BTC Boosted By Grayscale News

A pivotal moment has arrived for BTC: Grayscale has triumphed over the SEC at the DC Circuit Court of Appeals, overturning the SEC’s initial reluctance to permit $GBTC’s transition to an ETF. Whilst this doesn’t immediately convert $GBTC into an ETF, it is undeniably a major advancement.

Unsurprisingly, there’s been a notable 8% appreciation in BTC/USD value. This positive verdict has rekindled the prospect that other potential BTC ETF candidates, such as Blackrock, might also secure approval down the road, which would boost institutional participation in BTC.

The nuances of the Grayscale-SEC contention are complex. For example, the SEC can still argue that GBTC’s assets under management substantially exceed the open interest in CME bitcoin futures. Yet, the court’s judgement that the SEC’s reasons for denying Grayscale’s ETF were insubstantial indicates a profound reversal, necessitating a thorough re-evaluation of Grayscale’s application.

The likely courses of action include: 1. Postponing the decision whilst formulating fresh grounds, 2. Acknowledging and approving the spot BTC ETF, or 3. Opting for a full court re-examination of the case. However, given the court’s definitive position and critique of the Commission’s deficient reasoning, a comprehensive re-evaluation appears unlikely.

In sum, this is a major milestone for BTC, potentially reinforcing the ‘buy on dip’ mentality going forward, particularly given forthcoming propitious developments like the impending halving effect.

Volatility Picks Up Once Again

Last week, cryptocurrency’s realised volatility saw a decline of 30 points as market activity closely adhered to the lower range. However, recent developments surrounding the Greyscale ETF caused a substantial uptick, elevating the 10d realised volatility back up to approximately 40% for both BTC and ETH.

Short-dated implied volatilities had experienced a 5 vol decrease for both assets. Yet, following the Grayscale news, the subsequent 8% surge in BTC meant that by week’s end, its volatility balanced out, while ETH’s volatility maintained a lower trajectory.

As for BTC, the volatility carry has returned to a neutral stance. However, for ETH, it remains in the negative, primarily because consistent volatility supply keeps gamma pricing cheap, despite sporadic but wild fluctuations.

Term Structure: Increase In Front-End Vols

BTC’s term structure observed a tilt back into contango initially, particularly as market moves stagnated over a week. However, there was a notable pick-up at the front end following the 8% surge.

The front-end volatilities closed relatively unchanged over the week.

At the longer end, there was a discernible increase of about 2 vols. This was due to a consistent demand on the upside, evident even before the spot prices climbed.

The ETH term structure, on the other hand, seemed to trend downwards, predominantly influenced by the front end. Despite this, the weekly volatility displayed an uptick in demand following yesterday’s gap higher.

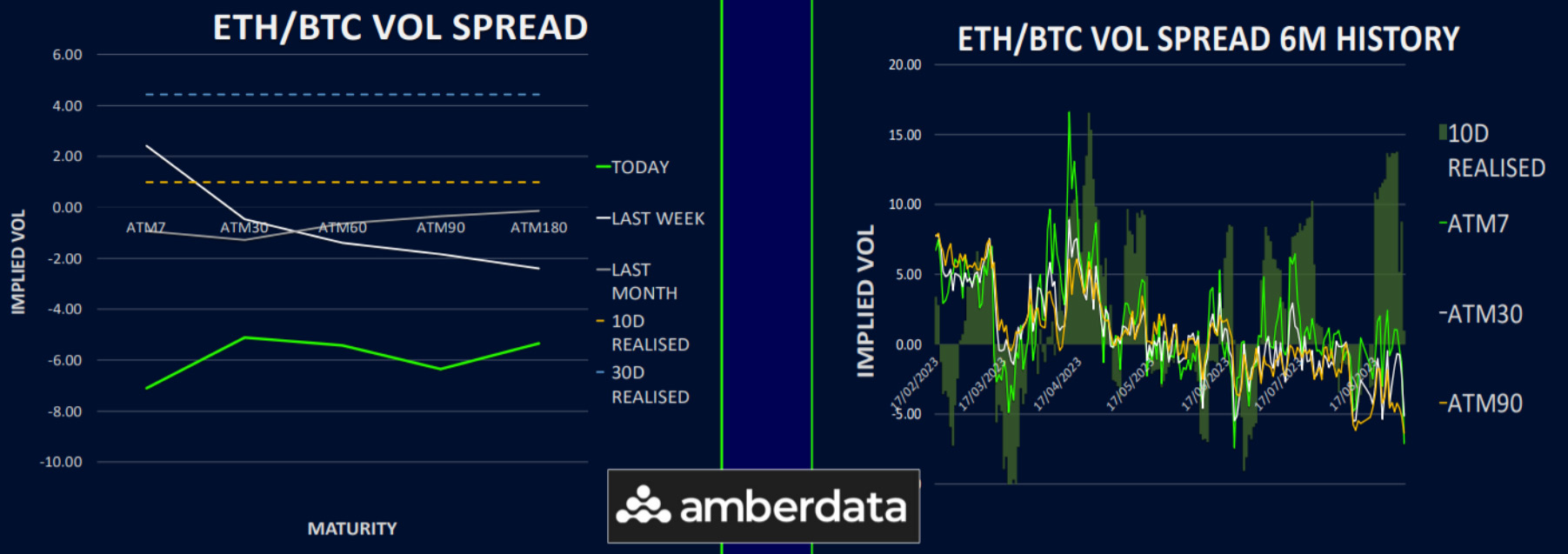

Vol Spread Remains At Historical Lows

The ETH/BTC volatility spread has been considerably reduced, now resting at about -6 across the board. With the recent revelations around Greyscale, it’s clear that BTC holds the reins. There were fleeting moments where it appeared ETH might gain some momentum, especially if market supports had broken. However, the latest surge has quelled such aspirations.

This negative vol spread (ETH vol under BTC) has been consistent for months. To reverse this trend and move the spread into positive territory, especially in the latter maturities, where VEGA supply is presently abundant, either a prolonged rise in ETH’s actual volatility or significant news flow exclusive to ETH would be required.

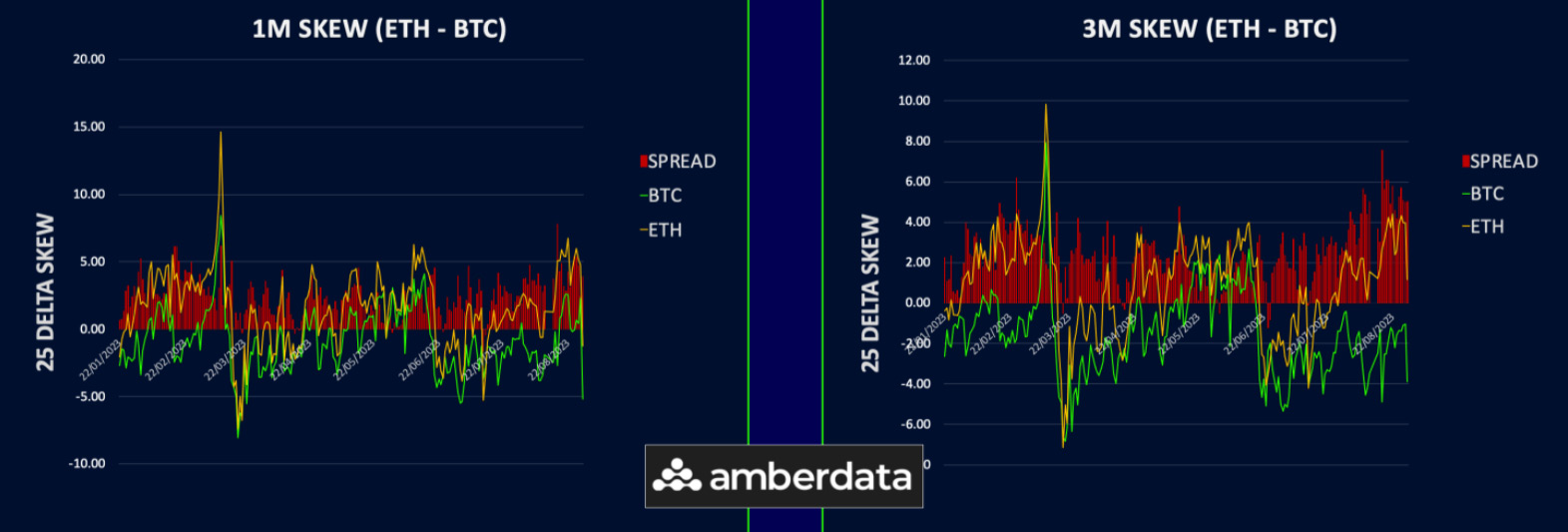

BTC Skew Back To Call Premium Across The Curve

Previously, Skew maintained a put premium in the front end for BTC, especially when markets teetered towards the lower boundaries. However, a surge in prices yesterday prompted a significant revaluation, favouring a call premium of approximately 5 vols across the term structure.

In a similar vein, ETH skew had steadfastly sustained a put premium around 4 vols. Post the spot rally, this has reduced to a mere 1 vol for durations of 2 months and beyond. The front end for ETH skew now slightly favours a call premium.

Such pronounced recalibrations in skew following substantial spot fluctuations highlight the propensity for crypto options markets to lean towards directional speculation rather than the typical structural hedging found in traditional finance. As the crypto landscape evolves, especially if ETFs usher more institutional entrants into the fold, we anticipate a shift towards a more constant and settled put skew, notably in longer-term expiries. Presently, however, this stability seems distant, resulting in the skew’s volatility remaining elevated.

Option Flows And Dealer Gamma Positioning

Option activities in BTC were robust as some two-way flow returned. Interest in the 29 Dec 26k and Jun24 27k strike calls ensured that the long-end volatility remained in high demand. Gamma sellers had enjoyed their rewards, only to be caught off-guard by the Greyscale’s 8% surge.

As for ETH, the option volumes remained relatively unchanged throughout the week. Prior to the rally, we observed protection buying in the Sep strikes between 1600 and 1400 through puts and put spreads. The surge in the market rejuvenated interest in outright calls.

BTC dealer gamma is moving towards a neutral stance, especially after the roll-off of the 25Aug local short strikes. The uptrend in spot prices instigated weekly call buys, causing a slight downturn in dealer gamma. However, it’s of no significant concern given holdings of 29 Sep long strikes.

Meanwhile, ETH dealer gamma has been on a steady rise. The market predominantly remains in a long position. This trend could potentially serve to moderate the volatility for ETH on the upside in the forthcoming month.

Strategy Compass: Where Does The Opportunity Lie?

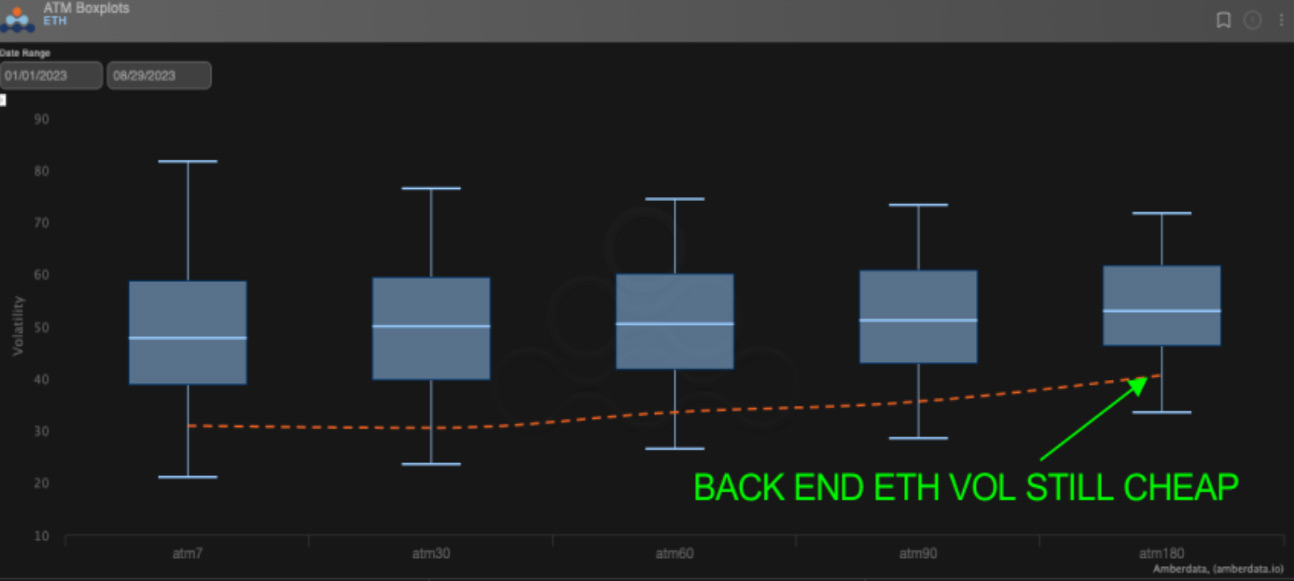

The quick move higher on the first whiff of ETF ‘good news’ show that you probably want to lean long this market. We still find longer dated calls to be the most compelling expression as implied vols are still close to their lows, especially in ETH.

One way to structure a more neutral position may be to own long dated BTC calls, but use short-dated ETH puts to hedge them, given how cheap front-end ETH is trading. However, this is a net long vol trade and will have theta bleed to contend with.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)