Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The volatility smiles of both majors are pricing up- and down-side volatility at similar levels across the term structure after ETH’s risk-reversals recovered from a sharper skew towards OTM puts. ETH options are pricing for a slightly lower level of volatility at all tenors of the term structure. We also note a return to the high and positive funding rates for both assets, indicating a willingness of long positions to pay a rate for their exposure through the derivative contract.

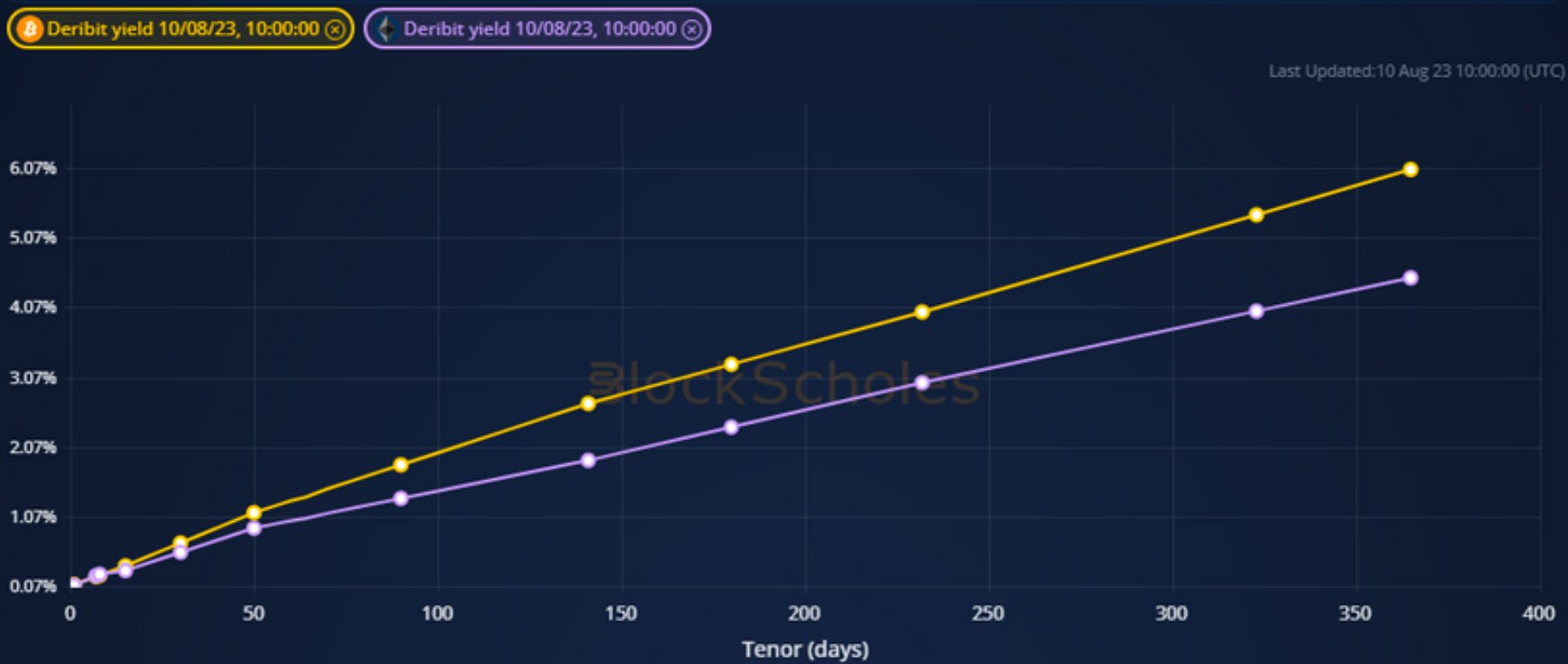

Futures implied yield term structure.

Volatility Surface Metrics.

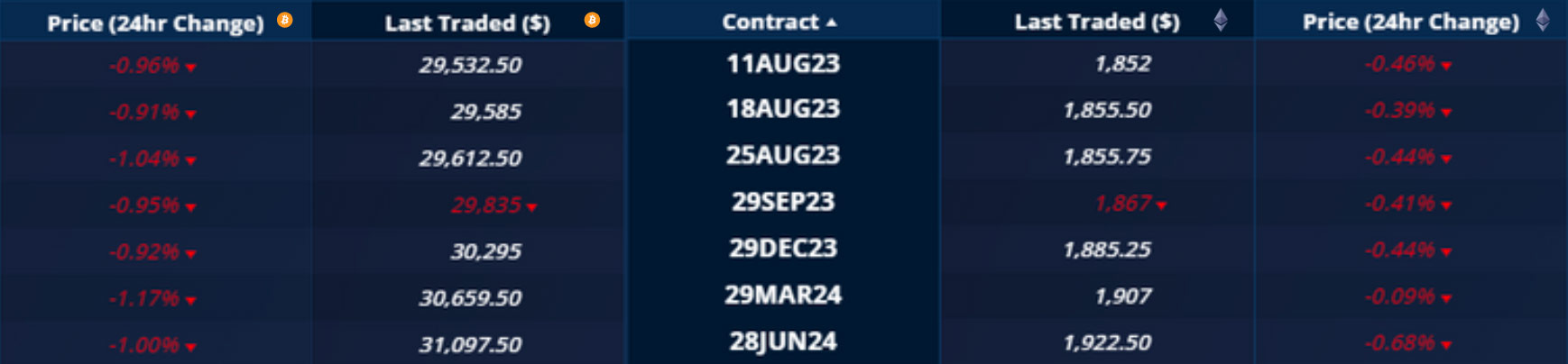

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – Remain positive at all tenors, with short maturity futures reporting a higher annualised yield.

ETH ANNUALISED YIELDS – Have moved with higher volatility than those of BTC, but with a similar inversion to their annualised term structure.

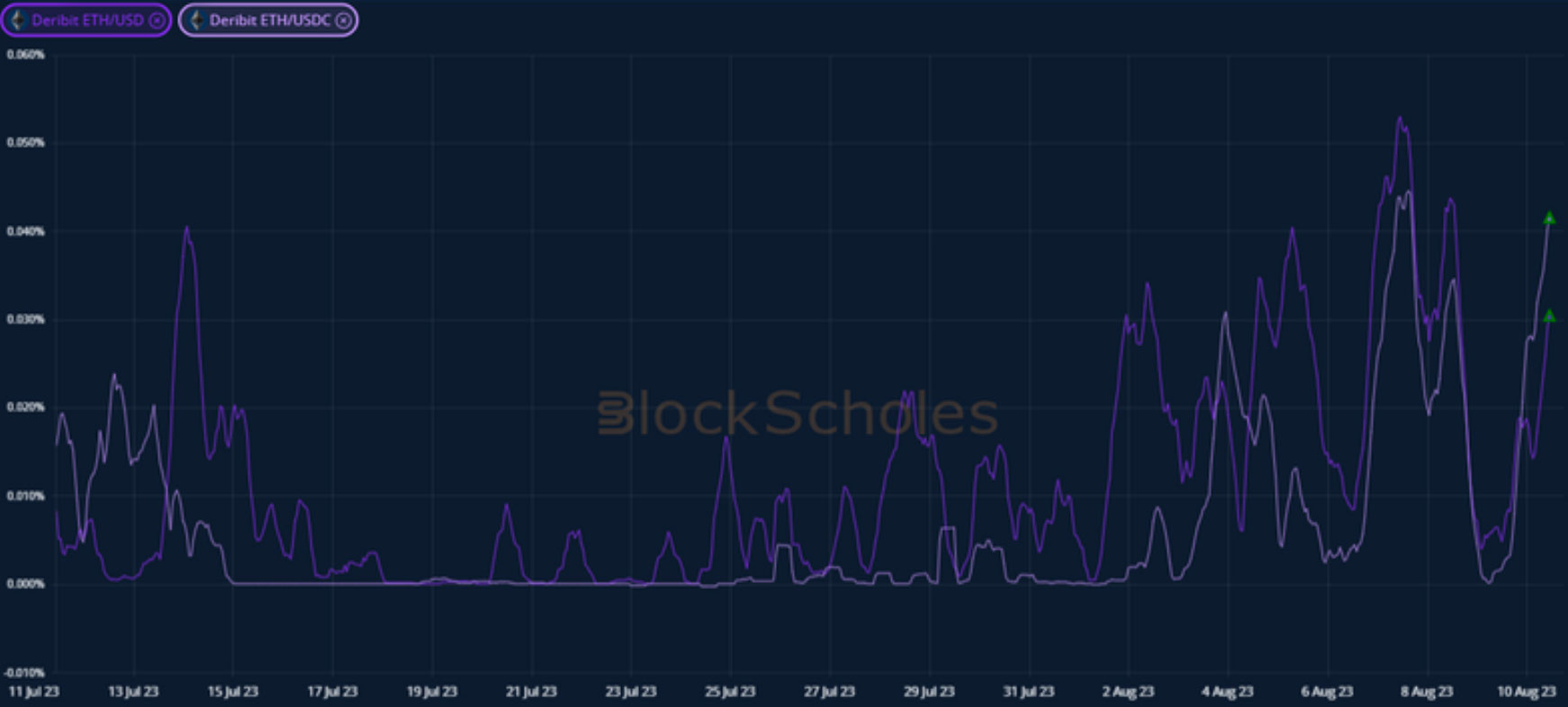

Perpetual Swap Funding Rate

BTC FUNDING RATE – Have remained high and strong for both BTC and USDC quoted contracts.

ETH FUNDING RATE – Has climbed to similar heights to BTC and to the levels we last say at the beginning of July.

BTC Options

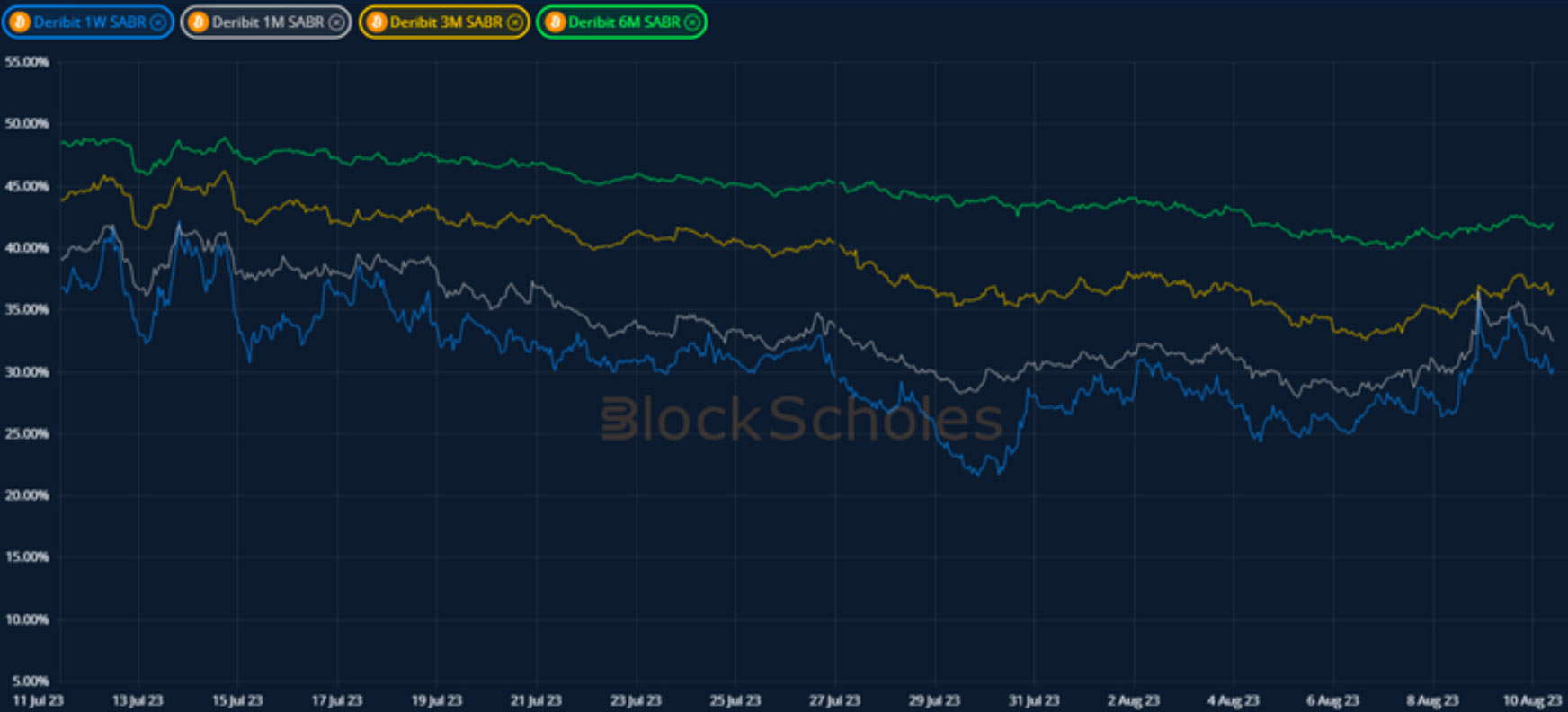

BTC SABR ATM IMPLIED VOLATILITY – Rise in response to the pickup in realised volatility, but do not climb out of their historically low range.

BTC 25-Delta Risk Reversal – Oscillate between -2% and +3% (in favour of OTM calls) across the term structure throughout the last week.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – Has oscillated around its historically low levels, and trades slightly lower than BTC’s.

ETH 25-Delta Risk Reversal – Have recovered more decisively than BTC’s from their distinct skew towards OTM puts.

Volatility Surface

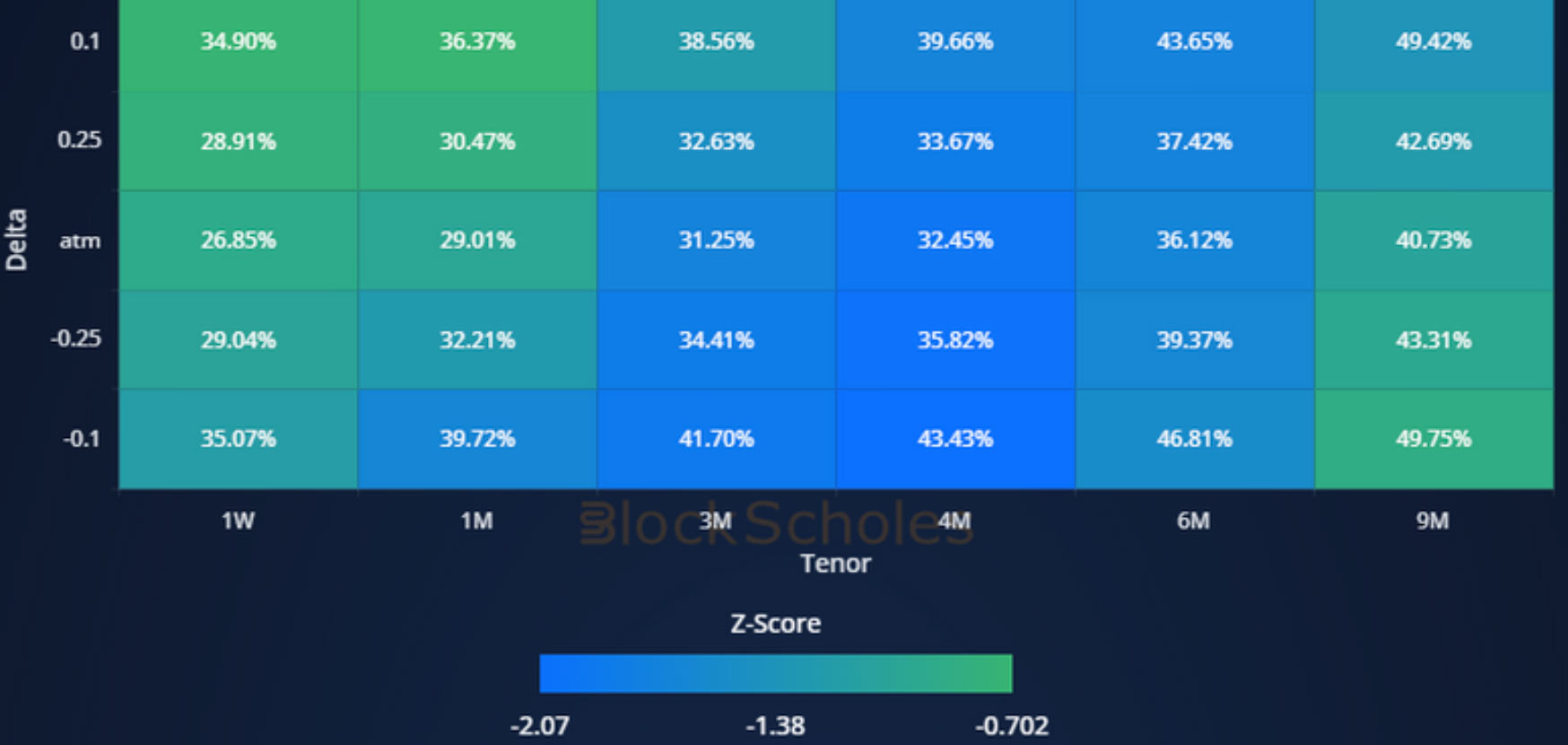

BTC IMPLIED VOL SURFACE – Sees a pickup in implied volatility in its 1- week tenor, 10-delta calls, with a cooling most prominent for longer dated down-side protection.

ETH IMPLIED VOL SURFACE – Sees a surface-wide fall in implied volatility compared to its 30-day average, without an increase in short term calls.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

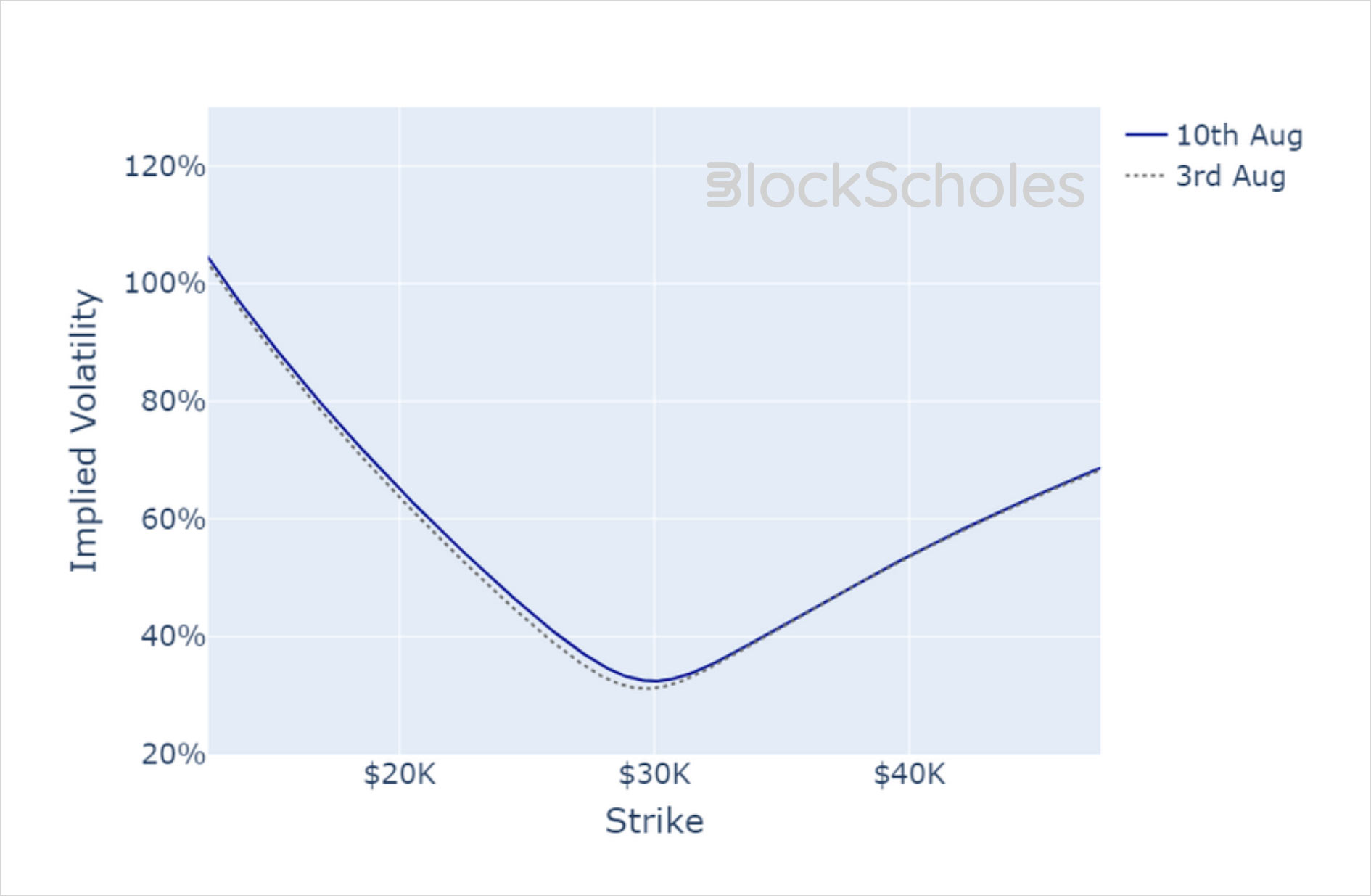

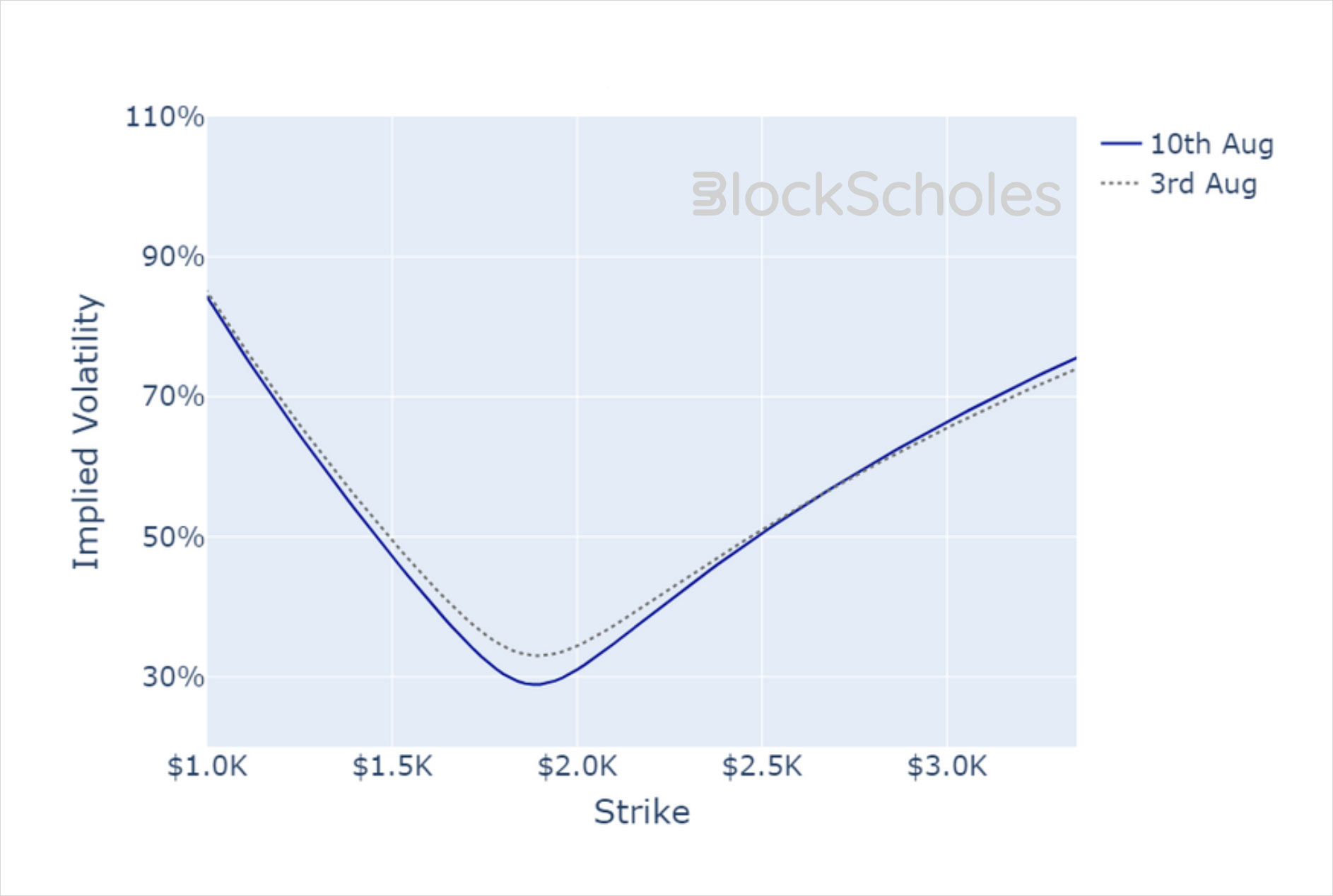

Volatility Smiles

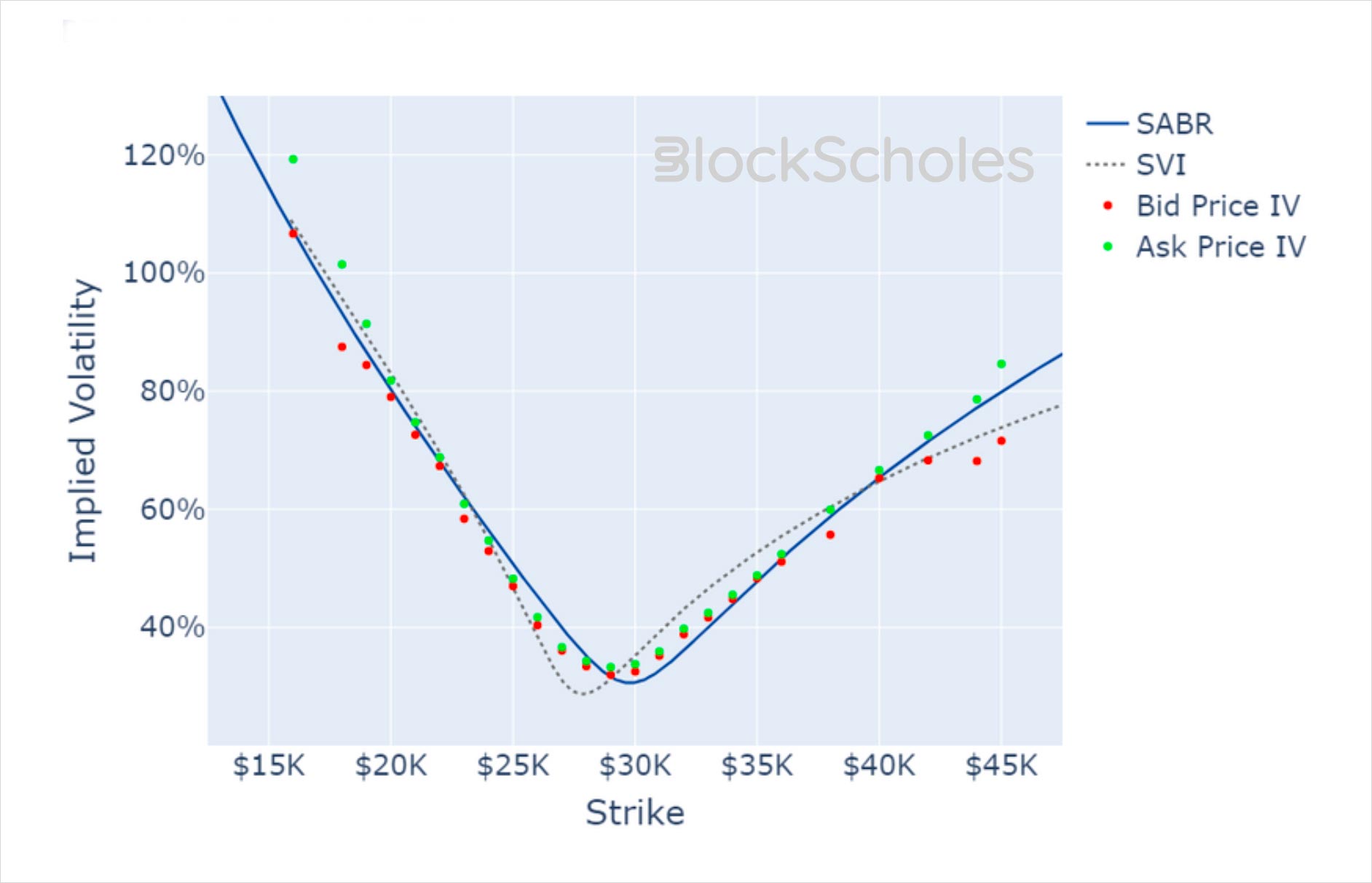

BTC SMILE CALIBRATIONS – 25-Aug-2023 Expiry, 10:00 UTC Snapshot.

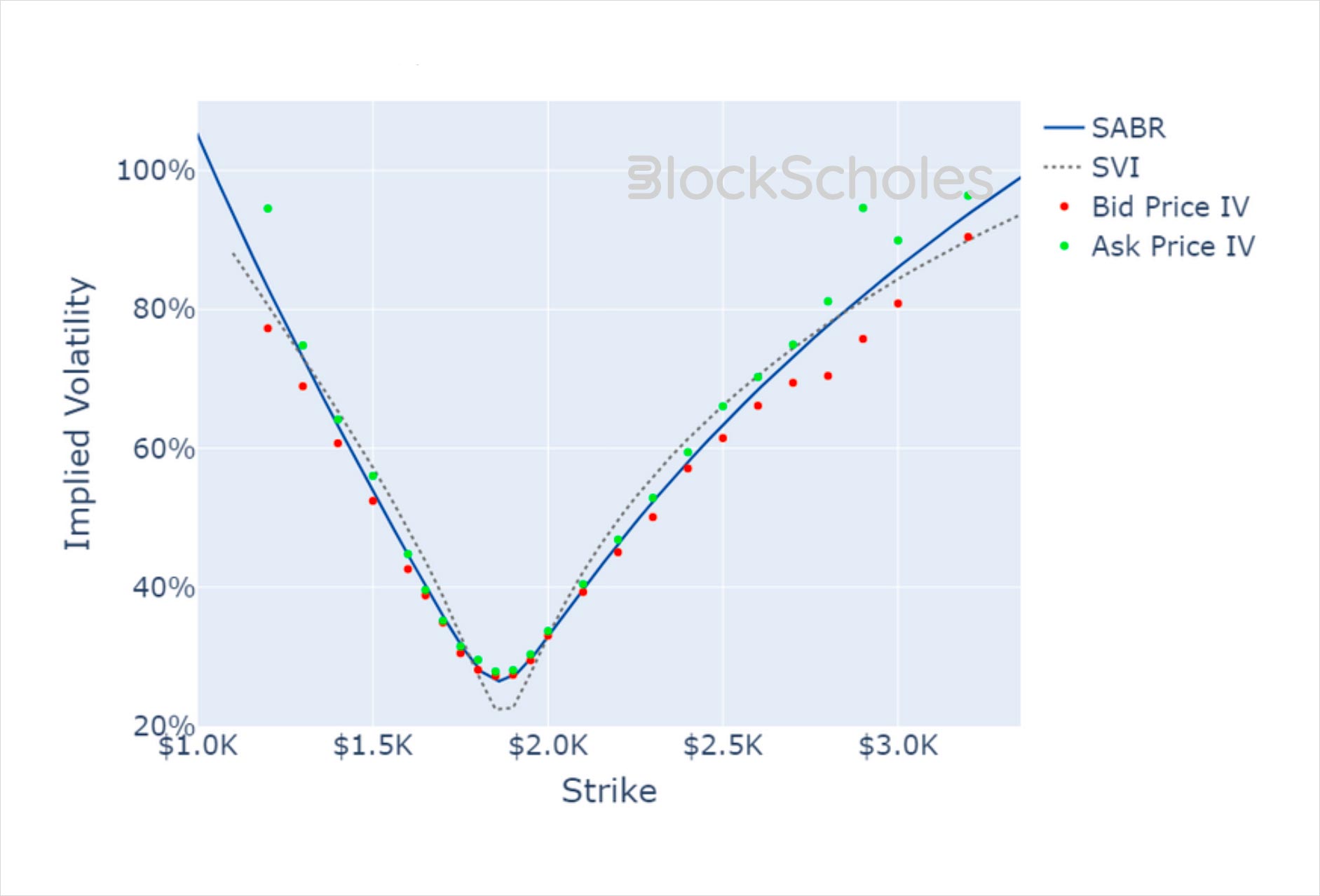

ETH SMILE CALIBRATIONS – 25-Aug-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)