Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

ETH futures have continued to under-perform BTC’s over the last week, with a rally returning their prices closer to spot prices in the last 24 hours. Implied volatility has remained steady between 25% and 45% across the term structure of both majors, with a stronger skew towards downside protection in the vol smiles of BTC options. The funding rates of both assets have spiked to their largest values since early August, expressing a strong demand for long spot exposure through the derivative contract.

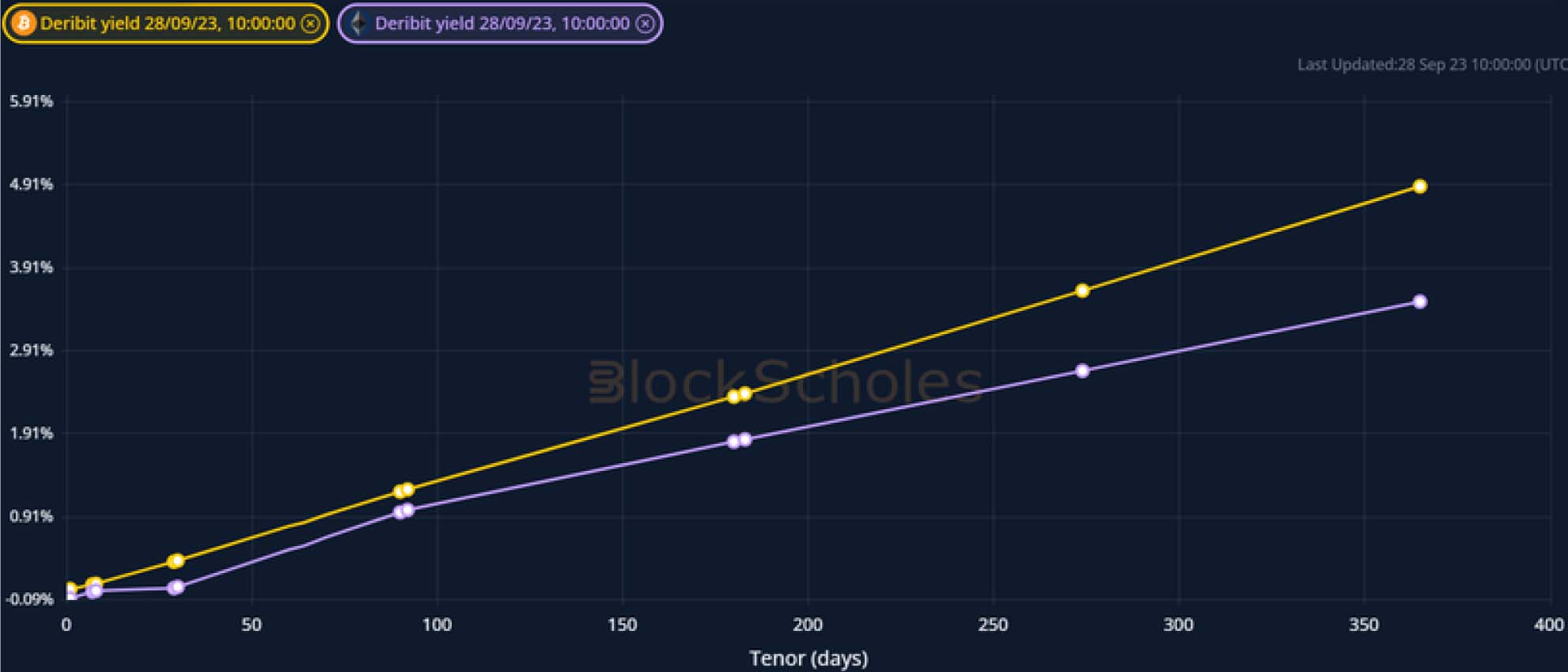

Futures implied yield term structure.

Volatility Surface Metrics.

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

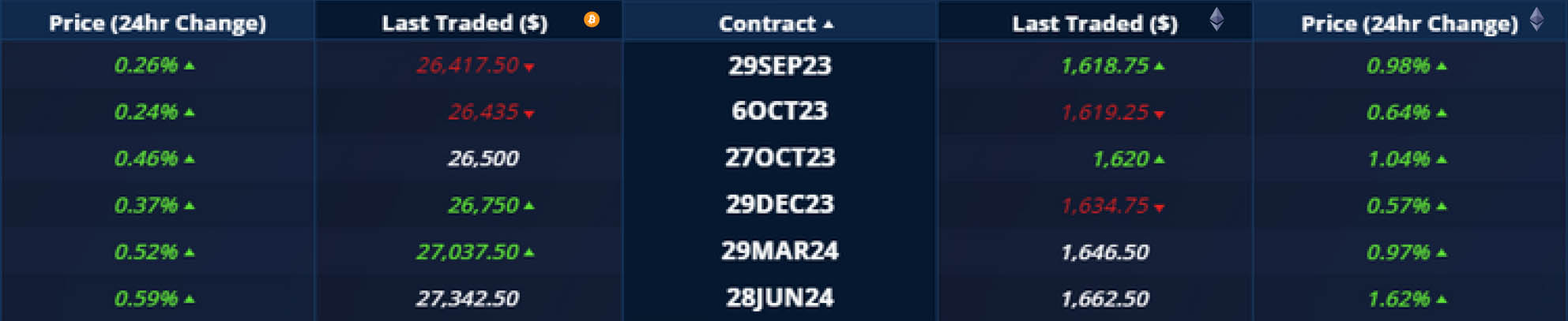

Futures

BTC ANNUALISED YIELDS – rallied alongside spot prices in the last 24H before returning to levels just above 2% at an annualised rate.

ETH ANNUALISED YIELDS – have halted their trend downward, trading sideways below zero for much of the week before recovering to 0.

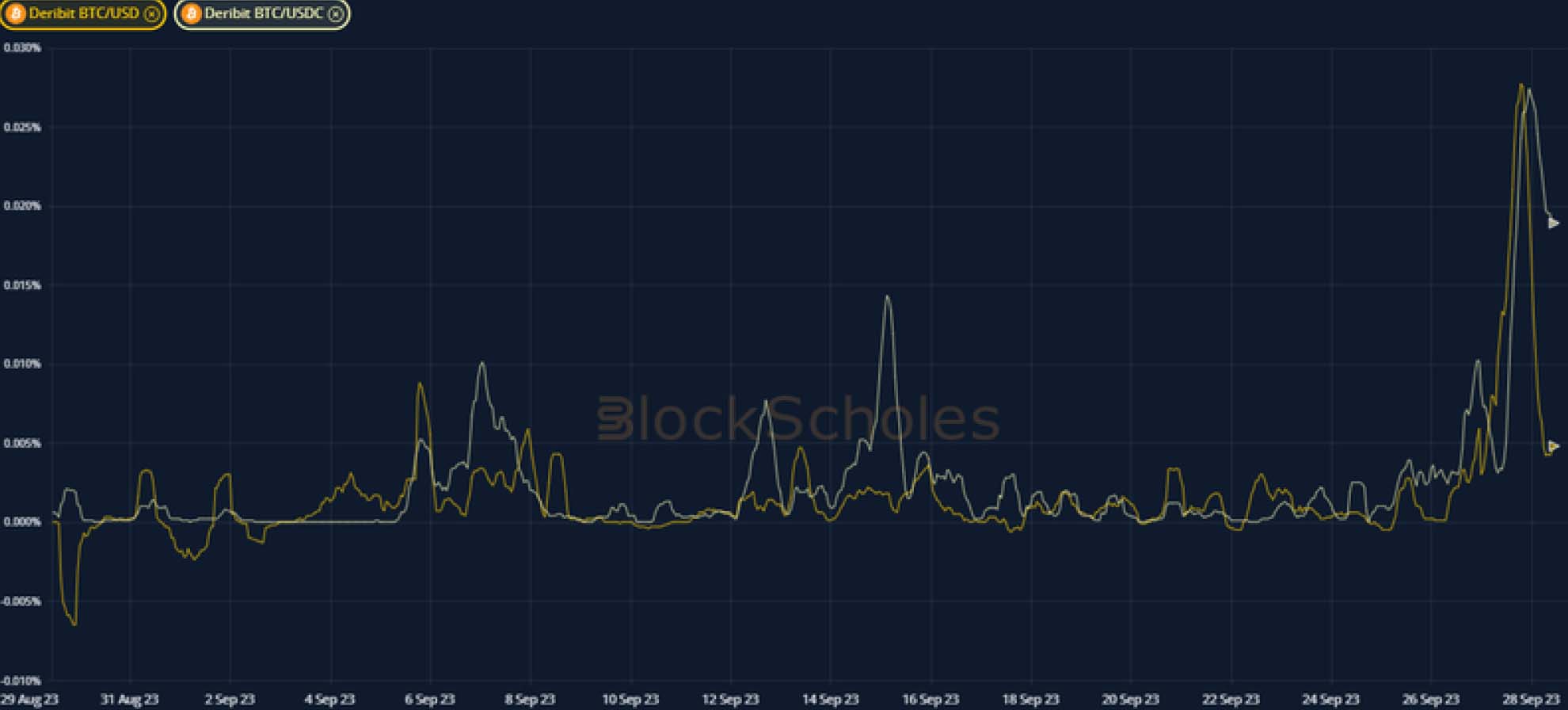

Perpetual Swap Funding Rate

BTC FUNDING RATE – spiked to their largest values since early August in response to the rally in spot prices.

ETH FUNDING RATE – have risen at the same time as BTC’s, having moved conversely in the first few weeks of this month.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – remains steep, with 1W tenors oscillating between 25% and 30%, and 6M tenors above 45%.

BTC 25-Delta Risk Reversal – slide further towards downside protection over the last 7 days, with a higher skew in shorter tenor smiles.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – trades with similar levels and steepness spread that of BTC’s vol term structure.

ETH 25-Delta Risk Reversal – has not trended towards puts as sharply as BTC’s has, leaving ETH’s smiles with only a slight skew towards OTM puts.

Volatility Surface

BTC IMPLIED VOL SURFACE – OTM puts at a 3M and 4M tenor show the largest increase in implied volatility, with a much sharper cooling in 1m OTM calls.

ETH IMPLIED VOL SURFACE – we see a smile-wide cooling of implied volatility at a 1M tenor, with longer dated vols increasing strongly.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

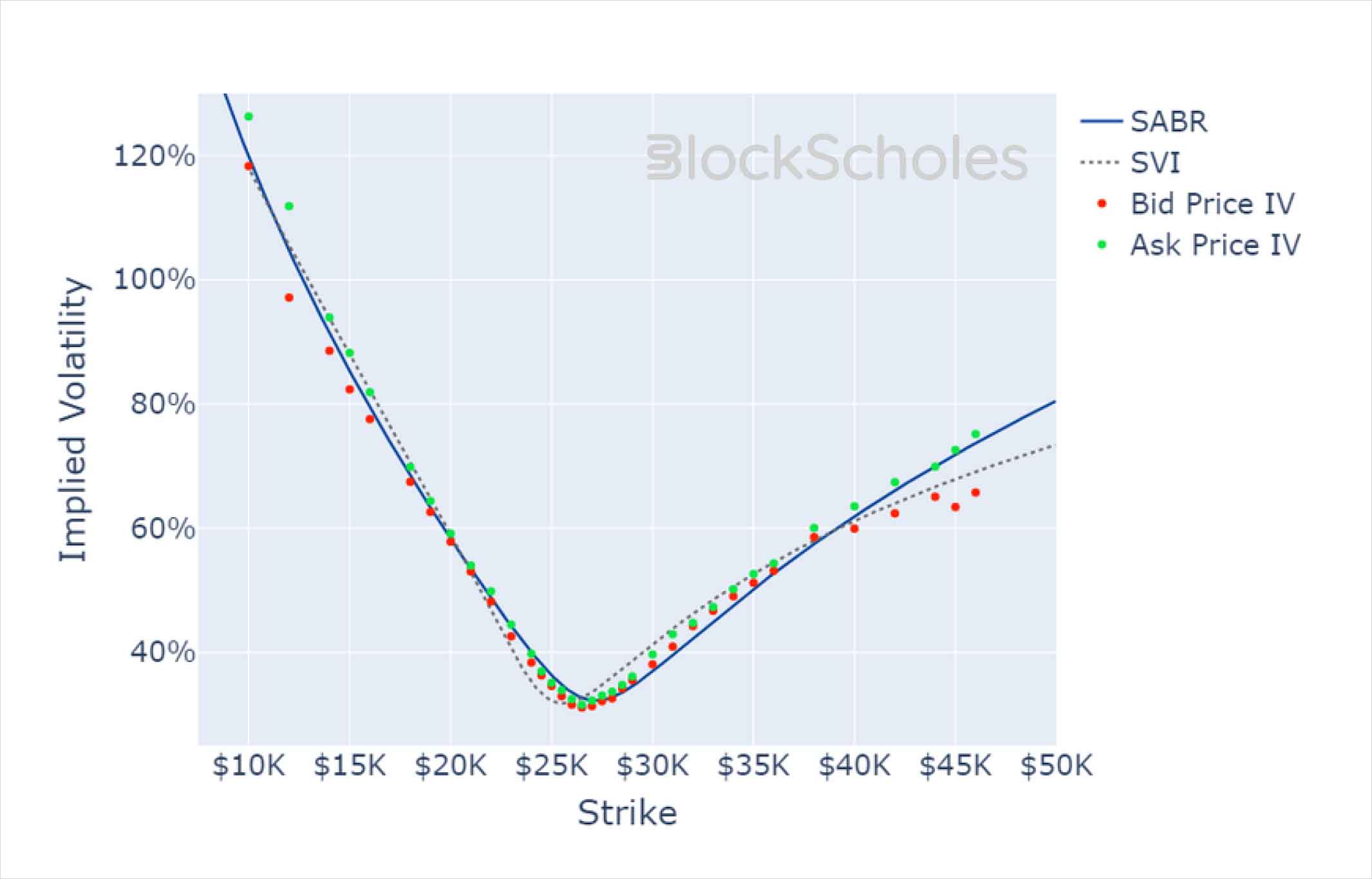

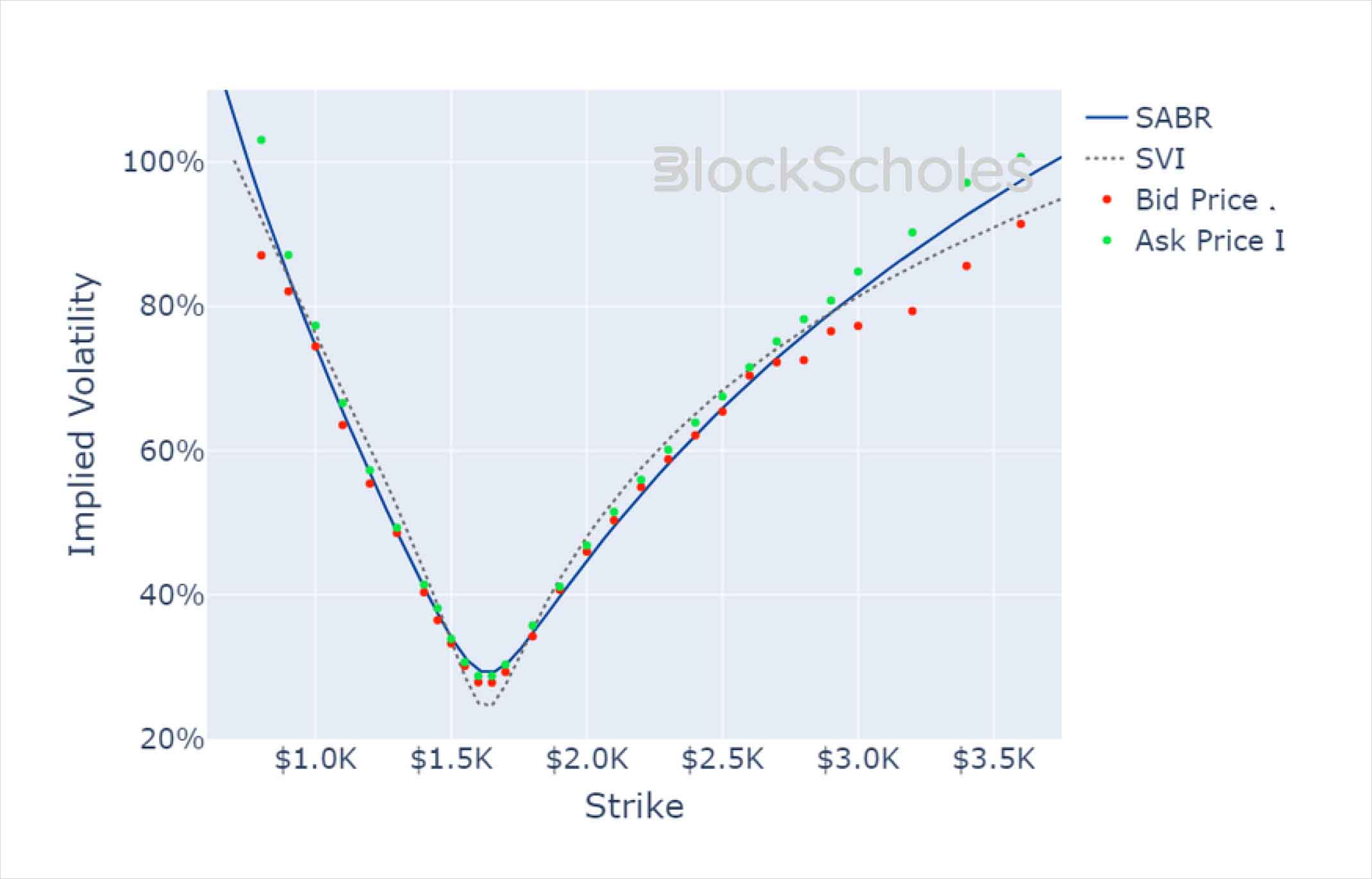

Volatility Smiles

BTC SMILE CALIBRATIONS – 27-Oct-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 27-Oct-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)