Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

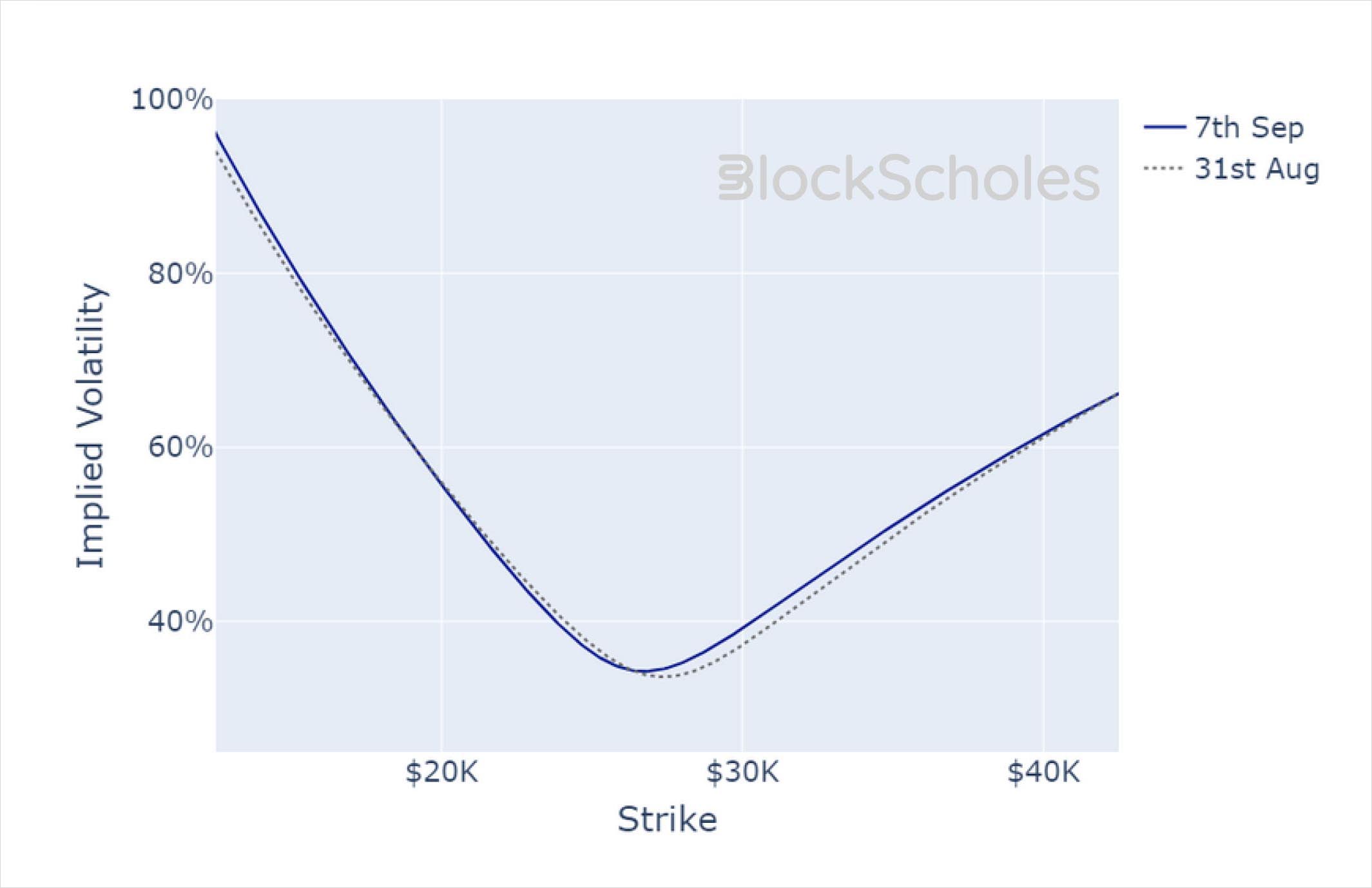

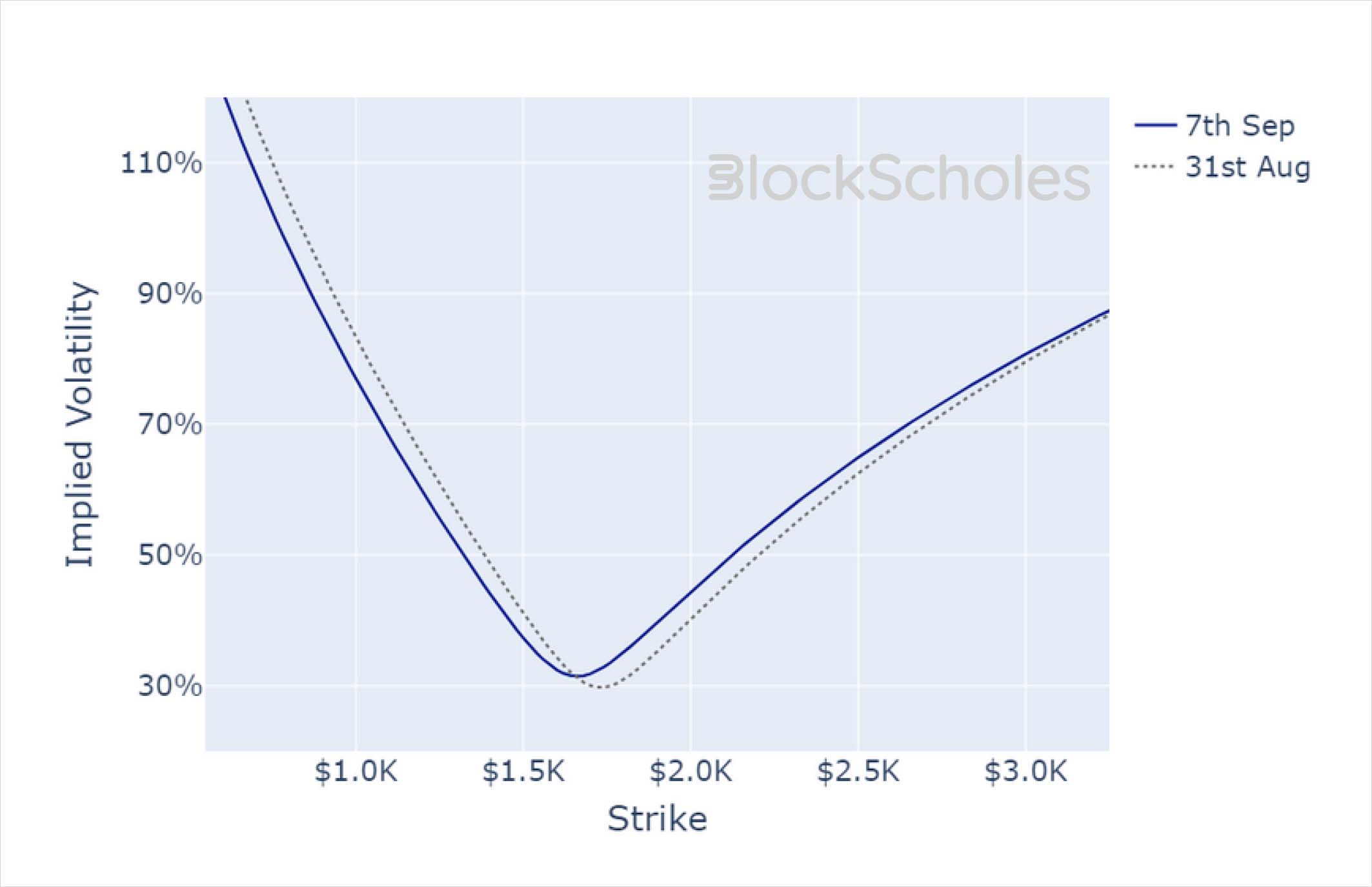

Whilst futures-implied spot yields remained subdued, we have seen a return to more positive funding rates in the perpetual swaps markets, albeit far from the large positive rates that we observed last month. Implied volatility was little changed throughout the last week, but both surfaces report an increase in relative demand for short-dated downside protection, with BTC’s vol smile skew falling below that of ETH’s against its historical behaviour.

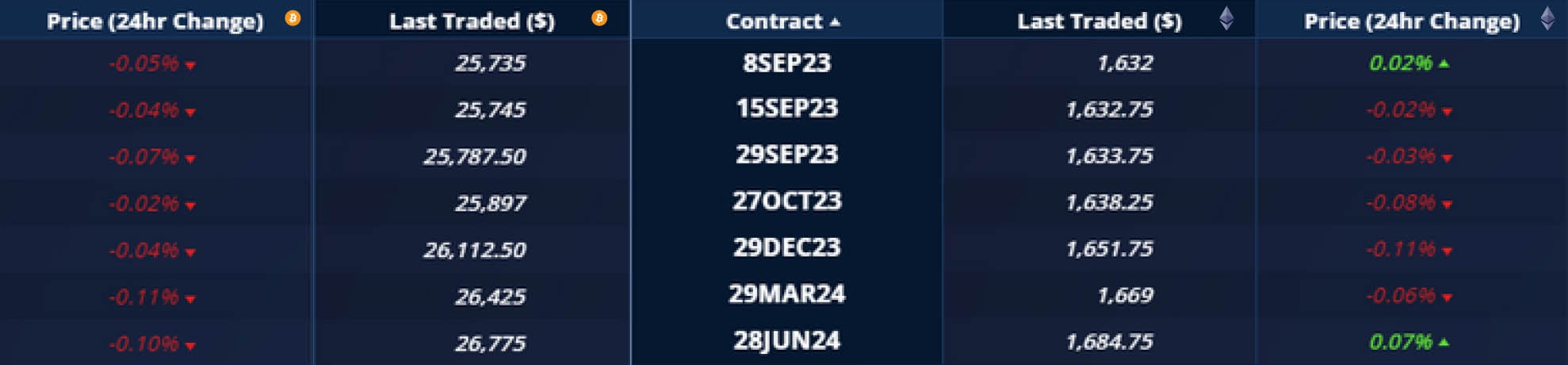

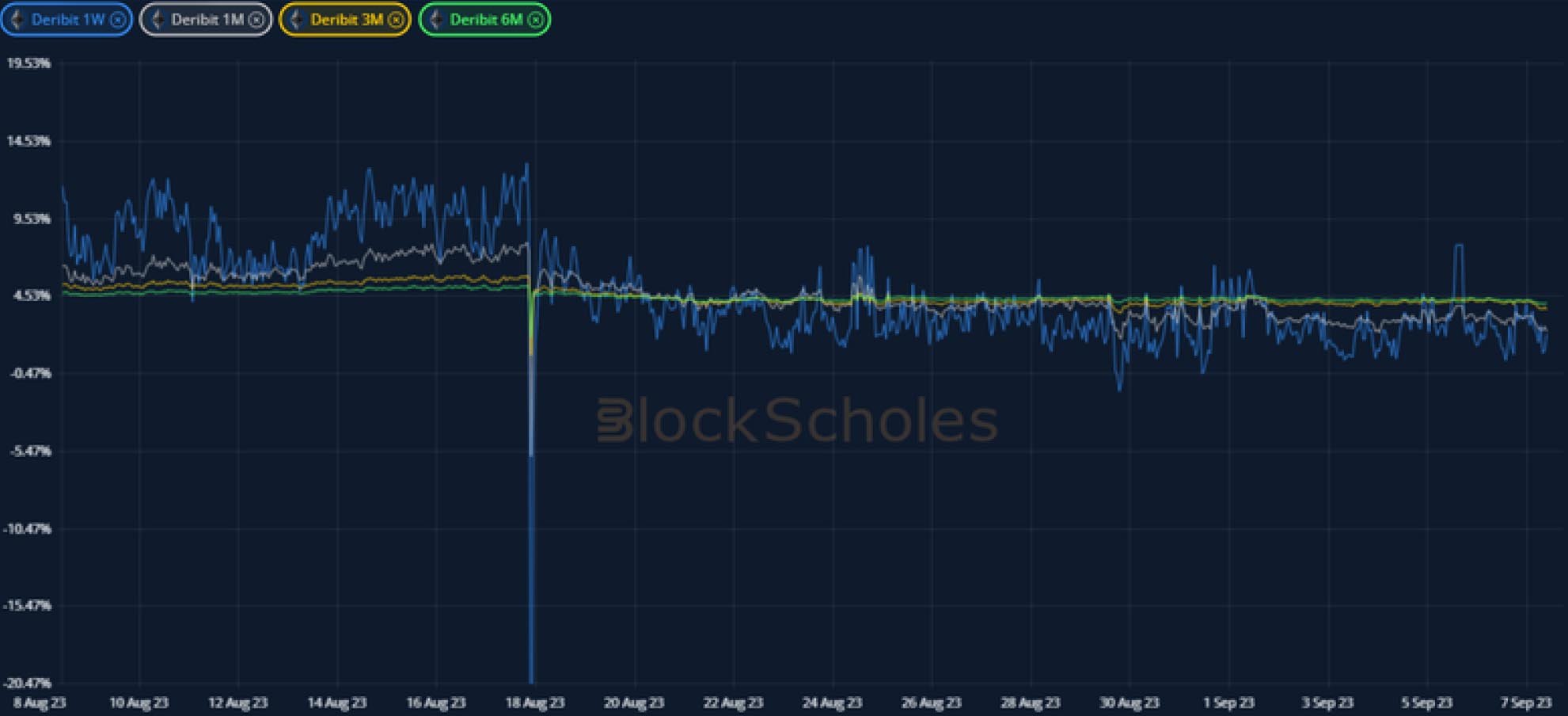

Futures implied yield term structure.

Volatility Surface Metrics.

*All data in tables recorded at a 10:05 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – continue to trade in a tight range between 0% and 4.5% across the term structure.

ETH ANNUALISED YIELDS – remain subdued at their lower levels between 0% and 4.5% across the term structure.

Perpetual Swap Funding Rate

BTC FUNDING RATE – has shown a pickup in demand for long exposure over the last 24H, but remains far below the strong levels of last month.

ETH FUNDING RATE – echoes BTC’s increase in demand for long exposure, but at much lower levels than we observed last month.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has not yet shown the same spikes that we observed in August, continuing to trade between 30% and 45%.

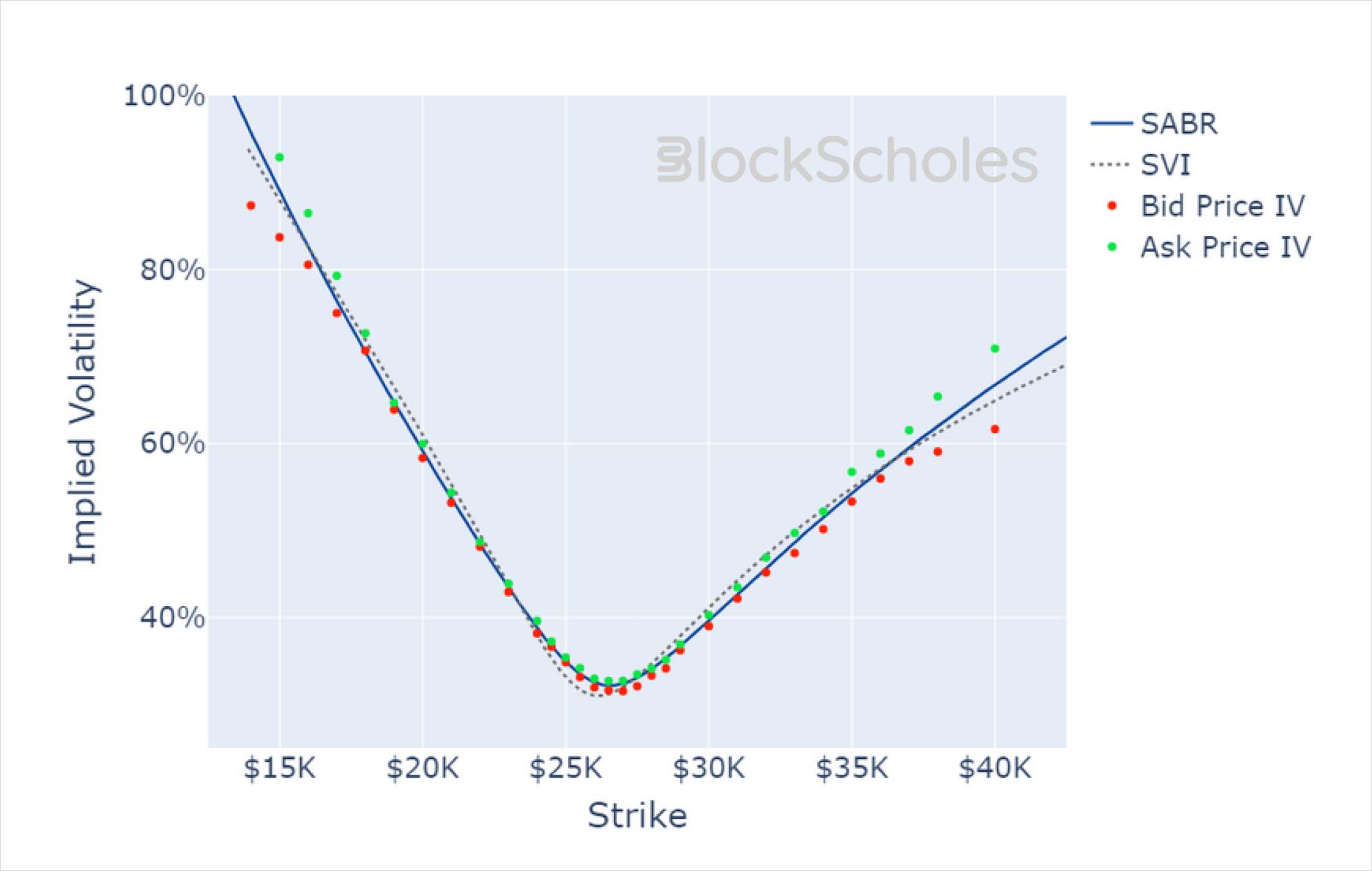

BTC 25-Delta Risk Reversal – has fallen significantly negative to reflect a change to a more bearish positioning that is strongest at short tenors.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – remains below that of BTC’s options, but has traced similar paths throughout the past month.

ETH 25-Delta Risk Reversal – reflects a similar increase in bearish positioning, but has reached shallower depths than BTC.

Volatility Surface

BTC IMPLIED VOL SURFACE – the strongest pickup in implied volatility has been focused on long dated downside protection. In contrast, short dated OTM calls have fallen – reflecting an increase in skew towards puts.

ETH IMPLIED VOL SURFACE – the vol of long dated options has risen more in OTM calls than puts, whilst short dated OTM calls fall.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

BTC SMILE CALIBRATIONS – 29-Sep-2023 Expiry, 10:05 UTC Snapshot.

ETH SMILE CALIBRATIONS – 29-Sep-2023 Expiry, 10:05 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:05 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:05 UTC Snapshot.

AUTHOR(S)