Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

At-the-money implied volatility has tapered off alongside the bullish momentum in spot prices that we saw late last week, with ETH options just lower than BTC’s at all tenors. Both continue to price up- and down-side optionality at similar levels, whilst their future-implied yields have converged somewhat at small positive rates. The funding rate of ETH’s perpetual swap has overtaken that of BTC, having lagged it’s strong performance during the rally last week.

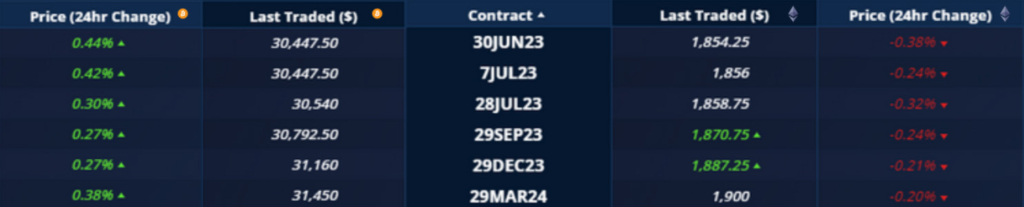

Futures implied yield term structure.

Volatility Surface Metrics.

*All data in tables recorded at a 10:06 UTC snapshot unless otherwise stated.

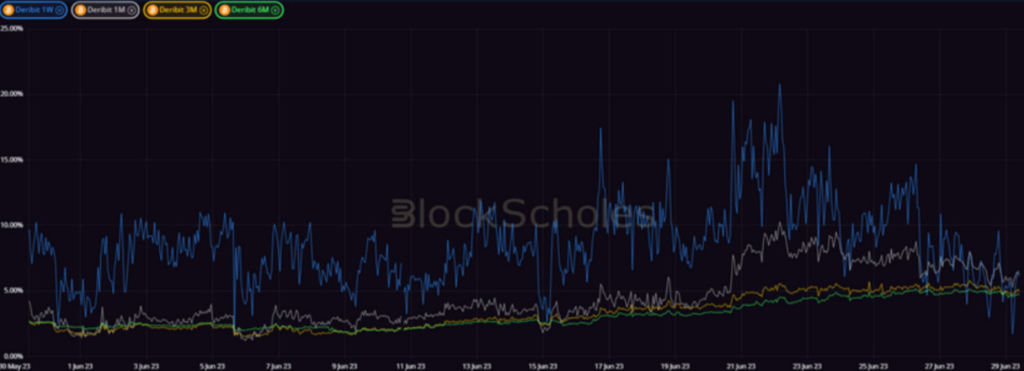

Futures

BTC ANNUALISED YIELDS – Fall lower at short tenors as last weeks rally loses pace.

ETH ANNUALISED YIELDS – trend upwards from a lower level, trading between 2% and 3% at all tenors.

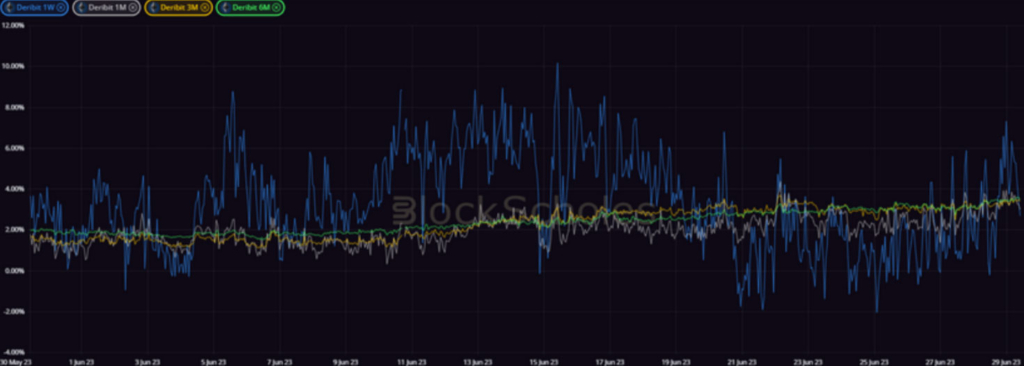

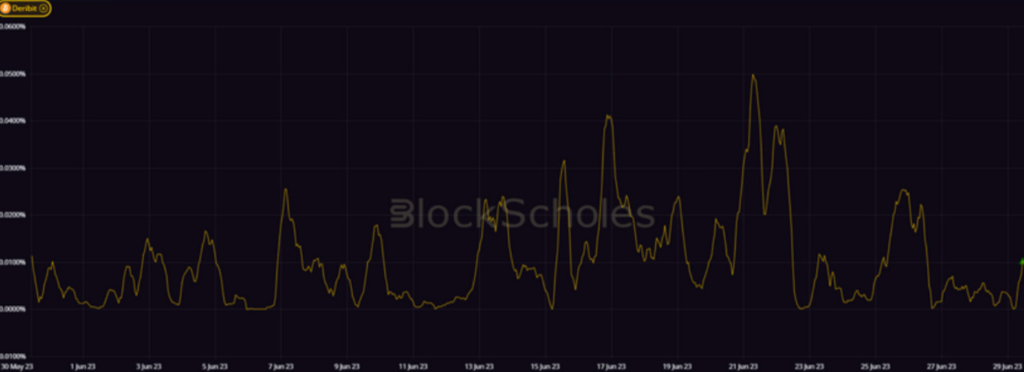

Perpetual Swap Funding Rate

BTC FUNDING RATE – remains positive, but at a much lower level than we have become accustomed to throughout the last month.

ETH FUNDING RATE – has reached its highest level since the 17th June after rising gradually throughout the week.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has tapered slightly after reaching its highest levels in 2 months last Thursday.

BTC 25-Delta Risk Reversal – has reflected a neutral volatility smile since Thursday’s spot price rally.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – has tapered off since last late last week, at a lower level than BTC’s and steeper across the term structure.

ETH 25-Delta Risk Reversal – rose alongside BTC’s at a lag last week, and continues to price near a neutral volatility smile this week.

Volatility Surface

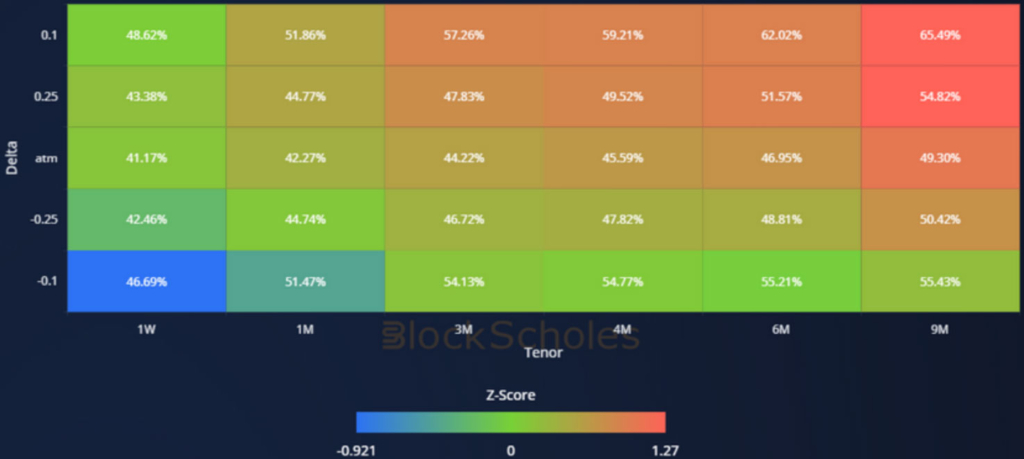

BTC IMPLIED VOL SURFACE – reports a broad cooling, with the implied volatility of OTM calls at longer tenors high against their recent history.

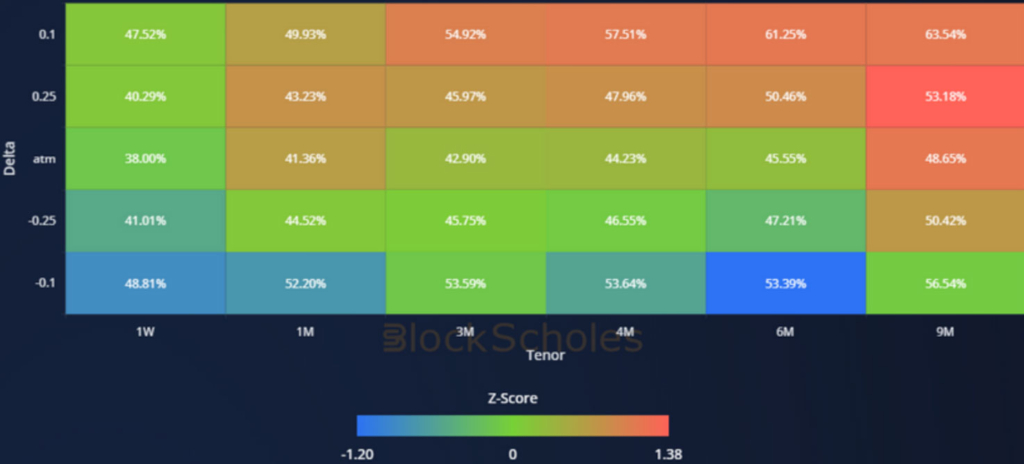

ETH IMPLIED VOL SURFACE – shows a similar rise in the implied vol of calls at long tenors, with the entire surface at a slightly lower level overall.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

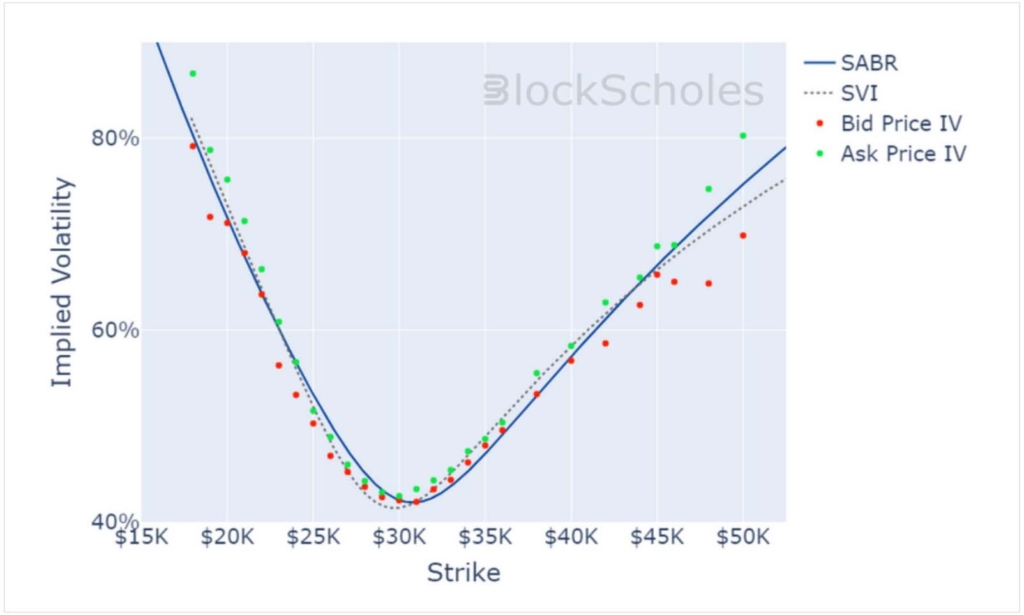

BTC SMILE CALIBRATIONS – 28-Jul-2023 Expiry, 10:00 UTC Snapshot.

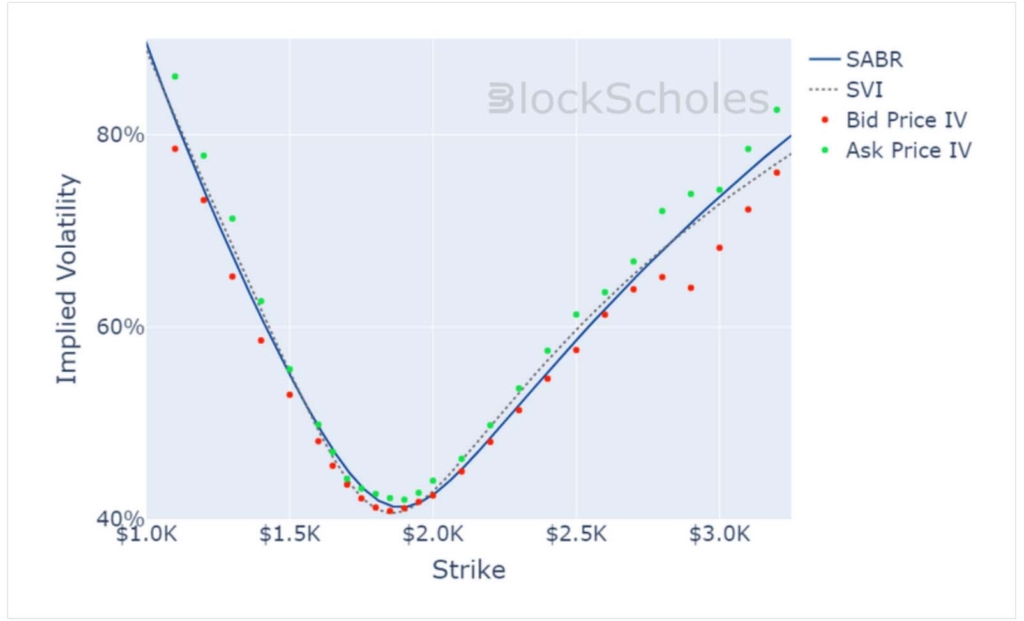

ETH SMILE CALIBRATIONS – 28-Jul-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:06 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:06 UTC Snapshot.

AUTHOR(S)