Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

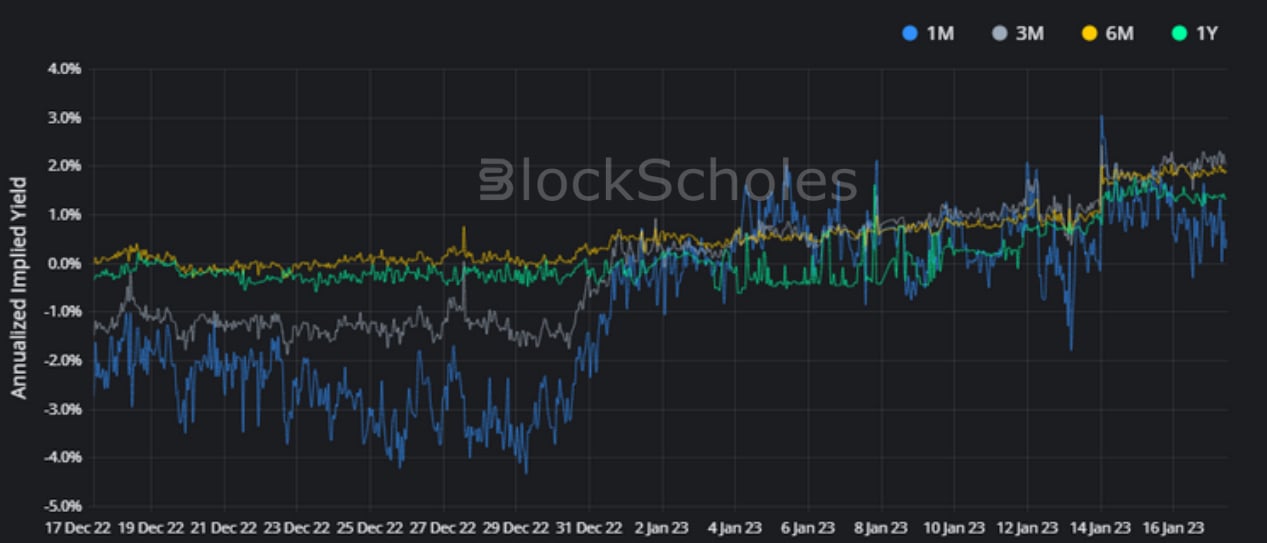

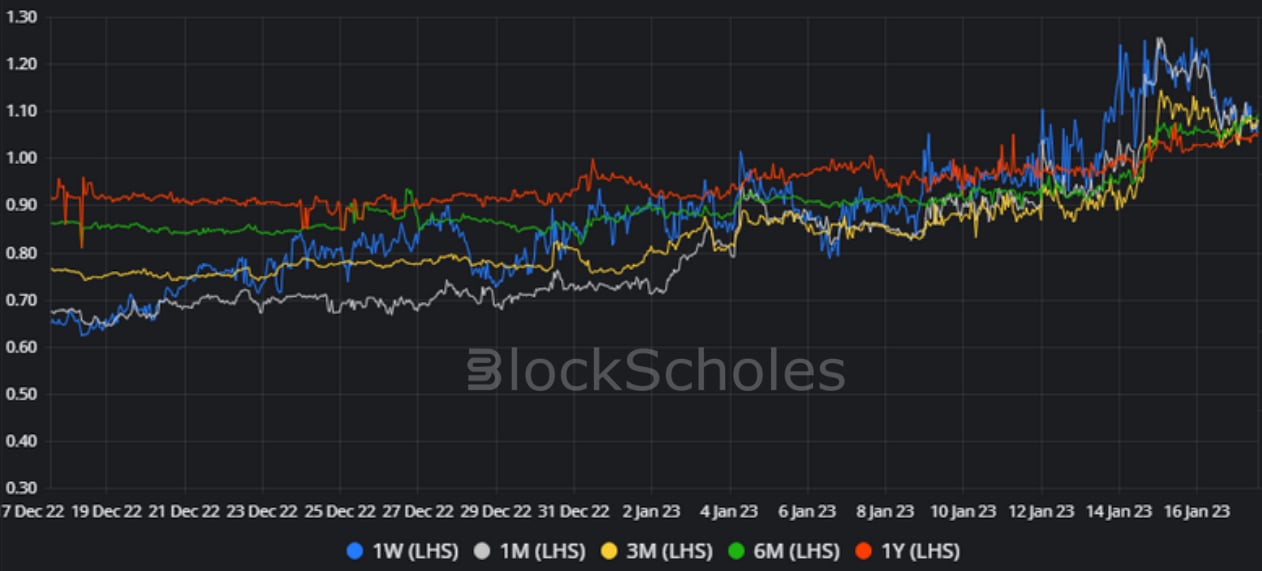

Whilst BTC’s and ETH’s recent swift return to the prices seen before the FTX crash has caused futures implied yields to turn distinctly positive and ATM implied vol to rise, the move was largely focused on an increase in the implied volatility of OTM calls. The renewed demand for upside protection sees the putcall skew of short-tenor BTC and ETH options rise above 1. However, longer-dated ETH options still price for a volatility smile that is skewed towards downside protection at tenors of three months and above.

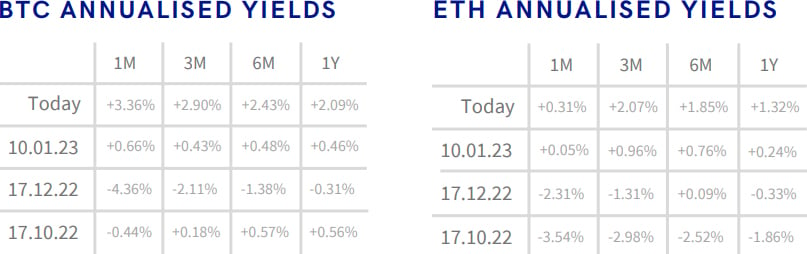

- BTC ANNUALISED YIELDS – futures prices rise decisively above zero in response to the recent rally in spot prices.

- ETH ANNUALISED YIELDS – see similar gains to near 2% at 3M and 6M tenors, whilst 1M and 1Y tenor futures remain closer to 1% above spot.

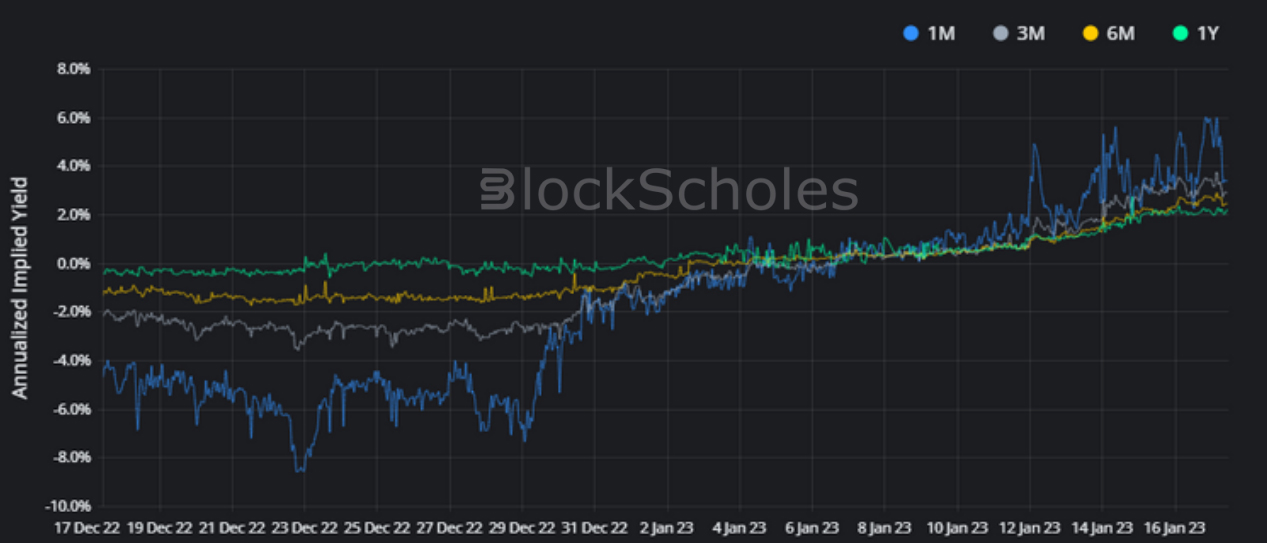

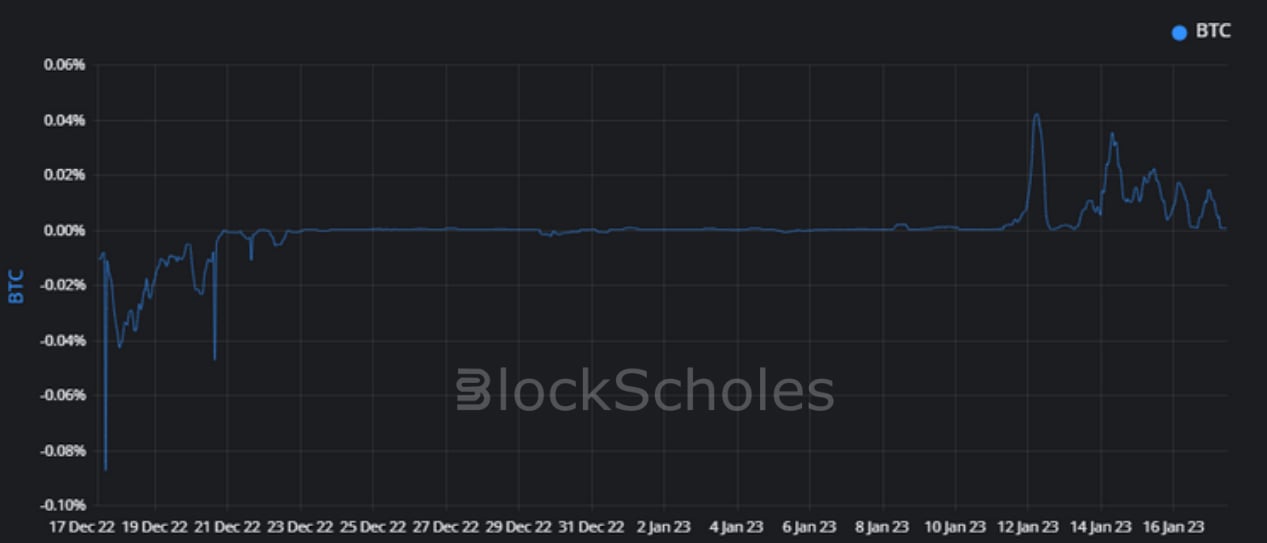

- BTC FUNDING RATE – spikes positively as traders seek exposure to BTC’s recent spot rally.

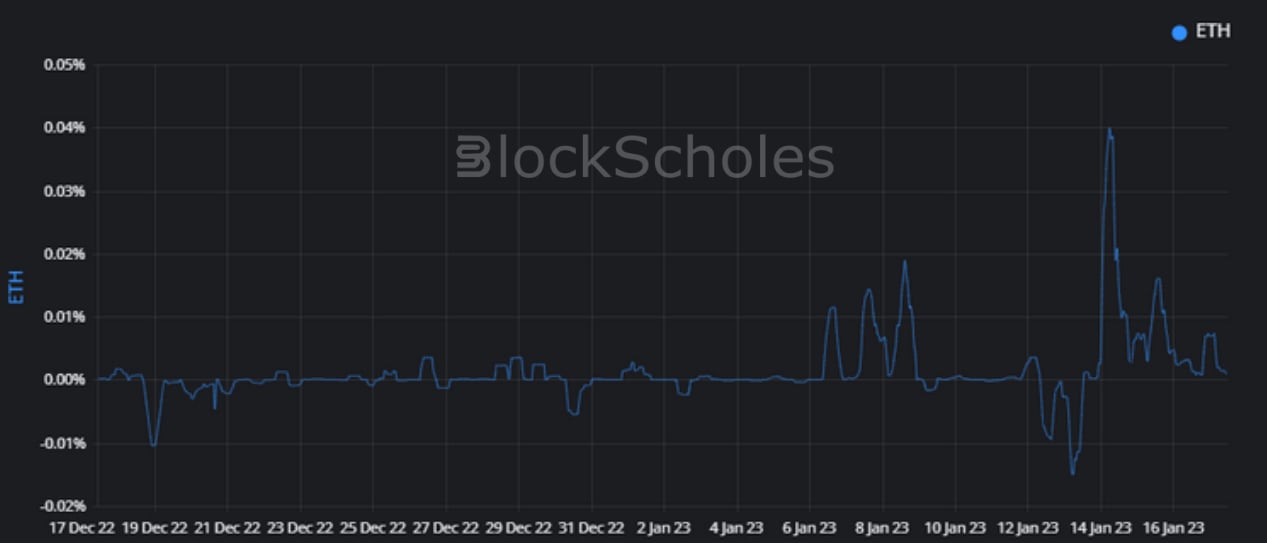

- ETH FUNDING RATE – reflects a similar demand for long exposure to upside moves in spot price via the perpetual swap contract.

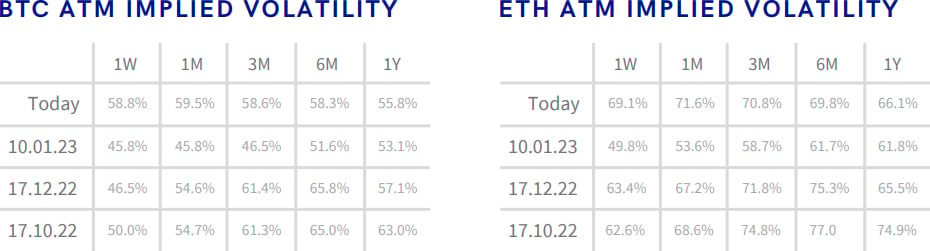

- BTC SABR ATM IMPLIED VOLATILITY – climbs higher in response to the sharp rally over the past week.

- ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s pickup to recover to the top of the range that it traded at post-FTX crash.

- BTC IMPLIED VOL SURFACE – shows that the increase in volatility is focused largely on short dated, OTM calls.

- ETH IMPLIED VOL SURFACE – displays a faster cooling in OTM calls with 3M to 6M tenors, but retains a higher IV across the surface.

- BTC 10 DELTA PC SKEW – reflects a higher demand for calls than puts for the first time since September.

- ETH 10 DELTA PC SKEW – reflects a stronger demand for upside optionality than we saw just before the FTX crash in November.

Futures

BTC ANNUALISED YIELDS – futures prices rise decisively above zero in response to the recent rally in spot prices.

ETH ANNUALISED YIELDS – see similar gains to near 2% at 3M and 6M tenors, whilst 1M and 1Y tenor futures remain closer to 1% above spot.

Perpetual Swap Funding Rate

BTC FUNDING RATE – spikes positively as traders seek exposure to BTC’s recent spot rally.

ETH FUNDING RATE – reflects a similar demand for long exposure to upside moves in spot price via the perpetual swap contract.

Options

BTC SABR ATM IMPLIED VOLATILITY – climbs higher in response to the sharp rally over the past week.

ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s pickup to recover to the top of the range that it traded at post-FTX crash.

Volatility Surface

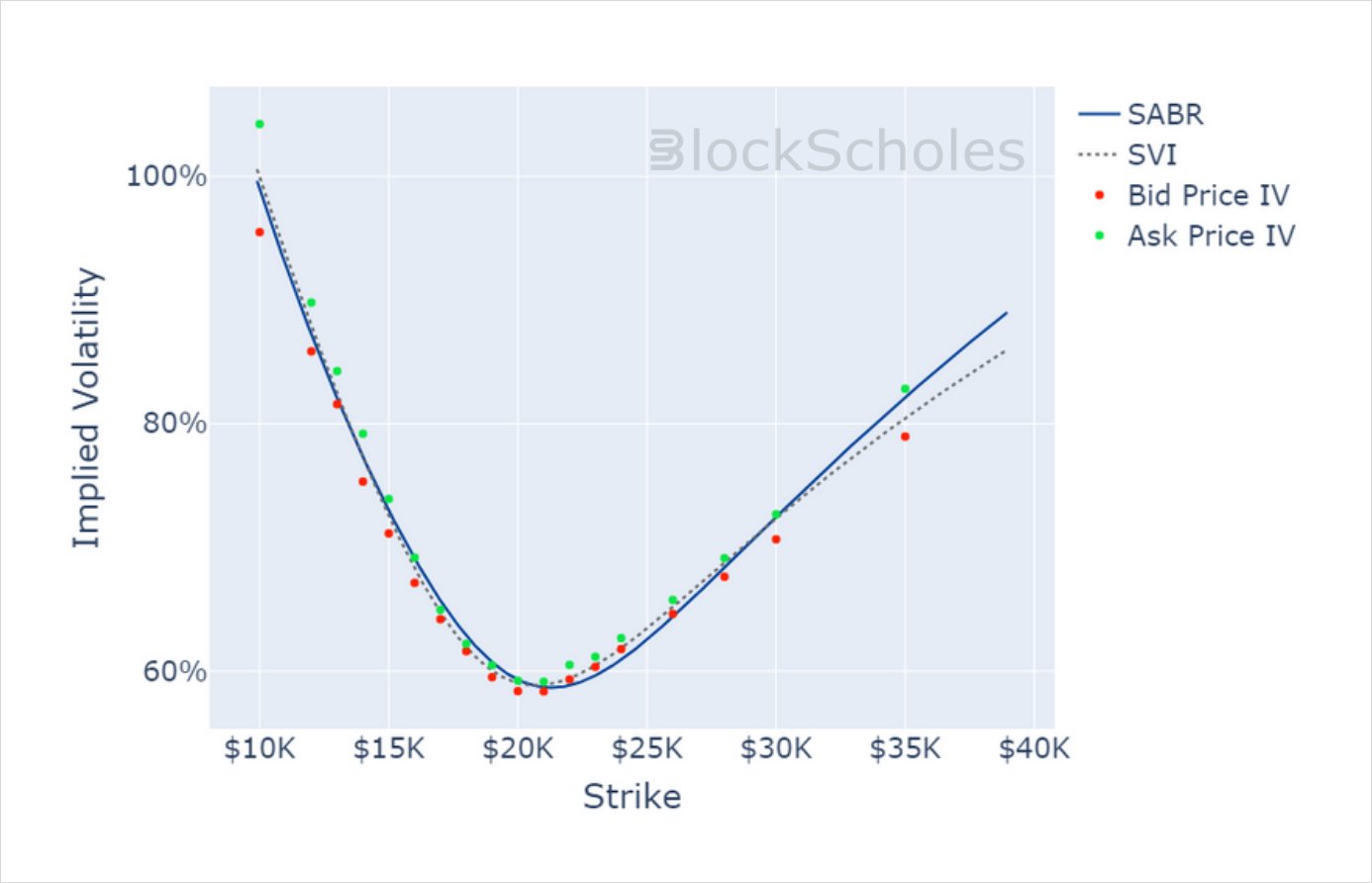

BTC IMPLIED VOL SURFACE – shows that the increase in volatility is focused largely on short dated, OTM calls.

ETH IMPLIED VOL SURFACE – displays a faster cooling in OTM calls with 3M to 6M tenors, but retains a higher IV across the surface.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

Put-Call Skew

BTC 10 DELTA PC SKEW – reflects a higher demand for calls than puts for the first time since September.

ETH 10 DELTA PC SKEW – reflects a stronger demand for upside optionality than we saw just before the FTX crash in November.

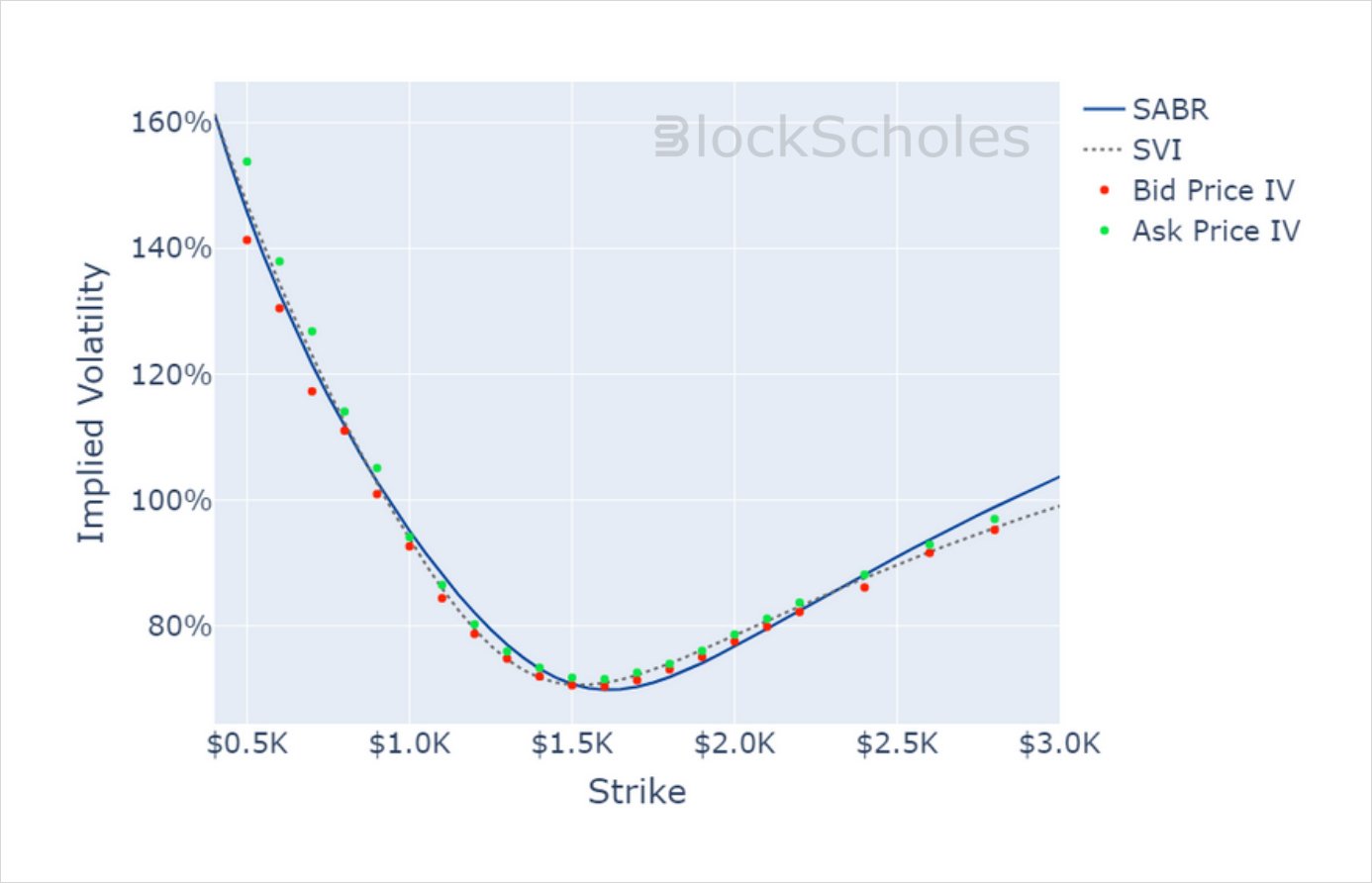

Volatility Smiles

BTC SMILE CALIBRATIONS – 24-Feb-2023 Expiry, 11:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 24-Feb-2023 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 11:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 11:00 UTC Snapshot.

AUTHOR(S)