Buying cryptocurrency options can often offer investors a relatively inexpensive and low-risk way of trading digital assets compared to trading cryptocurrency futures or open-ended swaps. A reminder – an option is a type of derivative contract that gives its buyer the right (but not the obligation) to buy or sell the underlying asset at a set price upon its expiration date (or, in some cases, prior to expiration).

Options are some of the most complex instrument on the crypto market. But do not worry – there are numerous unique trading strategies, which will come in handy when learning how to use them. Today, we will review the Butterfly Options strategy, which allows users to profit even during the flat periods of the market. Read our previous article to learn the fundamentals of options trading.

Recap – What is an Option?

First, let’s look at the basic concepts associated with options trading and especially implied volatility. An Option is a derivative financial instrument based on an asset (in this case, a cryptocurrency) in the form of a contract between the seller and the buyer.

Here are a few of the options’ properties:

- The buyer can buy or sell an asset (the keyword here is can, as they are not obligated to execute the contract) at a predetermined strike price before the contract’s expiration;

- The seller undertakes to buy or sell an asset at the request of the buyer. In doing so, he receives a premium – a payment for the option, which the seller receives regardless of the trade’s outcome;

- Options are categorized in one of two models: European or American. The European model allows the settlement of the contract only on the expiration date, while the American options can be settled at any time up to the fixed date.

Let’s review an example of options trading in practice. Let’s assume you expect that by the potential option expiration date the value of bitcoin will go up to about $75,000 (within a month), while at the moment BTC can be bought at the market price of $60,000. You find an offer to buy an option with a strike price of $65,000, a $5,000 premium and an expiration time of one month.

The value of the cryptocurrency moves in the predicted direction and you decide to execute your contract. You purchase the coins at $65,000 and now can immediately sell BTC at the market price of $75,000 and get the net profit from this transaction after deducting the spent premium.

Let’s consider the possibility of an alternate scenario. The price of Bitcoin drops sharply to $40,000. In this case, it is not profitable to execute the contract and the reasonable decision would be to lose the $5,000 premium. Thus, an Option is a useful tool for hedging risks in case of a sudden market collapse.

There are two types of Options:

- Call Option (Call) – a contract that allows its buyer to buy an asset at a fixed price;

- Put Option (Put) – a contract that allows its buyer to sell an asset at a fixed price;

Options are becoming more and more popular in the cryptocurrency market, but they can also bring certain losses to beginners because of their complexity. Such losses are usually caused by implied volatility and a number of challenges associated with the digital asset industry.

What is implied volatility?

Implied volatility predicts the range of possible asset price changes over a certain period of time. This parameter tracks the change in the price of the asset but not its direction. That is, the higher the volatility, the higher the potential for spikes in prices on the chart in the future. Implied volatility should not be confused with historical volatility, also known as realized volatility or actual volatility. Realized volatility measures past market movements and the actual results of those movements.

Investors use implied volatility to assess options contracts’ prices. Implied volatility can help an investor predict the likelihood of the contract expiring above the strike price. If the asset is expected to outperform the option’s price, the premium is likely to be higher.

It is important to remember that implied volatility is based on market expectation. It is only an estimate of future prices, not an accurate prediction. However, investors take implied volatility into account when making investment decisions, and this dependence inevitably has some impact on the prices themselves.

There is no guarantee that options prices will follow the predicted pattern. However, when making an investment decision, it is useful to consider the actions taken by other market participants, which is best demonstrated by the implied volatility.

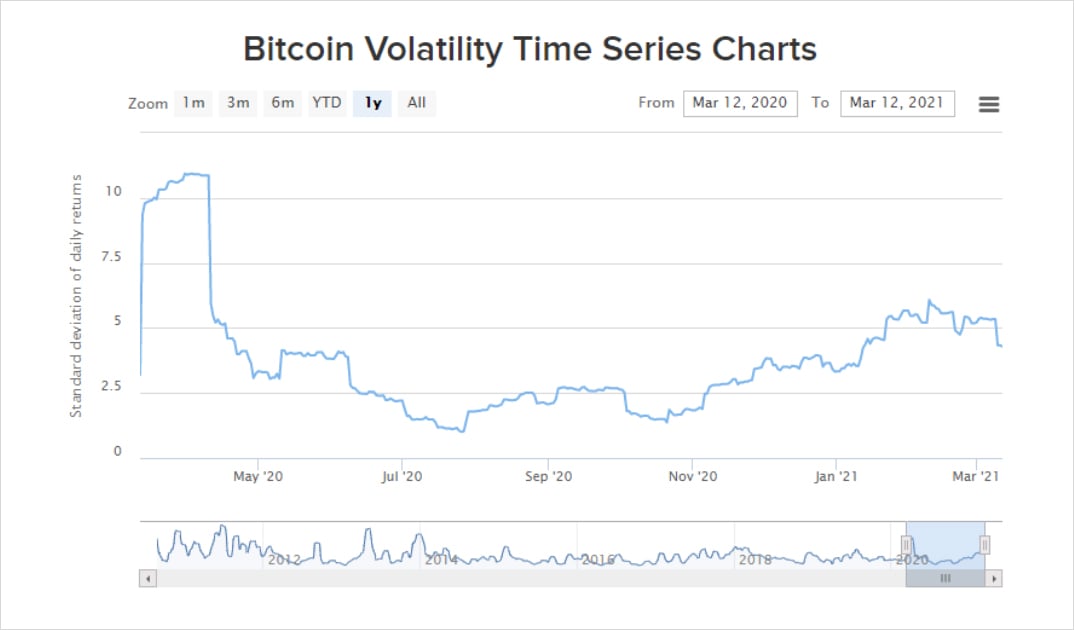

For example, here is a 1-year Bitcoin chart. The rise in this indicator’s value increases both the potential profitability and associated risks.

Bitcoin’s implied volatility v.s. historical volatility. Source Deribit

Implied volatility is subject to unpredictable changes. Supply and demand are the determinant factors of implied volatility. When an asset is in high demand, the price tends to rise. The same is true with implied volatility, which leads to a higher option premium due to higher risk. The opposite is also true when supply is high but there is not enough demand. Implied volatility drops and the premium becomes cheaper.

Another factor that affects the premium is the time value of the option (the time left until the contract’s expiration). A short-term option often results in low implied volatility, while a long-term option has a tendency to result in higher implied volatility. The difference lies in the amount of time remaining until the contract’s expiry. Since there is a longer period of time, the price has more time to move to favourable price levels.

“Butterfly” Trading Strategy

The Butterfly strategy is based on the assumption that the price of the asset will either stay in a certain range until expiration or it will break the range in either direction.

First, let’s indicate the assumed Bitcoin price consolidation channel on the chart. Let this be a $40,000 – $52,000 range on a 1-day chart. Let’s also define the median of the range at $46,000.

The strategy is simple: we buy two call options with a strike price at the channels’ borders and sell one call option with the strike price in the middle of the channel. We also need to double the sell volume of the third option against the previous ones. In case the price remains within the set range by the expiration date, we will end up collecting profit. The trader will earn the most money if the price is in the middle of the diapason by the expiration date. Let us explain why:

- The option with a $40,000 strike price will be profitable, as the price of the Bitcoin increased above it.

- The option with a strike price at $52,000 would expire worthless, as the price within the range makes it not profitable for the trader to execute;

- Profit will be generated from the premiums collected by the options sold with a $46,000 strike.

As a result, the profit on the sold call option and the bought $40,000 option will be greater than the loss from the $52,000 option.

Summary

The “Butterfly” strategy is perfectly suited for the after-growth periods, often also referred to as the consolidation stages. At this time, the price usually moves in a horizontal channel. Given the currently bullish sentiment, channels often break in an upward direction towards the next stage of consolidation. In both cases, Long and Short Butterfly strategies can be a useful hedging tool. We hope this was helpful and we wish you happy trading!

Practice performing the Long Butterfly strategy using the 3commas Options Bot – open the options bot tab in the 3Commas dashboard, select the Long Butterfly strategy and start trading!

AUTHOR(S)