Weekly recap of the crypto derivatives markets by BlockScholes.

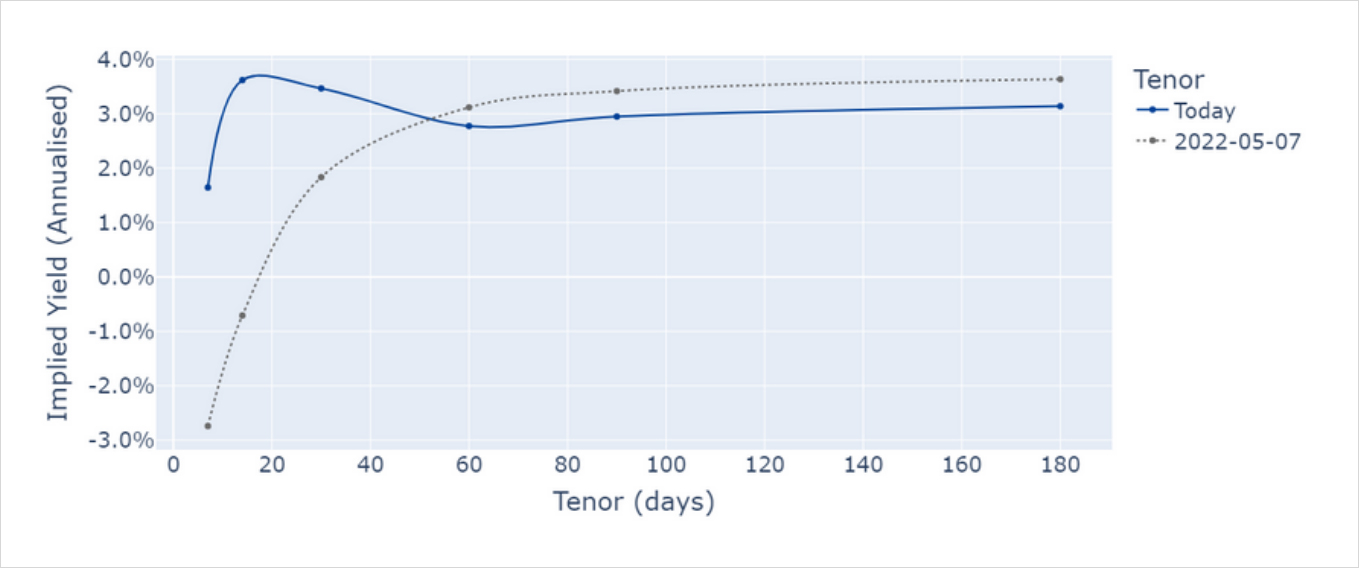

BTC futures term structure regains its positive slope

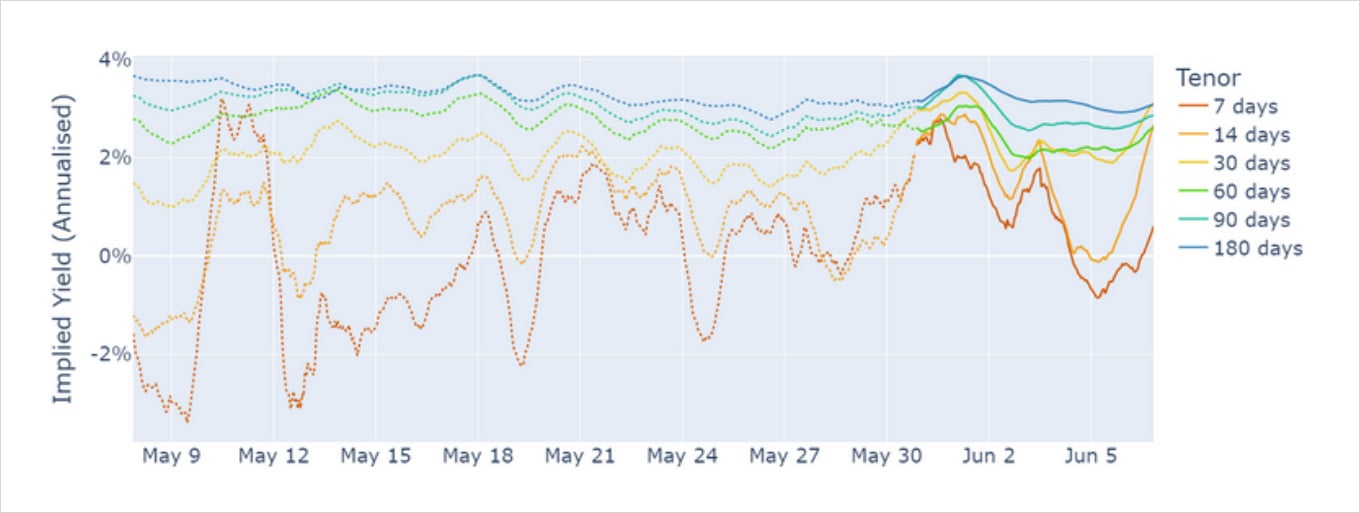

Annualised Futures Implied Yields

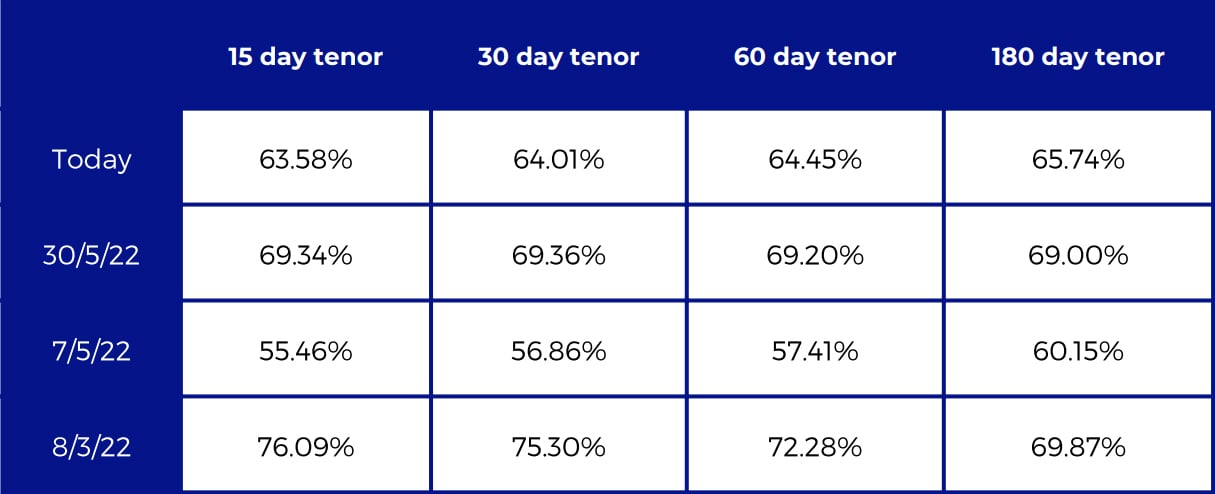

Annualised Futures Implied Yields Table

NB: Data from the past week is plotted in block colour, whilst dotted lines denote data from between 30 and 7 days before publishing date.

Bitcoin Volatility Metrics

Implied volatility returns to normal shape after the LUNA blow up at the beginning of the month

Put skew remains near to all-time highs

ATM Implied Volatility Table

NB: Data from the past week is plotted regularly, whilst dotted lines denote data from more than 7 days before publishing

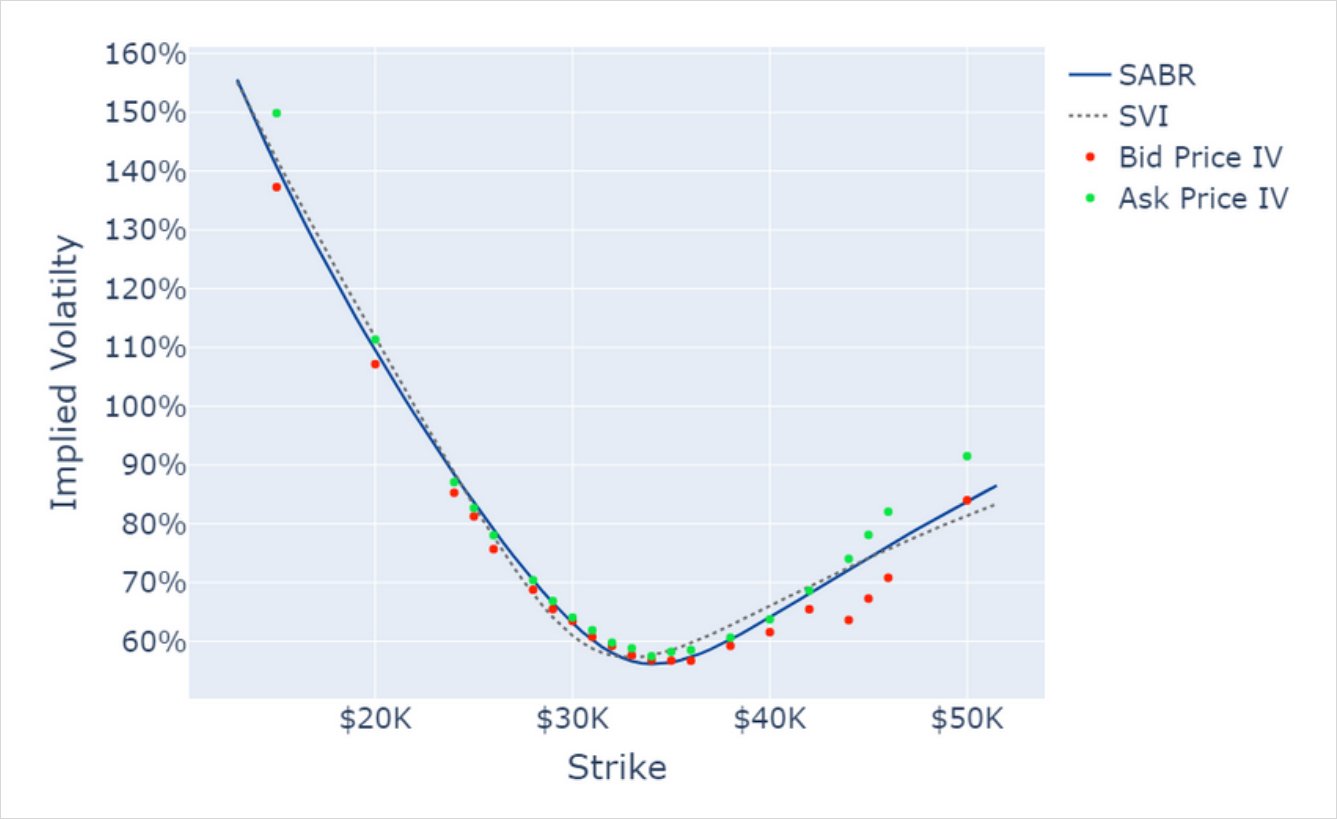

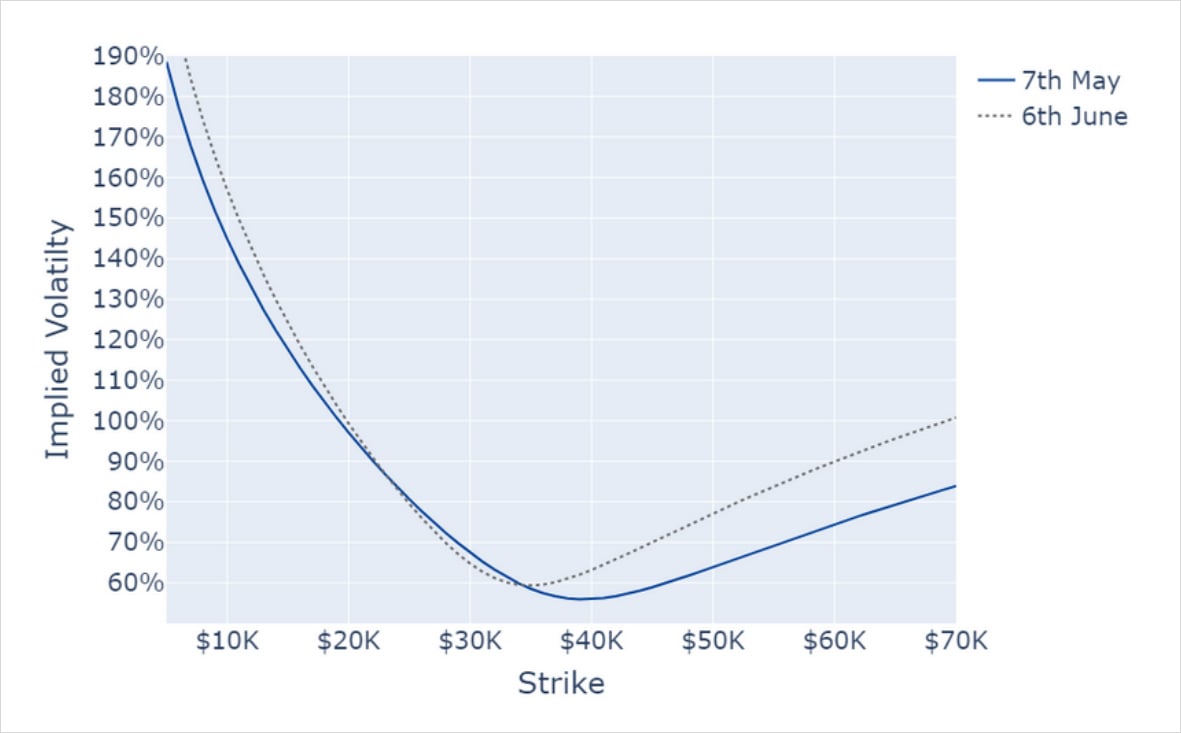

BTC 24th June Expiry smiles

SABR and SVI Smile Calibrations.

The smile steepens but skew towards puts remains high

1 Month SABR Implied Vol Smile.

AUTHOR(S)