Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Another week of low delivered volatility heralded a further fall in the volatility implied by both BTC and ETH options, continuing the trend of all-time low levels that we have observed intermittently over the last few months. Risk-reversals continue to trade ina tight range near zero, reflecting a slight tilt towards OTM puts at shorter tenors. The futures market, however, boasts large positive yields and a resumption of the positive funding rate regime enjoyed by short positions over the last 30 days.

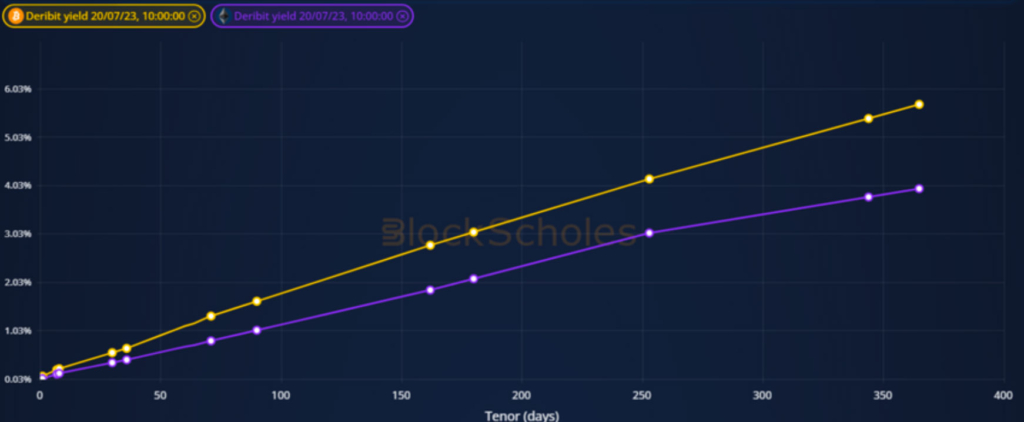

Futures implied yield term structure.

Volatility Surface Metrics.

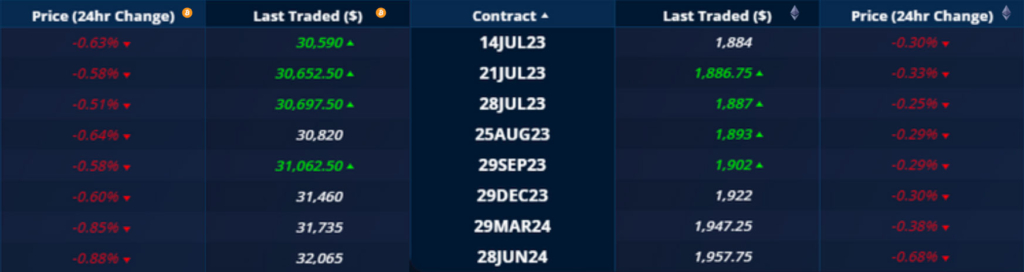

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – Show that futures trade above spot by about 5%, with 1-week yields higher at close to 10%.

ETH ANNUALISED YIELDS – Show that futures have reached similar spreads above spot to BTC’s.

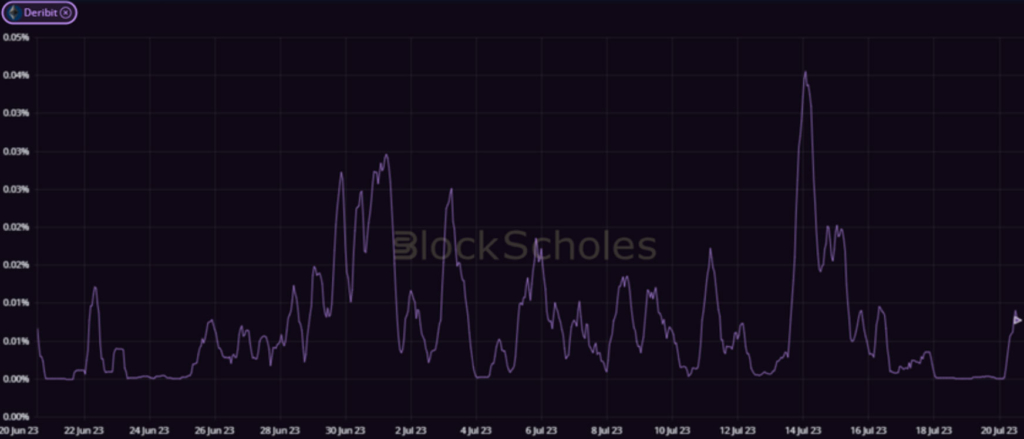

Perpetual Swap Funding Rate

BTC FUNDING RATE – has risen once again, following a brief pause in the large rates paid from long positions to short positions over the last 30 days.

ETH FUNDING RATE – took a pause from the high rates seen throughout the last month, before showing signs of a resumption of its trend this week.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – continues to fall closer to the all- time low levels in the low 30s.

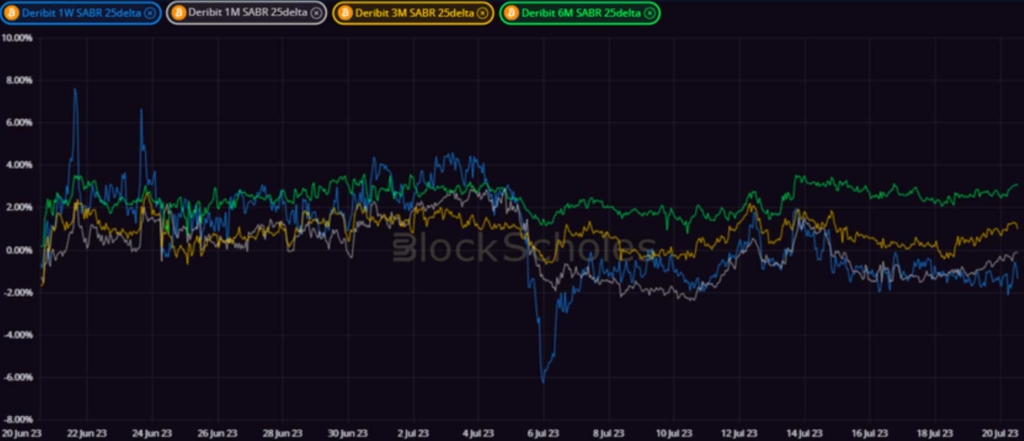

BTC 25-Delta Risk Reversal – the skew reflects a neutral sentiment in the market longer term, with a tilt towards OTM puts at shorter tenors.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – whilst vol levels are slightly higher than BTC’s, both assets remain close to all-time low levels.

ETH 25-Delta Risk Reversal – show a wider spread across the term structure than BTC’s, whilst tilting towards OTM puts at shorter tenors.

Volatility Surface

BTC IMPLIED VOL SURFACE – chart the continued fall in implied volatility throughout the last month at all points on the surface.

ETH IMPLIED VOL SURFACE – reports a similar fall in implied volatility surface wide.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

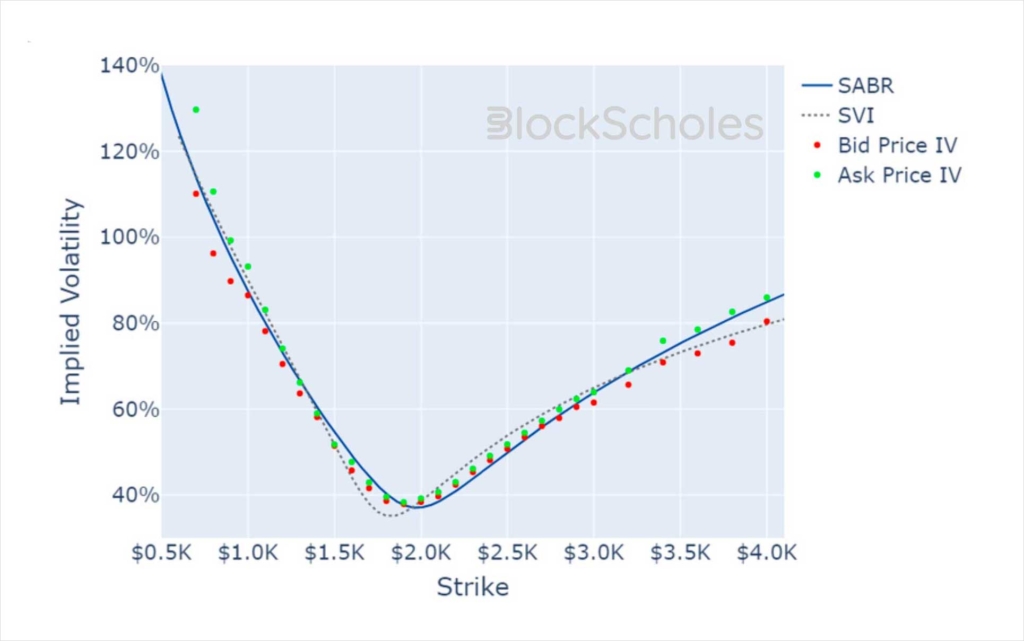

Volatility Smiles

BTC SMILE CALIBRATIONS – 25-Aug-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 25-Aug-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)