BTC Dips Below 30k Ahead Of Heavy News Week

Bitcoin’s (BTC) recent price instability has sparked concerns for the bulls, given that a swath of positive news failed to bolster the price above the 29.5/30k key support.

Even as we’ve had further evidence of softer US inflation, and rising institutional adoption by Blackrock’s Bitcoin ETF application, BTC’s price hasn’t significantly improved.

In fact, earlier this week, the 29.5/30k support was lost. However, the weekly technicals are still pointing at a dip that represents a solid buying opportunity if support levels at 28k and 25k are potentially retested. The upcoming halving event and the broader macroeconomic backdrop should help.

The broader crypto market, excluding BTC and Ethereum (ETH), also shows potential for growth as long as the path towards more certain regulation clears up. Furthermore, Hong Kong’s acceptance of crypto might boost engagement from Asian financial institutions.

Upcoming US macroeconomic events like the FOMC meeting, GDP release, and PCE report are on our radar this week as well as other central bank meetings from ECB and BoJ. Traders will be keen on the FOMC’s forward guidance amidst decreasing inflation, which promotes the soft-landing narrative. As the correlation between BTC prices and stock markets diminishes, BTC is less likely to be affected by these events though.

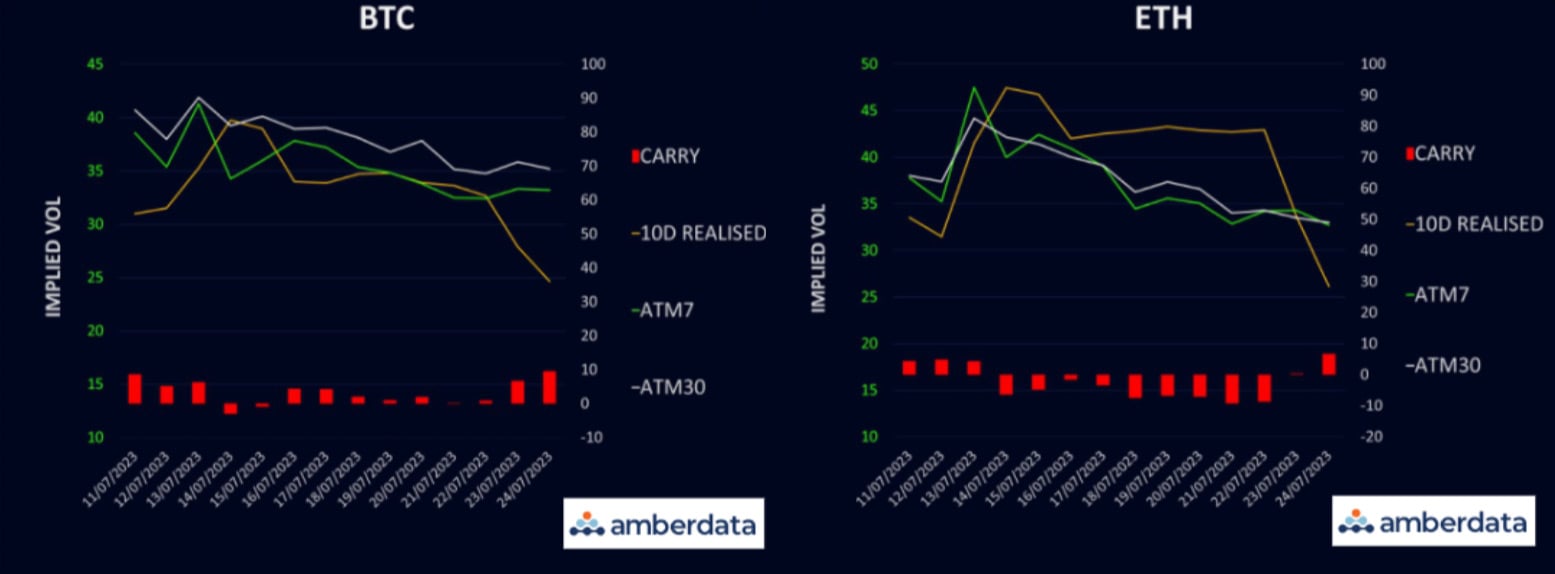

Realized Vol Near Historical Lows

Last week, we saw the volatility in cryptocurrency decrease significantly, with the prices gravitating towards recent averages, undisturbed by any notable macroeconomic shifts. Both Bitcoin (BTC) and Ethereum (ETH) have recorded a 10-day realised volatility of approximately 25%, nudging quite close to historical lows.

In step with this, the anticipated volatility too had a bit of a tumble, losing about five vols over the week, making it a bit of a task to hold onto gamma. Even though implied volatility dipped, carry still remains positive at about 7-10 vols. That’s around median levels, providing ample premium to coax gamma sellers.

This week sees the expiration of the 28th of July, where about 30% of BTC and 25% of ETH open interest will be rolling off. The gamma positioning has lengthened as spot prices have trickled lower, which is partly why we’ve seen vol lower on this dip in spot price despite breaking the 30k support zone.

Term Structure Shifting To Lower Levels

The Bitcoin (BTC) term structure is shifting downwards, becoming slightly steeper in contango, primarily at the front end. This is driven by the low realized volatility pushing down the front of the curve. However, even the back end is succumbing as option flows are dwindling, with spot prices failing to make significant gains.

The Ethereum (ETH) term structure has taken a more considerable hit this week, as it too failed to gain traction, and the realized volatility has dwindled. The August and September expiries have fallen by about 6-7 vols, which, considering the absolute low vols, is quite a tumble. The back end is also down, but to a lesser extent, falling by about 1-2 vols.

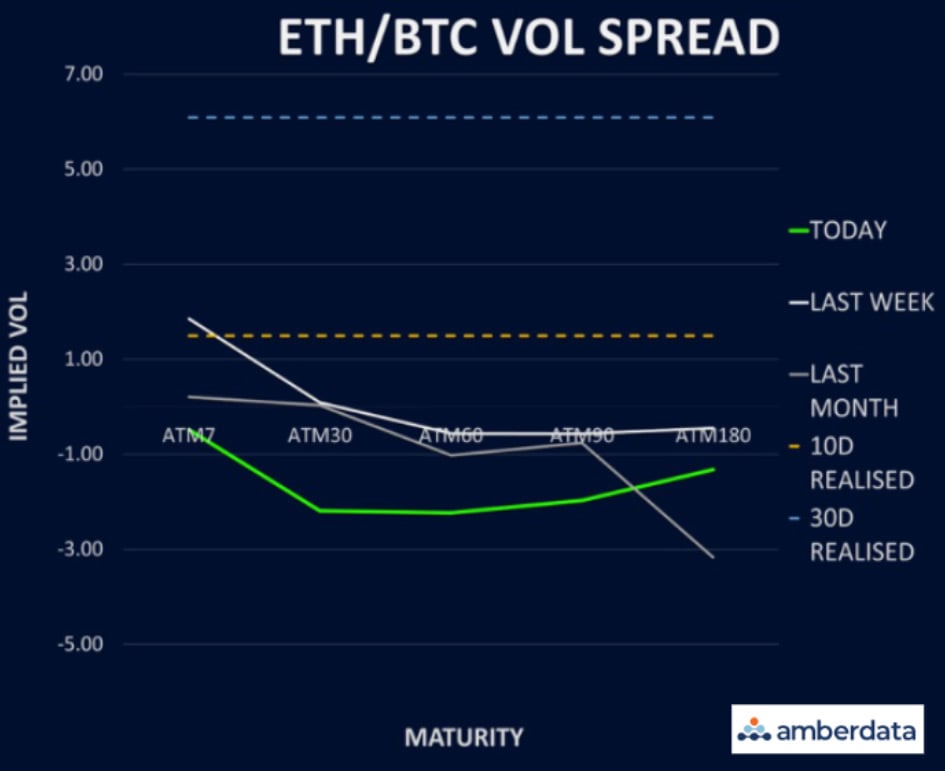

Relative Value: Vol Spread Shows Shift In Sentiment

The volatility spread between Ethereum (ETH) and Bitcoin (BTC) is decreasing, dipping below zero, as the ETH/BTC spot loses steam and Ethereum’s volatility faces pressure. The rapid return of this spread below zero indicates a shift in sentiment within the crypto options market. The expectation now is that Ethereum’s volatility won’t surpass Bitcoin’s in the foreseeable future.

Currently, it appears the optimistic outlook for crypto in the coming year is primarily focused on Bitcoin, considering institutional acceptance and halving, rather than further innovation within the Ethereum ecosystem. However, we do anticipate that once Bitcoin starts a robust bullish trend, surpassing the 40k mark, the narrative is likely to change. This should shift focus to altcoins, led by Ethereum. In light of this, we believe owning long-term upside in Ethereum could be beneficial.

Skew: BTC Back-End Call Premium Prevails

This week, the Bitcoin (BTC) skew term structure has become steeper. Front-end puts have gained momentum as BTC dipped below 30k, as expected. However, the back-end call premium remains and has slightly expanded. We’re observing a 0.8 vol put premium on a 1-week skew versus a 5 vol call premium on a 6-month skew. This situation suggests a clear message from the options market to the recent sell-off – dips are for buying, we will finish the year higher!

Ethereum (ETH) skew follows a similar pattern, with a deepening front-end put skew. However, most of the ETH skew curve now resides in put premium, except for the back-end from 6 months onwards. The weekly skew stands at 3 vols for puts, 3-month is flat, and 6-month is 2 vols for calls.

The skew differential introduces a considerable discount for ETH longer dated calls in comparison to BTC calls. Although we’re generally cautious about shorting BTC upside, Ethereum appears to offer fantastic value for those bullish in the long run.

Option Flows And Dealer Gamma Positioning

Option volumes took quite a hit this week as spot prices trickled lower. However, flows remain tipped to the upside, with outright calls bought for 28 July and 4 August, or being rolled over.

Ethereum (ETH) options volumes have also relaxed following last week's surge, but still with a substantial skew towards bullish trades. Large outright calls were bought for December 2023 and March 2024 at 2300 strikes.

Bitcoin (BTC) dealer gamma has remained largely flat this week, as the principal short strike at 31k has decayed, and dealers are long the local strikes around 29k. This light gamma positioning doesn’t seem to be having a significant impact.

Ethereum (ETH) gamma positioning has gradually grown longer as the 1900 strike becomes sizeable again. We don’t anticipate as much impact as the last expiry, but there seems to be an increase in overwriting flows, potentially making it challenging for Ethereum to surpass 1900 in the near term.

Strategy Compass: Where Does The Opportunity Lie?

Whilst we agree that BTC is firmly in the driving seat for crypto markets over the next 3-6 months, we still think ETH, being a deflationary asset, will see some resurgence early next year. Long dated call options look very cheap from a historical perspective and whilst gamma is not performing in the current market environment, a lot can change in a year.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)