Summary: Traders are 86% confident that a Bitcoin ETF will come. We remain optimistic that the Bitcoin bull market continues, and pocketing extra yield through selling puts could juice up any returns for long-term holders. Trading calendar spreads is another way to position ahead of a potential SEC approval. Below, we run through some possible strategies.

Analysis

While we have no privileged information about the Bitcoin ETF approval process of the U.S. Securities and Exchange Commission (SEC), we can break down current market pricing to determine the most likely date traders expect the ETF decision to be released.

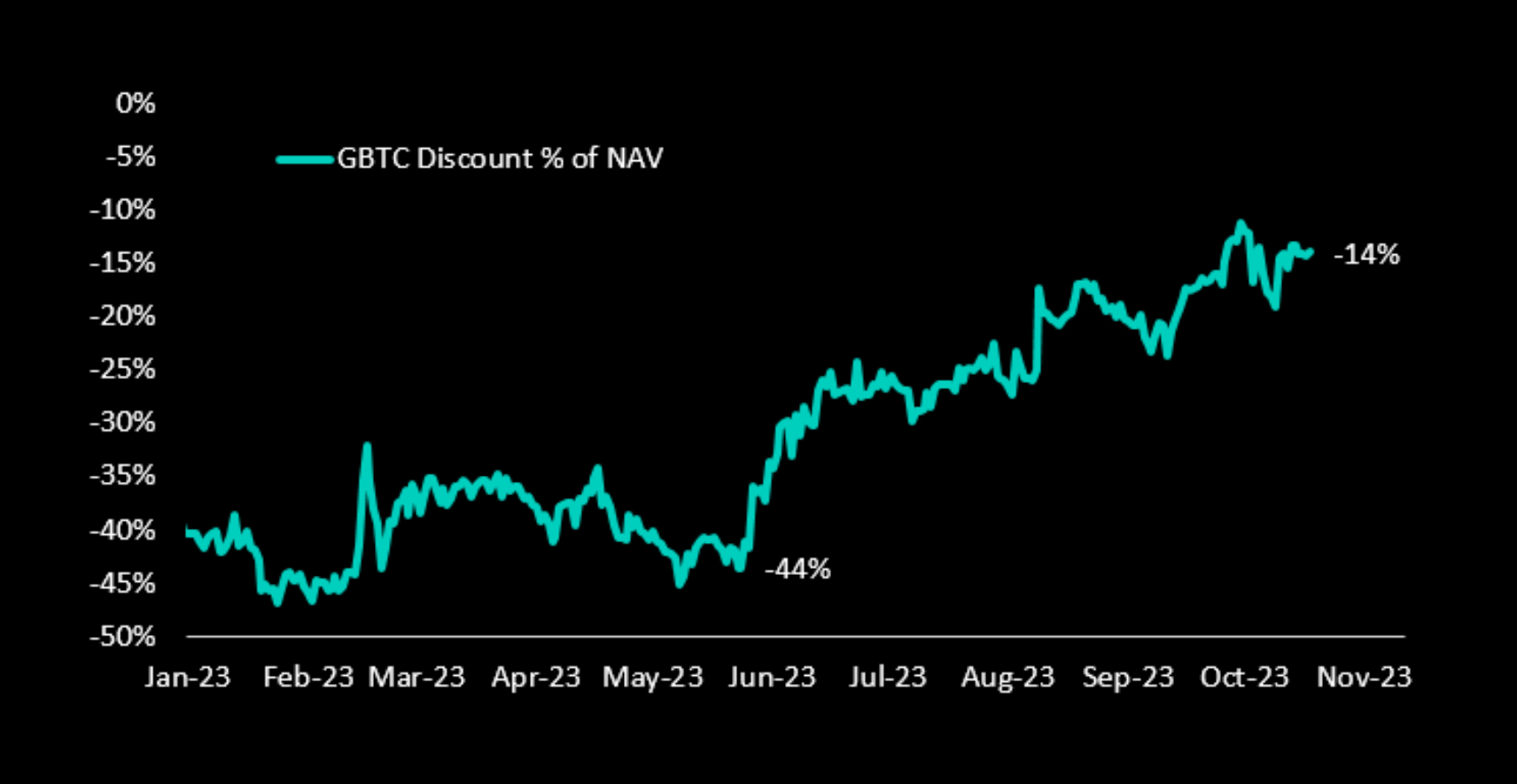

Since the BlackRock Bitcoin ETF filing on June 16, 2023, the discount of the Grayscale Bitcoin Trust (GBTC) has narrowed from -44% to just -14%. As the GBTC shares are not very liquid and a small discount is always justified for closed-end funds, the market is confident that the SEC will approve a US-listed Bitcoin ETF based on this narrow discount level. A straightforward assumption would flip this – 13% discount around and ‘assume’ that traders are 86% confident (100%-14%) that an ETF will be coming. That’s why Bitcoin prices rallied from 25,100 to 35,000.

Discount of GBTC shares to their net-asset-value

But as we showed in one of our previous reports, if the 2017 CME Bitcoin futures roadmap is seen as a trading reference, then Bitcoin prices might rally further on any announcement.

Bitcoin prices jumped +10% in a heartbeat when a false rumor hit the wires that the SEC had approved the BlackRock Bitcoin ETF already. While this turned out incorrect, it showed that Bitcoin could jump by +10% or more when the announcement is released to the market.

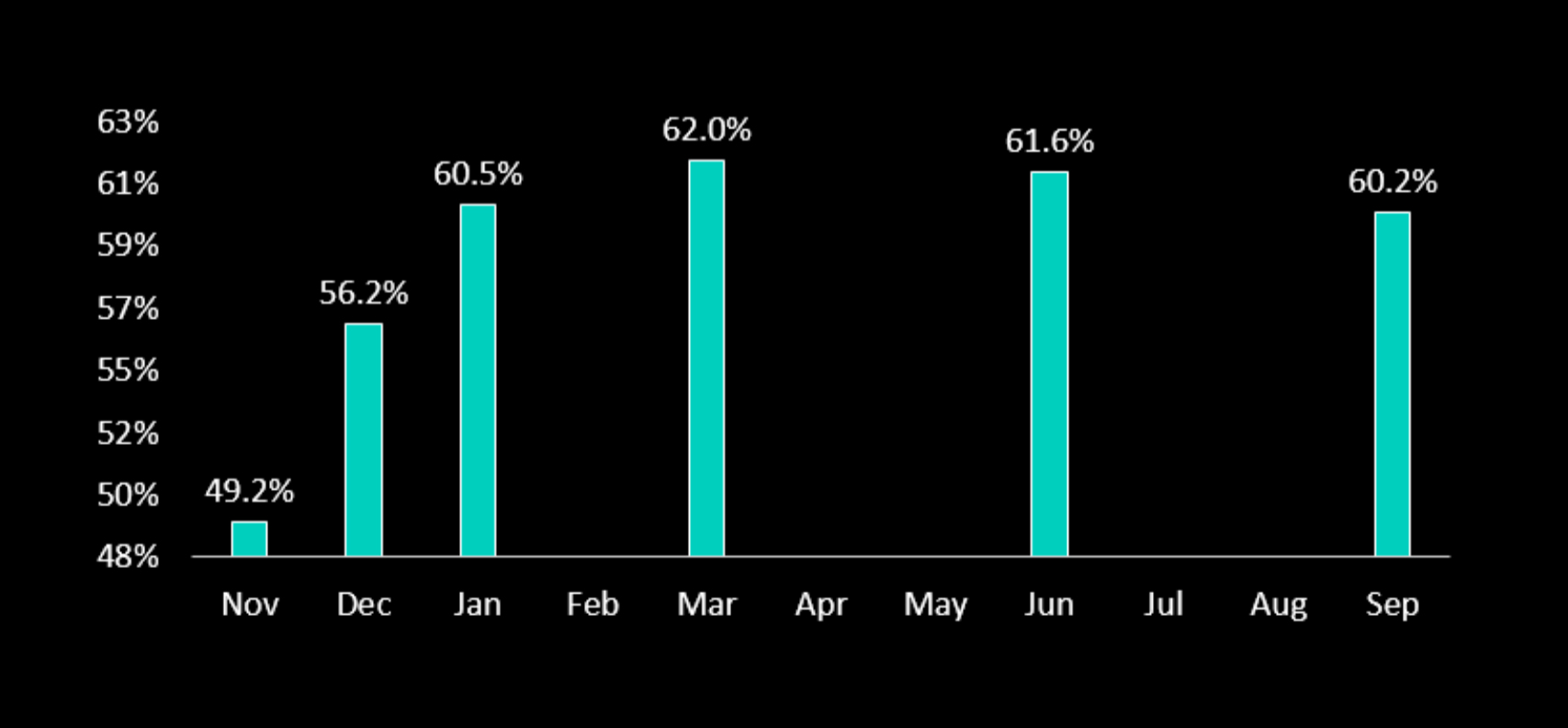

When Bitcoin prices rallied above 30,000 in October, many option market makers were caught short gamma. They had to buy upside exposure to hedge their books that sold calls previously to generate yield. This ‘gamma squeeze’ caused an accelerated move from 31,000 to 34,000 in a matter of hours. As a result, implied volatility was repriced from 30-35% to 50-60%. Yield-seeking traders can take advantage of those high implied volatility levels by selling options. Trading – and especially selling – options can be risky, but an educated analysis and prudent risk management could offer attractive risk-return opportunities. The coming three option expiries could be very interesting and rewarding for traders.

The most profitable trade will likely be a deep out-of-the-money call option that suddenly finds itself ‘in-the-money,’ but timing this event is the tricky part. When we analyze the at-the-money implied volatility for call options, we can see a big jump from the November 2023 expiry to December 2023 and from December 2023 to January 2024, while the implied volatility levels appear to peak immediately after January 2024. This indicates that the market expects the SEC to approve a Bitcoin ETF shortly before Christmas or sometime in January 2024.

At-the-money implied volatility for Bitcoin call options for different expiries

Taking this ‘market intelligence’ into account, we could sell an at-the-money call with expiry on November 24, 2023, for $1,545 and buy December 29, 2023, for $3,266 as approval by the end of this month appears less likely. This so-called calendar spread lowers the cost of trading options considerably.

We could be confident to sell this November upside as it would cheapen our December upside by 47%. Instead of buying a 1.0x upside call for the December expiry, we could purchase 1.5x December and sell 1.0x the November expiry call. If nothing happens in November, we could buy significantly more exposure into year-end.

If, instead of December, we prefer to have exposure until the end of January 2024, we would need to spend $4,370 on our at-the-money calls. Those costs can still be lowered by selling the November at-the-money call for $1,545, or 35% of our January call value. Hence, we could buy 1.35x as much upside.

Alternatively, traders could sell an at-the-money put for the January 2024 expiry and potentially pocked the premium of $3,575, roughly ~10%, for approximately the next ten weeks. We remain relatively confident that the Bitcoin bull market continues, and pocketing this extra yield could juice up any returns for long-term holders.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)