Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

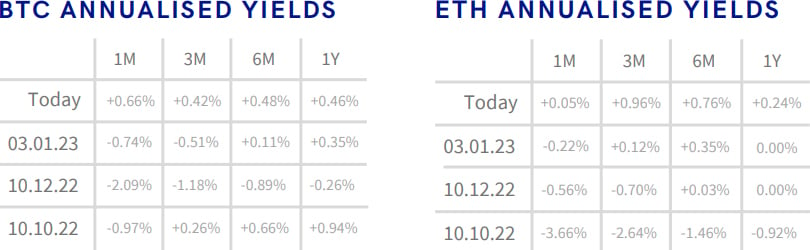

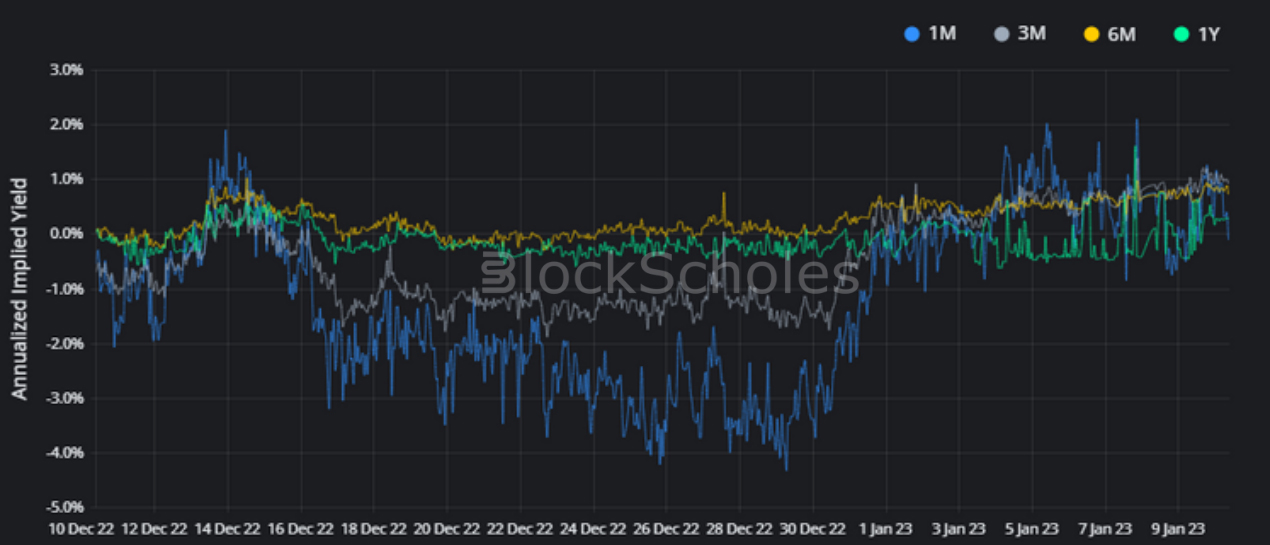

- BTC ANNUALISED YIELDS – futures at all tenors shorter than 1Y are trading above spot for the first time since before the FTX collapse.

- ETH ANNUALISED YIELDS – are trading above spot, with more volatility in the 1W and 1Y tenors.

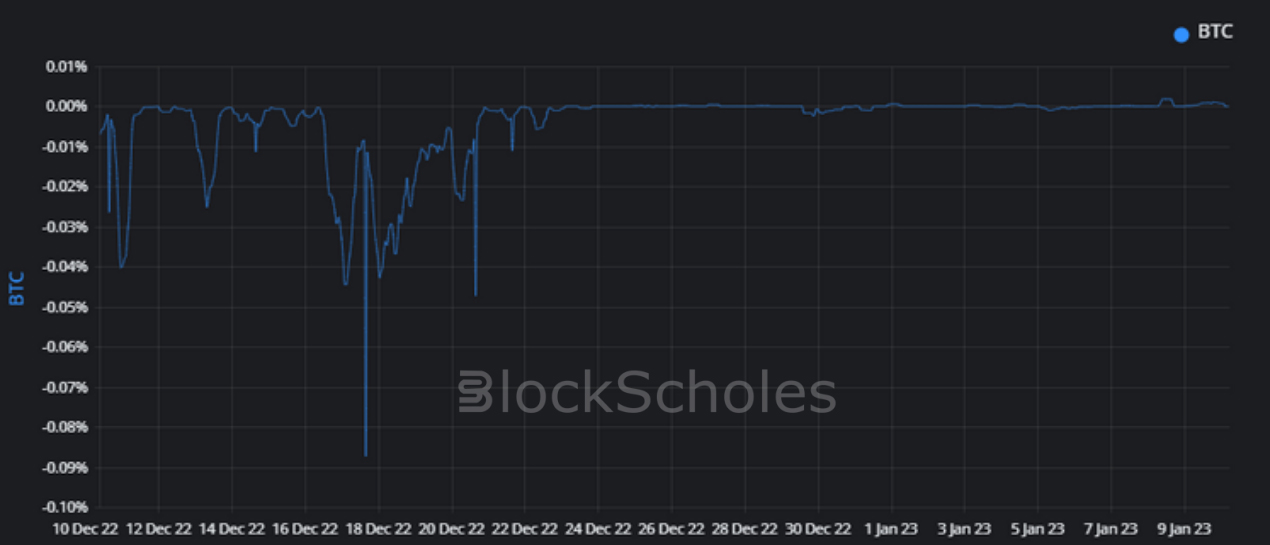

- BTC FUNDING RATE – remains near to the low values it has reported since late December.

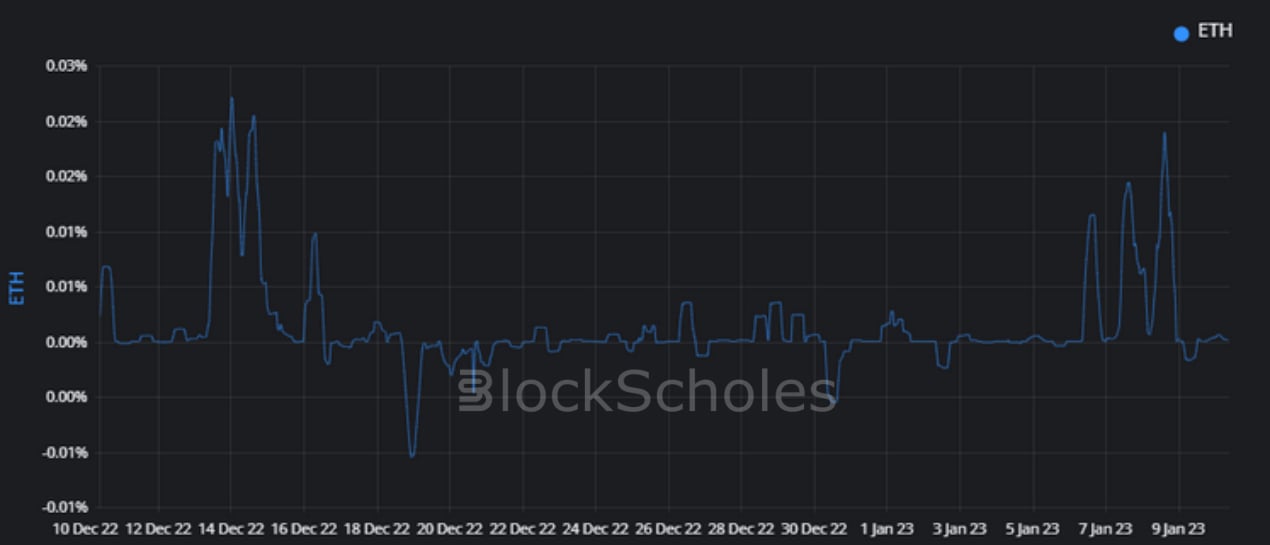

- ETH FUNDING RATE – spiked positively this week, indicating an increase in demand for long exposure via the perpetual swap contract.

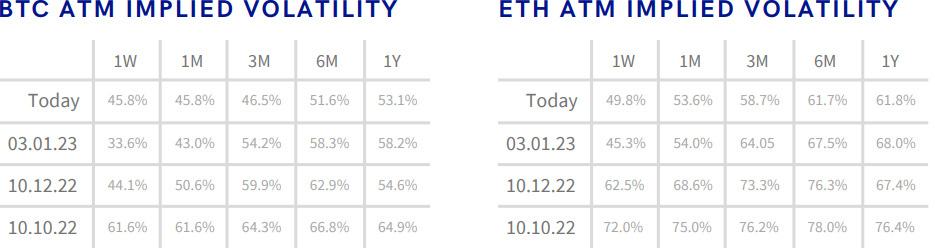

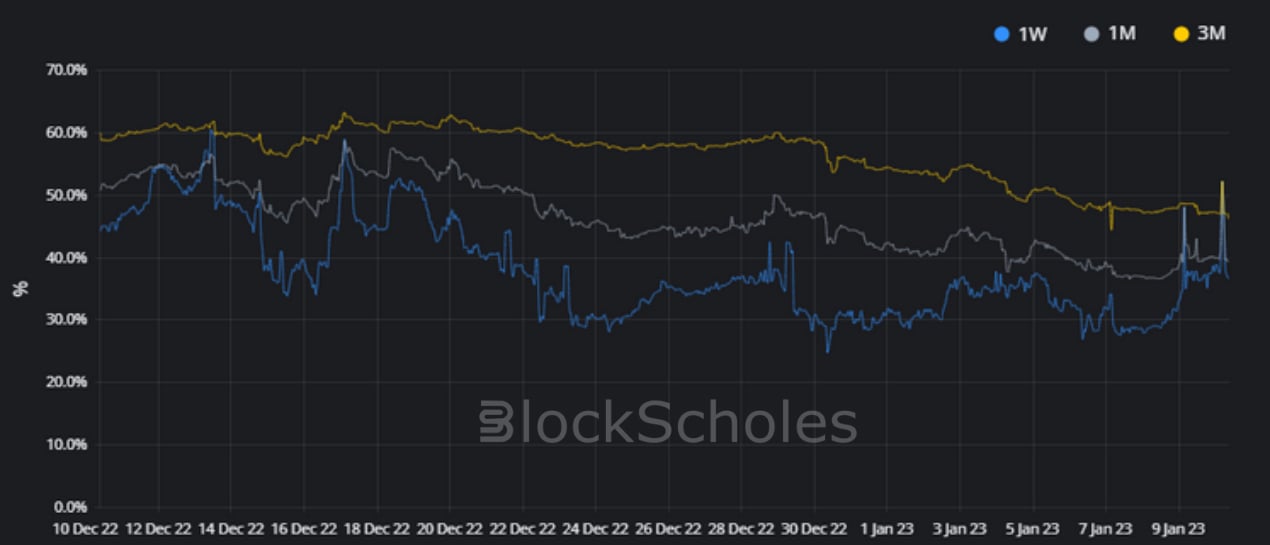

- BTC SABR ATM IMPLIED VOLATILITY – is still at remarkably low levels, despite a pickup in the 1W tenor in the last 24H.

- ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s pickup at a 1W tenor and remains near to the bottom of its range.

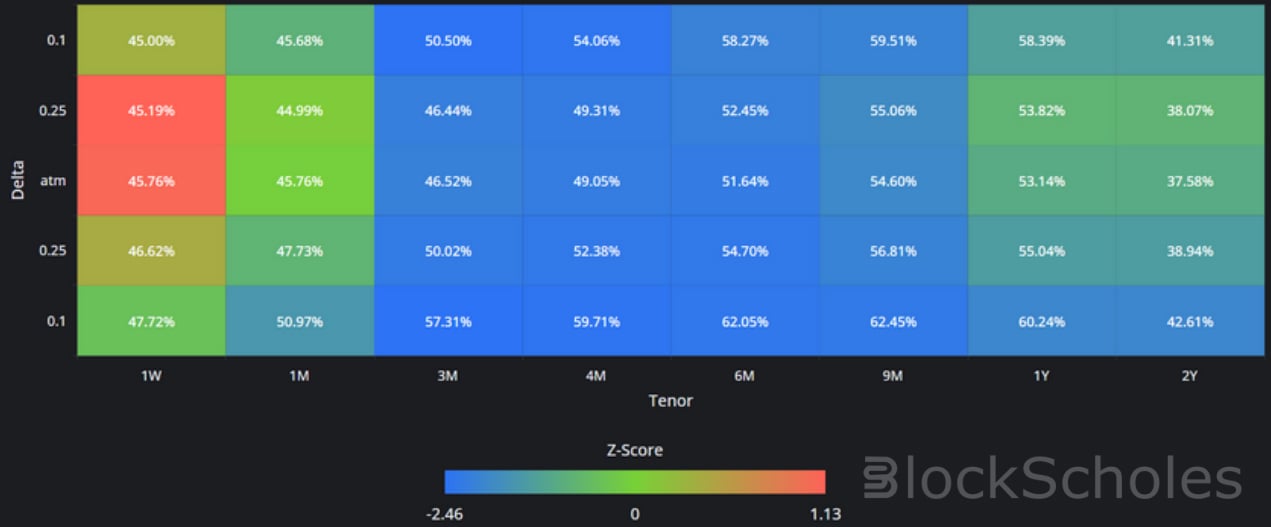

- BTC IMPLIED VOL SURFACE – sees a cooling at all deltas for tenors longer than 1M, and sees an increase in the richness of short tenor, OTM calls.

- ETH IMPLIED VOL SURFACE – also sees a cooling in mid-dated tenor OTM puts without the increase in richness of short term optionality.

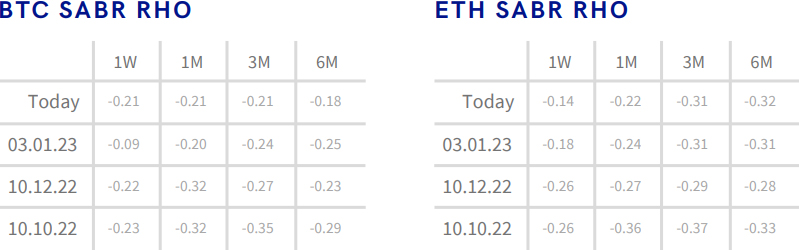

- BTC SABR RHO – the trend towards a neutral skew in the vol smile at longer dated tenors follows the trend to neutral set by 1W tenor options.

- ETH SABR RHO – reflects a significantly higher preference for OTM puts in the middle of the term structure than BTC’s volatility surface.

BTC’s and ETH’s derivatives markets both report low implied volatility, spot yields close to or above zero, and stationary volatility smiles week on week. However, the term structure of ETH’s volatility surface is much more skewed at longer tenors, marking an unusual divergence from BTC’s behaviour.

Futures

BTC ANNUALISED YIELDS – futures at all tenors shorter than 1Y are trading above spot for the first time since before the FTX collapse.

ETH ANNUALISED YIELDS – are trading above spot, with more volatility in the 1W and 1Y tenors.

Perpetual Swap Funding Rate

BTC FUNDING RATE – remains near to the low values it has reported since late December.

ETH FUNDING RATE – spiked positively this week, indicating an increase in demand for long exposure via the perpetual swap contract.

Options

BTC SABR ATM IMPLIED VOLATILITY – is still at remarkably low levels, despite a pickup in the 1W tenor in the last 24H.

ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s pickup at a 1W tenor and remains near to the bottom of its range.

Volatility Surface

BTC IMPLIED VOL SURFACE – sees a cooling at all deltas for tenors longer than 1M, and sees an increase in the richness of short tenor, OTM calls.

ETH IMPLIED VOL SURFACE – also sees a cooling in mid-dated tenor OTM puts without the increase in richness of short term optionality.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

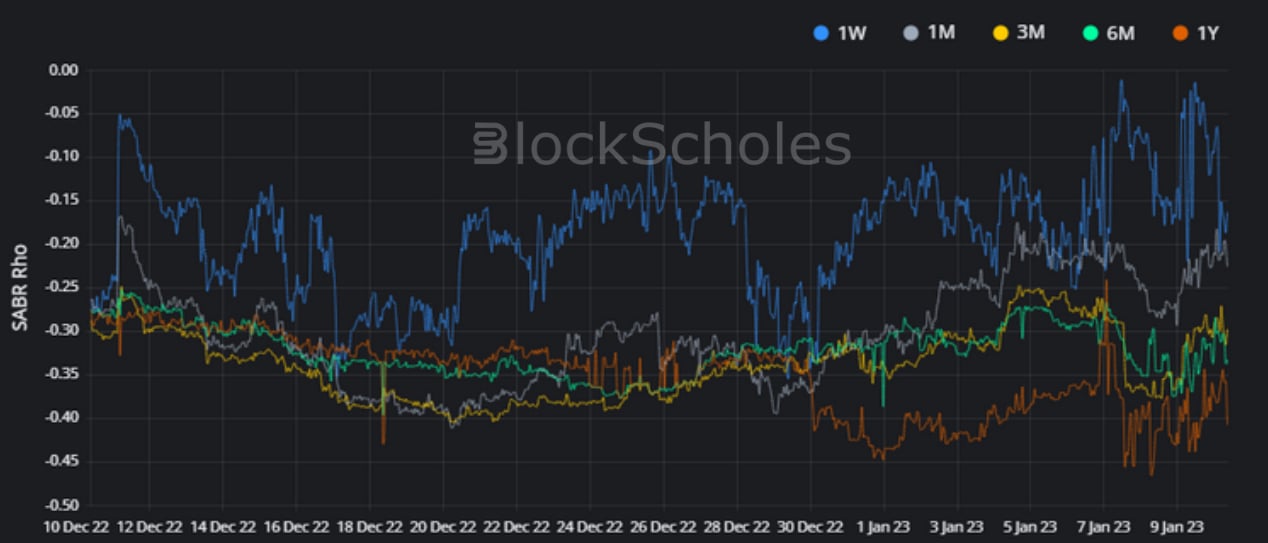

SABR Rho

BTC SABR RHO – the trend towards a neutral skew in the vol smile at longer dated tenors follows the trend to neutral set by 1W tenor options.

ETH SABR RHO – reflects a significantly higher preference for OTM puts in the middle of the term structure than BTC’s volatility surface.

Volatility Smiles

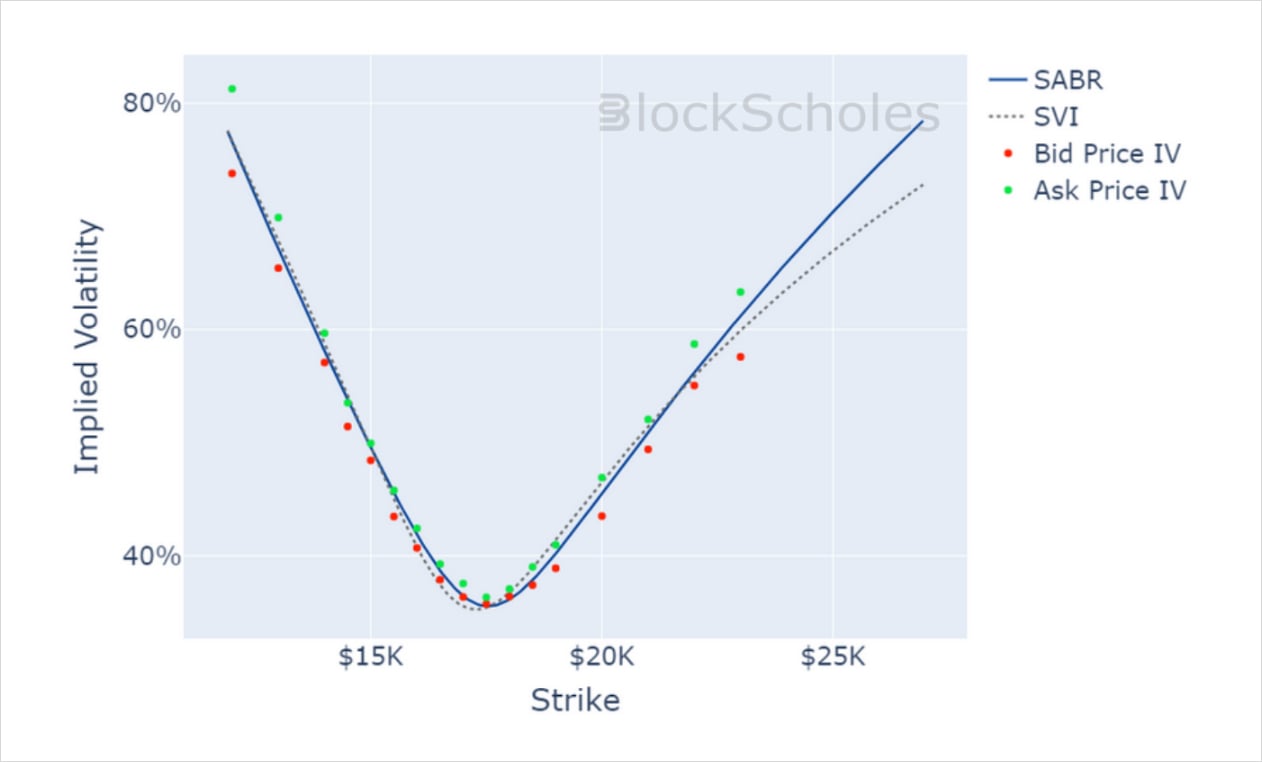

BTC SMILE CALIBRATIONS – 27-Jan-2023 Expiry, 10:00 UTC Snapshot.

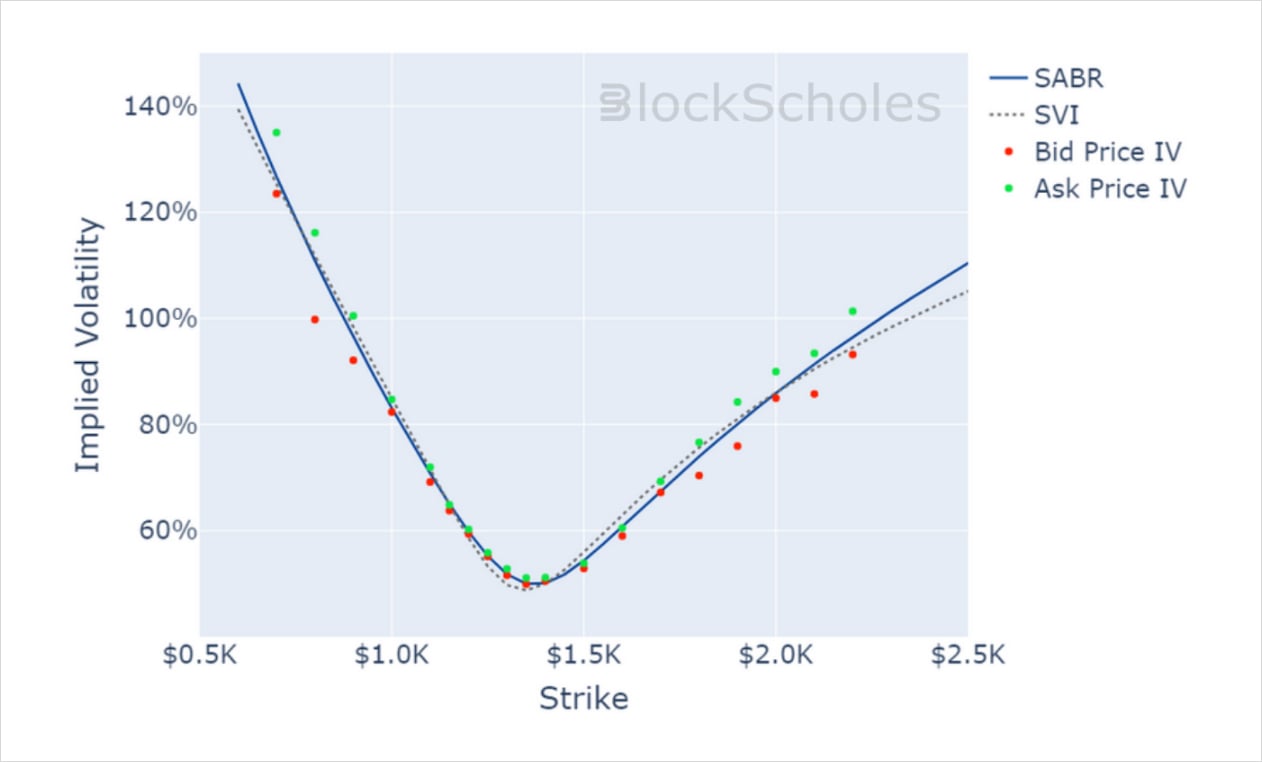

ETH SMILE CALIBRATIONS – 27-Jan-2023 Expiry, 10:00 UTC Snapshot.

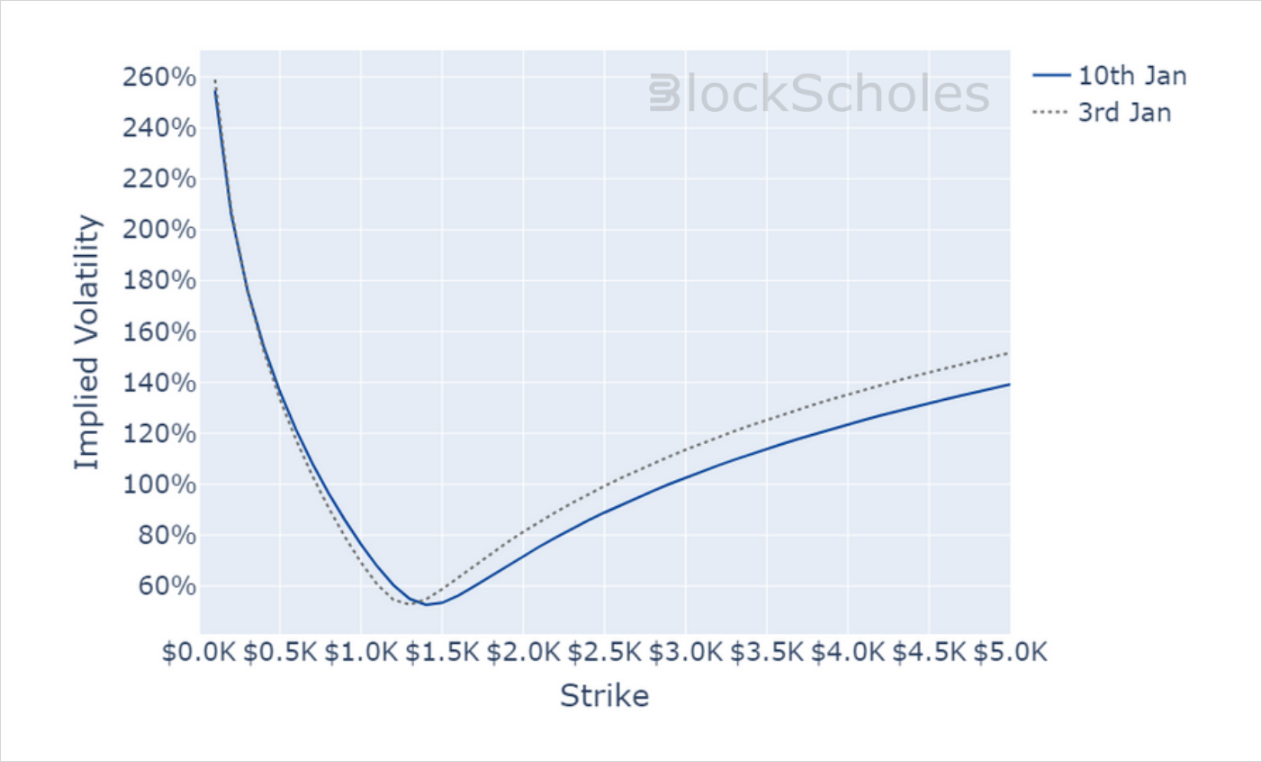

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 11:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 11:00 UTC Snapshot.

AUTHOR(S)