Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

ETH’s volatility smile has reduced its skew towards OTM puts and now prices shorter tenors much closer to neutral smiles of BTC options. However, ETH derivatives are pricing for a distinctly higher volatility expectation over the next month compared to BTC. Future-implied yields remain cautiously optimistic above 0 for both assets and, with little spot price action to move the perpetual swap, their funding rates remain low.

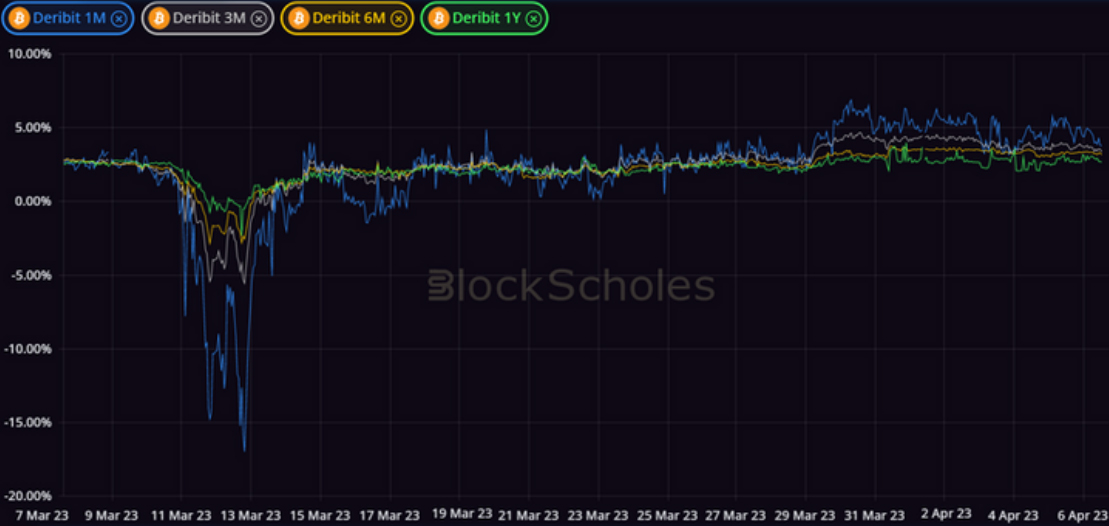

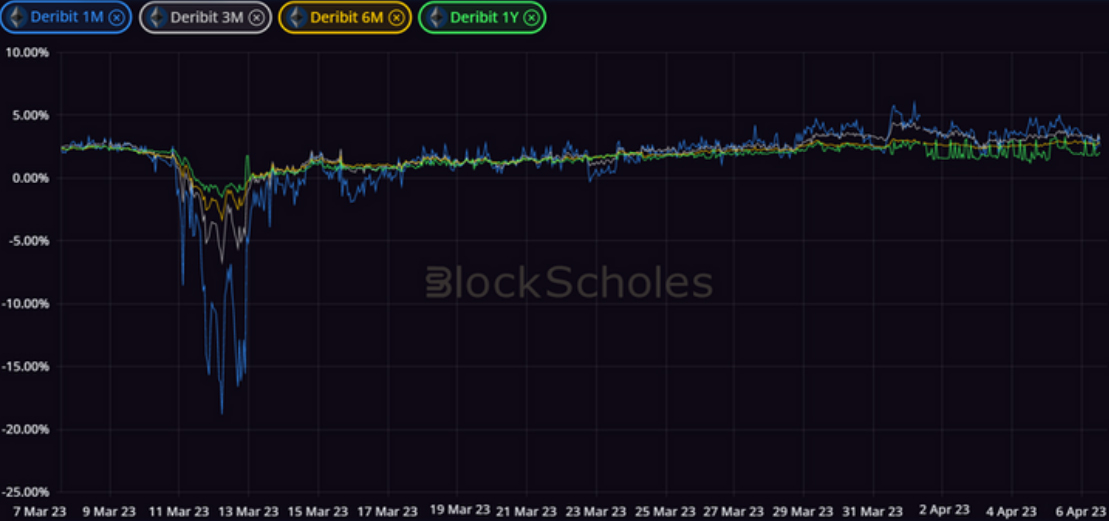

Futures

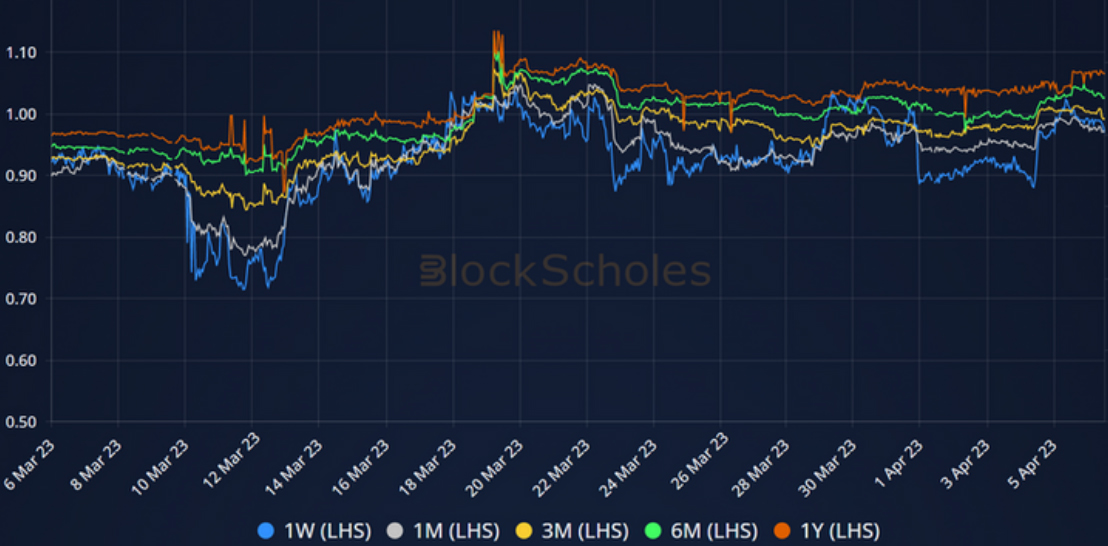

BTC ANNUALISED YIELDS – remain at their slightly elevated levels with an inverted terms structure.

ETH ANNUALISED YIELDS – trade slightly lower than BTC’s with very similar behaviour.

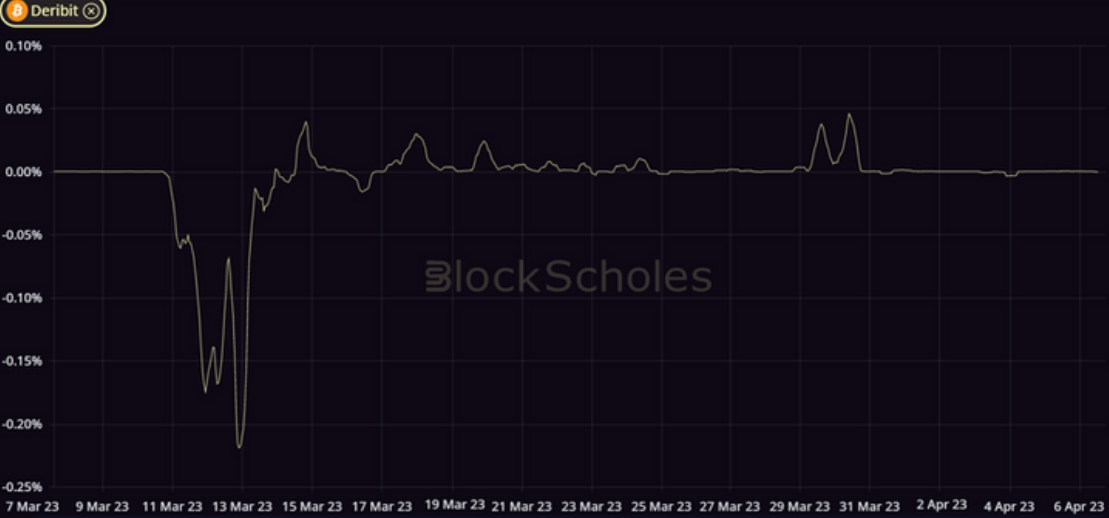

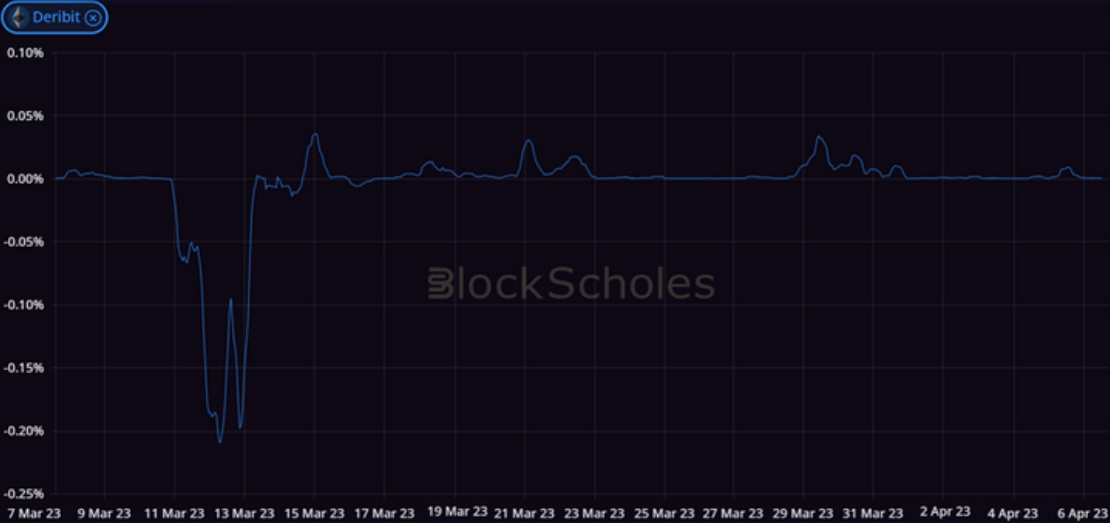

Perpetual Swap Funding Rate

BTC FUNDING RATE – has remained flat since the bullish action of a week ago saw funding rate spike positively.

ETH FUNDING RATE – has traded positively at times above BTC’s in the last week or so.

Options

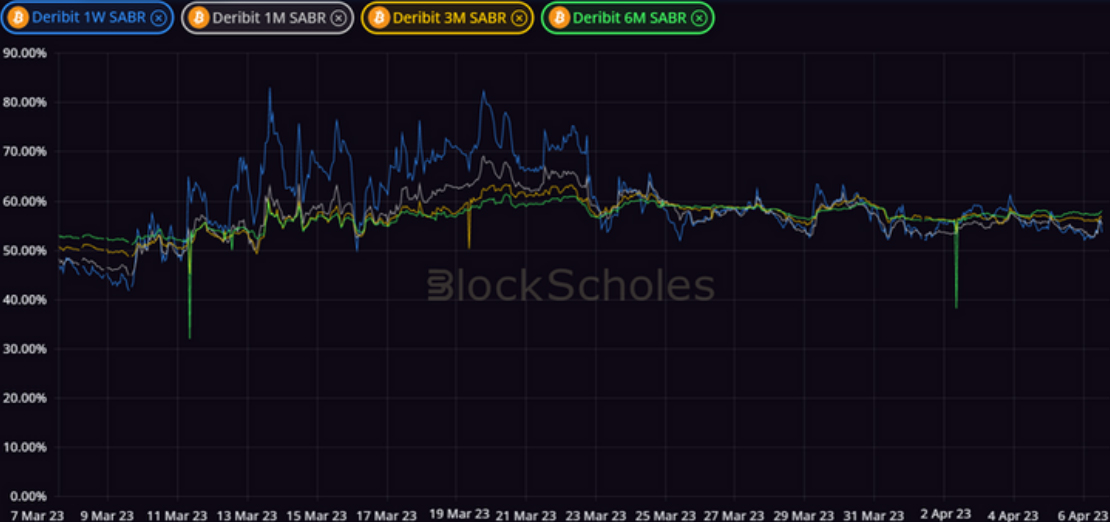

BTC SABR ATM IMPLIED VOLATILITY – holds a flat term structure at muted levels between 50-60%.

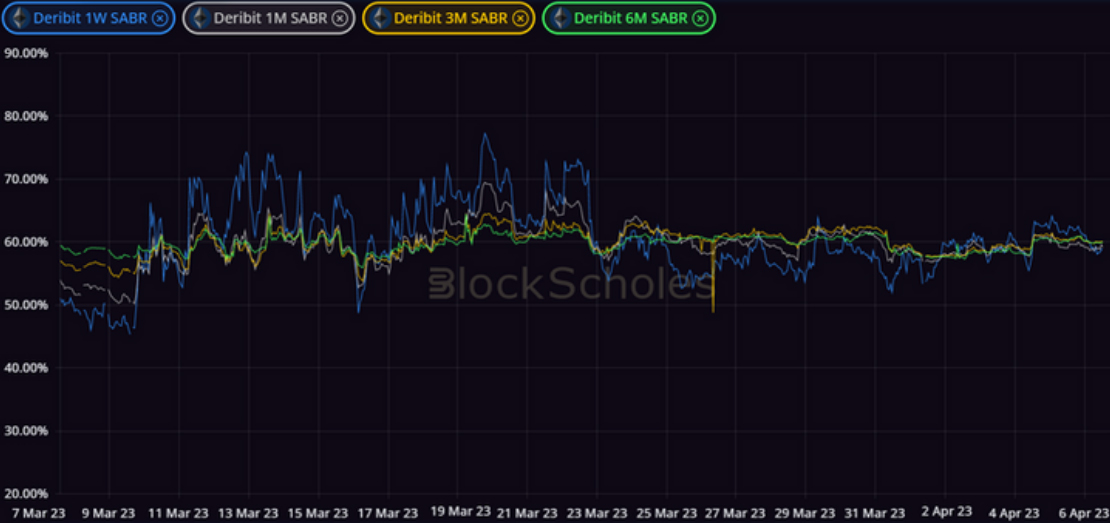

ETH SABR ATM IMPLIED VOLATILITY – trades with a similar flat term structure at the higher level of BTC’s range.

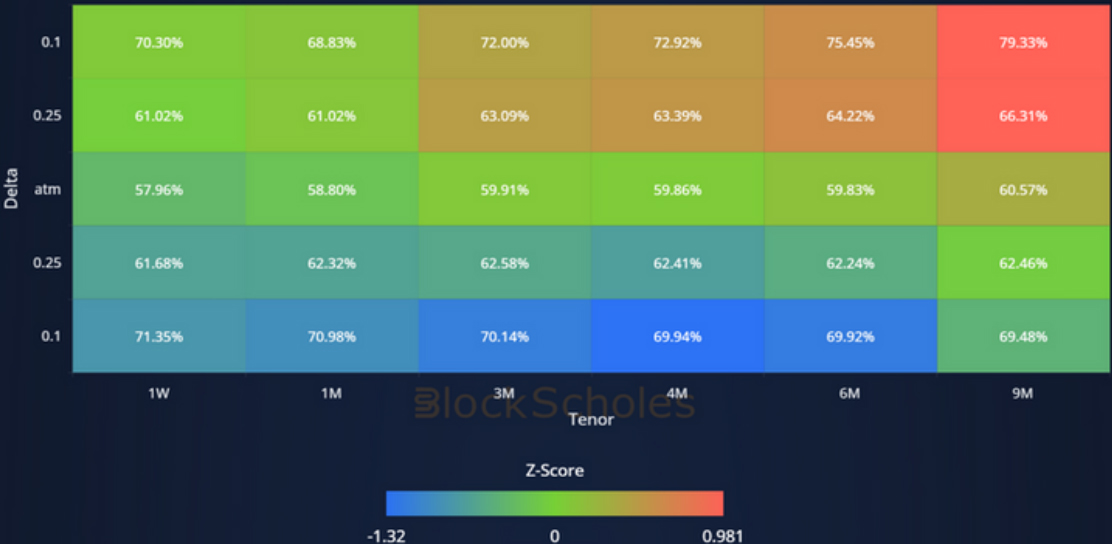

Volatility Surface

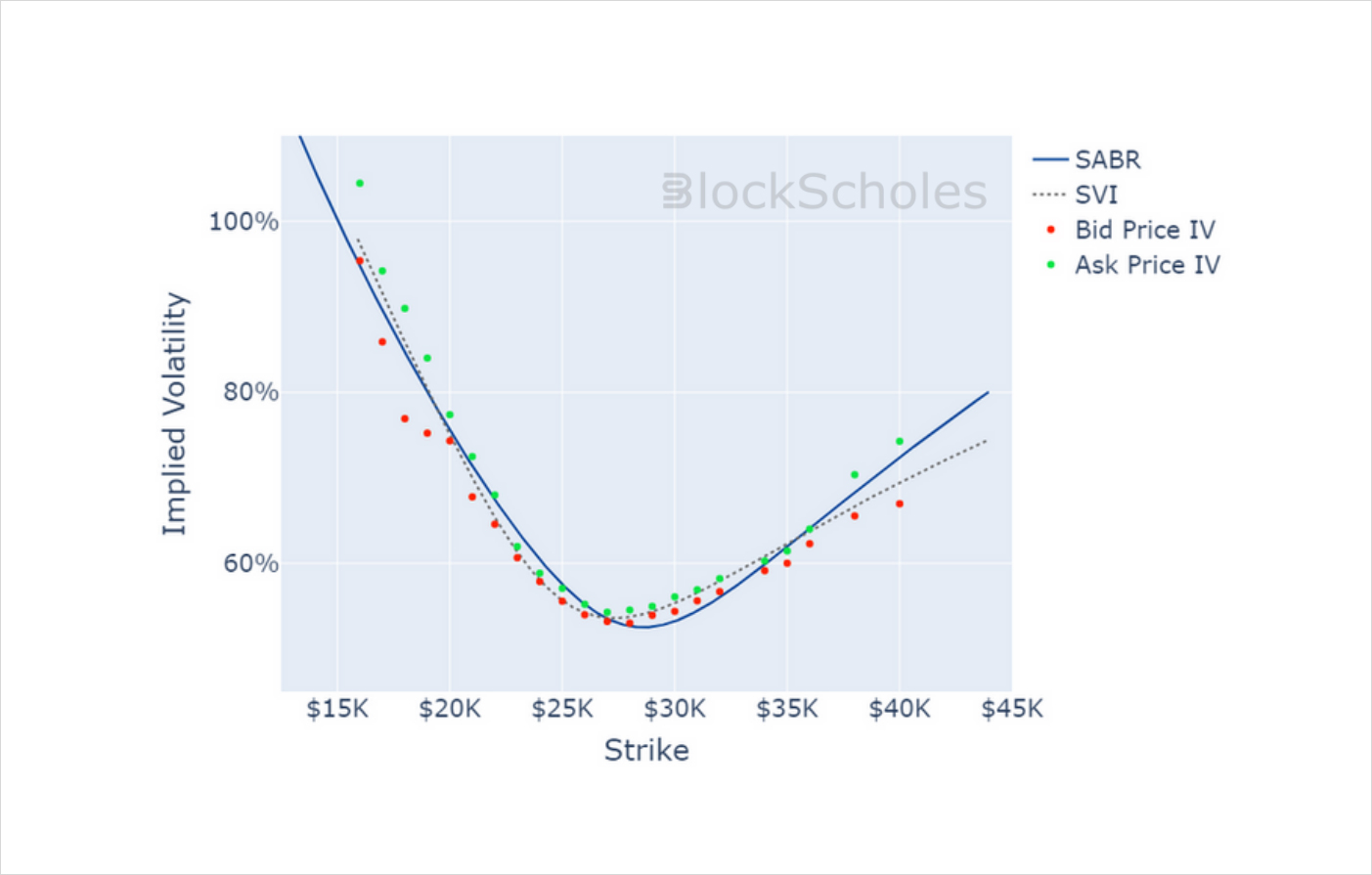

BTC IMPLIED VOL SURFACE – cools at the short end of the term structure, and particularly in OTM puts resulting in a drop in short term put-call skew.

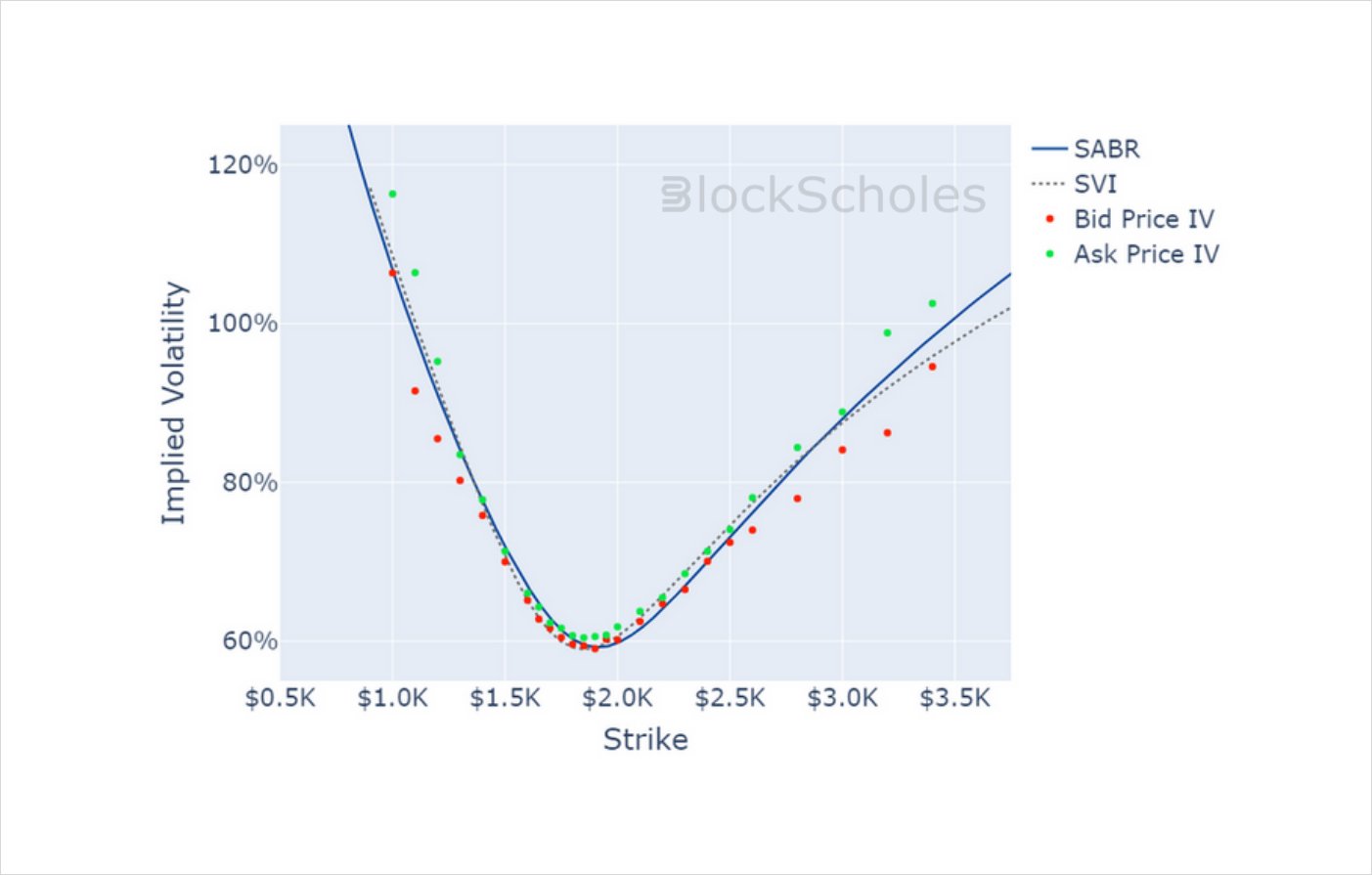

ETH IMPLIED VOL SURFACE – sees a similar cooling in OTM puts but longer into the term structure than BTC’s vol surface.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

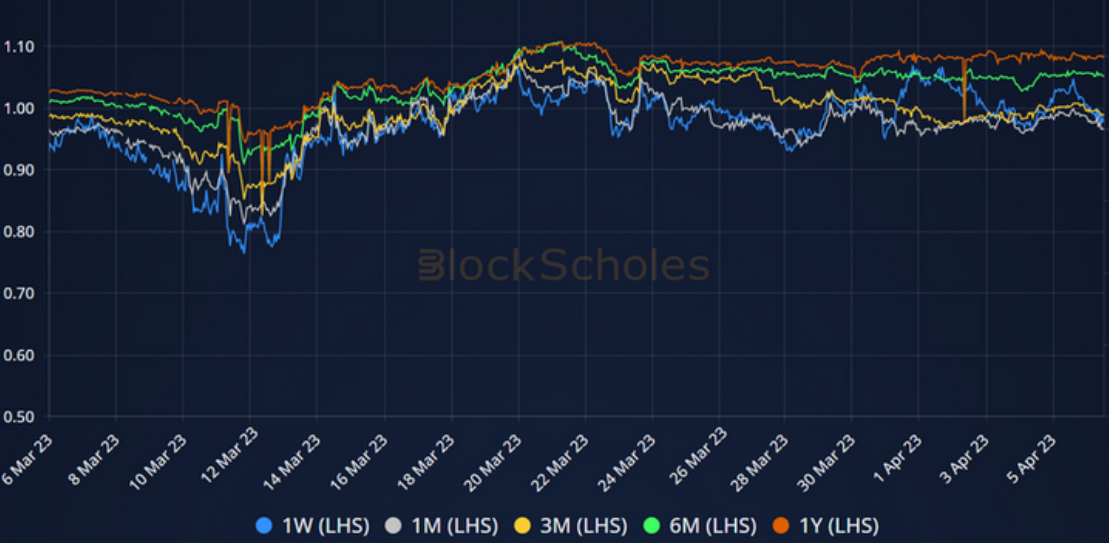

Put-Call Skew

BTC 25 DELTA PC SKEW – continues at similar levels, with longer dated tenors pricing for a more optimistic out look than the neutral short tenors.

ETH 25 DELTA PC SKEW – turns neutral in a decisive move seen predominantly in shorter tenor vol smiles.

Volatility Smiles

BTC SMILE CALIBRATIONS – 28-Apr-2023 Expiry, 10:00 UTC Snapshot.

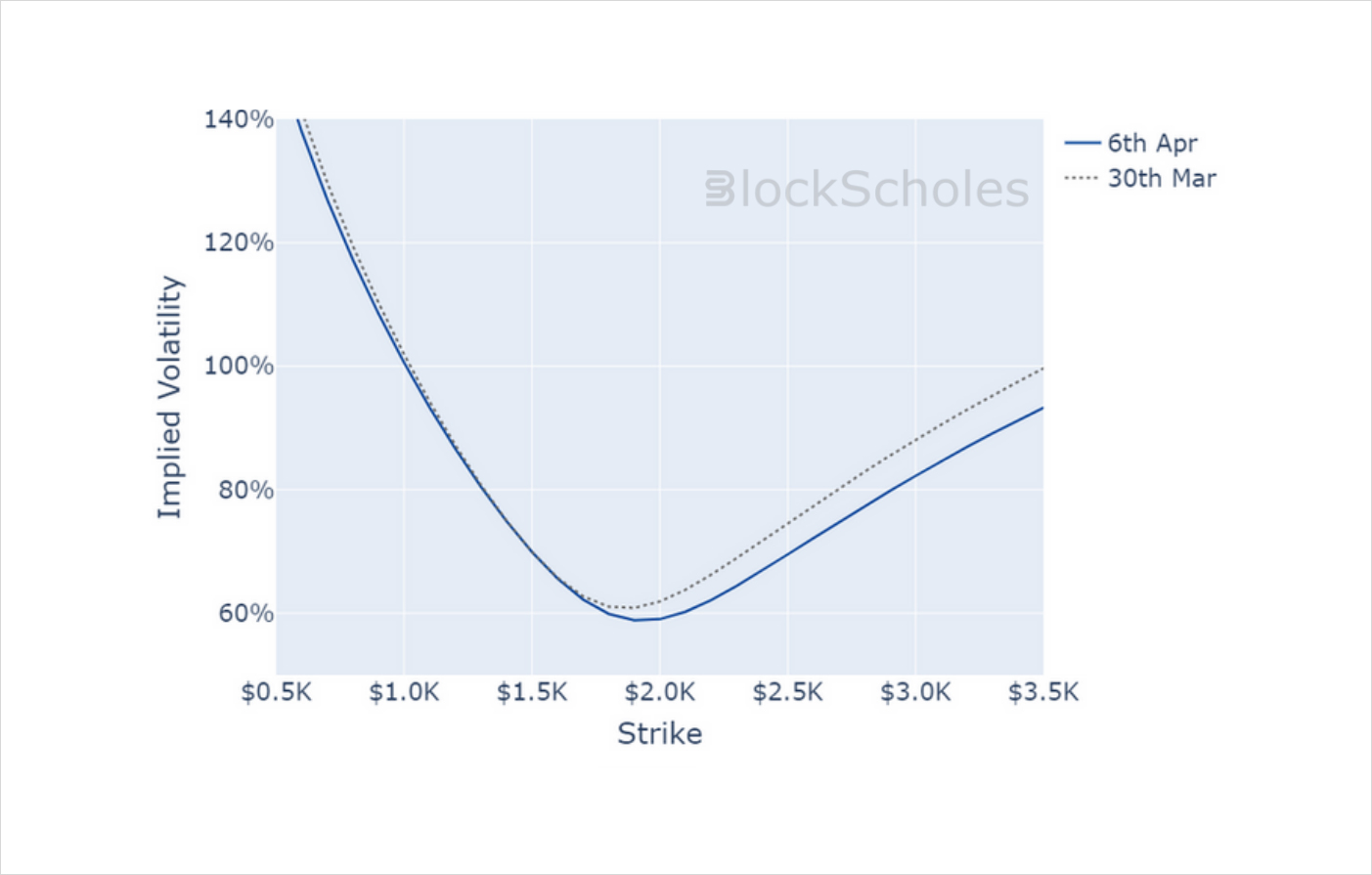

ETH SMILE CALIBRATIONS – 28-Apr-2023 Expiry, 10:00 UTC Snapshot.

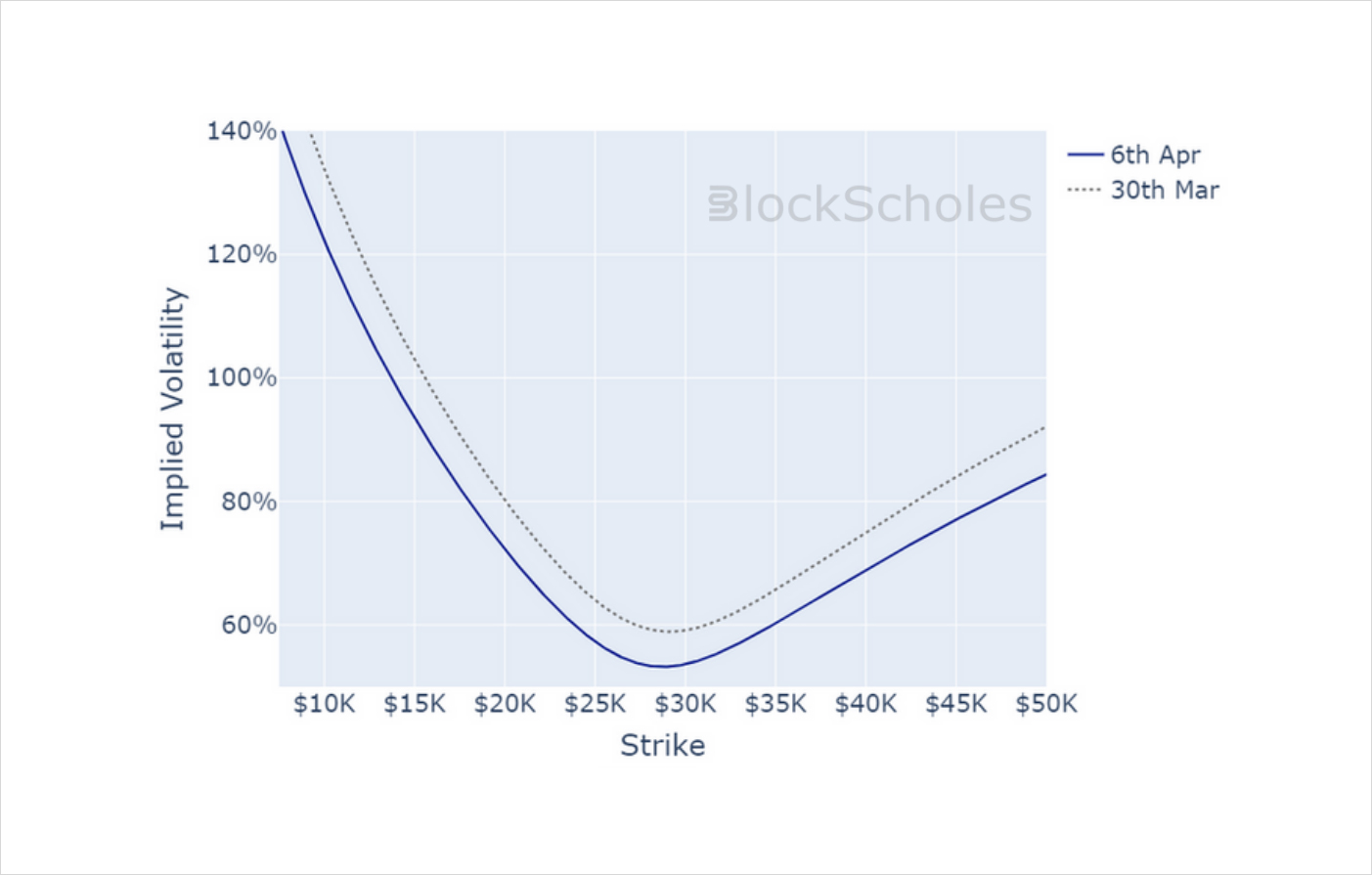

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)