Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

At-the-money implied volatility has fallen and remained low since the FOMC meeting on the 22nd March confirmed a 25 bps interest rate hike. Further bullish movements in spot price have buoyed several key derivatives metrics in the last couple of days, with a rise in futures-implied yields, positive funding rates, and a slight move towards OTM calls by the volatility smile of both BTC and ETH options.

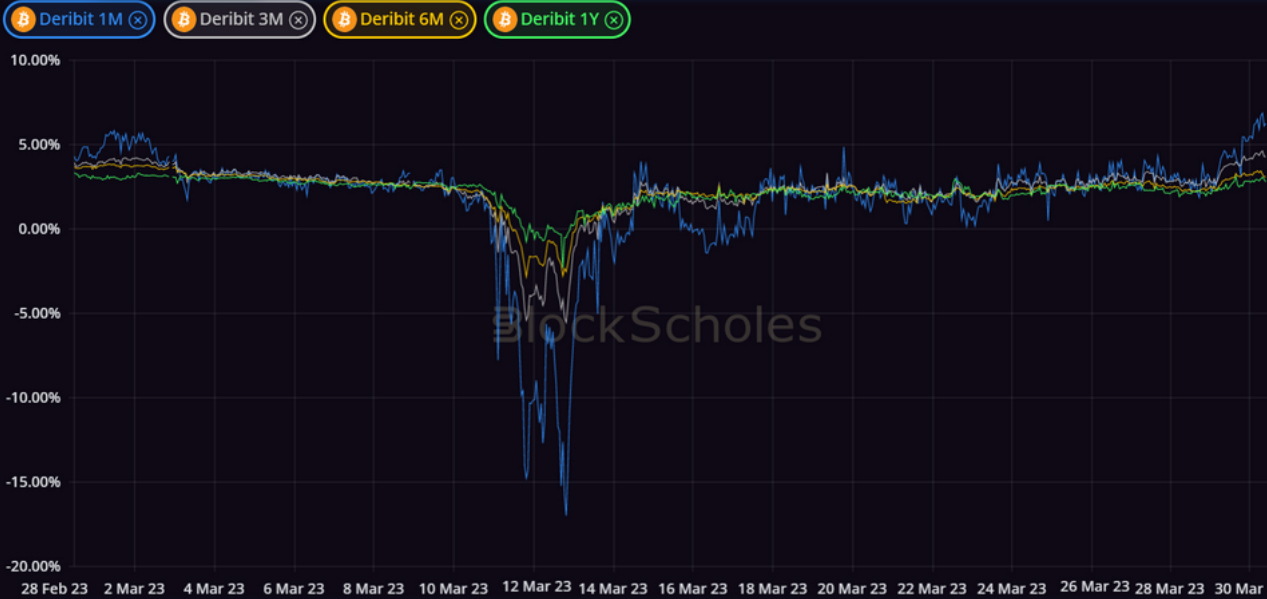

Futures

BTC ANNUALISED YIELDS – have risen distinctly in recent days owing to the strong performance of spot price over the same period.

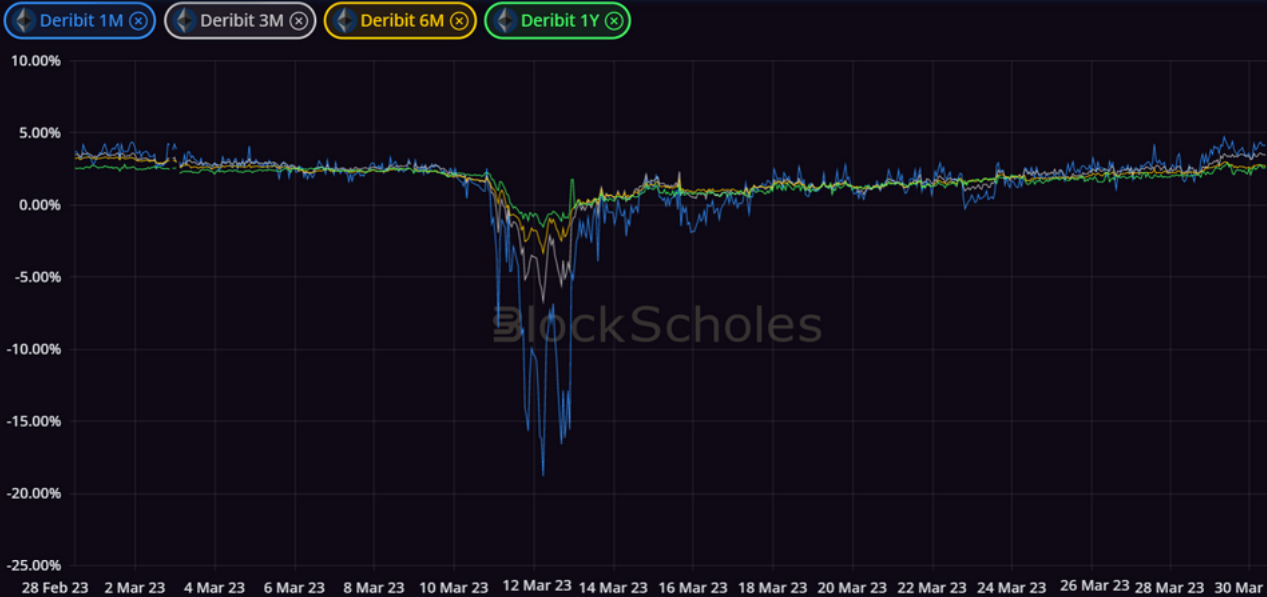

ETH ANNUALISED YIELDS – traded sideways just above zero since the recovery of USDC’s peg to the dollar, rising slightly in the last 24 hours.

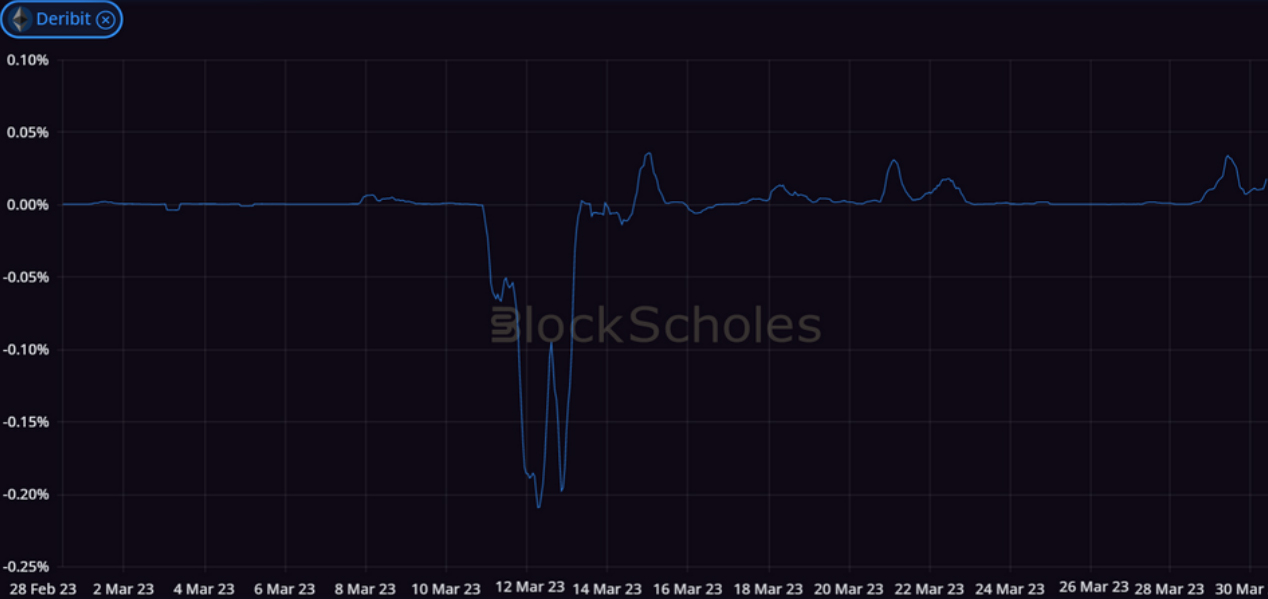

Perpetual Swap Funding Rate

BTC FUNDING RATE – records month long highs paid to short positions as demand for long exposure to the perpetual swap contract surges.

ETH FUNDING RATE – saw little action midweek, before reflecting a desire for upside participation in the most recent spot rally.

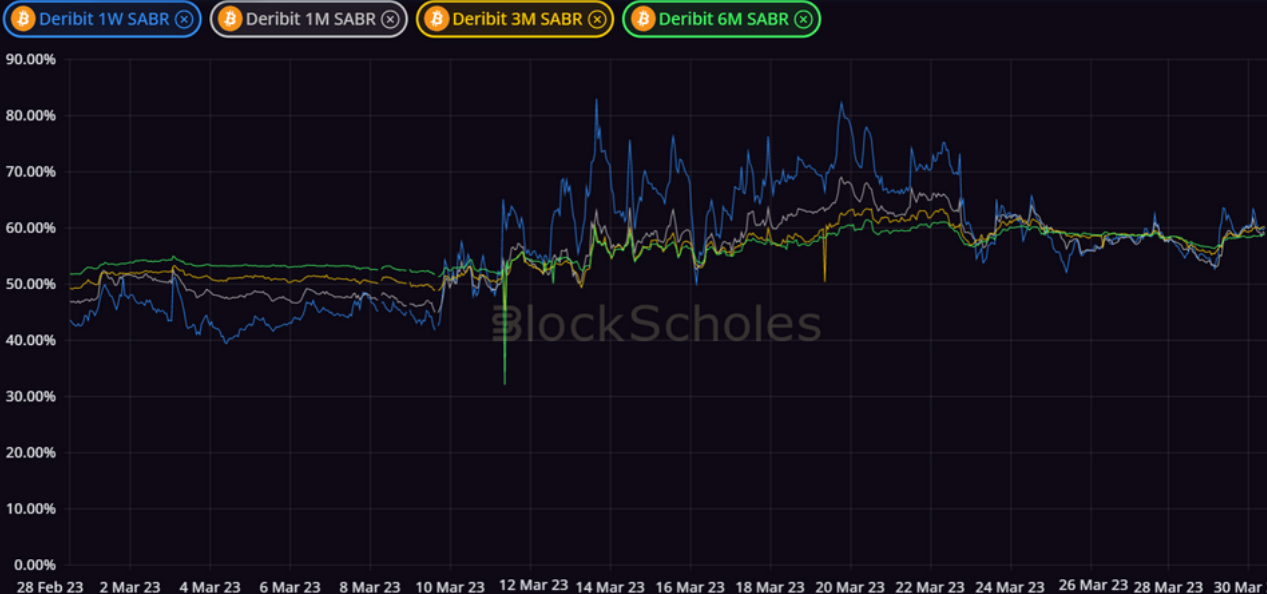

Options

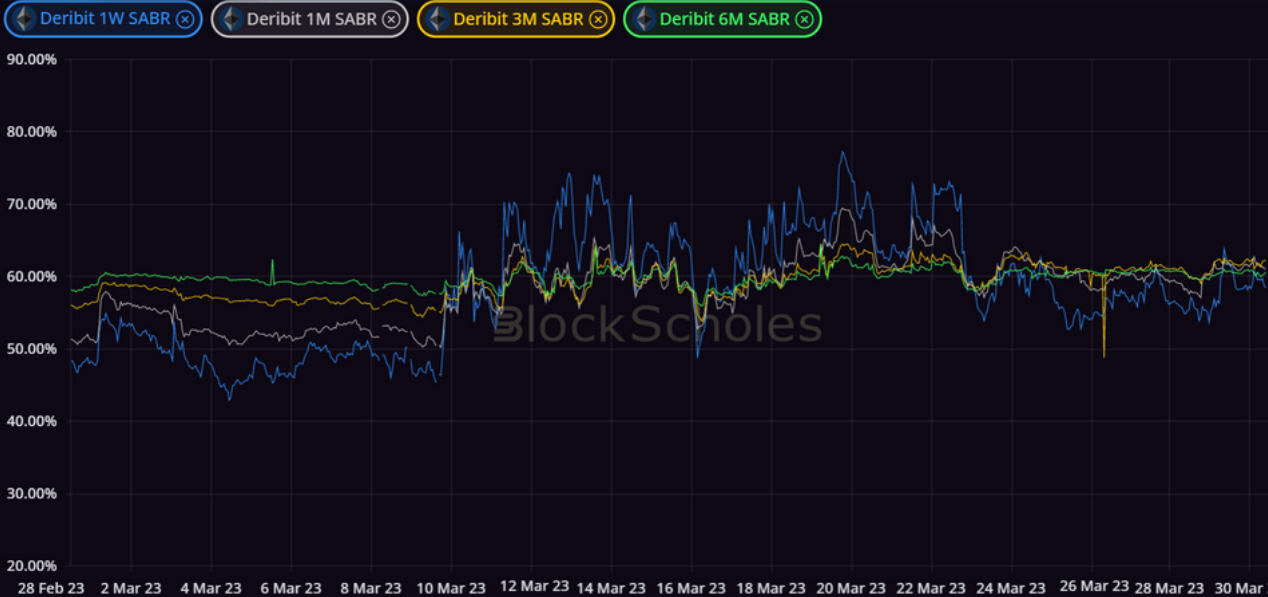

BTC SABR ATM IMPLIED VOLATILITY – trades at distinctly lower levels to last week, following the end of a week of macroeconomic announcements.

ETH SABR ATM IMPLIED VOLATILITY – cooled dramatically following the FOMC meeting on 22nd March, now trades below 60% at all tenors.

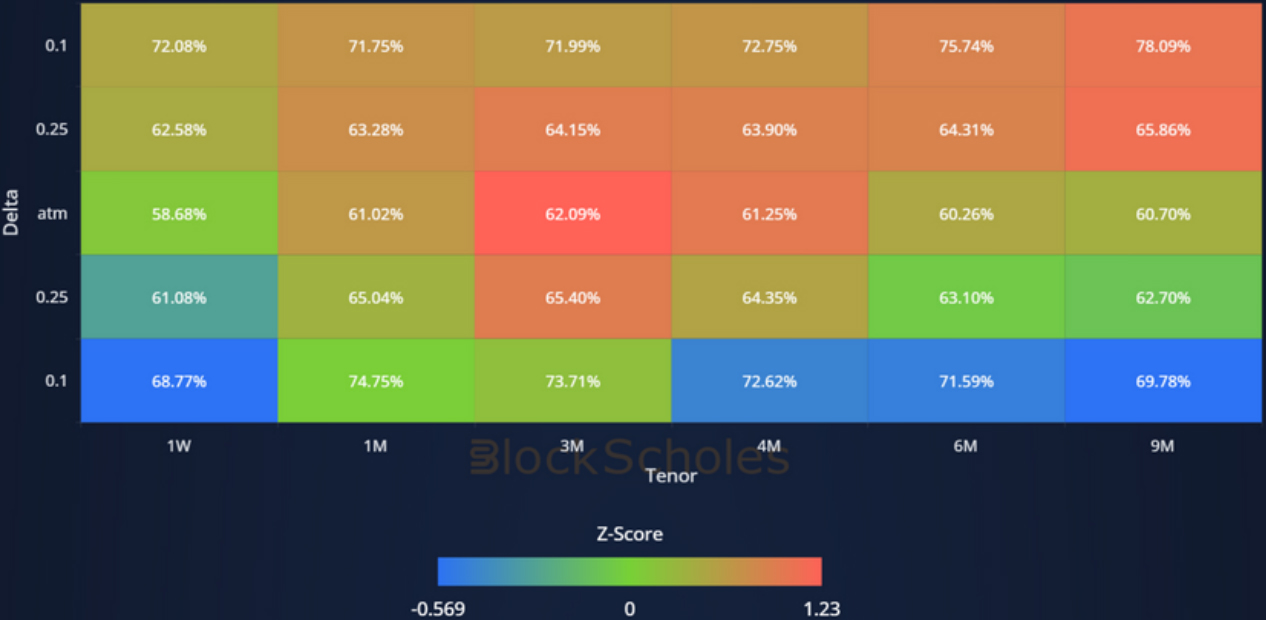

Volatility Surface

BTC IMPLIED VOL SURFACE – almost all points on the surface have increased volatility expectations, particularly at ATM strikes at 3M and 4M tenors.

ETH IMPLIED VOL SURFACE – sees the strongest cooling in OTM puts in the last few days, reducing its excess skew to OTMs puts at all tenors.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

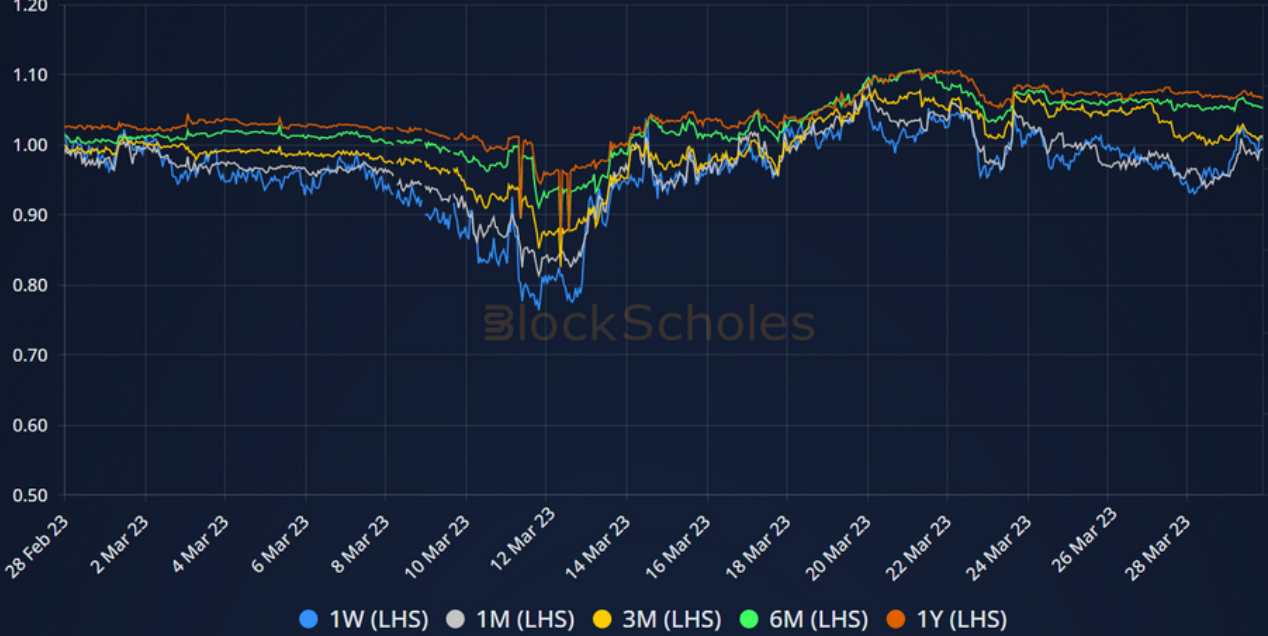

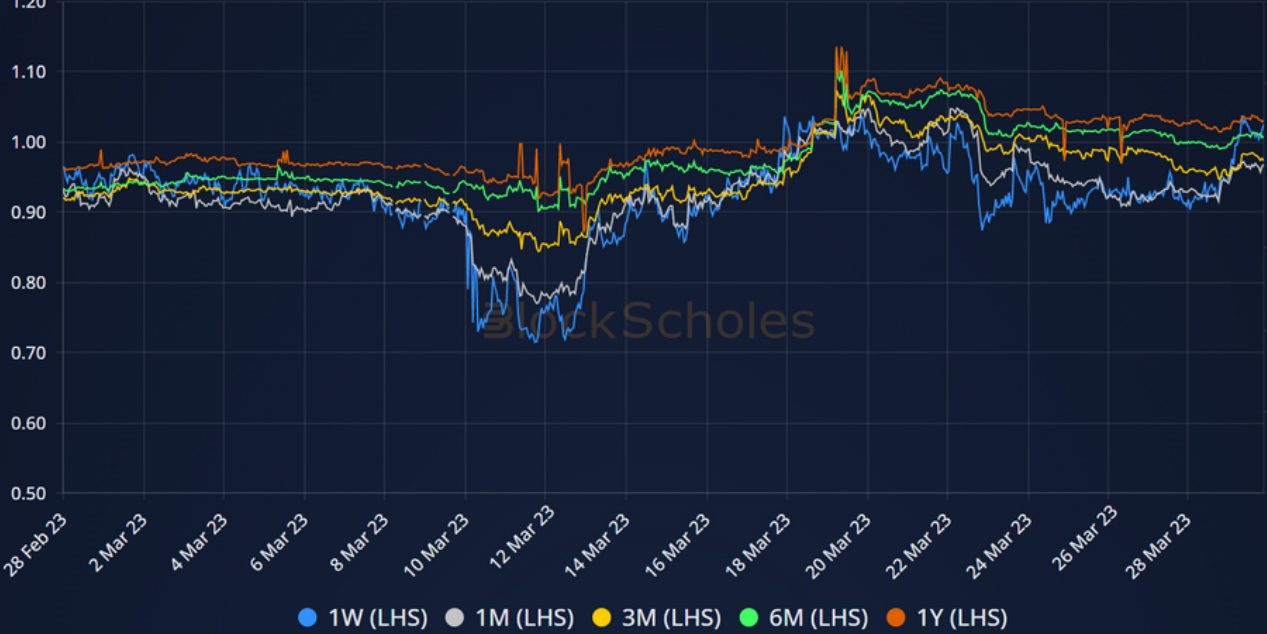

Put-Call Skew

BTC 25 DELTA PC SKEW – trades in a tight spread above 1, with the vol smile at short tenors reducing its skew towards OTM puts.

ETH 25 DELTA PC SKEW – has traded sideways over the previous week, at a slightly stronger skew towards OTM puts than BTC’s vol smile.

Volatility Smiles

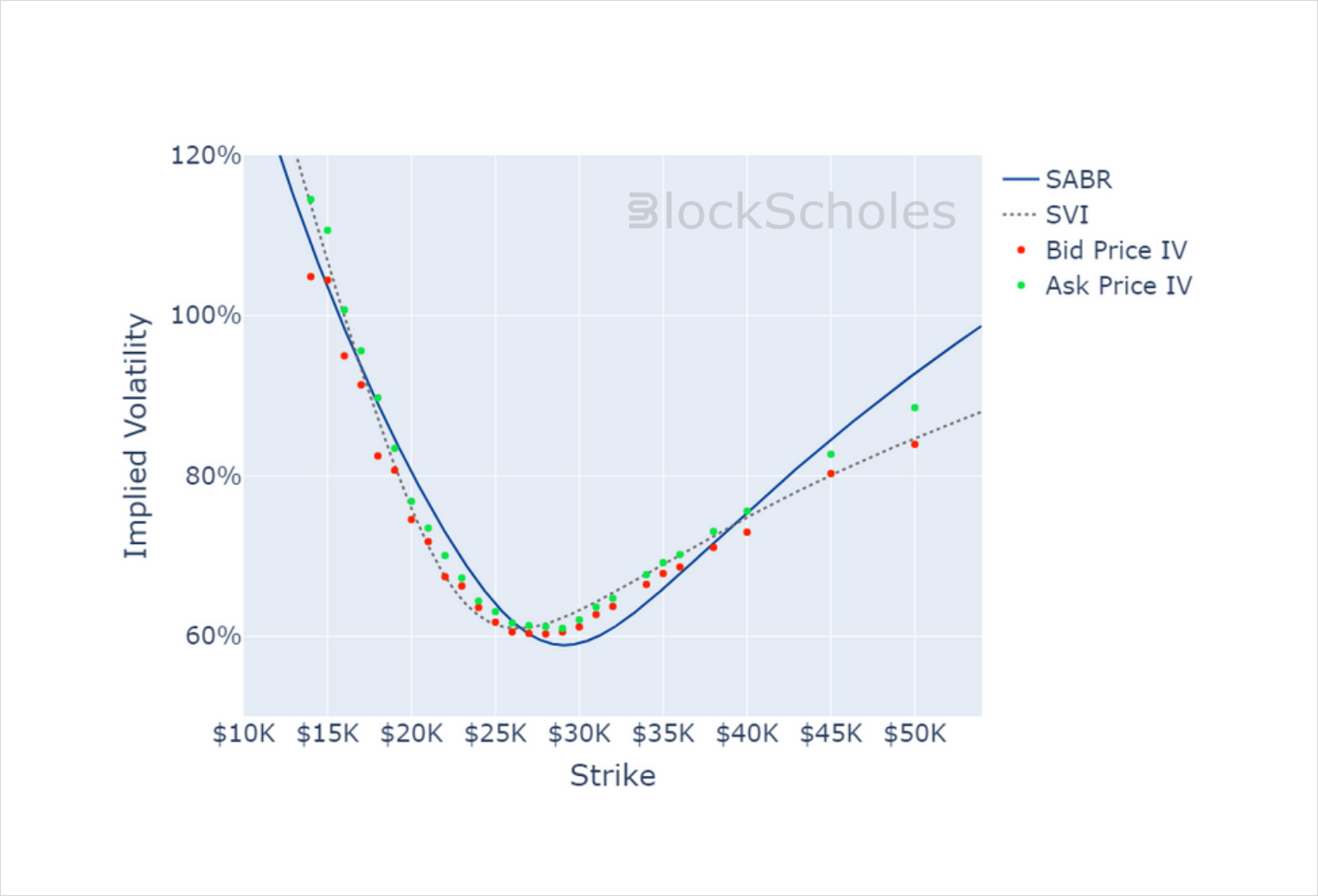

BTC SMILE CALIBRATIONS – 28-Apr-2023 Expiry, 10:00 UTC Snapshot.

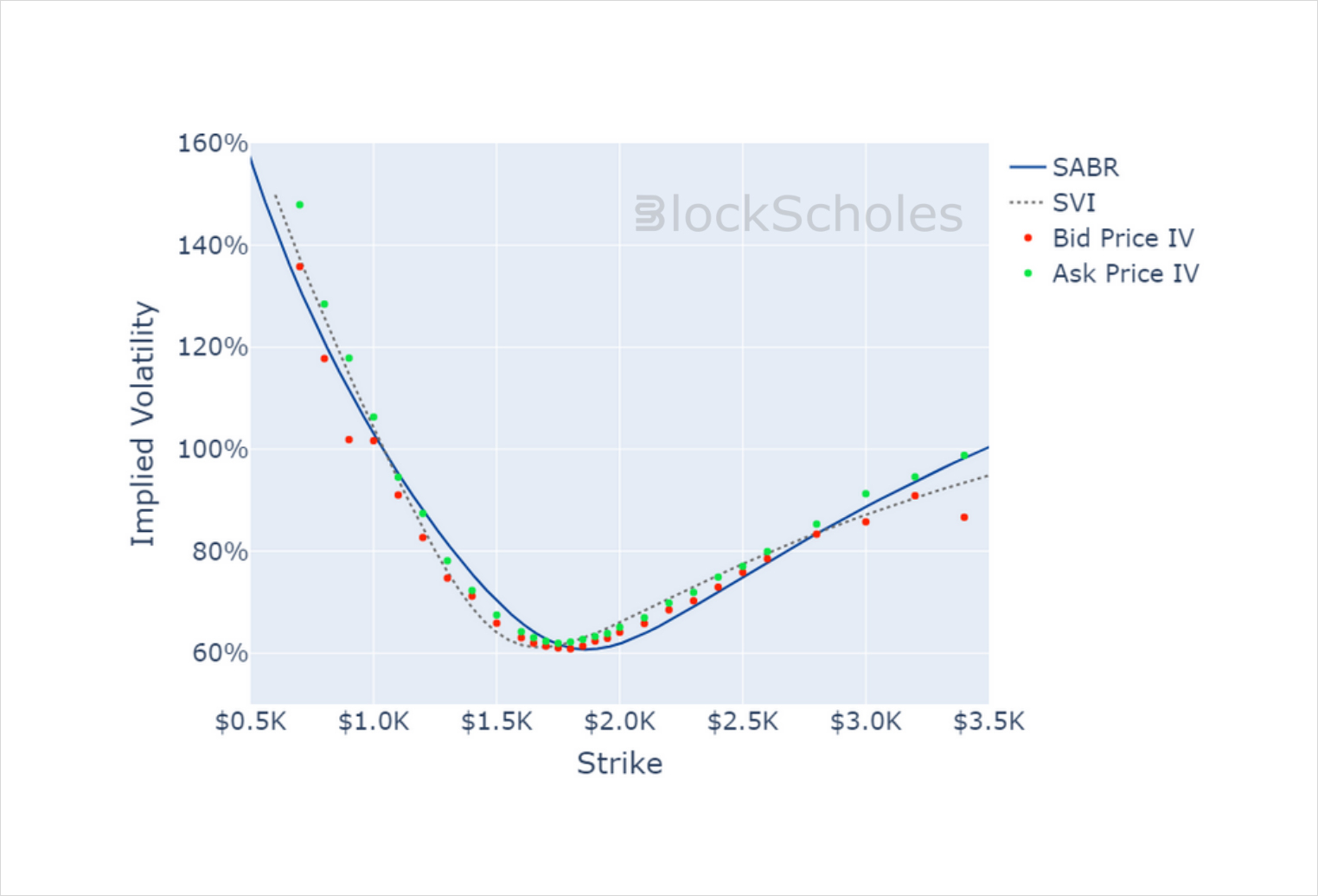

ETH SMILE CALIBRATIONS – 28-Apr-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

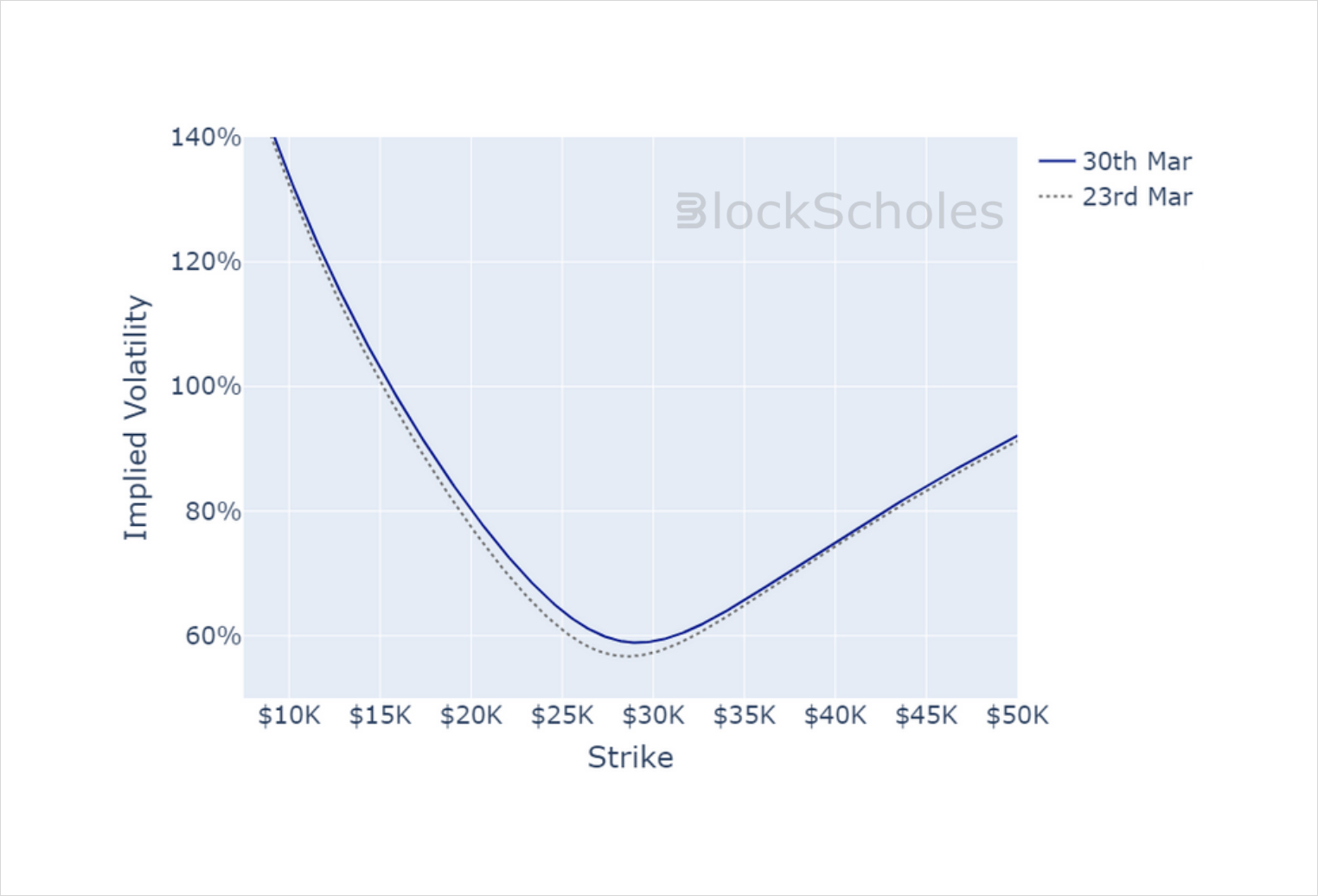

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

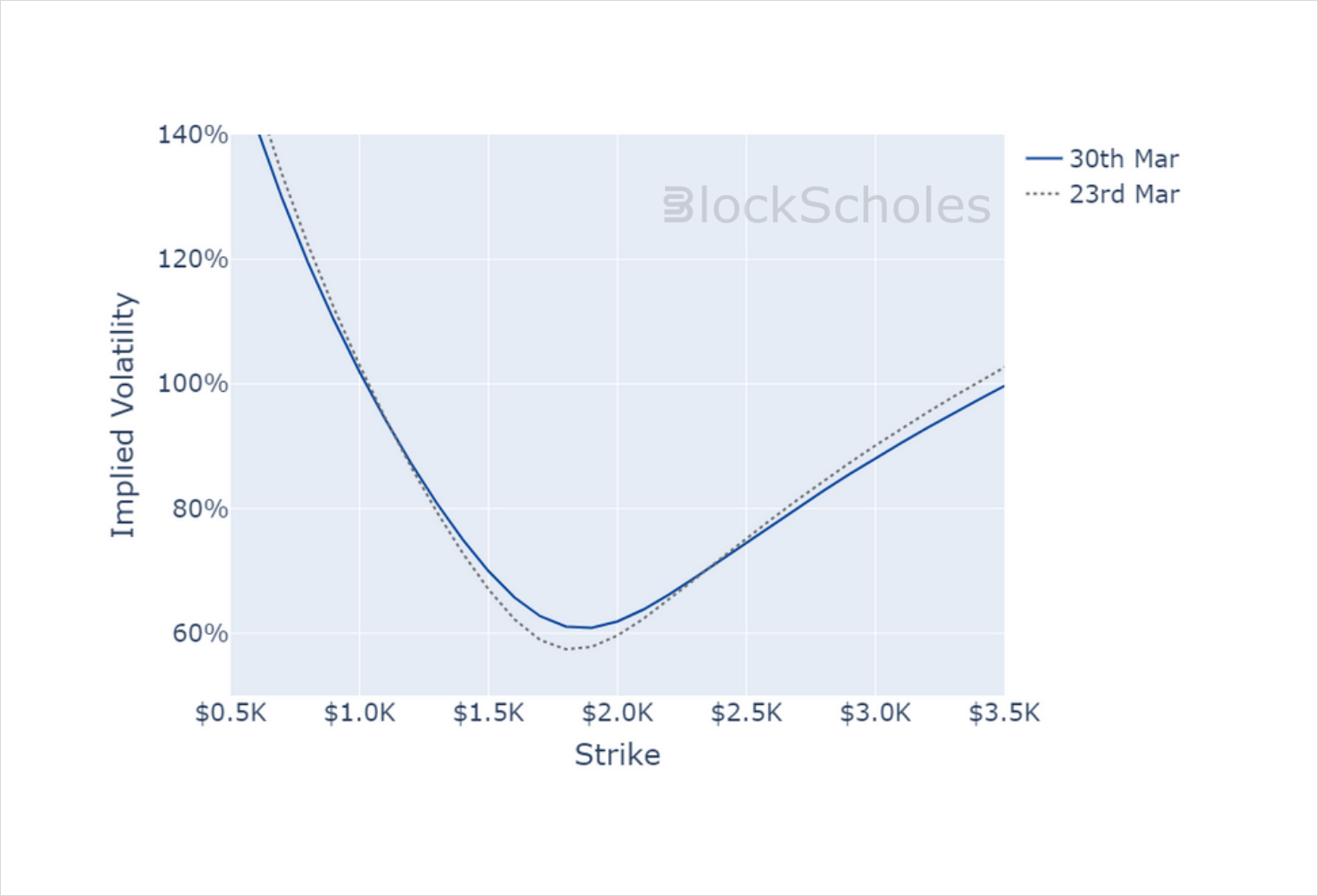

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)