A Changing Pulse: A More Recession-Conscious Market

In the wake of the recent FOMC meeting and the rather subdued US CPI last Wednesday, it was notable that both events failed to ignite any substantial market movements. Therefore, the familiar ranges in BTC and ETH continue to be respected, uninfluenced by these macro tides.

This reinforces the ongoing paradigm shift in market focus, as we see a transition from concerns around inflation and rate hikes to those focussed on potential recession in the US.

The shift is evident when analysing the stronger correlations seen in assets such as the SPX and short-dated bond yields, which have risen to levels as high as 50% on a 60-day rolling basis. Besides, let’s not forget that the prolonged restrictive Fed policy where real yields are way above equilibrium also tends to be a recipe for impending recessionary phases in the US economy.

A key driver of this shift is the market’s growing confidence in the stance of the Fed. The consensus view now anticipates a more extended period of wait and see, buoyed by Chair Jerome Powell’s reassuring rhetoric in the last FOMC and the current market pricing.

However, uncertainty looms on the horizon. The brewing banking crisis and the ongoing discussions around the US debt ceiling are predicted to reach a crescendo within the next two months, introducing an element of ambiguity and risk into the financial landscape.

In this fluid environment, market participants will need to remain vigilant and adaptable in trading the large-cap crypto assets (BTC and ETH), ready to navigate these uncertain market currents. That said, there are some tentative signs in the options market that make us believe BTC is well positioned to capitalize on any rallies that we may see on the broader markets.

Realized vs Implied Vols: BTC Still Offers Positive Carry

Bitcoin’s (BTC) realized volatility has remained stable, hovering in the mid to low 40s, despite a brief dip to a 25k handle on Friday. The leading cryptocurrency swiftly rebounded from this downturn.

Concurrently, Ethereum’s (ETH) realized volatility has seen a slight decline, aligning more closely with BTC as it grapples to carve out its distinct narrative.

Heading into the weekend, we noticed a downward trend in implied volatilities, particularly in the short term. However, this was promptly met with a strong purchase of short-dated calls and call spreads, capitalizing on the low volatility levels.

BTC continues to provide a positive carry (also known as volatility risk premium VRP), following the latest surge in volatility, which is yet to be substantiated by any significant realized movement. Meanwhile, the carry on ETH hovers near zero, with the implied volatilities remaining at low levels and offering minimal risk premium.

Term Structure: BTC Better Positioned To Outperform

Over the weekend, the term structure of Bitcoin (BTC) maintained a flat profile, despite a fleeting dip into contango territory. Concurrently, Ethereum’s (ETH) term structure displayed subtle movements towards contango, with the crypto seemingly unfazed by a test drop below 1800.

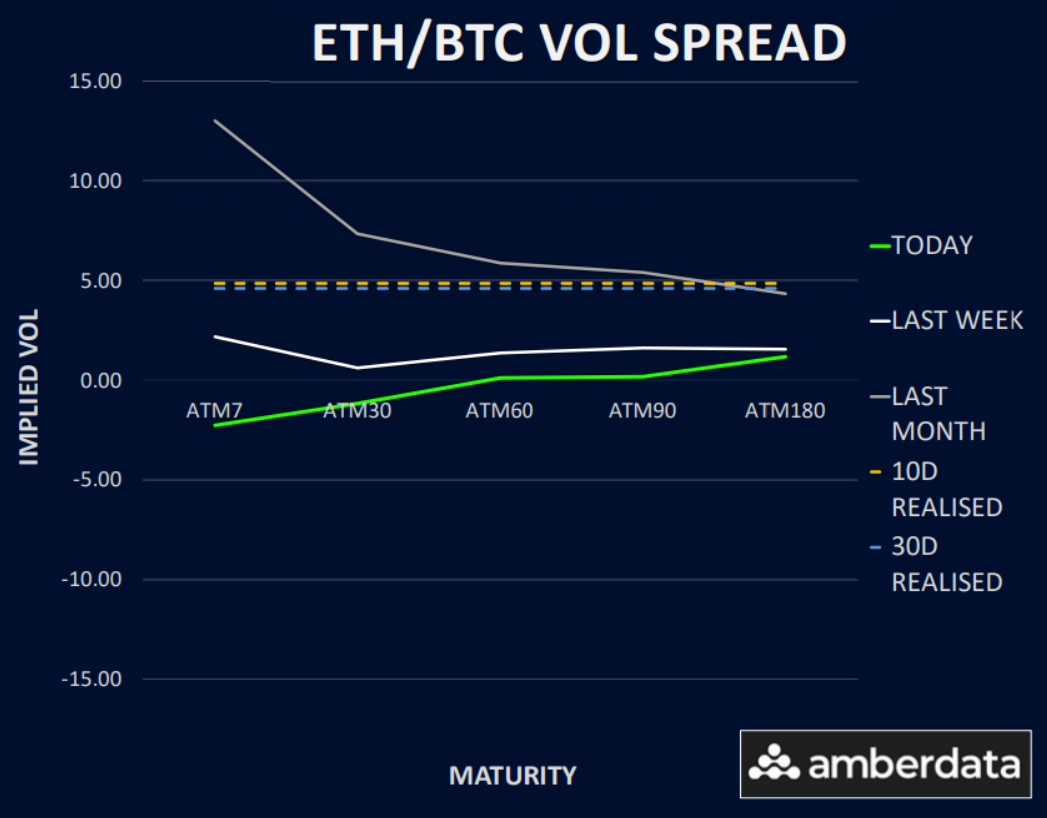

As we continue to monitor the ETH/BTC volatility spread, it’s evident that it’s once again on a downward trend. This shift is primarily led by the front end, where the current demand for BTC gamma is higher, pushing the spread into the negative for up to a 1-month expiry. Nonetheless, the back end of the curve remains slightly above zero, with the realised spread for ETH being 5 vols higher.

The current market signals suggest that an investment strategy favouring BTC upside and ETH downside could prove prudent. The recent rise in BTC’s front-end indicates a short-term shift towards bullish sentiment. Given this scenario, it’s reasonable to predict that BTC may outperform in any upcoming market rally.

Skew: Sentiment Shift In BTC Options

Up until Monday, May 15th, the crypto markets had been displaying a certain fragility, with put skew widening as they tested the lower range supports. The weekly skew for Bitcoin (BTC) reached 3 vols for puts, and even the premium for back-end calls had dwindled to below 1 vol.

However, this landscape has seen a considerable shift. As short-dated call buyers entered the fray, the skew has dramatically reversed. It’s now trading at a call premium across the entire curve, with the front end at 2 vols for calls, tapering down to 1 vol at the back end.

This development signals a significant sentiment shift in the options market, despite the spot price not moving substantially.

Ethereum’s (ETH) skew has followed a similar turnaround. After peaking at 6 vols for weekly puts, it has now receded to a mere 1 vol put premium. However, the middle of the curve continues to hold a 2-3 vol put premium, a trend that diverges from the BTC skew.

Considering these shifts, we’re led to believe that this condition – wherein BTC and ETH display opposite signs – could persist for a while. It seems to be emerging as a prevailing theme within the crypto markets with BTC acting more like Gold with a right tail and ETH still maintains a left tail risk with stocks.

Option Flows And Dealer Gamma Positioning

The volume of BTC options has remained relatively consistent, with a slight increase observed. Approximately 30% of block flows are accounted for by puts. When Bitcoin (BTC) took a plunge under 26k, investors sought protection due to the low vol level, purchasing puts and put spreads. The other 70% of blocks was calls and call spreads, particularly in the front expiries as dip buyers took advantage of the weakness in spot and relative cheapness in implied vol.

Ethereum (ETH) flows, however, have sustained a more bearish tone. We have observed short-dated call sellers (with 1900-2000 strikes) and put buyers (with 1800 to 1600 strikes).

On the dealer positioning front, BTC dealer gamma has been going back and forth. Currently, it stays slightly negative due to both the spot price bouncing back and a flow of call buying.

ETH, on the other hand, has maintained a positive stance throughout the week, even as the spot price hovered around 1800, a significant long strike for dealers across various expiries. This divergent positioning from BTC suggests that ETH may continue to underperform, especially during crypto market rallies.

Strategy Compass: Where The Opportunity Lies?

With some bullish signs forming in BTC and the front end vols holding up with a call skew, we like 30Jun call ratio structures which are long delta, vega neutral and slightly theta positive.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)