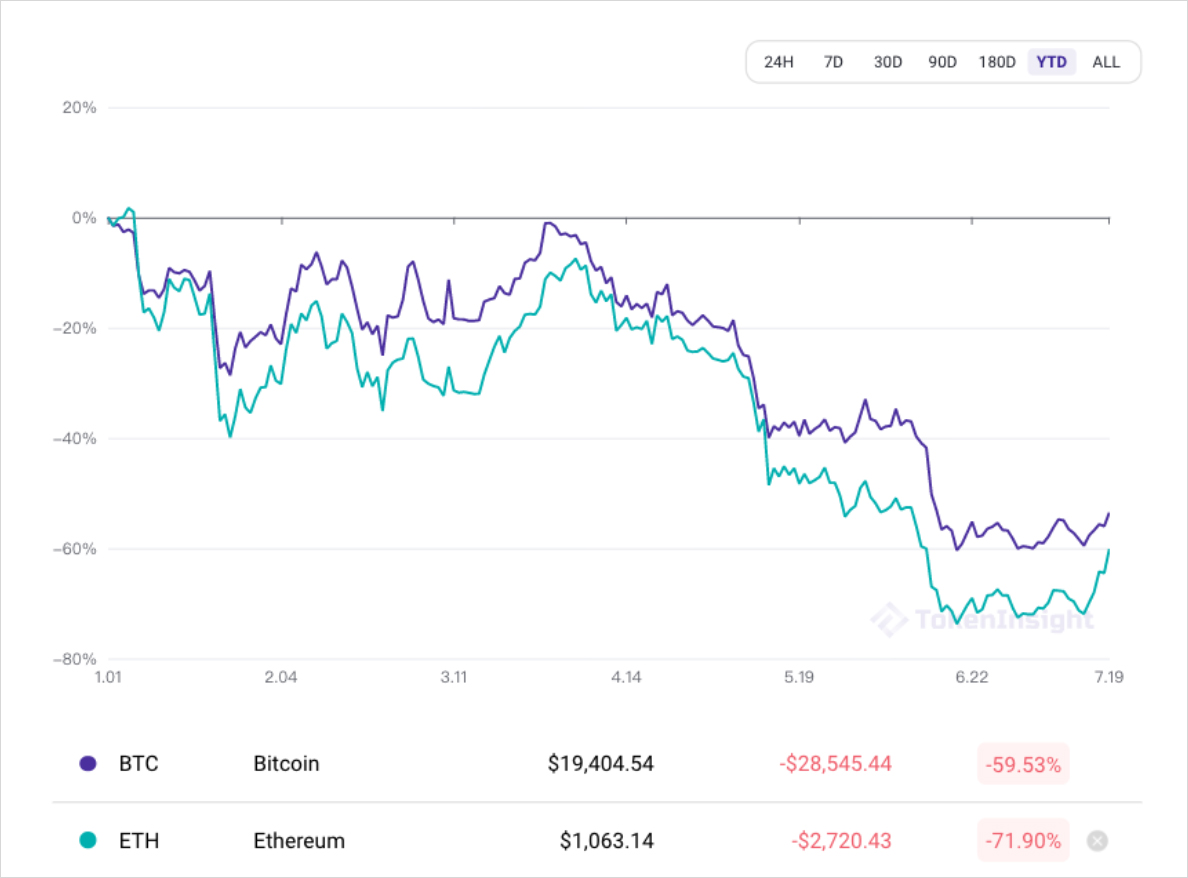

Under the influence of the highest CPI and the expectation of over 80% possibility of a 100 basis point interest rate hike in July last week, the bearish sentiment in the crypto market has dominated the market steadily, and the price of ETH was hovering at the edge of $1,000. Many investors estimate that the market performance of ETH will be difficult to improve until the Fed publish its policy.

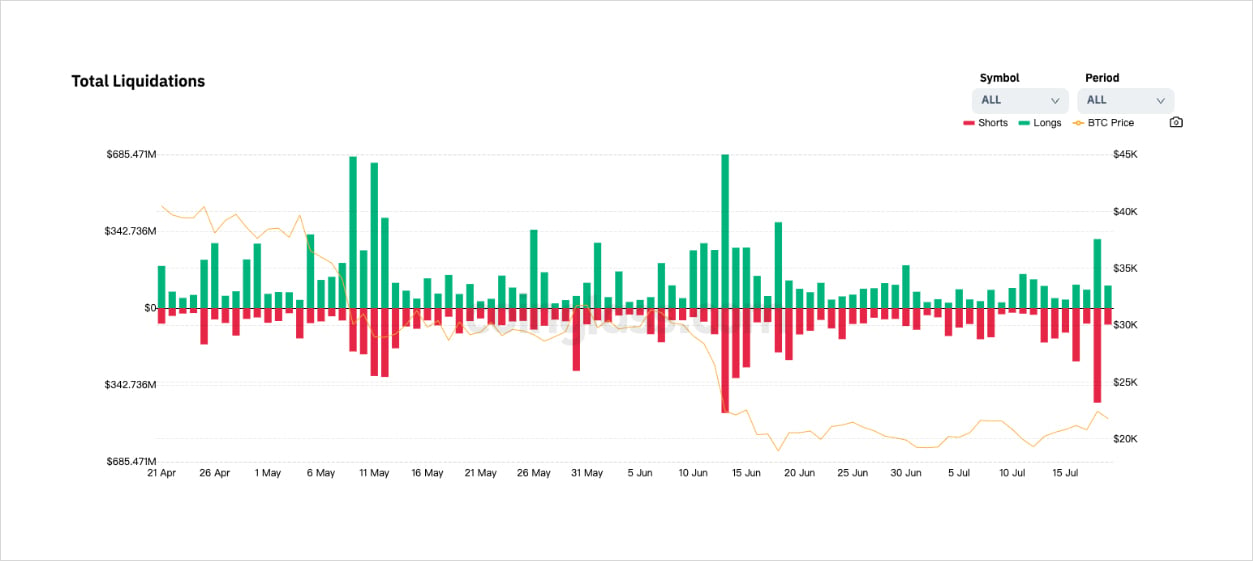

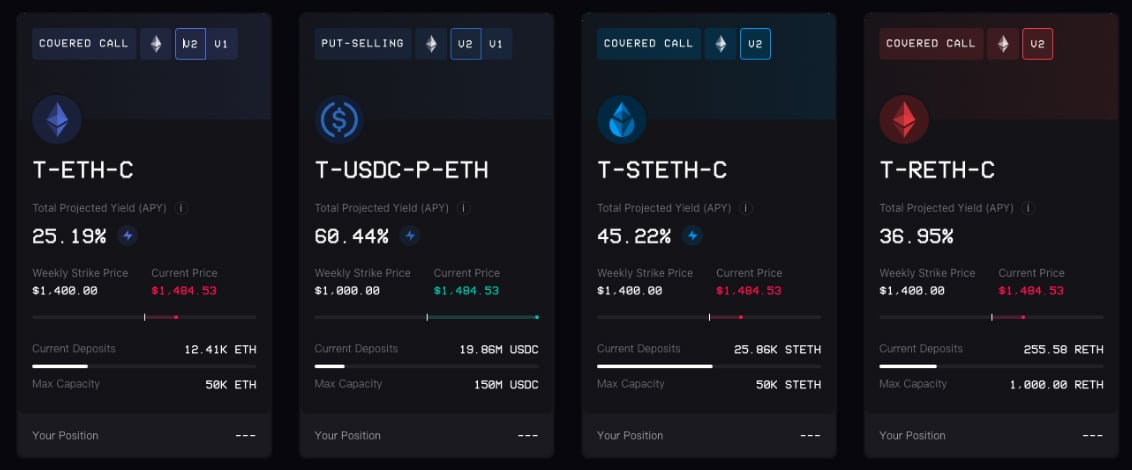

However, the price of ETH saw an unexpected surge over the weekend. In four days, the price of ETH rose by more than 40%, while the price of BTC rose by less than 10%. The short sides on derivatives groan: more than $600 million in Delta 1 contract shorts were liquidated, while Ribbon Finance, one of the well-known sellers in the OTC crypto options market, added an at-risk position in ETH options with a notional value of $57 million overnight.

Compared with the “bull market” in the crypto market, other risk asset markets have not significantly followed the performance of crypto assets. U.S. stocks remained low and fluctuated, and emerging market indexes were not out of the falling interval. The above seems counterintuitive: typically, significant increases in the price of risky assets occur during periods of easy liquidity and rarely during tight liquidity; this is especially true for riskier crypto assets.

The emergence of divergence often means a significant change in the fundamentals of an underlying asset, or there are factors in the market that can manipulate prices to a certain extent. Considering that BTC and ETH are not stock indices, it is not impossible to exert a significant impact on prices when liquidity is poor and certain conditions are met.

Benefiting from the ample derivatives in the crypto market, it has become a common method for many institutions to influence the spot market through derivatives. For example, by shortening some specific exchanges’ perpetual contracts, the “directional blasting” of the index price is realized. However, as the crypto market continues to improve, so too are the ways to influence crypto assets, one of which is gamma squeeze, widely known in the 2021 GME event.

Unlike the previous methods, gamma squeeze has relatively stricter implementation conditions, requiring the cooperation of various derivatives and spot products, which is more difficult. But once it is successfully realized, investors can obtain rich non-linear returns with the blessing of derivatives.

Gamma squeeze usually needs to meet the following conditions (indispensable):

- Market bearish sentiment continues to dominate,

- The underlying asset generally has poor liquidity,

- The underlying asset has a relatively complete derivatives market,

- Certain bullish signals can guide market sentiment.

Based on the above conditions, let’s review what happened to ETH recently.

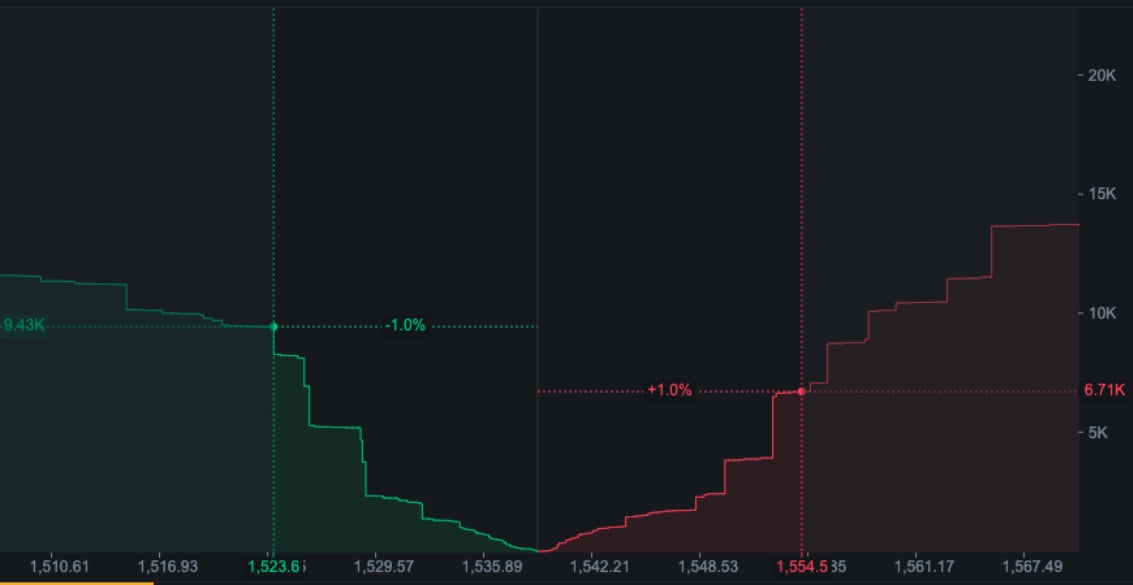

The price of many crypto assets has fallen by more than 70% year-to-date amid the Federal Reserve’s continuous rate hikes. With the drop in price and the continuous shrinking of liquidity, investors’ enthusiasm for trading has generally declined. The depth of the spot market on various exchanges has gradually bottomed out: on exchanges such as Binance, it only takes a few thousand ETH’s to push up spot prices by more than 1%.

Since the beginning of 2022, investors’ enthusiasm for ETH options trading has gradually increased. In the Deribit exchange alone, the open interest of ETH options contracts has been maintained at more than 2 million contracts for a long time and even exceeded 3 million contracts sometimes. Sufficient options holdings can already significantly impact the crypto market; this is the premise of gamma squeeze.

Time to early July. At this time, “everything is ready” in the crypto market. The catalyst for the market’s bullish sentiment also happened to come. The probability of the Fed raising interest rates by 100 bps has decreased, which has made the risk appetite of risk asset investors return, and the arrival of ETH Merge has further triggered market sentiment; a gamma squeeze began.

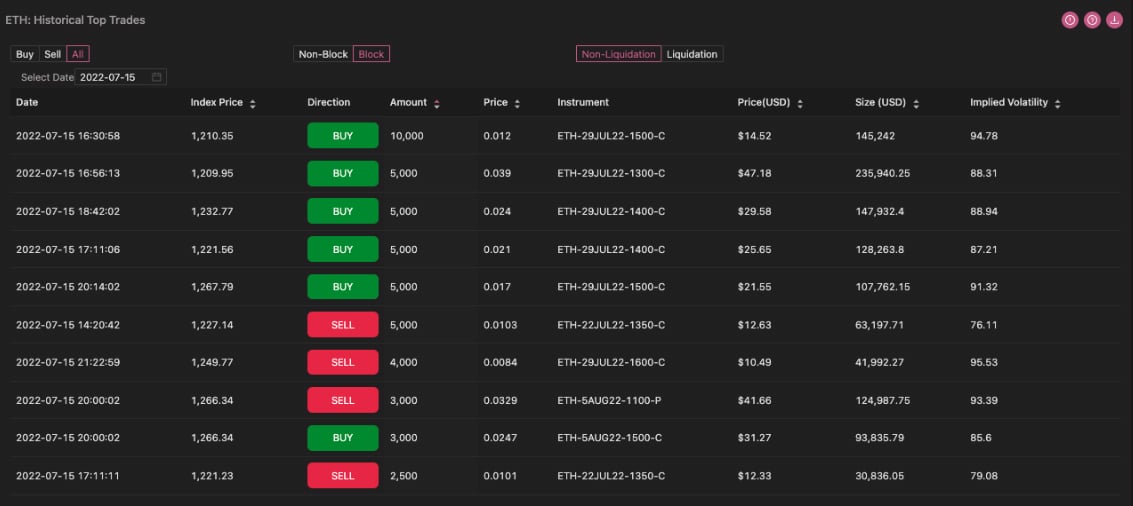

Around July 16, block traders began to take action, buying a large number of short-term ETH out-of-the-money options that expired in the current week and the following week. The maximum single transaction amount even reached 10,000 contracts, and the premium was over $100,000.

For market makers, they need to hedge their risks by buying spot or long perpetual contracts when selling call options to maintain risk neutrality. However, due to the limited market size of the exchange, the massive buying behavior pushed up the price, making some options go from out-of-the-money to in-the-money; this brought additional risk exposure. Market makers had no choice but to buy again; as a result, the price of ETH began to skyrocket.

At this point, retail investors noticed the price movement and began to speculate on whether it was due to the positive impact brought by ETH Merge and traded on it. Under the premise of the Federal Reserve to appease the market, the risk appetite of retail investors has increased, and a large number of options and spots have been followed to buy, which has brought further pressure on option sellers and market makers. As a result, ETH’s gamma exposure has reached a new historical record high.

As of July 19, ETH’s Gamma exposure has stabilized near 1 million, which means that if the price of ETH rises by 1%, the market maker will have to buy an additional $1 million worth of ETH spot or equivalent perpetual contract positions to hedge the exposure from selling the call option. Moreover, the market maker’s buying behavior will further stimulate the price increase.

However, as prices rise, the ability of investors to push prices through gamma squeeze tends to diminish. Due to the soaring demand for call options, the price of options has risen rapidly, and the price/performance ratio has decreased. On the other hand, as prices rise, liquidity conditions improve, and the cost of raising ETH prices through options, perpetuity contracts, and spots increases step-wise.

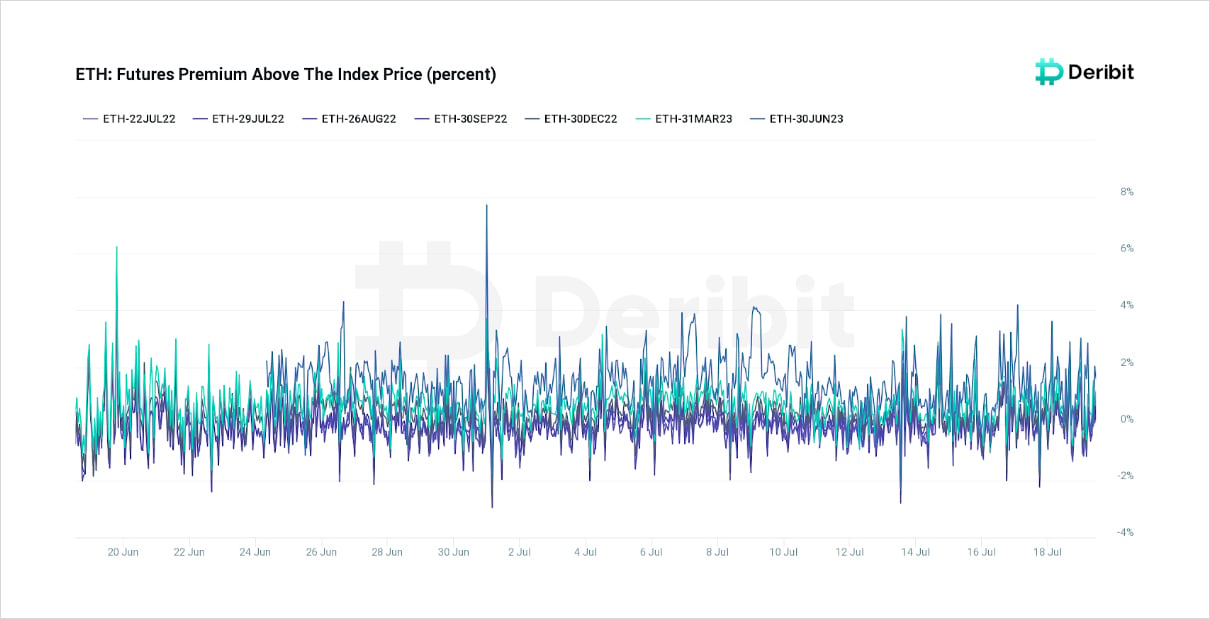

ETH’s implied forward yield has not changed significantly from last week as liquidity has not improved at the macro level, which means that the overall bid ceiling for investors in the current situation is still relatively low. As buyers and sellers balance out, prices and gamma exposure remain elevated, creating a “peculiar and interesting” steady status in the bear market.

There is no doubt that this steady state is temporary. With the arrival of delivery, the release of margin and hedging positions will bring considerable selling pressure. The positive delta of nearly 90,000 ETH has accumulated in the options contracts expiring on July 22 alone, which is comparable to the quarterly contracts expiring on September 30. The selling pressure after delivery can be imagined.

We are not sure that spot prices can get enough support ahead of delivery day, but it’s safe to say whether prices turn down or up is relatively favorable for volatility bulls. Taking into account the imminent Fed rate hike, long volatility is still one of the somewhat more feasible strategies.

AUTHOR(S)