Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Shorter-dated ETH futures trade below their spot prices, a trend we’ve seen for the majority of the last month. The vol surfaces of both assets have seen their term structure steepen following a rise in implied volatility of longer-dated tenors, with ETH’s being skewed towards downside protection. BTC perpetual contracts indicate a resilient willingness to pay for long exposure, a sentiment not shared in the ETH perpetual market.

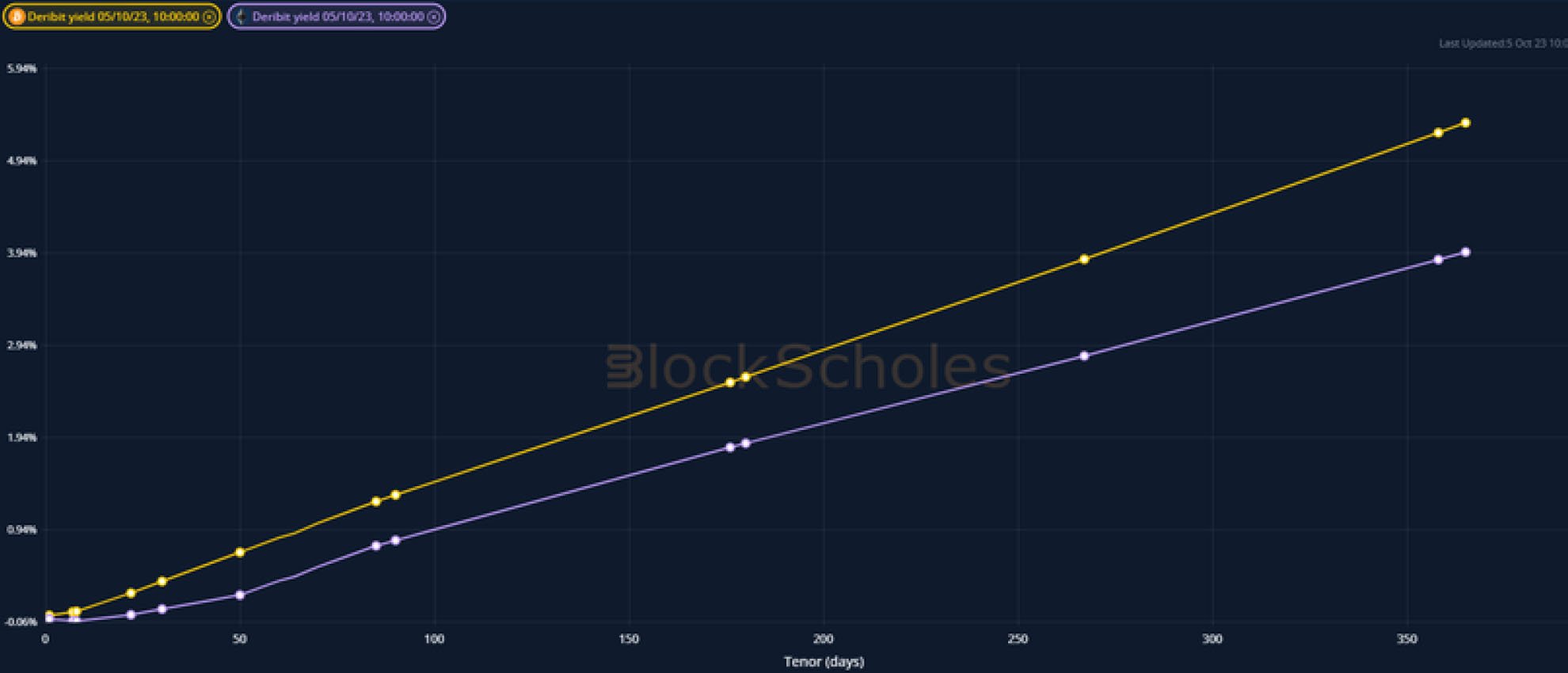

Futures implied yield term structure.

Volatility Surface Metrics.

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – have recently dipped below zero having traded near to 4% across the term structure for much of the week.

ETH ANNUALISED YIELDS – remain below BTC’s and below zero at short tenors, with the 3M and 6M tenors trading near to 4%.

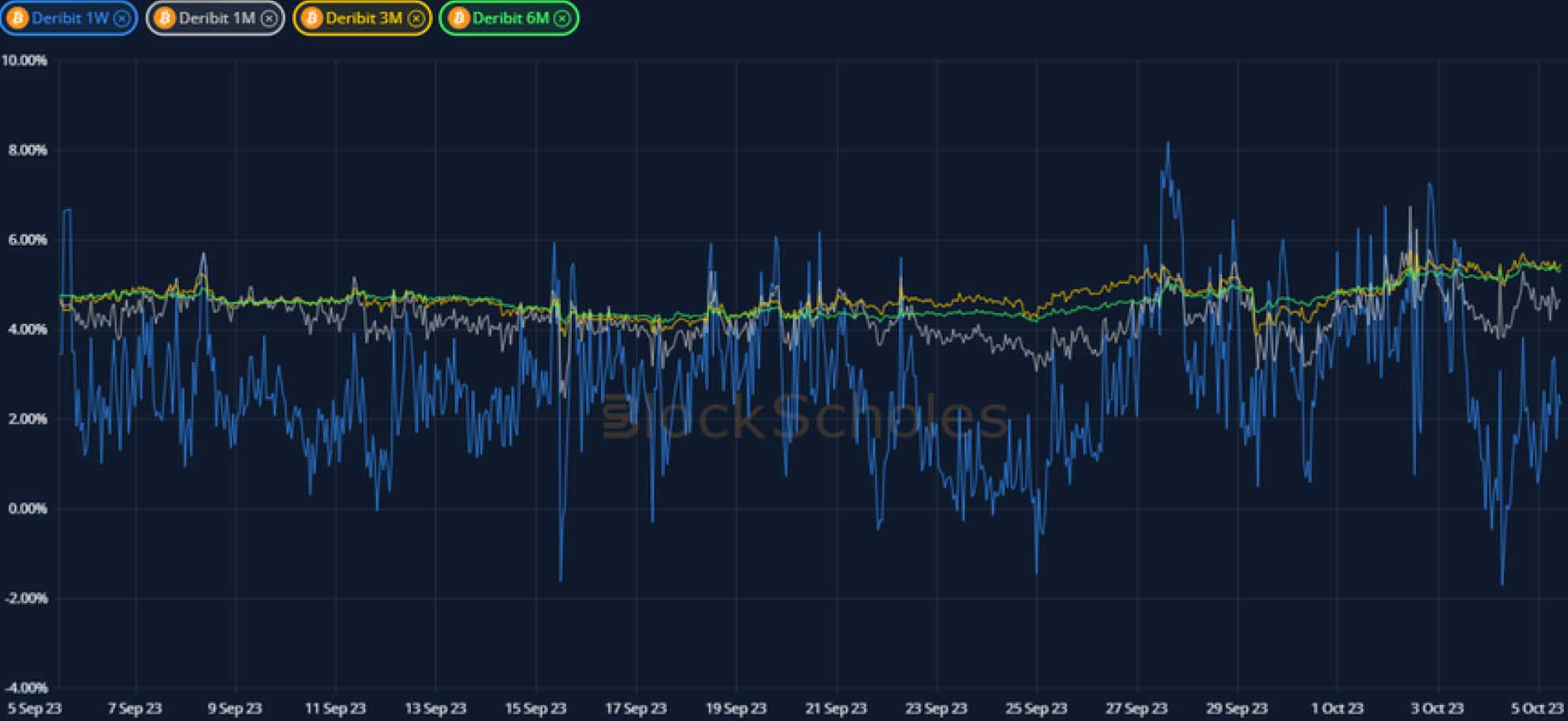

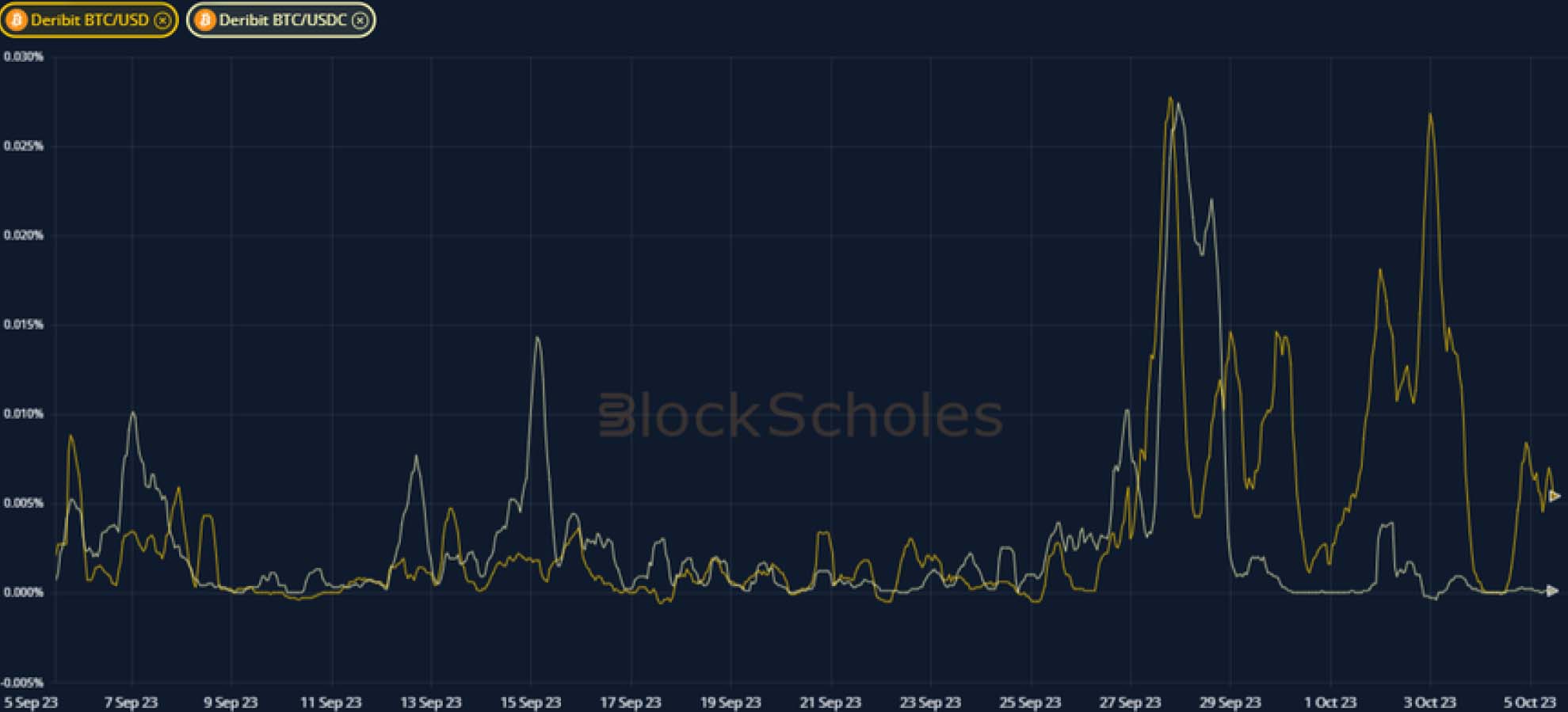

Perpetual Swap Funding Rate

BTC FUNDING RATE – remain at elevated levels, indicating a willingness by long position holders to pay for their exposure.

ETH FUNDING RATE – remains strangely low given the high positive rates paid by long holders of BTC’s perpetual swap contract.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has seen seen shorter tenor retrace a small midweek rally that has returned it to levels seen last week.

BTC 25-Delta Risk Reversal – sees shorter tenor skew more towards OTM puts, after trading mostly sideways in the past week.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC movements with longer dated tenors seeing little change in levels since last week.

ETH 25-Delta Risk Reversal – traded in a tighter range across the term structure than BTC’s, with a 6M tenor being skewed towards OTM puts in the last week.

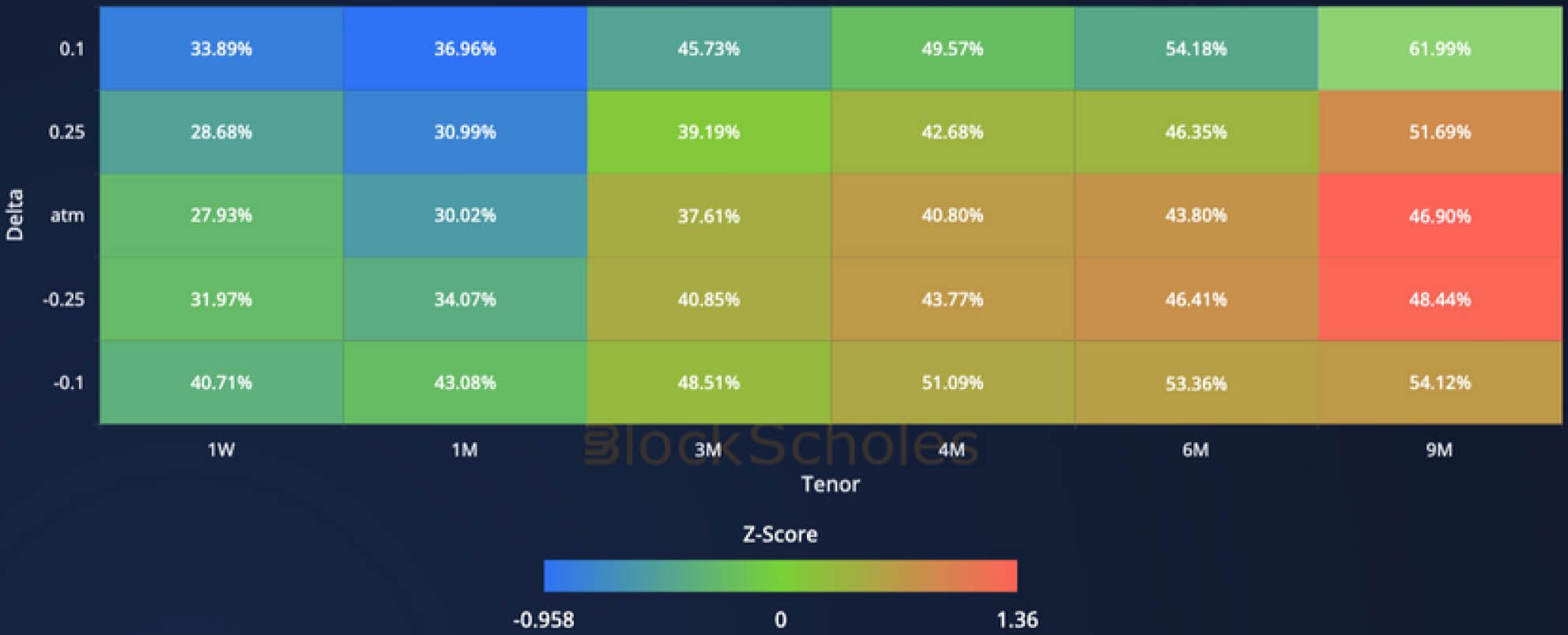

Volatility Surface

BTC IMPLIED VOL SURFACE – sees the term structure steepen, with the implied vols at a 1M tenor falling furthest. Meanwhile 6M and 9M tenors have shared a rise in ATM implied volatility.

ETH IMPLIED VOL SURFACE – sees the implied volatility of OTM puts increase relative to OTM calls, a trend most prominent further out along the term structure.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

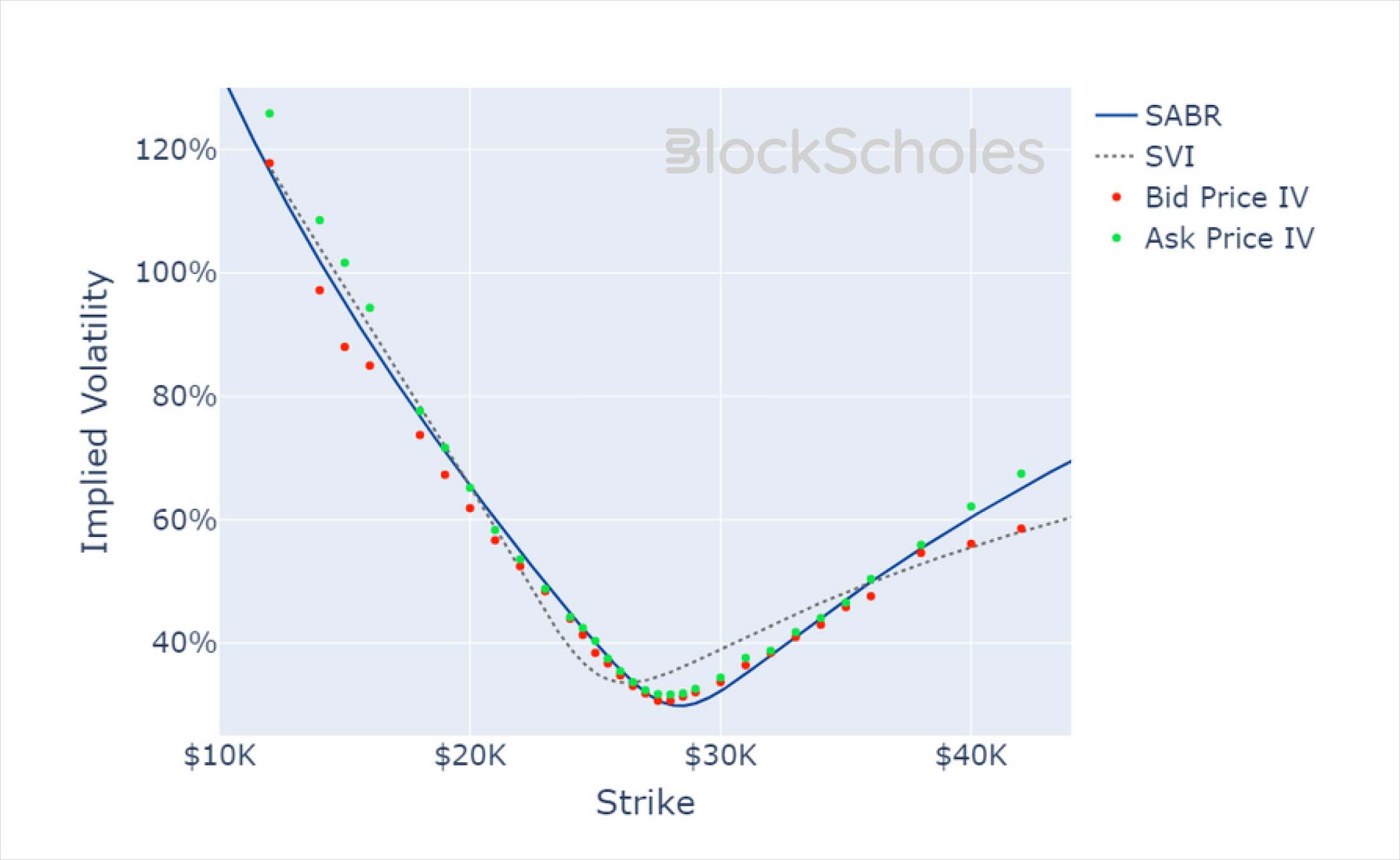

Volatility Smiles

BTC SMILE CALIBRATIONS – 27-Oct-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 27-Oct-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)