Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

A Grayscale-inspired retrace of last week’s spot market selloff saw at-the-money volatility rise for BTC and ETH options alike. However, neither event managed to cause a sustained recovery from the historically low range in which volatility has traded throughout the last six months. Neither has this week’s rally seen a return to the strong and positive funding rates paid by long positions in perpetual swap contracts – a fact reflected by the subdued spot-yields implied by Futures.

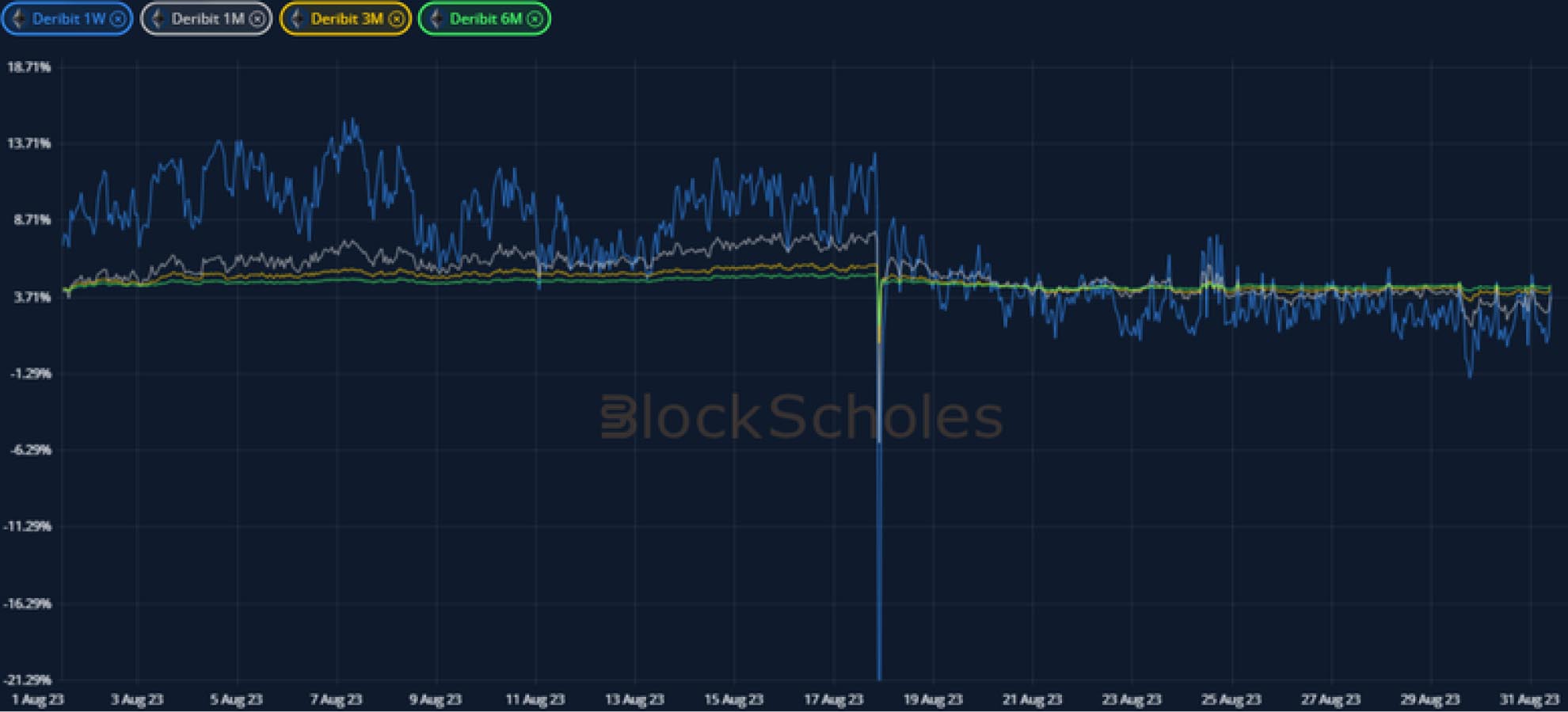

Futures implied yield term structure.

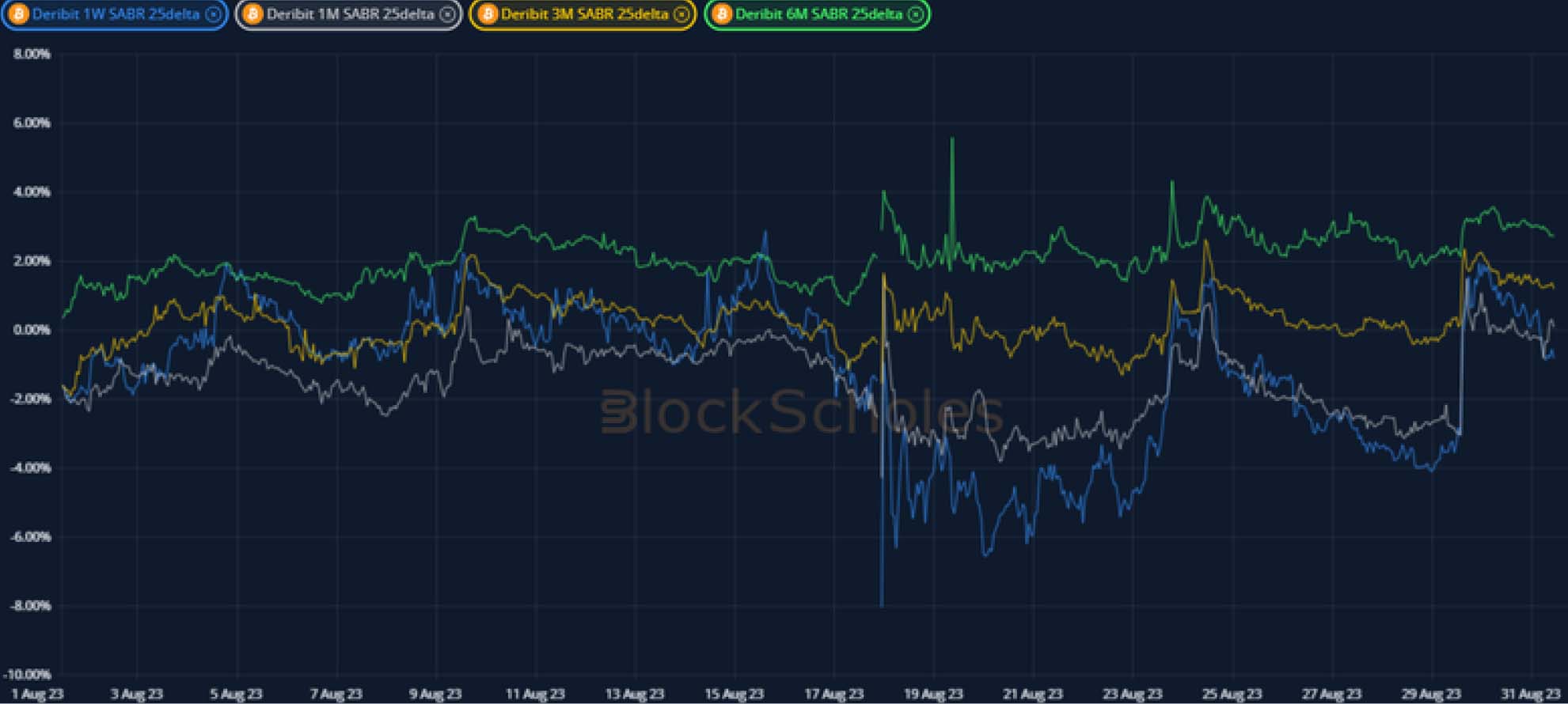

Volatility Surface Metrics.

*All data in tables recorded at a 10:05 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – have repeated last week’s subdued performance despite the retrace in spot prices to the $27K level.

ETH ANNUALISED YIELDS – have also repeated last weeks’s behaviour, trading in a tight, relatively subdued range above zero.

Perpetual Swap Funding Rate

BTC FUNDING RATE – has moved close to zero since the selloff appeared to moderate some of the sentiment that saw high rates paid by longs.

ETH FUNDING RATE – has reported a more consistently positive rate paid by longs than BTC’s, but remains below the levels seen in early August.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has spiked upwards twice this month, but has struggled to sustain a rise above its historically low levels.

BTC 25-Delta Risk Reversal – has continue to trade with significant volatility, recovering strongly during this week’s re-rally to the $27K level.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – remains below that of BTC’s options, but has traced similar paths throughout the past month.

ETH 25-Delta Risk Reversal – does not enjoy the same positive sentiment as BTC’s surface and continues to reflect a skew towards OTM puts.

Volatility Surface

BTC IMPLIED VOL SURFACE – Highlights the increase in implied volatility over the last week in response to the retrace of the spot market selloff, with a rise most prominent at longer-dated expiries.

ETH IMPLIED VOL SURFACE – shows a similar but smaller rise in implied volatility that leaves ETH’s surface distinctly below BTC’s.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

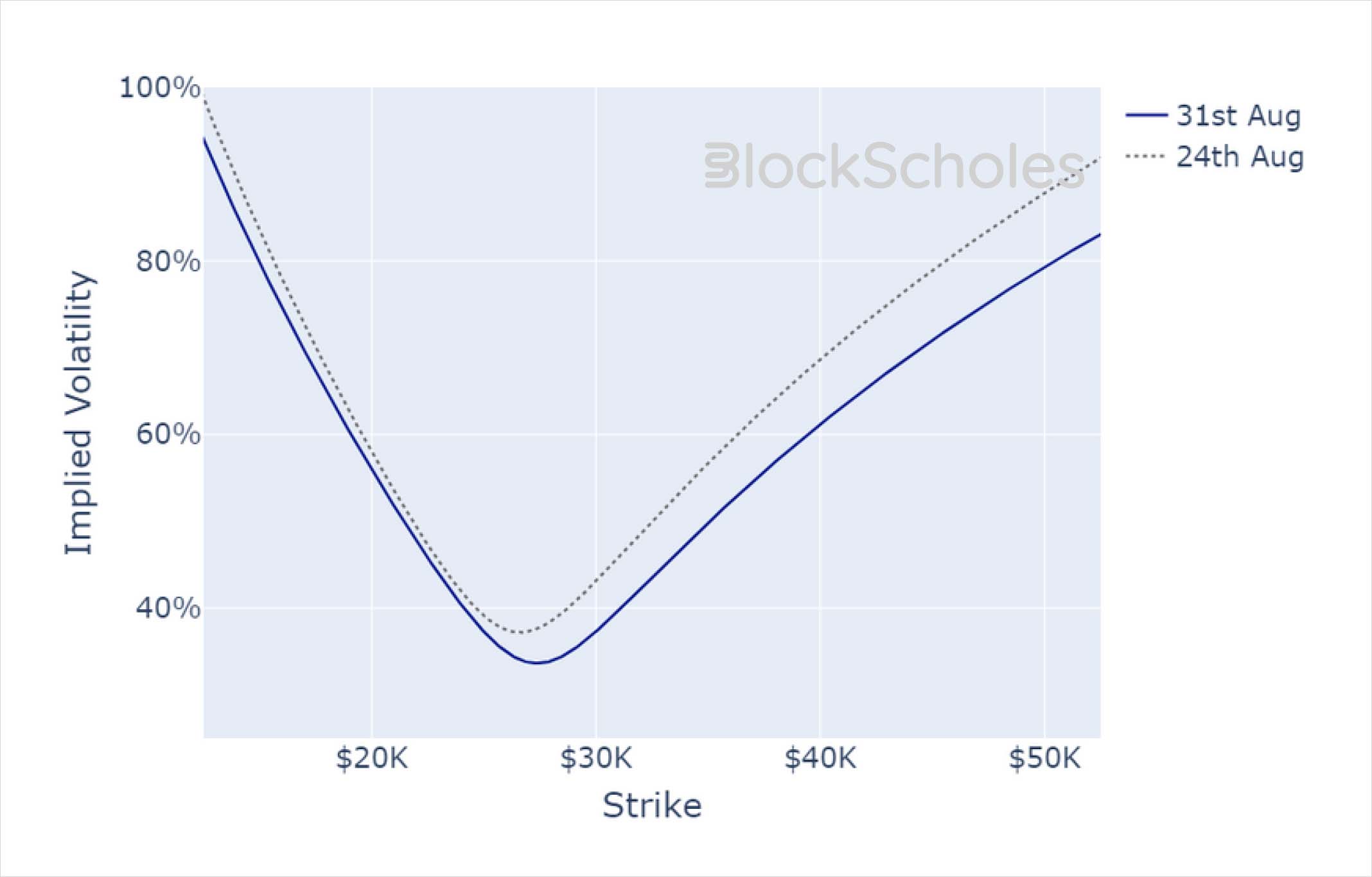

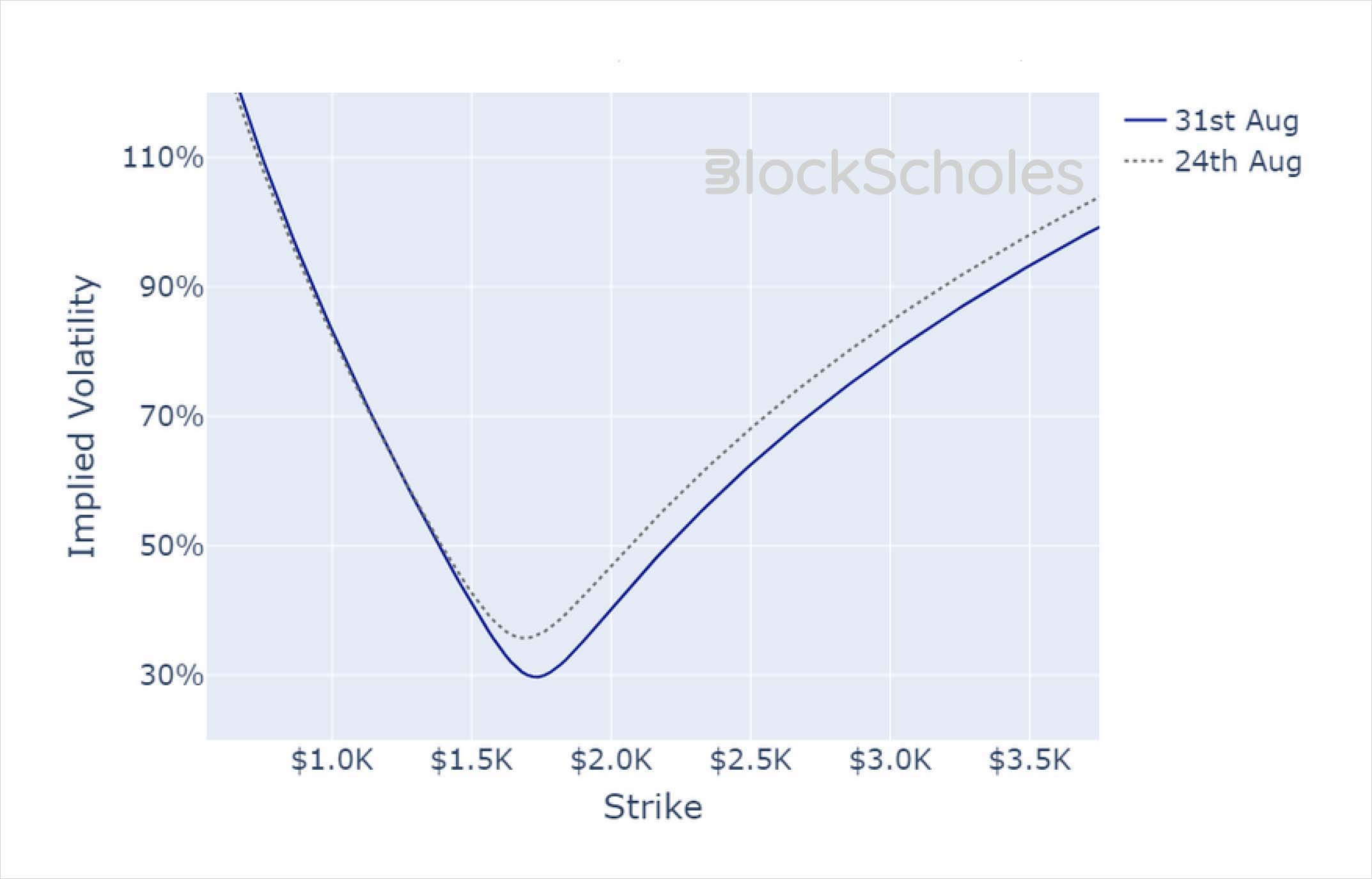

Volatility Smiles

BTC SMILE CALIBRATIONS – 29-Sep-2023 Expiry, 10:05 UTC Snapshot.

ETH SMILE CALIBRATIONS – 29-Sep-2023 Expiry, 10:05 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:05 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:05 UTC Snapshot.

AUTHOR(S)