This week, Bitcoin made a new yearly high, reflecting strong market expectations of an imminent approval for a spot ETF. The rise came as a reaction to solid indications that Blackrock’s ETF proposal could soon be approved.

Notably, the uptrend is supported by persistent, yet moderate, buying pressure. Trading volumes in both spot and futures markets have receded, and futures data shows comparatively subdued open interest and funding rates vs previous pump episodes, even as Bitcoin breaches key thresholds.

Furthermore, statistics from Glassnode reveal a sustained reduction in Bitcoin supply on trading platforms since June, reaching new multi-year lows. This indicates a decrease in selling activity.

Analyzing market dynamics, the current conditions imply a more stable environment than former periods where resistance was hit, signaling it is ready to enter a fresh bullish regime from a technical standpoint. Overall, this paints a promising picture for BTC.

It’s also worth noting that BTC keeps dismissing other macroeconomic or geopolitical developments this fourth quarter, with the anticipated spot ETF as the only narrative to act as a catalyst.

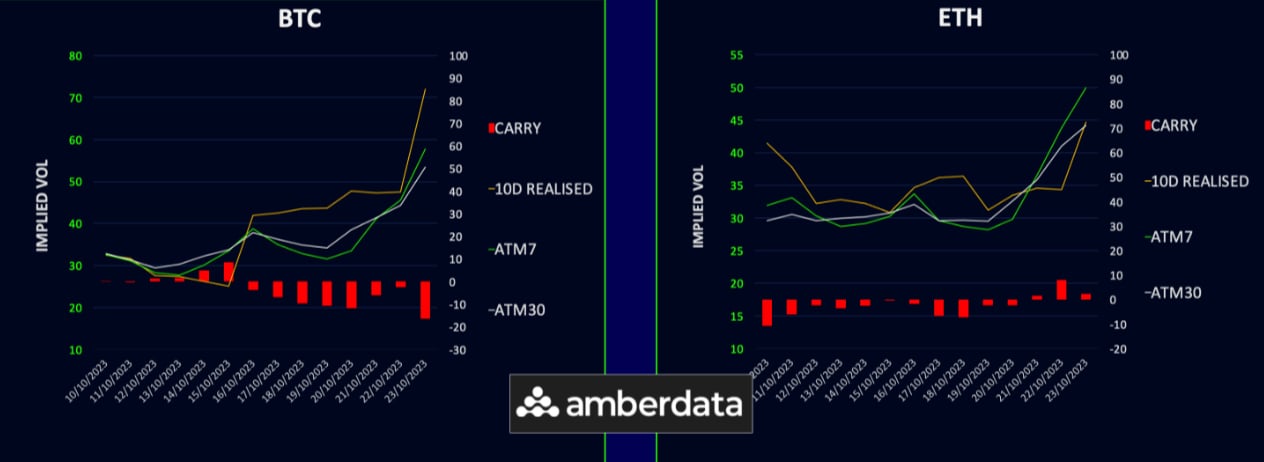

Realized Vol Explodes as BTC Hits New Yearly Highs

All signs point to the likely approval of Blackrock’s BTC spot ETF, a move driving substantial buying pressure and pushing Bitcoin’s to $34,000-35,000.

Bitcoin’s realized volatility has sharply risen, reaching the 70s, serving as a stark reminder to those with short gamma positions of the inherent risks in shorting crypto vol. Meanwhile, Ethereum (ETH) trails, registering a less pronounced increase and a maximum realized volatility of 45%.

The impending ETF approval has predictably influenced implied volatility, with a notable uptick in 1- month maturities, surging by 15-20 vol points, and weekly volatilities have doubled over the past week. This rapid revaluation of crypto vol in less than a week raises questions about the re-entry timeline for gamma sellers, particularly following likely liquidations.

The current negative carry in Bitcoin might deter sellers until more stable market conditions prevail.

BTC Term Structure Catches a Huge Bid

The BTC term structure is experiencing a significant surge, particularly at the front end. Volatility for the 03 November to 29 December expiration dates rose approximately 20 points. Post-March 2024, the movements are smaller yet substantial increases in vol. Notably, the curve is nearly flat, hovering in the high 50s, starting from 03 November.

ETH term structure mirrors these volatility patterns, although the spot price hasn’t risen as sharply as BTC’s. Front-end volatilities have increased in the range of 15 vol points, while the longer end recorded a 7-point climb. However, a noticeable trough exists in the ETH term structure for the 1-2 month expiration, likely attributable to a history of extensive call selling in this period.

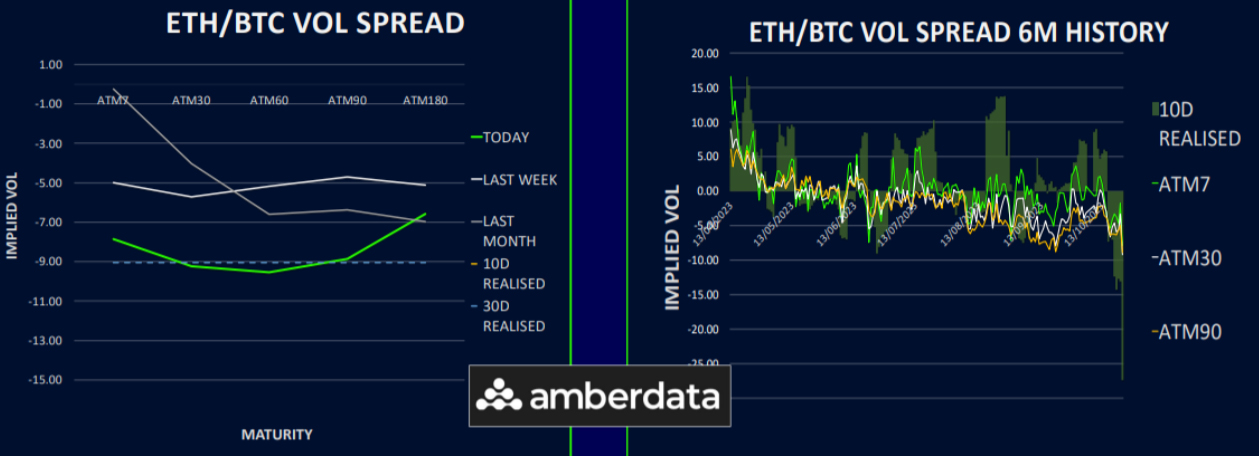

ETH/BTC Vol Spread Deeper into BTC Premium

The volatility spread between ETH and BTC is further widening in favor of BTC, showing a disparity of approximately 10 volatility points at its peak.

The spread in realized volatility has reached unprecedented levels, with BTC’s 10-day realized volatility surpassing ETH by nearly 30 points.

Market speculation surrounding the BTC spot ETF approval is intensifying, and with Bitcoin’s price stabilizing around $35,000, attention is predicted to shift back to ETH eventually, although this could take several months.

Additionally, the market must consider the potential reactions of significant call overwriting parties, who have likely been burnt due to recent market movements. Their reassessment of systematic strategies might result in a decreased supply of ETH volatility, potentially fostering conditions for an uptick in ETH’s realized volatility.

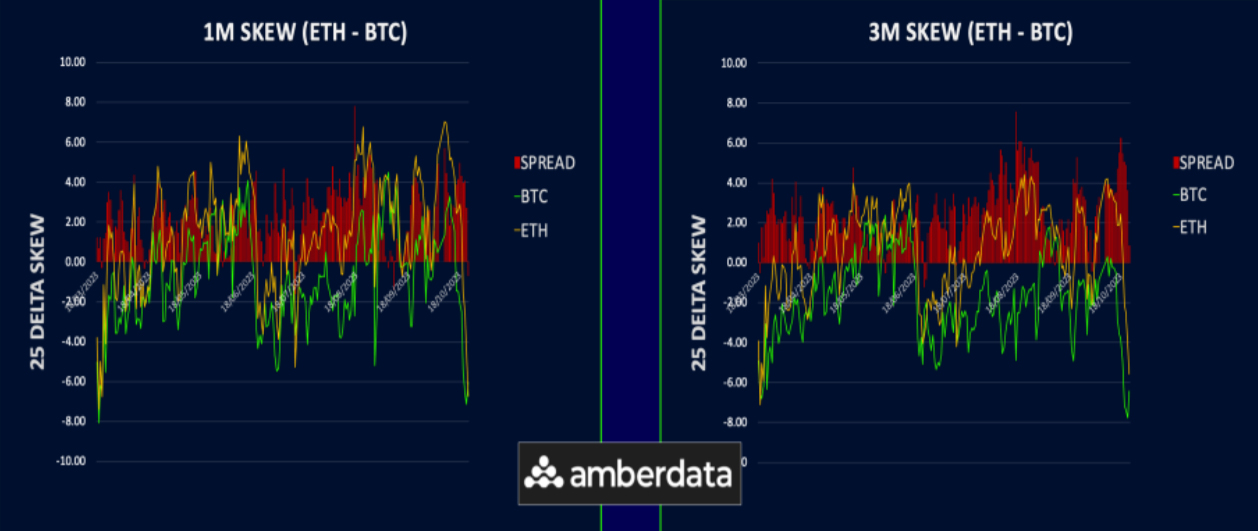

BTC Call Skew Explodes Before Collapsing

During the recent surge, call skew notably increased, a logical development as traders sought to capitalize on the rising trend. As BTC surpassed the $31,000 mark, the whole curve experienced a 6- 10 volatility call premium.

However, the landscape has shifted quickly, as Bitcoin hit $34,000 within hours. Intriguingly, the weekly skew receded dramatically, and even the mid-term skew fell to 2 from previous highs of 7, all while BTC spot prices remained robust at $34,000.

This skew fluctuation might signal an impending stagnation or pullback in the rally. It could also reflect new long positions with protection, especially with Gensler’s speech and potential ETF confirmation on the horizon.

In contrast, ETH’s call skew has remained more resilient, maintaining a 5-10 volatility call premium across the curve. This strength in ETH’s call skew implies that the options market foresees a catch- up trade in ETH is likely, while much of the BTC news could be priced in.

The prevailing sentiment is that the BTC surge is pre-emptive, anticipating institutional flows, indicating that any pullback will likely be met with buying interest. Additionally, once the ETF news is confirmed, attention could pivot to ETH owing to its perceived better value and underperformance throughout the year, underscored by the ETH/BTC ratio approaching its lowest since June 2022.

Option Flows And Dealer Gamma Positioning

BTC options witnessed an 85% surge in volumes this week, coinciding with BTC reaching its highest levels for the year. Amidst this volatility spike, there’s notable profit-taking activity, particularly in the 24 November 30k and 31k calls, as well as the 29 December 34k/40k call spreads. Additionally, overwriters are actively covering shorts on the 24 November 30k and 29 December 29k calls.

Conversely, ETH volumes remained subdued until the last acceleration higher prompted substantial call buying in the 24 November 2023 1700 and 1650 calls. Most of the activity was centred around call buying for the 29 December 1800 strike. This includes establishing new long positions and some short covering from overwriters.

As for dealer gamma positioning in BTC, there was a shift to short as the asset breached the 30k level. However, stability has been observed since the explosive move up due to profit-taking in calls and call spreads. Significant long positions are identified at the 27 October 32k and 34k strikes, suggesting that further increases might prompt dealers to shorter exposure once more.

In the ETH market, dealer gamma briefly dipped, even entering negative zones during the initial spot price surge. It has rebounded to positive, driven by dealer holdings in the 1800 strike for 27 October. Should ETH maintain its upward trajectory, the prevailing long gamma is expected to dissipate.

Strategy Compass: Where Does The Opportunity Lie?

With such explosive rallies, anyone holding calls or call spreads has done well. If these positions are longer dated, investors will probably want to hold on to their exposure. One way to capitalise on recent price action but maintain upside is to overwrite longer dated bullish positions with short dated calls. For example, if you own 29Dec23 or 29Mar24 calls, you could sell some November calls against them to earn some quick premium that has become elevated due to the vol spike.

Another thing to consider if you are long the underlying asset, is to layer on protection for a pullback, through structures like put spreads and risk reversals.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)