Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Future-implied yields continued to trade sideways as at-the-money implied volatility climbed higher at the beginning of the week, following increase uncertainty sparked by the USDC depeg and a big week for monetary policy announcements. In the hours since the FOMC meeting on Wednesday, those high volatility expectations have fallen, and the volatility smiles of BTC and ETH options have skewed further towards OTM puts.

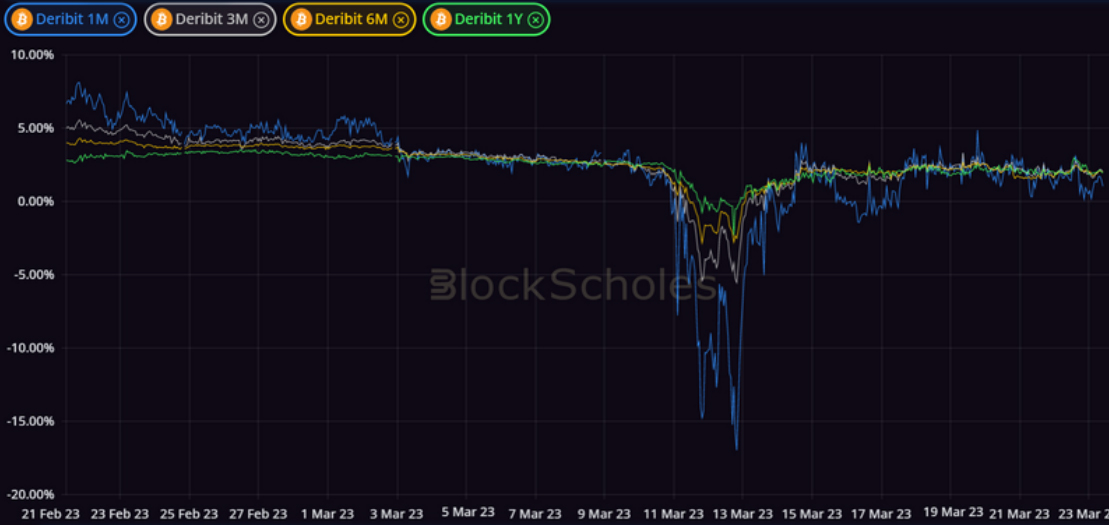

Futures

BTC ANNUALISED YIELDS – continue to trade sideways just above 0 at all tenors.

ETH ANNUALISED YIELDS – perform similarly to those of BTC, trading in a tight range near to zero.

Perpetual Swap Funding Rate

BTC FUNDING RATE – reflect the bullish sentiment in BTC’s spot price as the perpetual swap contract trades above the spot over the last week.

ETH FUNDING RATE – reflects a similar bullish sentiment over the last seven days as long exposure becomes attractive.

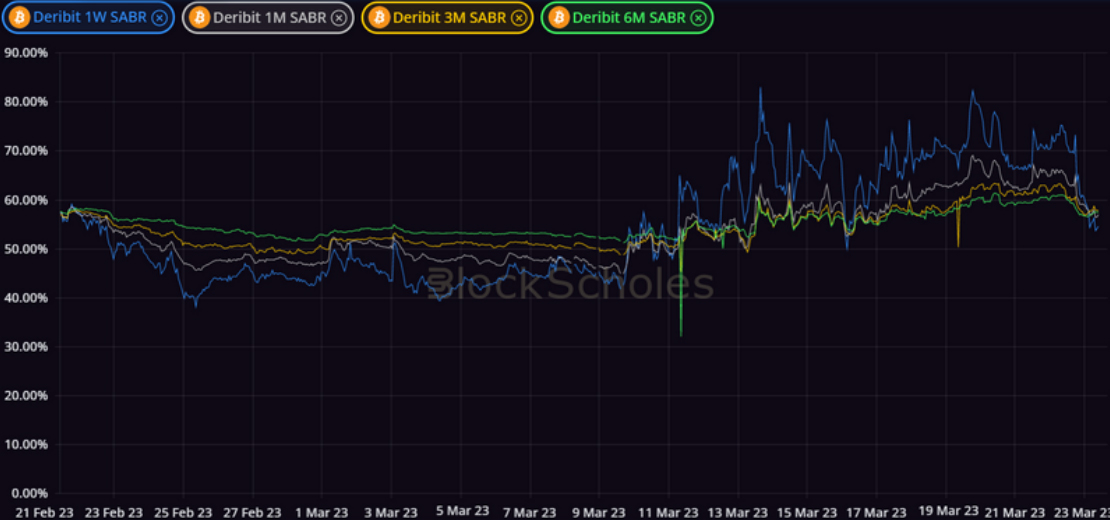

Options

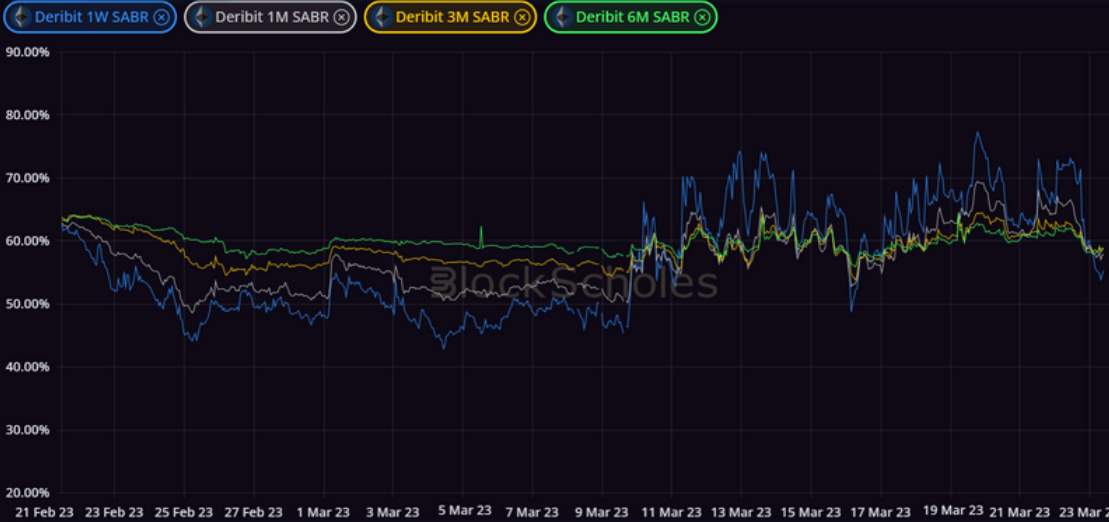

BTC SABR ATM IMPLIED VOLATILITY – continued its rise until the FOMC meeting on Wednesday, seeing a decisive drop in the hours since.

ETH SABR ATM IMPLIED VOLATILITY – has begun to trade at similar levels to BTC, sharing in the drop in vol following Wednesday’s FOMC meeting.

Volatility Surface

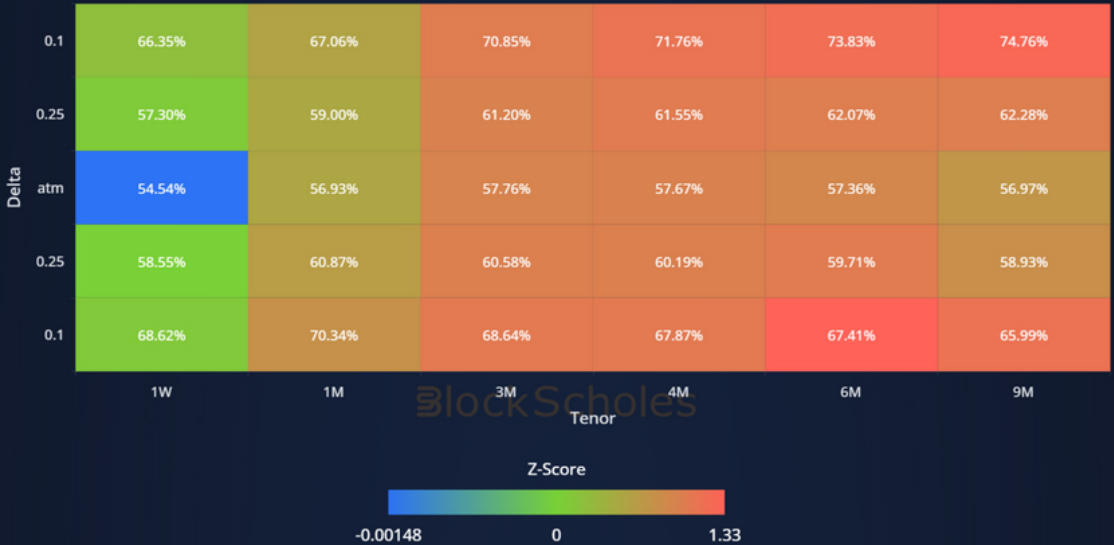

BTC IMPLIED VOL SURFACE – despite the drop in vol over the last 24 hours, most points on the vol surface are trading above their 30-day historic mean.

ETH IMPLIED VOL SURFACE – trades at or above its 30-day average at short tenors and in OTM calls, but sees a cooling in the implied volatility of longer term downside protection.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

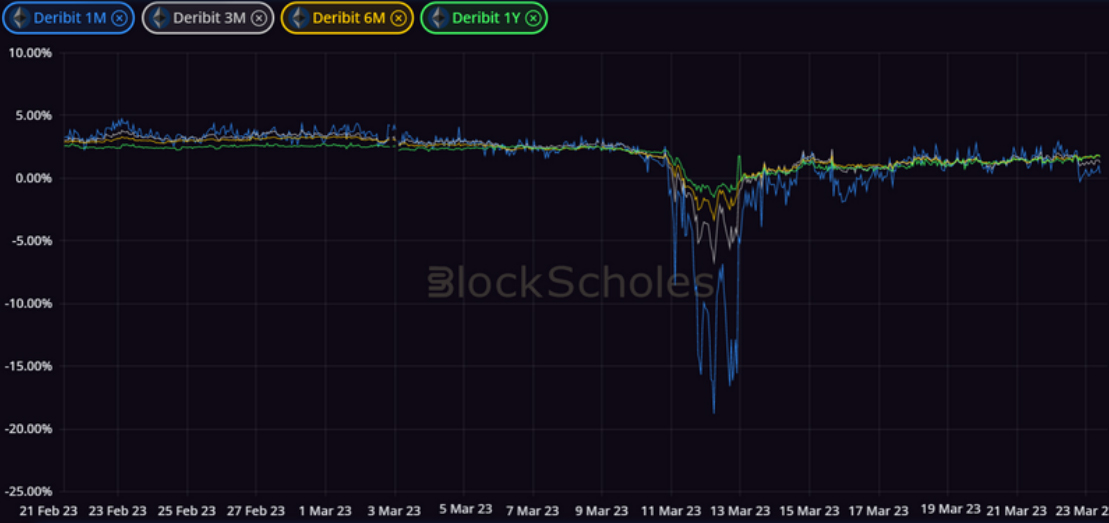

Put-Call Skew

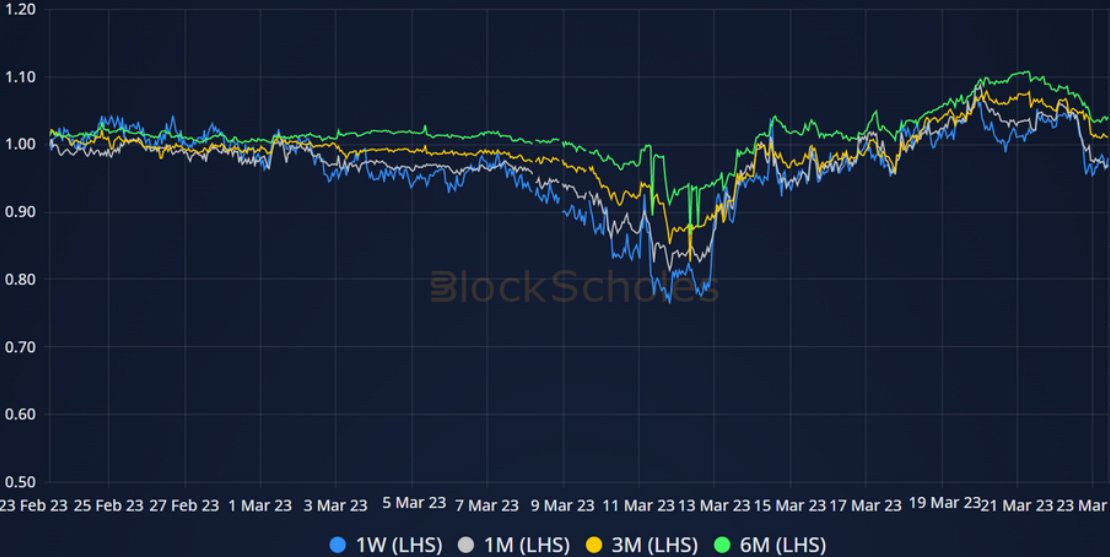

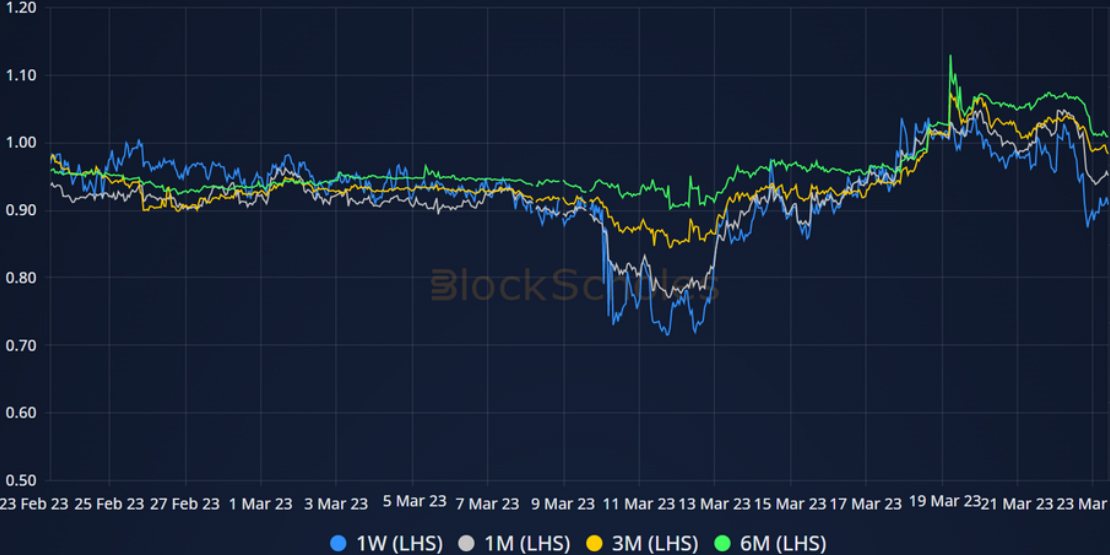

BTC 25 DELTA PC SKEW – has reversed its trend towards OTM calls in the last couple of days.

ETH 25 DELTA PC SKEW – has seen a similar but stronger reversal in sentiment, now trending back towards a skew to OTM puts at short tenors.

Volatility Smiles

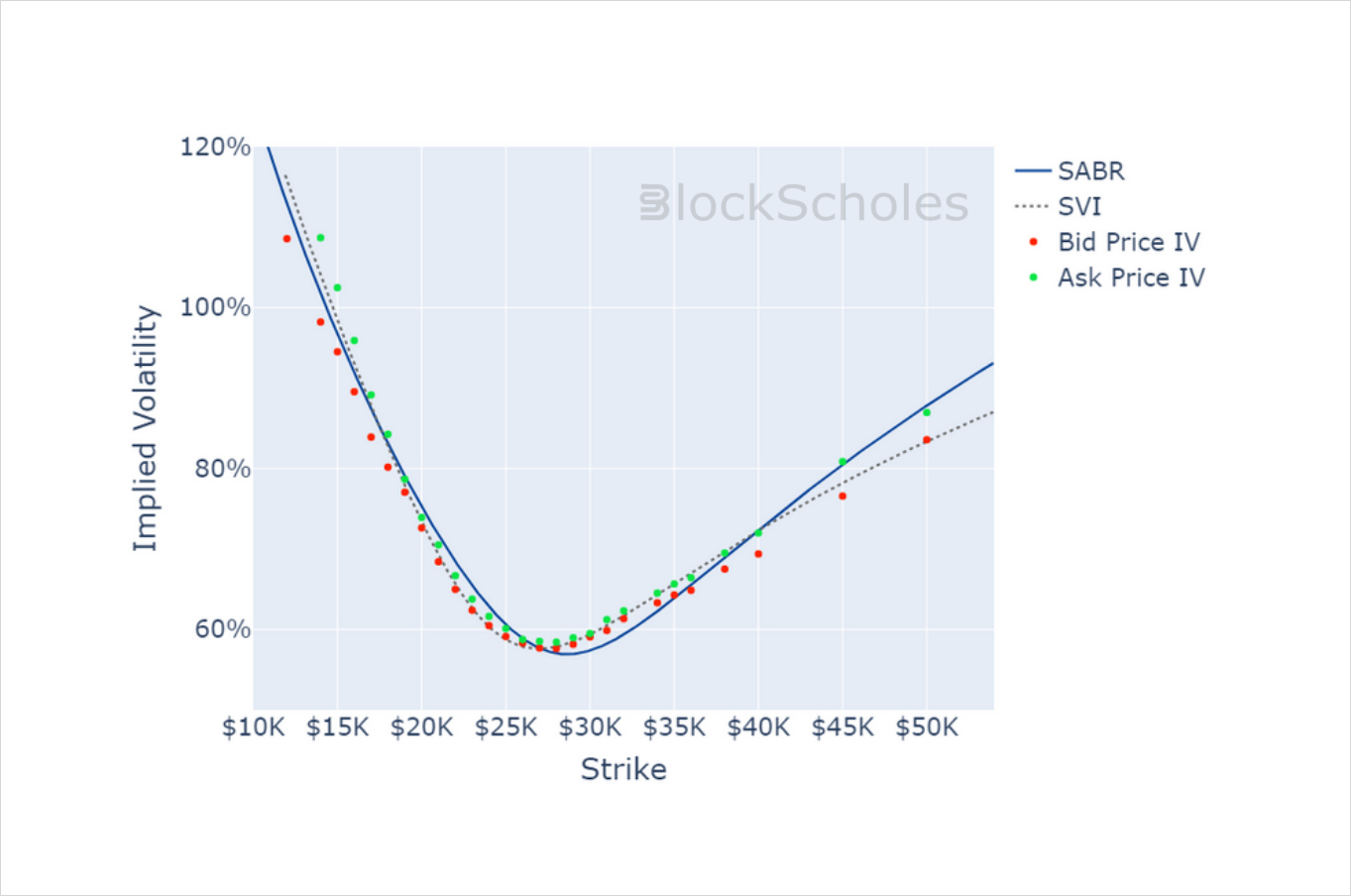

BTC SMILE CALIBRATIONS – 28-Apr-2023 Expiry, 10:00 UTC Snapshot.

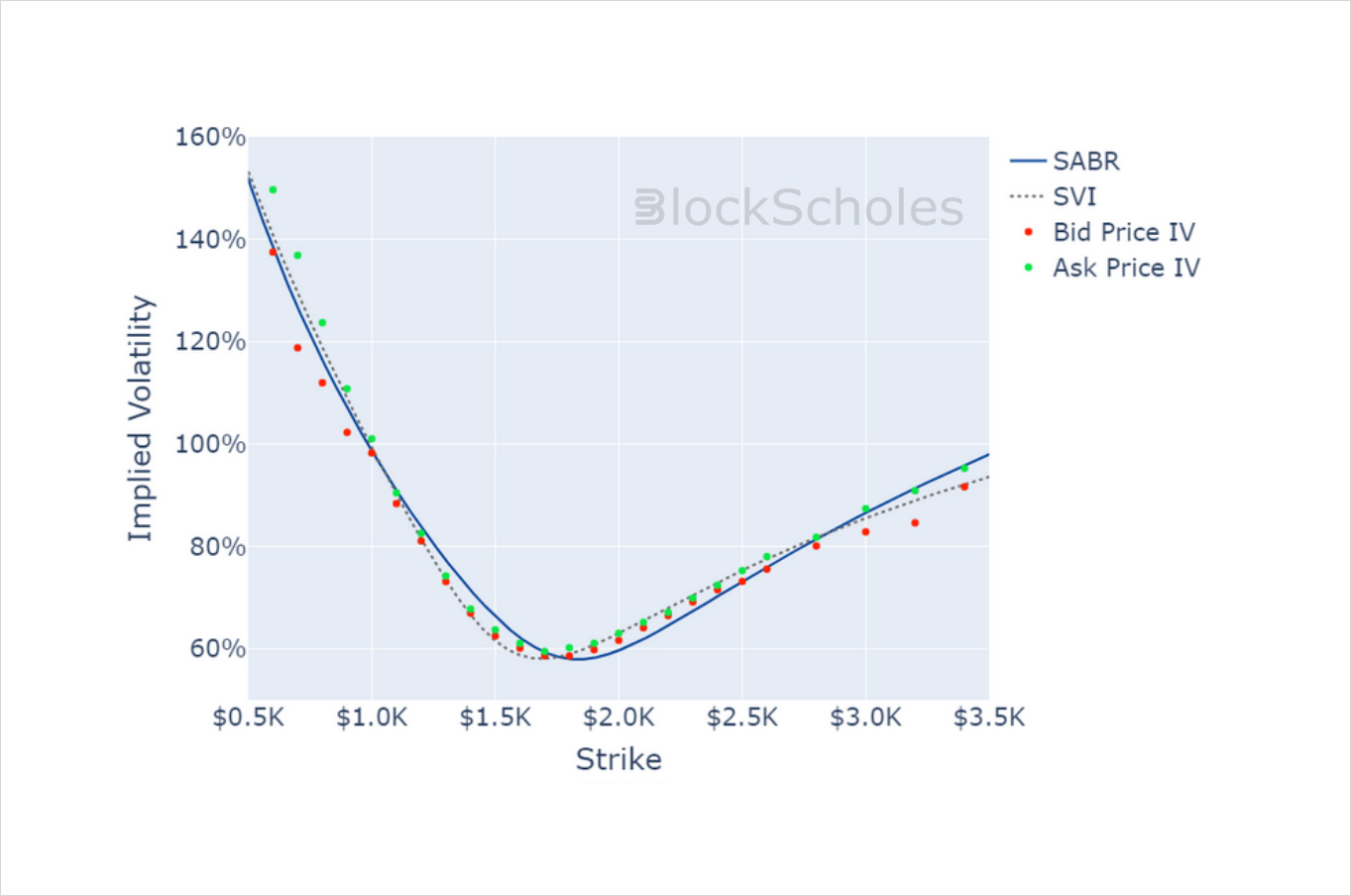

ETH SMILE CALIBRATIONS – 28-Apr-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

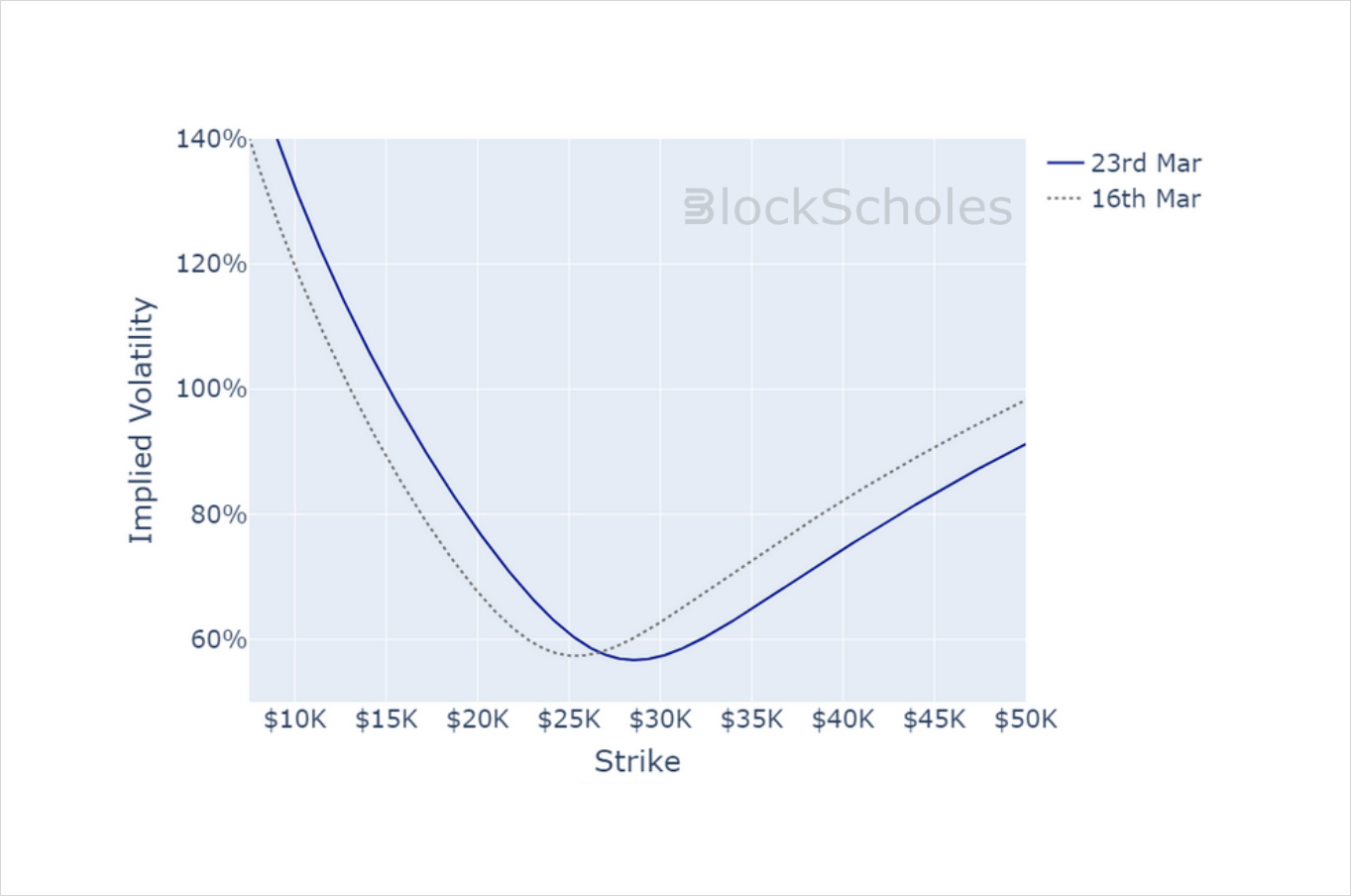

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

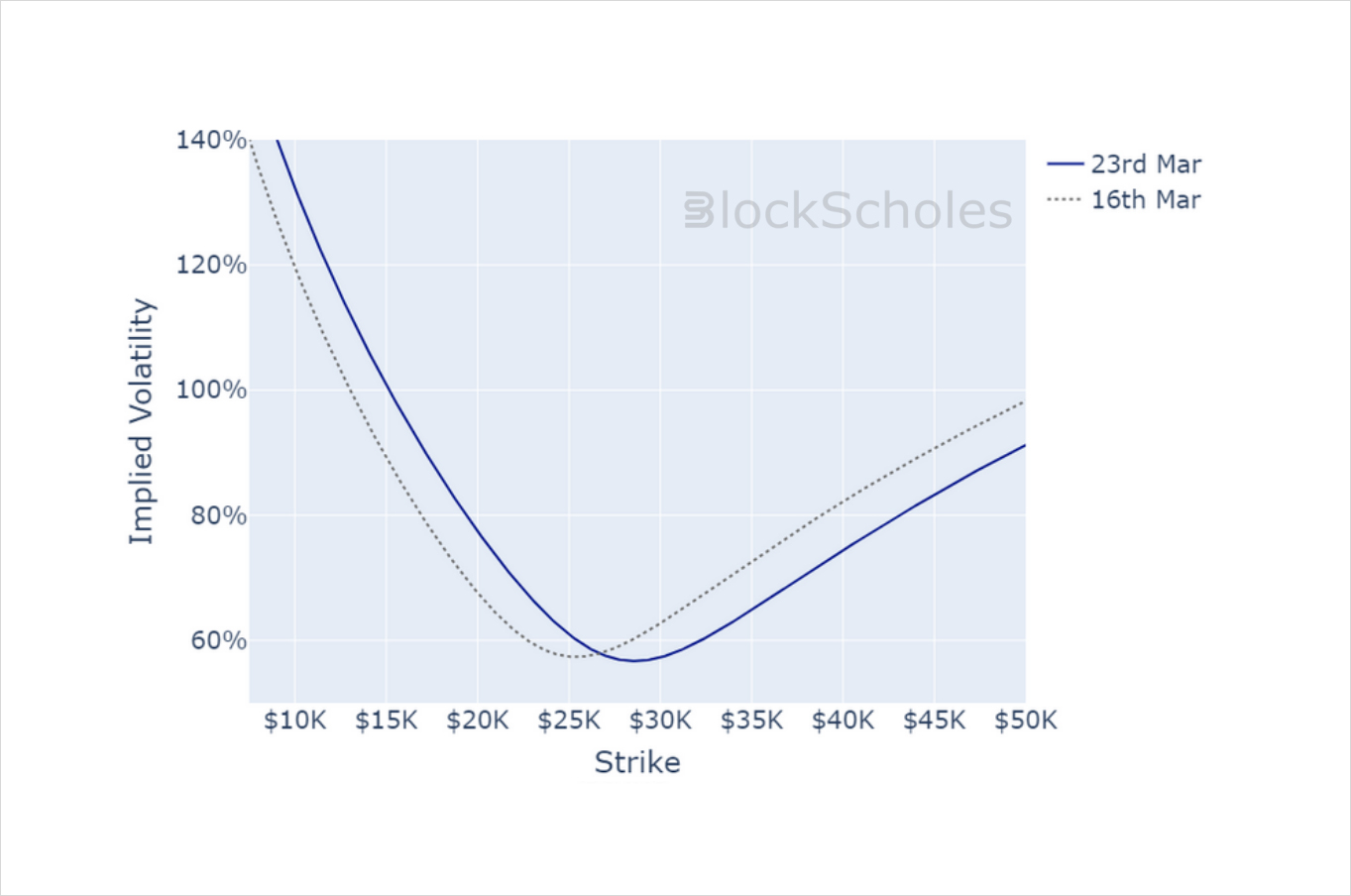

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)