Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

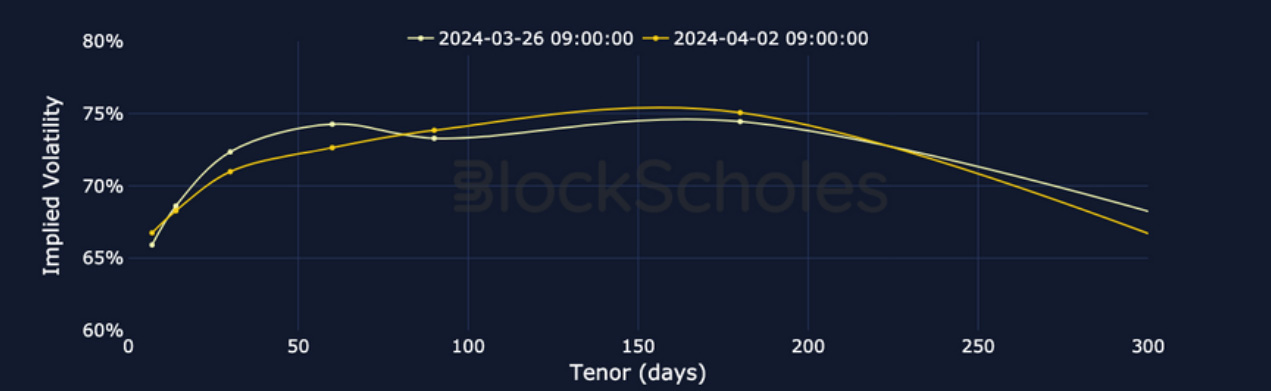

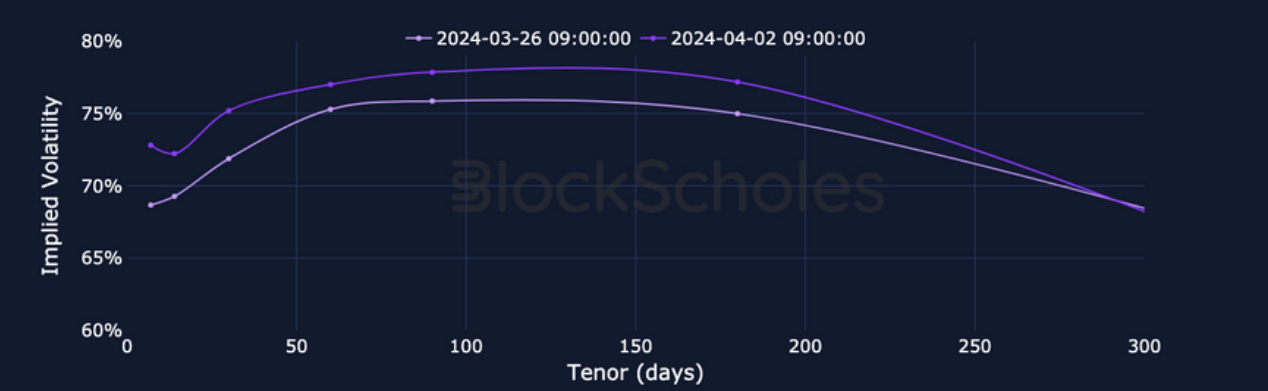

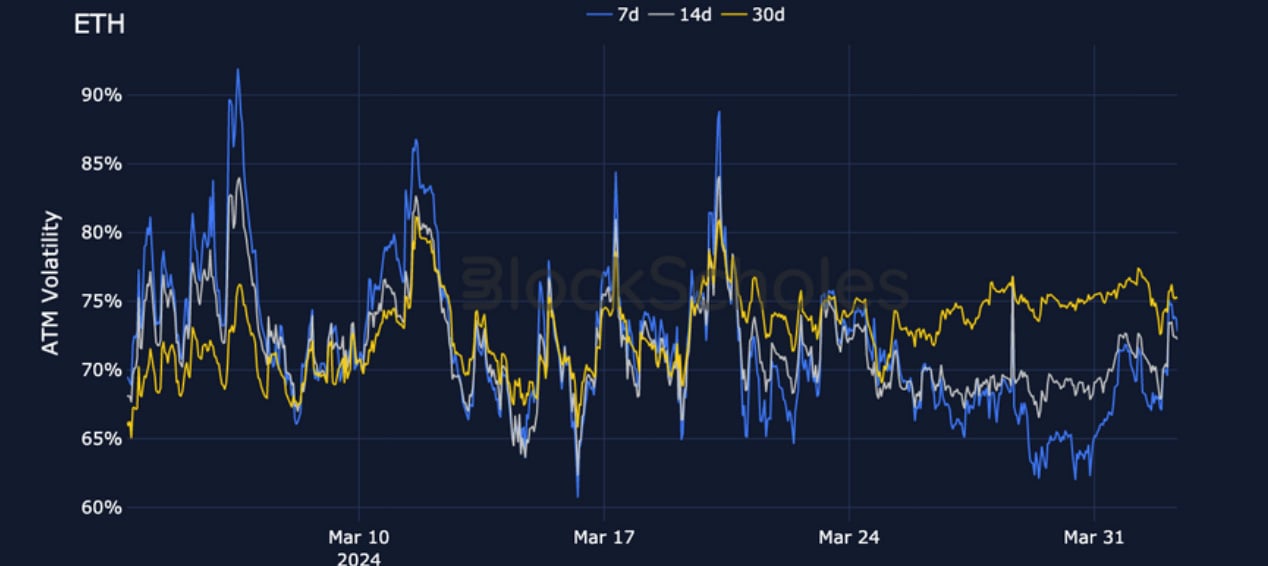

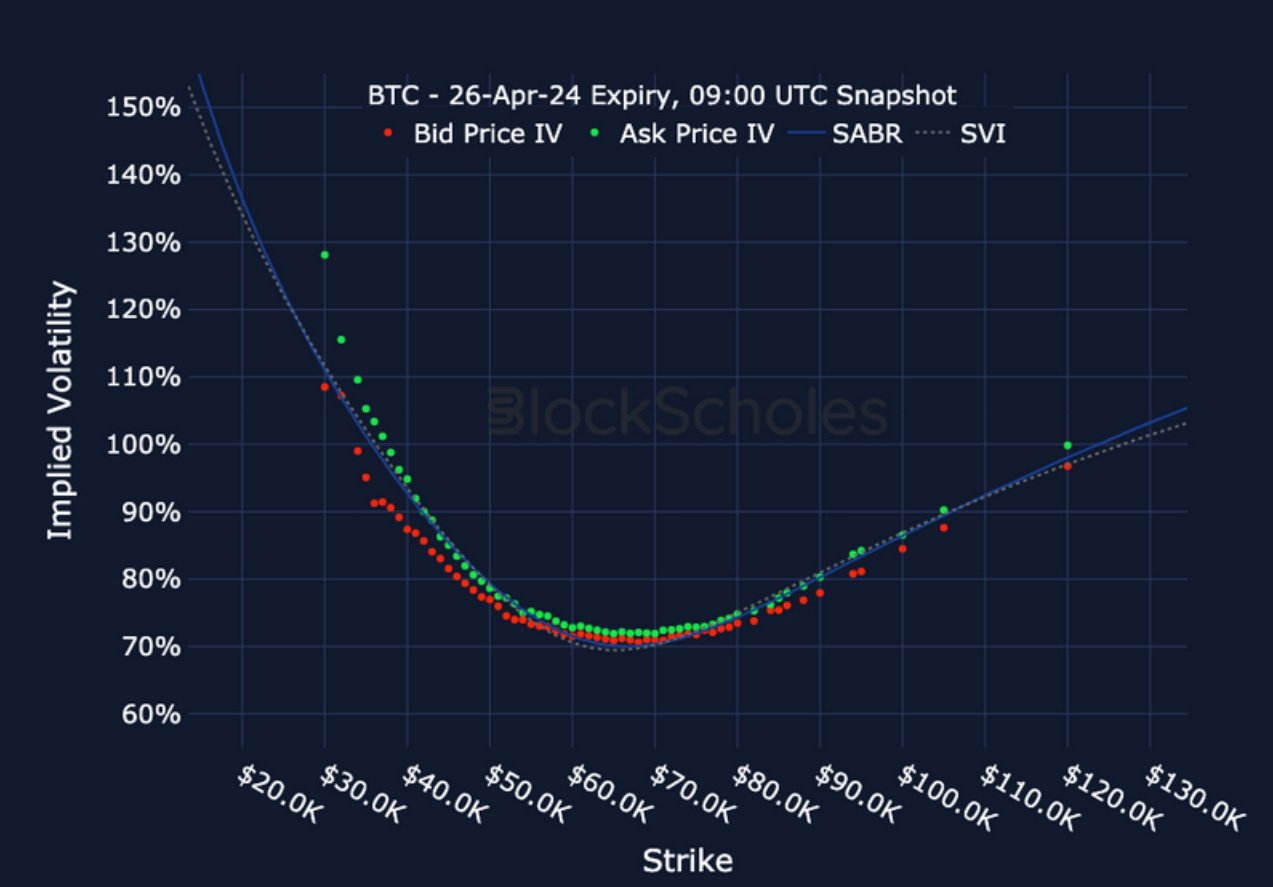

After reaching locals highs of $71k and $3.7k earlier in the week, both BTC and ETH spot prices have fallen. This pullback has resulted in a slight decrease in demand for leveraged long exposure, reinforced by the increased skew towards puts in the smiles of both majors. However, excess demand for downside protection is less extreme when compared to earlier in the month where the 25-delta risk reversal skew for BTC and ETH reached lows of -9% and -17% respectively. Rather, the bearish turn in derivatives appears to be a repeat of the leverage flush out that we have seen several times during this rally. Implied volatility has risen for both majors, and particularly in short-dated tenors which has resulted in a flattening of the volatility term structure from its previously steep shape.

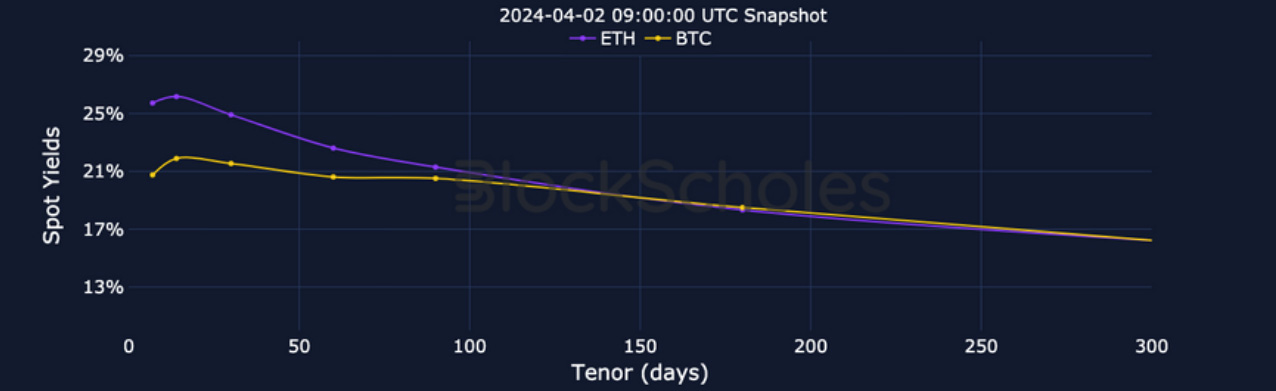

Futures Implied Yield, 1-Month Tenor

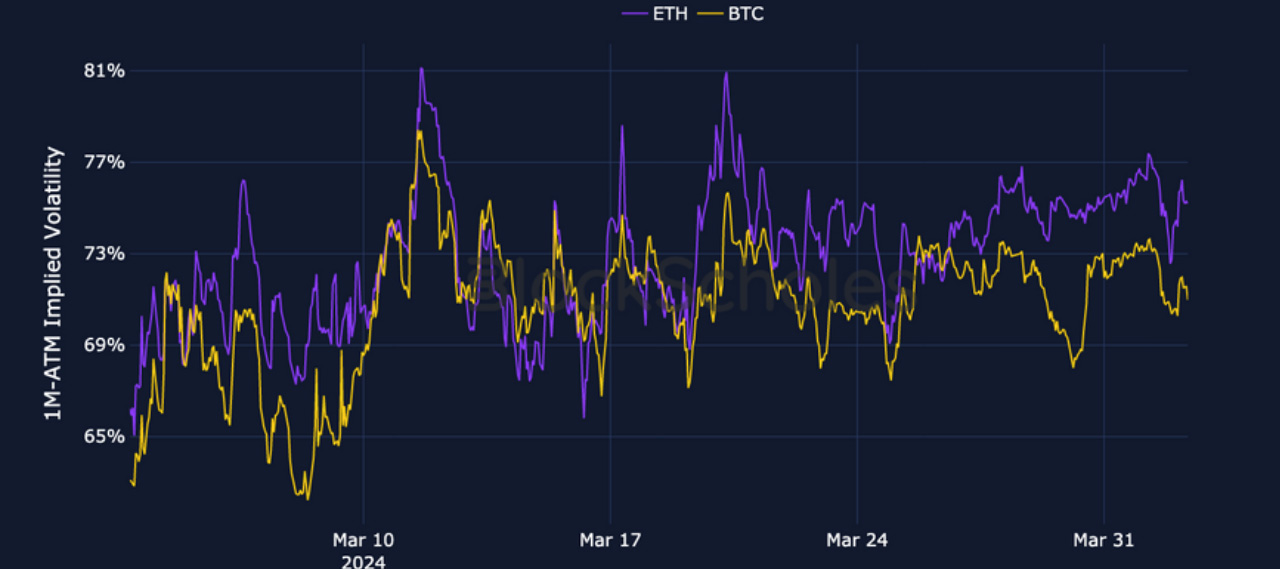

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – demand for leveraged long exposure increased earlier in the week, before falling abruptly following a reversal in BTC spot price.

ETH ANNUALISED YIELDS – we observe a reversal similar to BTC’s, although yields remain 4% higher at short-dated tenors.

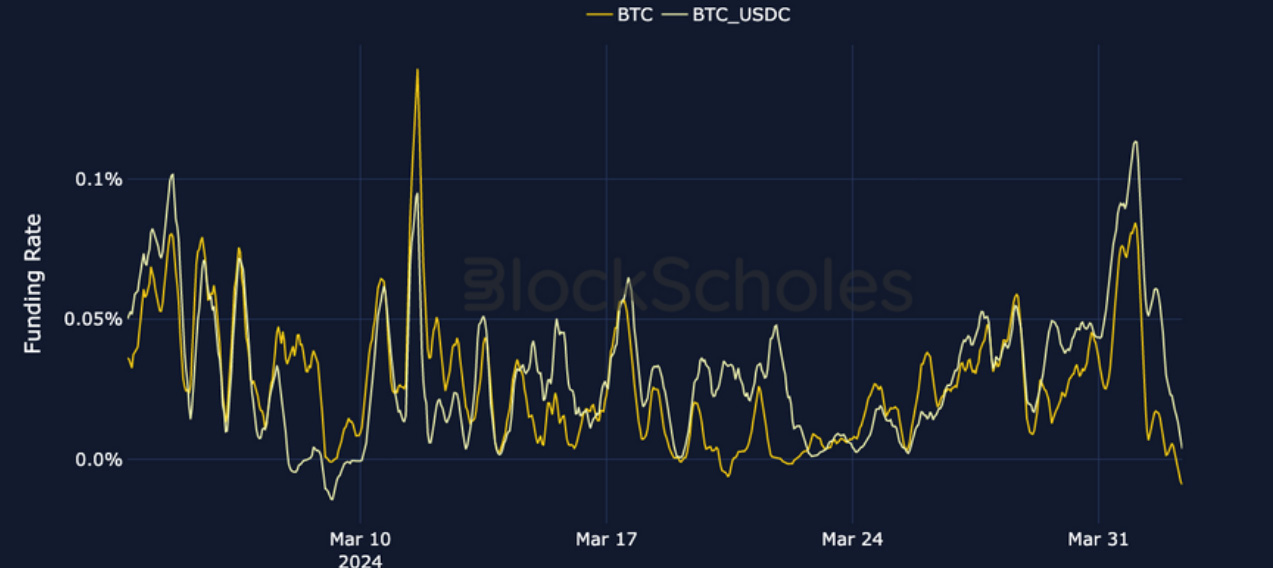

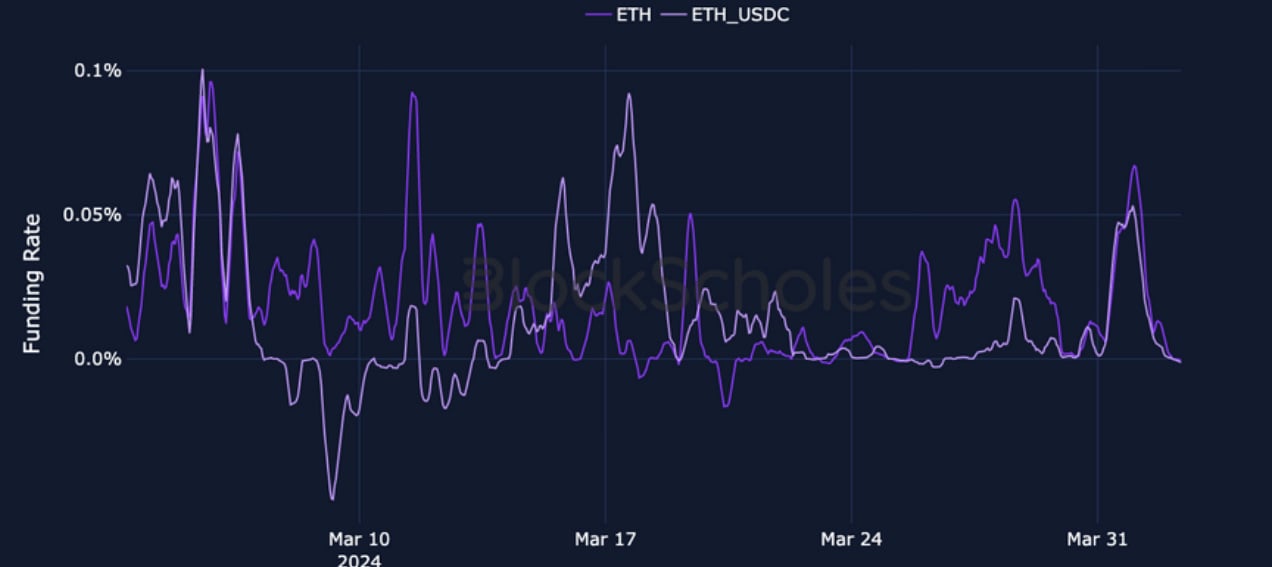

Perpetual Swap Funding Rate

BTC FUNDING RATE – funding has flushed out and returned to zero, which could indicate that traders are not capitalising on the recent fall in spot prices, a leverage flush out has pushed prices down further, or both.

ETH FUNDING RATE – following increased demand for leveraged long exposure as ETH revisited $3.7k, a similar pattern to BTC can be observed in ETH, drawing similar conclusions.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – remains within a tight range following a slight deviation in short-dated tenors earlier in the week.

BTC 25-Delta Risk Reversal – following a slight skew towards calls, a fall in BTC price has caused a shift in market sentiment towards puts.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – has increased at short-dated tenors following a fall in ETH spot price, indicating a compression in the term structure as vol has come up to meet vol at longer-dated tenors.

ETH 25-Delta Risk Reversal – has flattened out on two occasions over the past week as ETH briefly reached local highs.

Volatility Smiles

BTC SMILE CALIBRATIONS – 26-Apr-2024 Expiry, 11:00 UTC Snapshot.

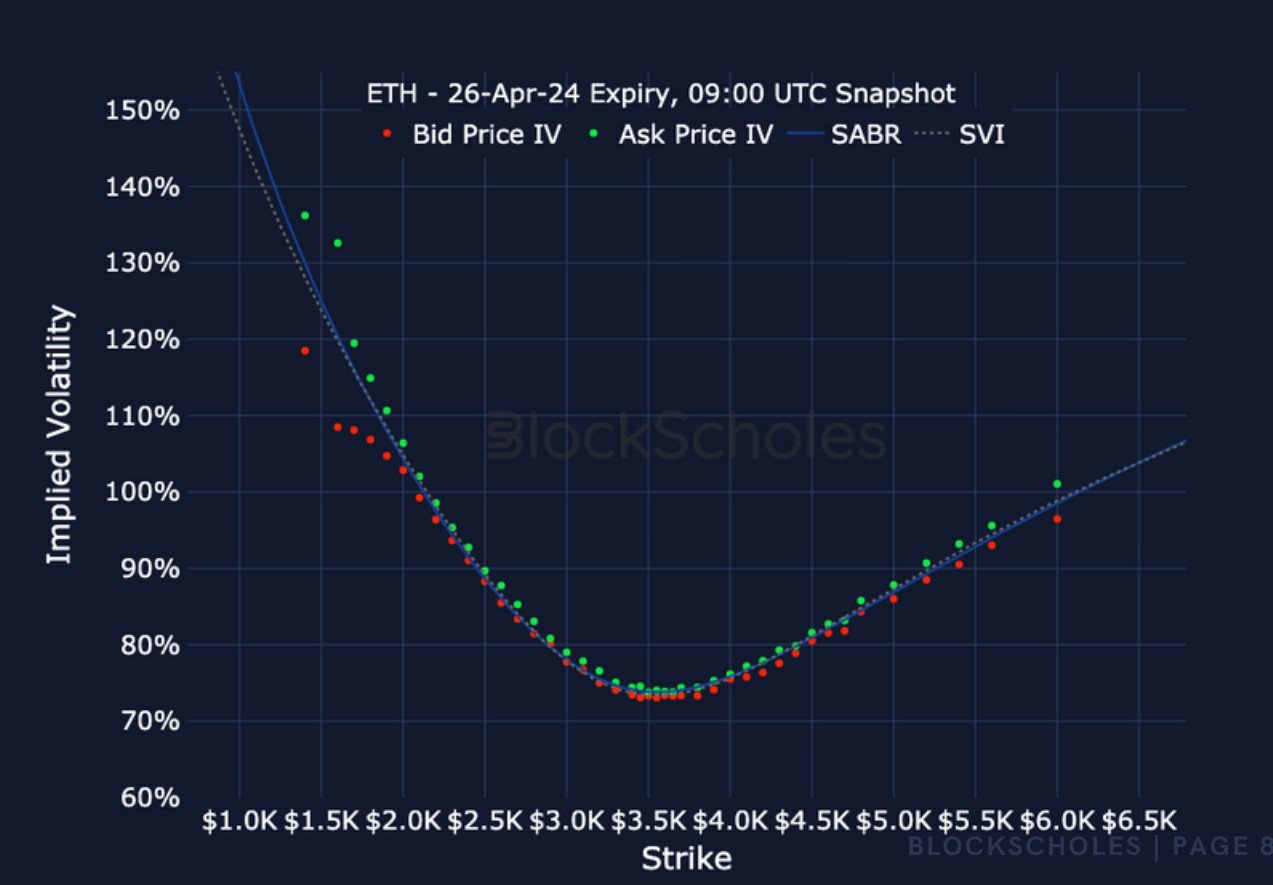

ETH SMILE CALIBRATIONS – 26-Apr-2024 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

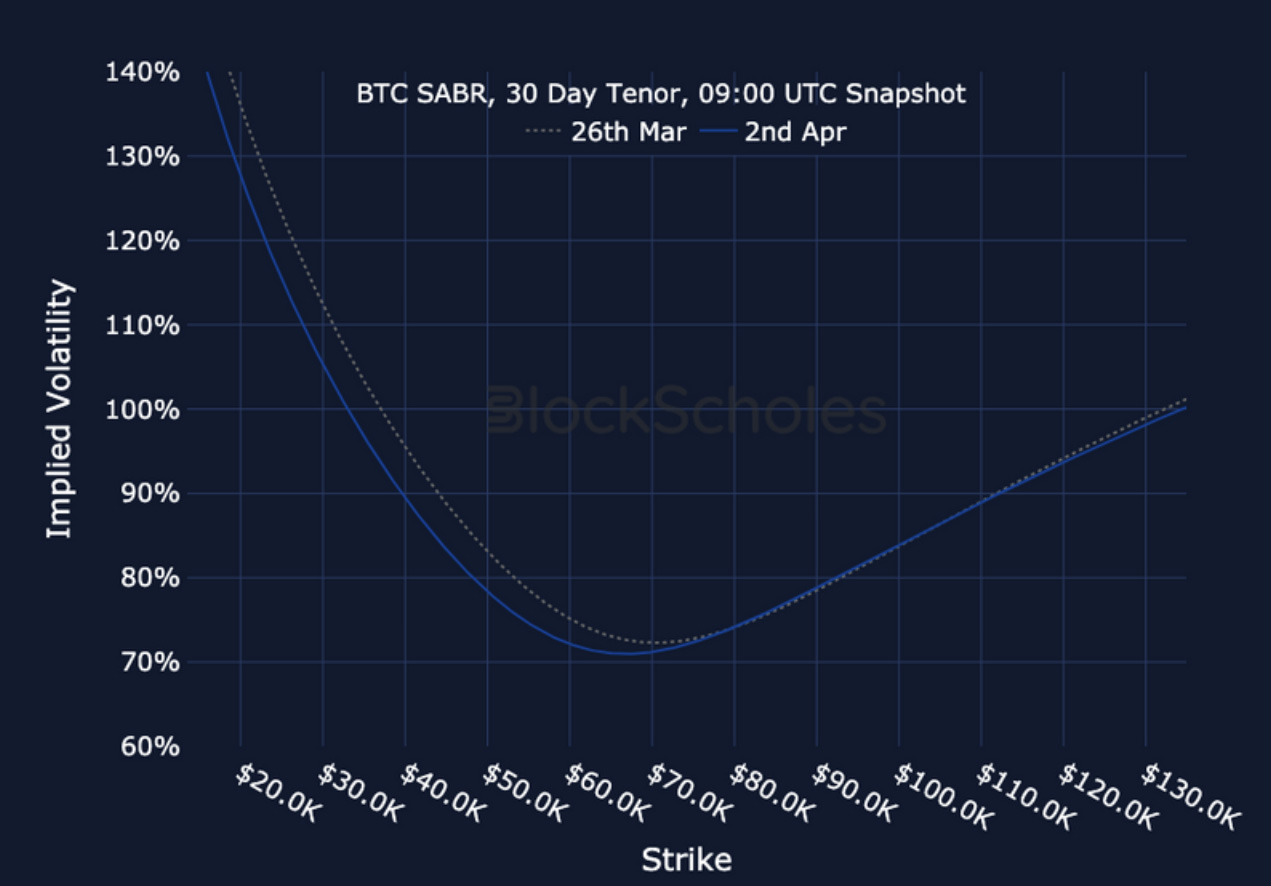

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

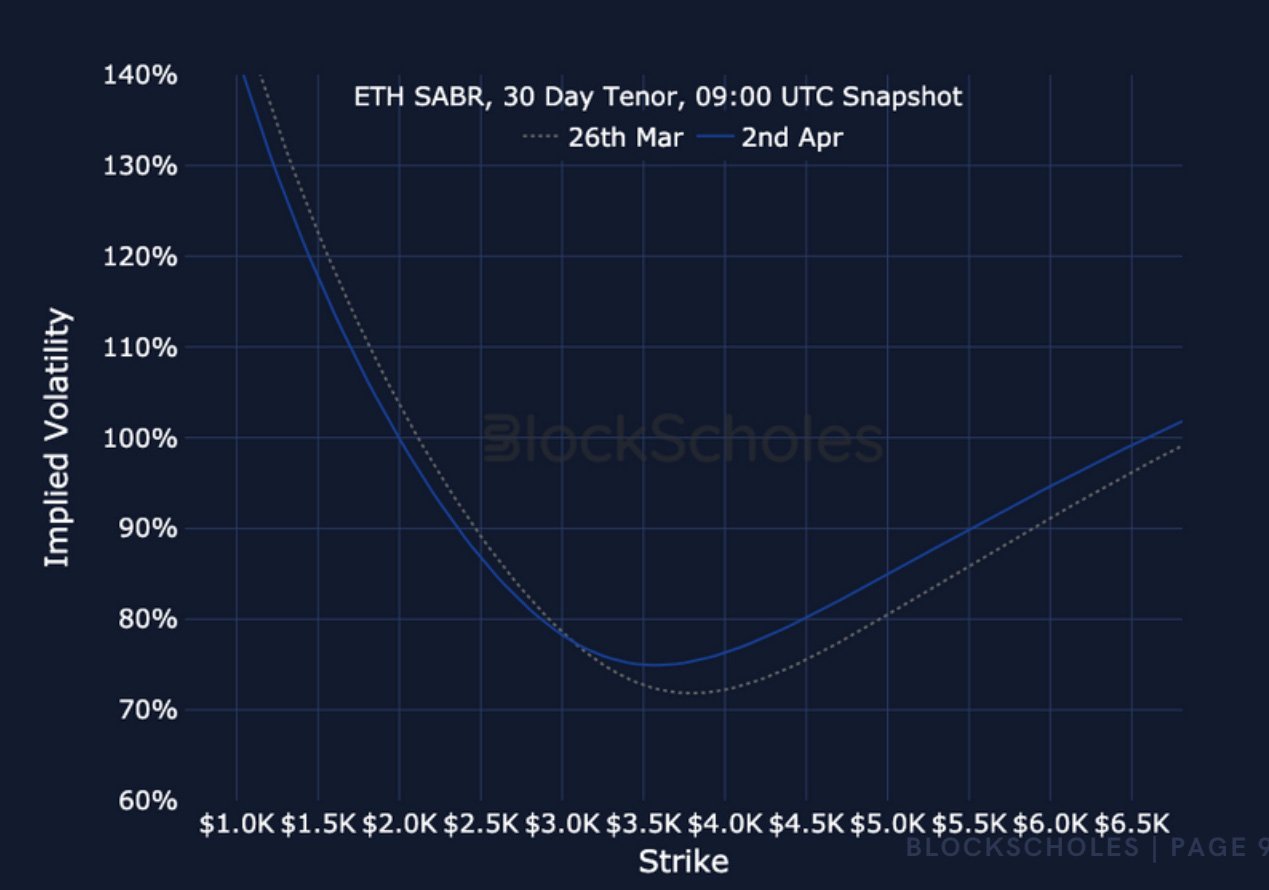

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)