Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

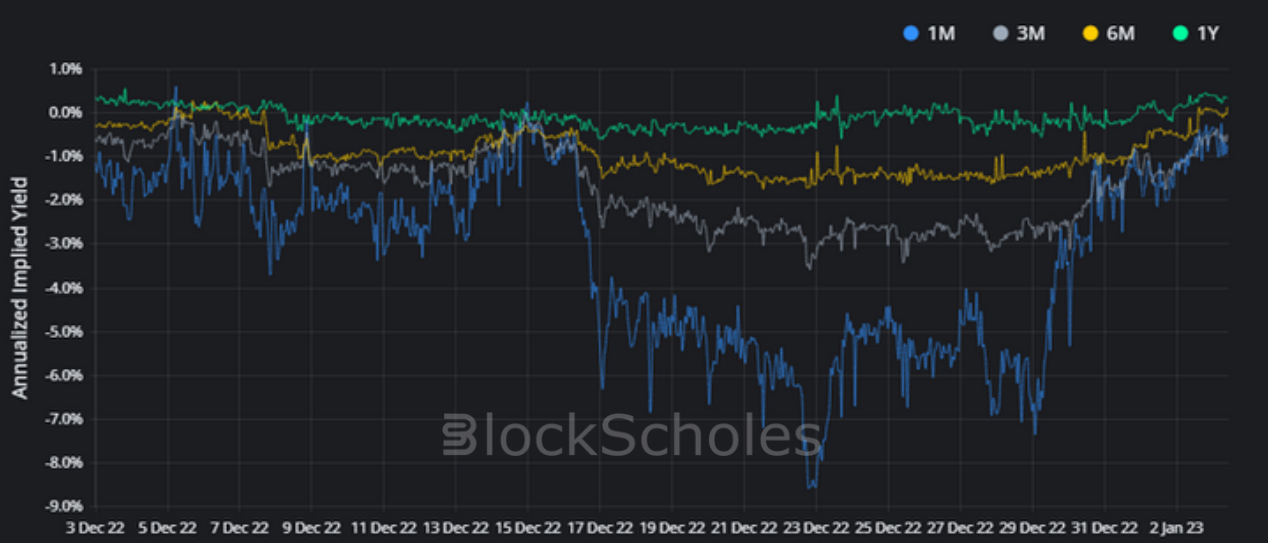

- BTC ANNUALISED YIELDS – shorter-dated yields rise to meet futures at 6M and 1Y tenors between 0% and -1% below spot.

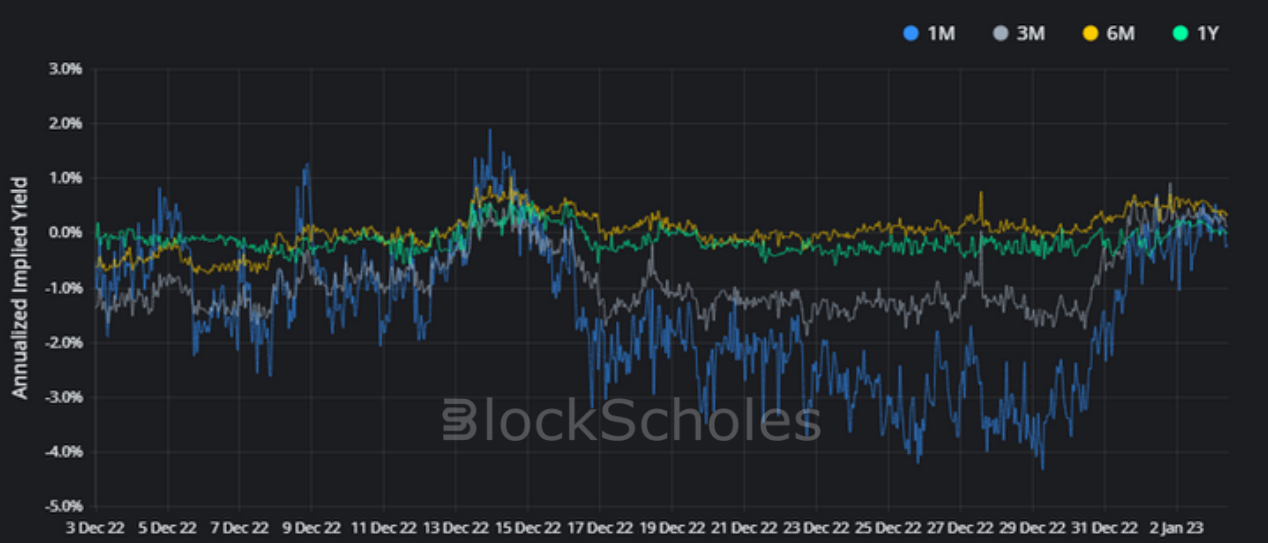

- ETH ANNUALISED YIELDS – see a similar but less dramatic recovery of yields at 1W and 1M tenors.

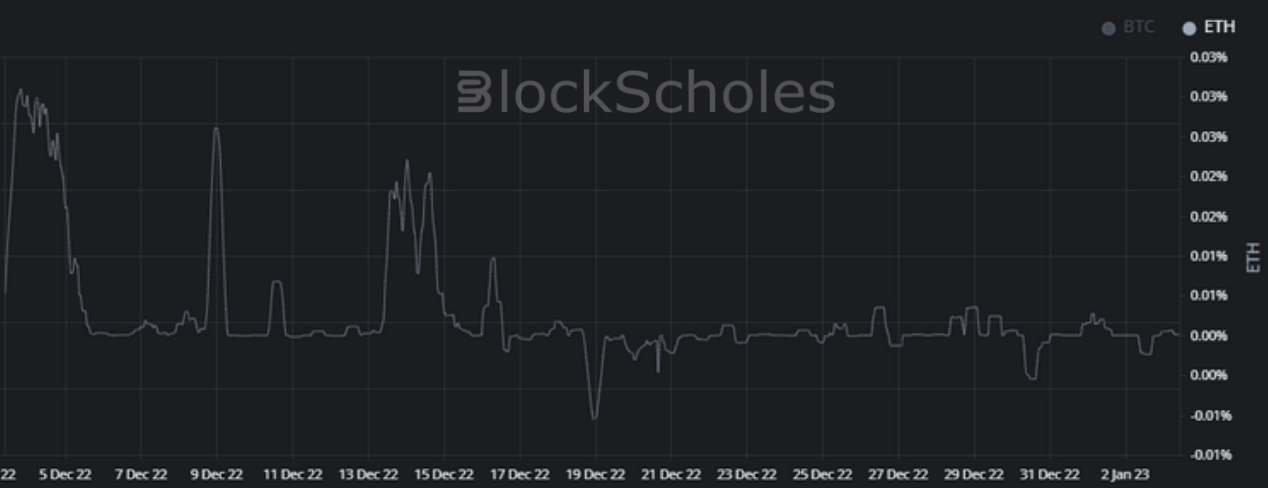

- BTC FUNDING RATE – is near 0% after several weeks of funding paid from shorts to long positions.

- ETH FUNDING RATE – is also closer to 0% this week after two weeks of large positive funding.

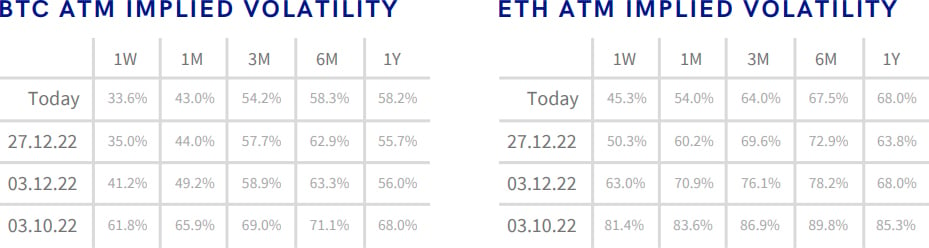

- BTC SABR ATM IMPLIED VOLATILITY – continues to waver near the bottom of its historic range at all tenors.

- ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s movements as it trades near to all-time low levels.

- BTC IMPLIED VOL SURFACE – sees the implied volatility of 3M to 6M OTM puts cooling, whilst seeing a small rise in longer dated ATM options.

- ETH IMPLIED VOL SURFACE – has experienced a similar cooling at tenors between 3M and 6M, with a rise in OTM puts at 1Y and 2Y tenors.

- BTC SABR RHO – the trend towards a neutral skew in the volatility smile continues at a 1W tenor and leads similar behaviour in longer dated tenors.

- ETH SABR RHO – has similar levels of skew towards OTM puts as BTC’s smiles, but with a less noticeable drop in skew over the last few days.

Each metric shows signs of decreasing conviction in the next move for both BTC and ETH, leaving the derivatives market in a state of anticipation. Yields for both assets now trade negative close to 0% at all tenors, funding rates imply little strong demand for long or short spot positions, ATM implied volatility remains near to its historic lows, and the skew of the volatility smile is moving away from OTM puts.

Futures

BTC ANNUALISED YIELDS – shorter-dated yields rise to meet futures at 6M and 1Y tenors between 0% and -1% below spot.

ETH ANNUALISED YIELDS – see a similar but less dramatic recovery of yields at 1W and 1M tenors.

Perpetual Swap Funding Rate

BTC FUNDING RATE – is near 0% after several weeks of funding paid from shorts to long positions.

ETH FUNDING RATE – is also closer to 0% this week after two weeks of large positive funding.

Options

BTC SABR ATM IMPLIED VOLATILITY – continues to waver near the bottom of its historic range at all tenors.

ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s movements as it trades near to all-time low levels.

Volatility Surface

BTC IMPLIED VOL SURFACE – sees the implied volatility of 3M to 6M OTM puts cooling, whilst seeing a small rise in longer dated ATM options.

ETH IMPLIED VOL SURFACE – has experienced a similar cooling at tenors between 3M and 6M, with a rise in OTM puts at 1Y and 2Y tenors.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

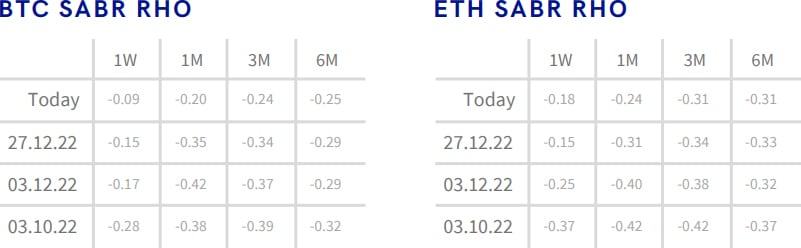

SABR Rho

BTC SABR RHO – the trend towards a neutral skew in the volatility smile continues at a 1W tenor and leads similar behaviour in longer dated tenors.

ETH SABR RHO – has similar levels of skew towards OTM puts as BTC’s smiles, but with a less noticeable drop in skew over the last few days.

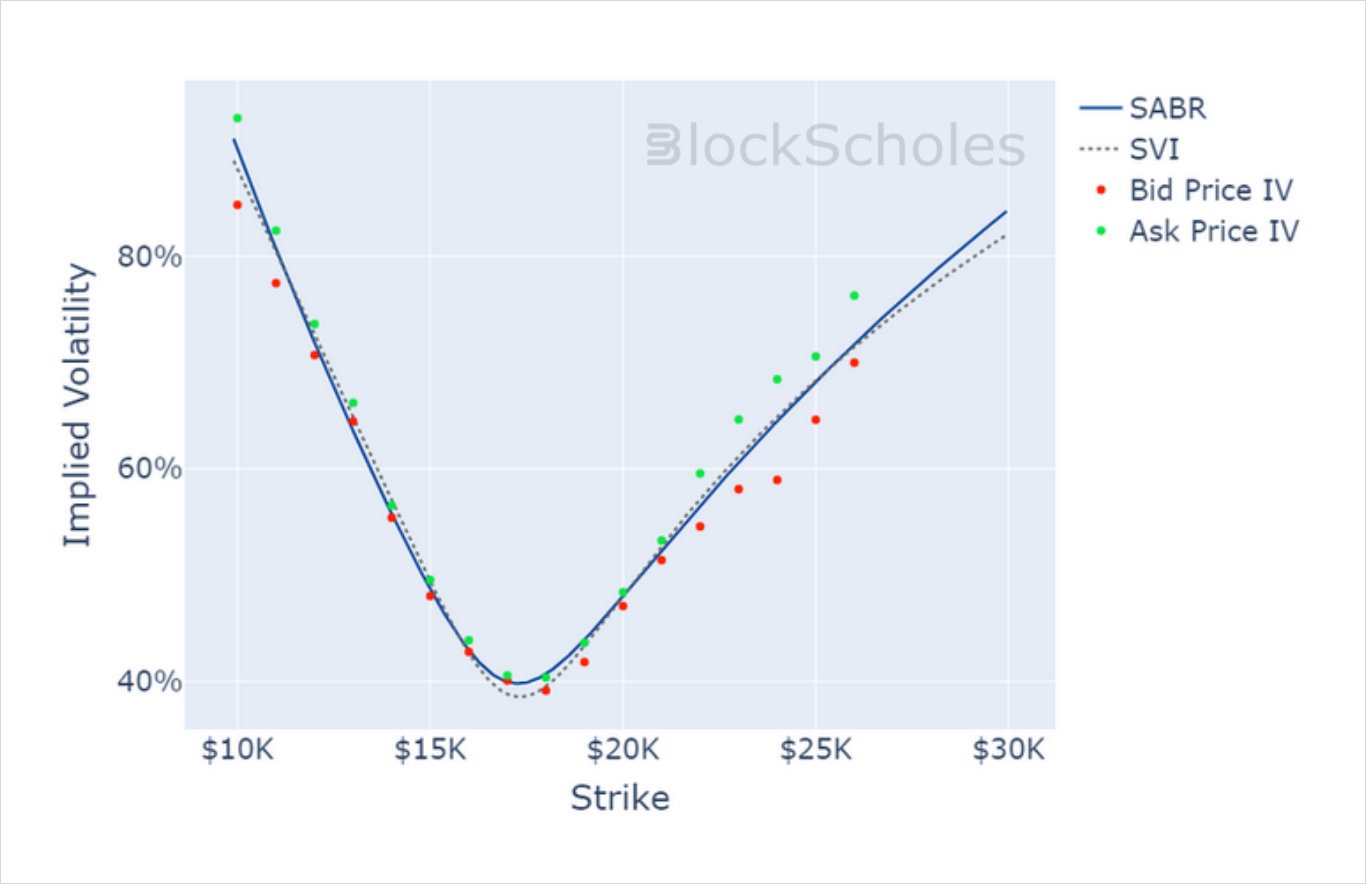

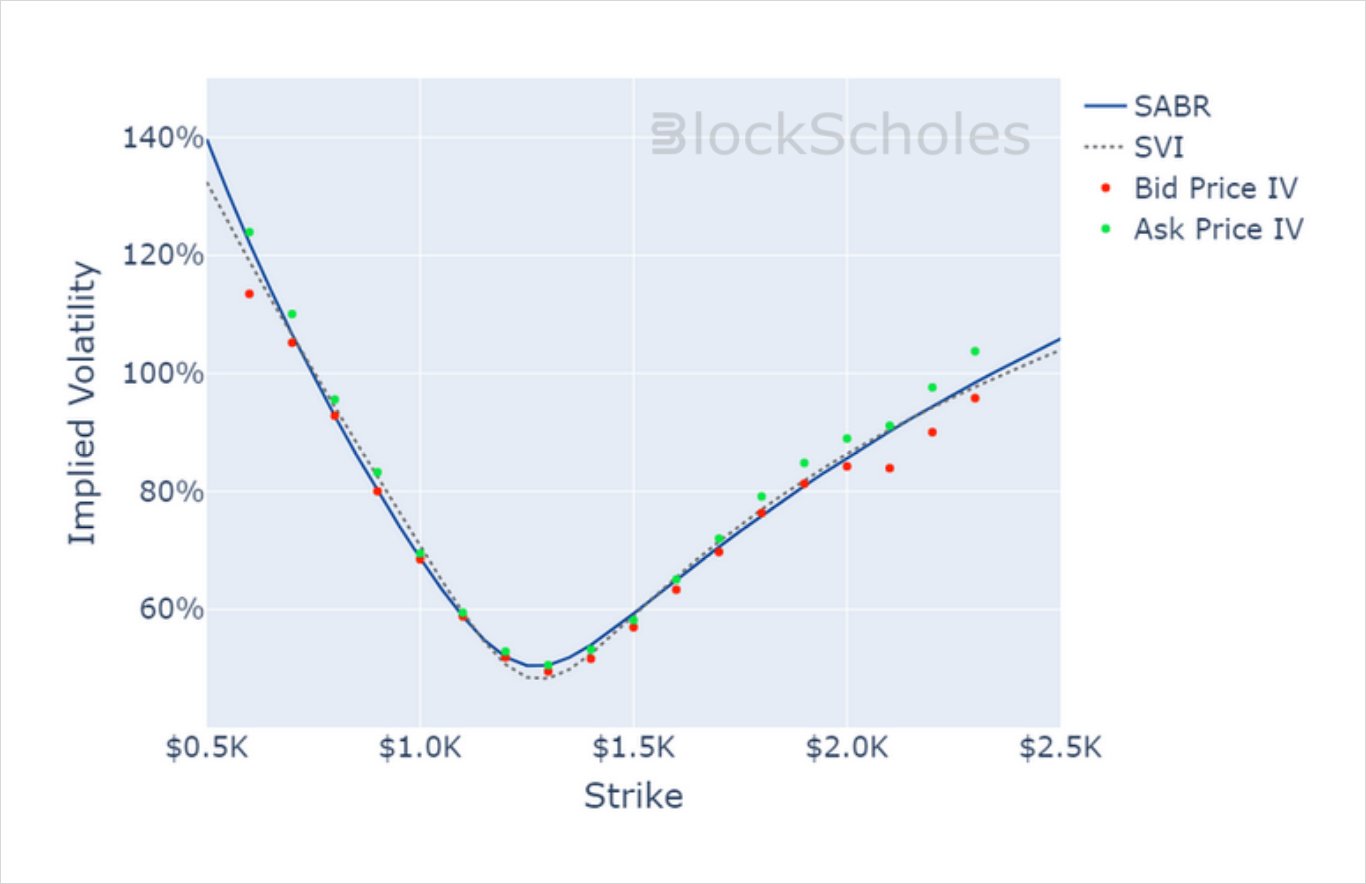

Volatility Smiles

BTC SMILE CALIBRATIONS – 27-Jan-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 27-Jan-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)