Weekly recap of the crypto derivatives markets by BlockScholes.

BTC

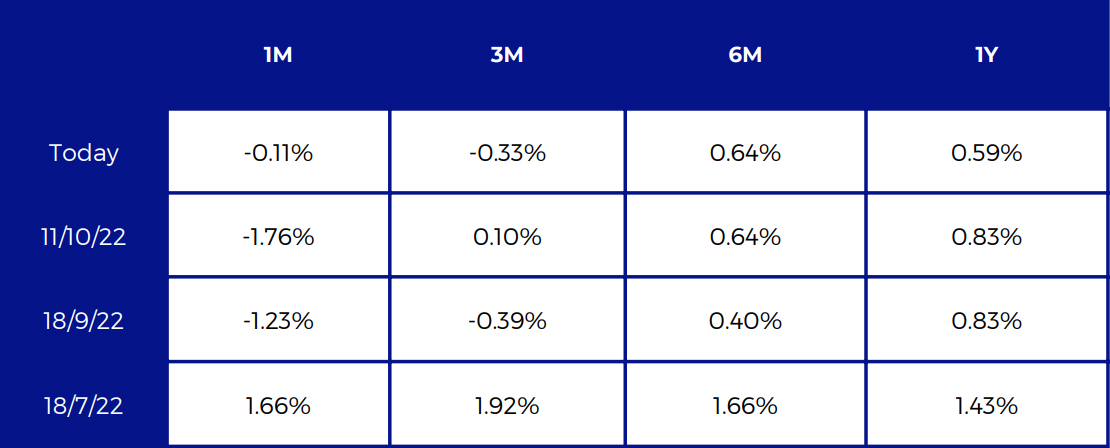

BTC Annualised Implied Yields – negative at 1M and 3M tenors, with longer tenors below 1%

BTC Annualised Implied Yields Table

All timestamps 10:00 UTC

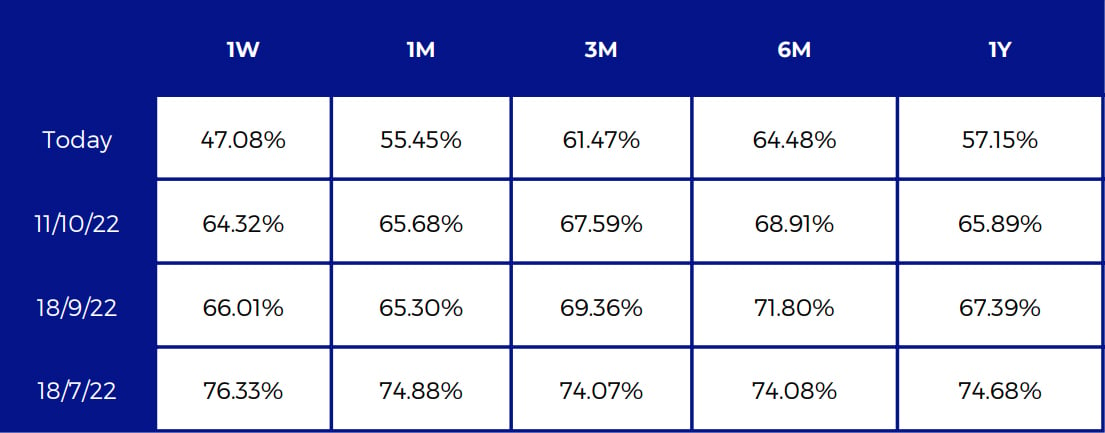

BTC ATM Implied volatility – collapsed at all tenors beginning on the 13th October, now between 45% and 65%

SABR Smile Calibration

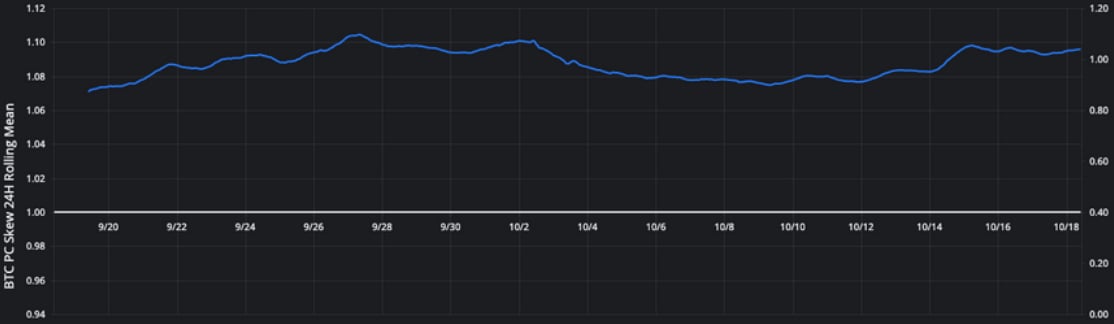

BTC 25-Delta Vol Skew-BTC – continues its skew towards OTM puts, skewing further towards OTM puts just after the 13th of October

SABR Smile Calibration

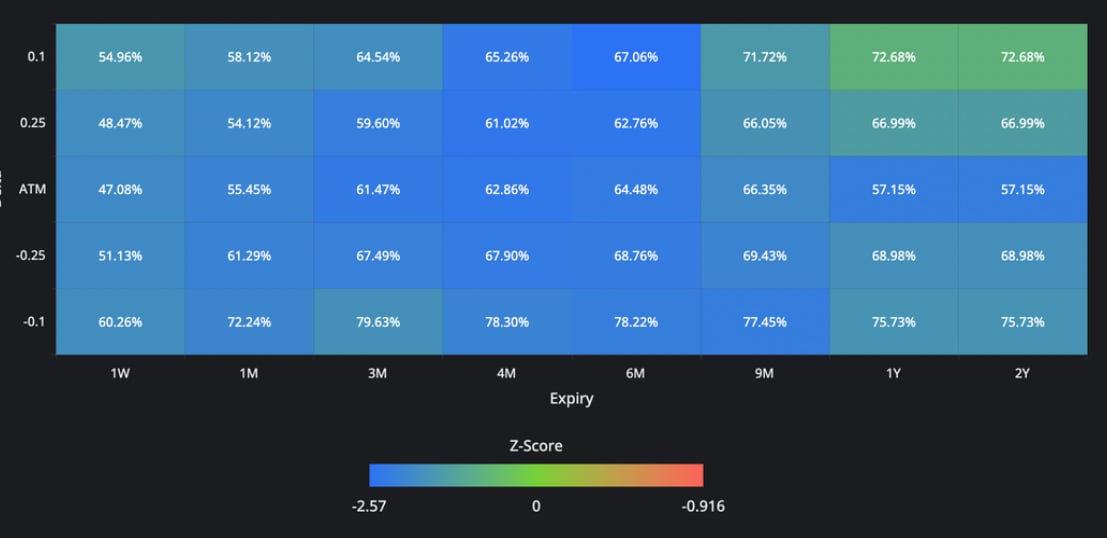

BTC Implied Vol Surface – options at all tenors and deltas fall near to the lowest levels recorded this year

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

BTC ATM Implied Volatility Table

All timestamps 10:00 UTC, SABR Smile Calibration

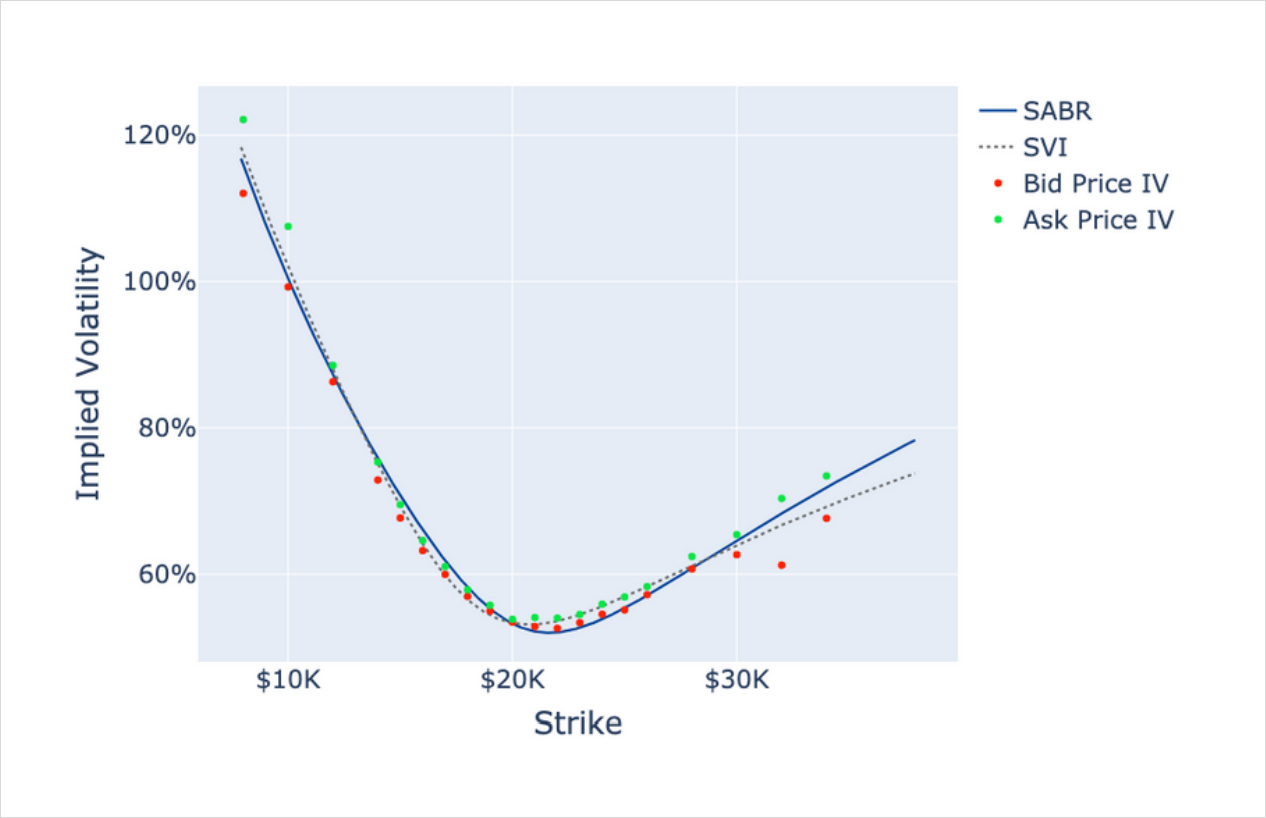

BTC SABR, SVI Smile Calibrations – 25th November Expiry

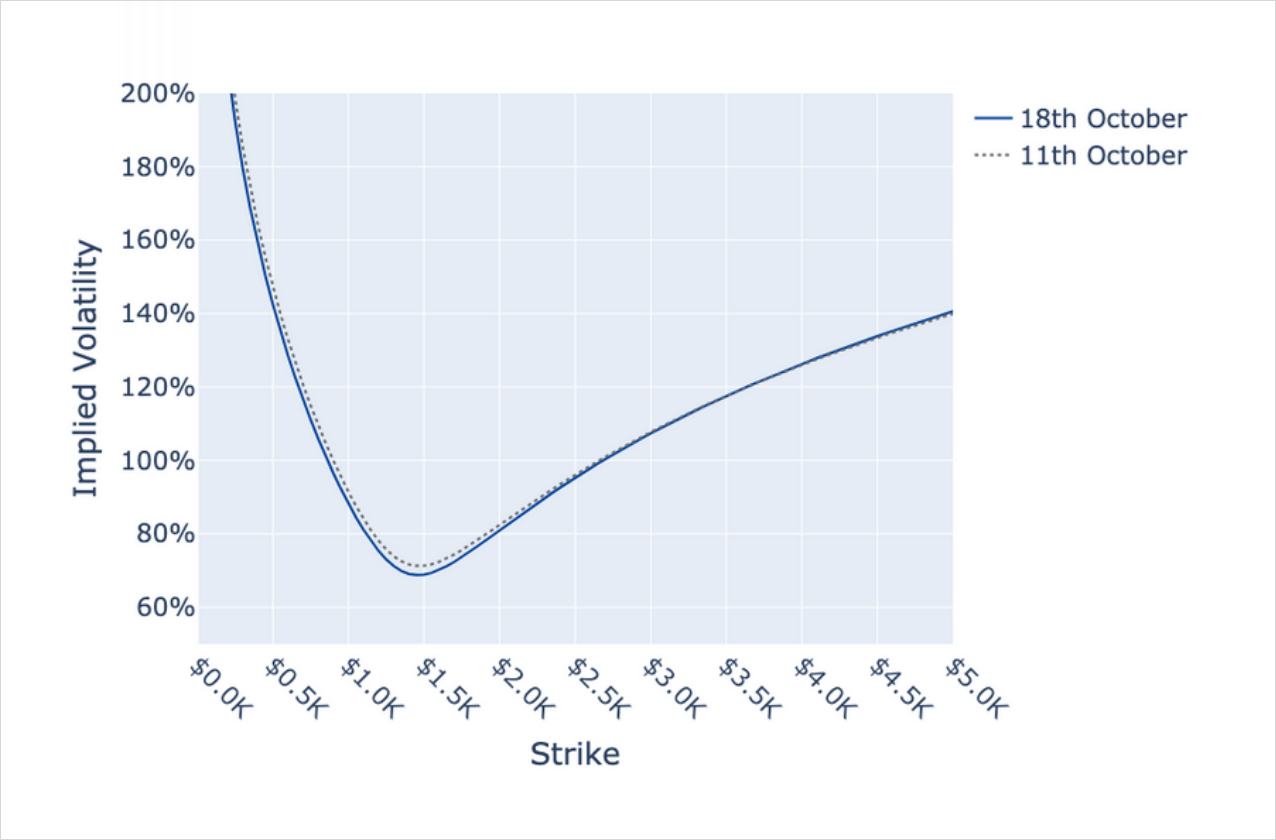

BTC 30d Tenor Vol Smile – implied volatility is falling across the strike domain

BTC 1 Month SABR Implied Vol Smile.

ETH

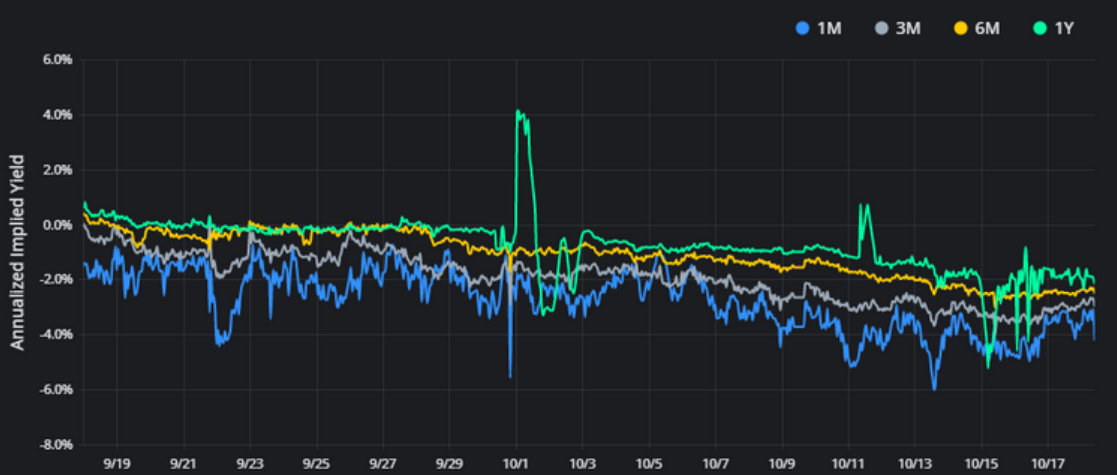

ETH Annualised Implied Yields – trend further negative at all tenors in a tight range between -4% and 0%

ETH Annualised Implied Yields Table

All timestamps 10:00 UTC

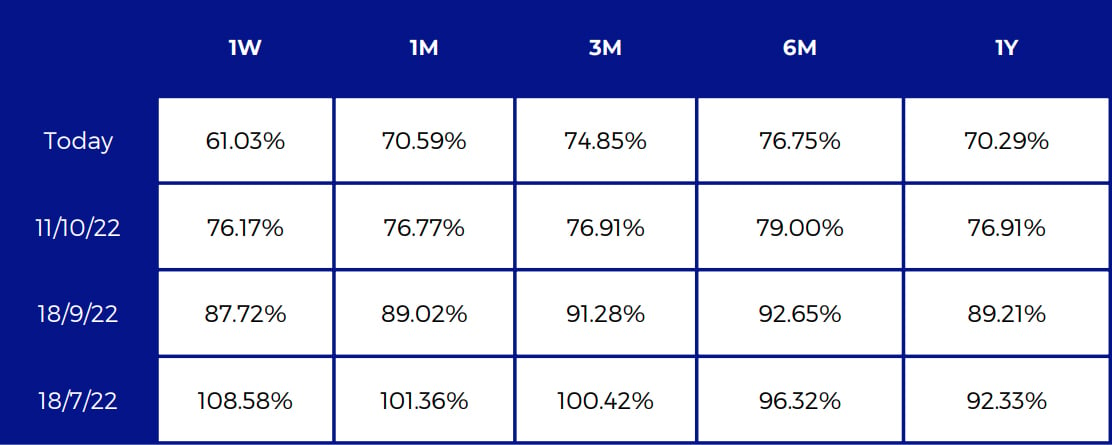

ETH ATM Implied Volatility – falling since October 13th to trade between 60% and 80% at all tenors shorter than 1Y

SABR Smile Calibration

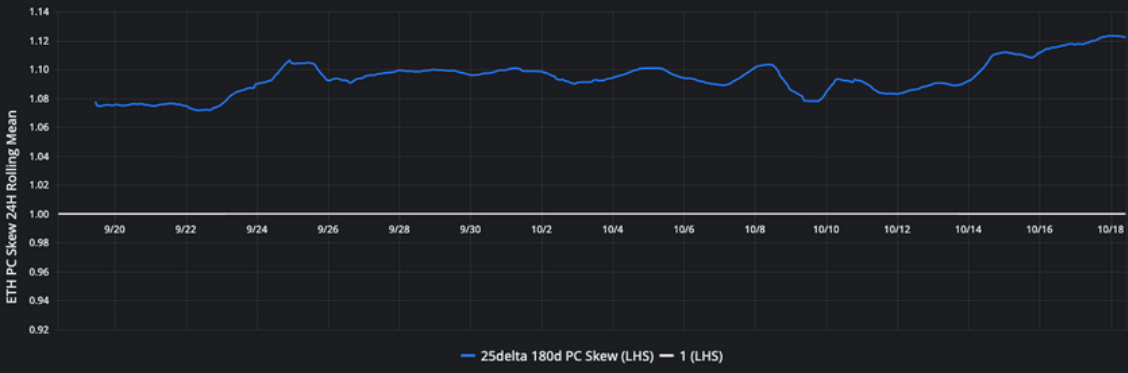

ETH 25-Delta 180d Vol Skew – increased following the 13th October, in line with that of BTC

SABR Smile Calibration

ETH Implied Vol Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

ETH ATM Implied Volatility Table

All timestamps 10:00 UTC, SABR Smile Calibration

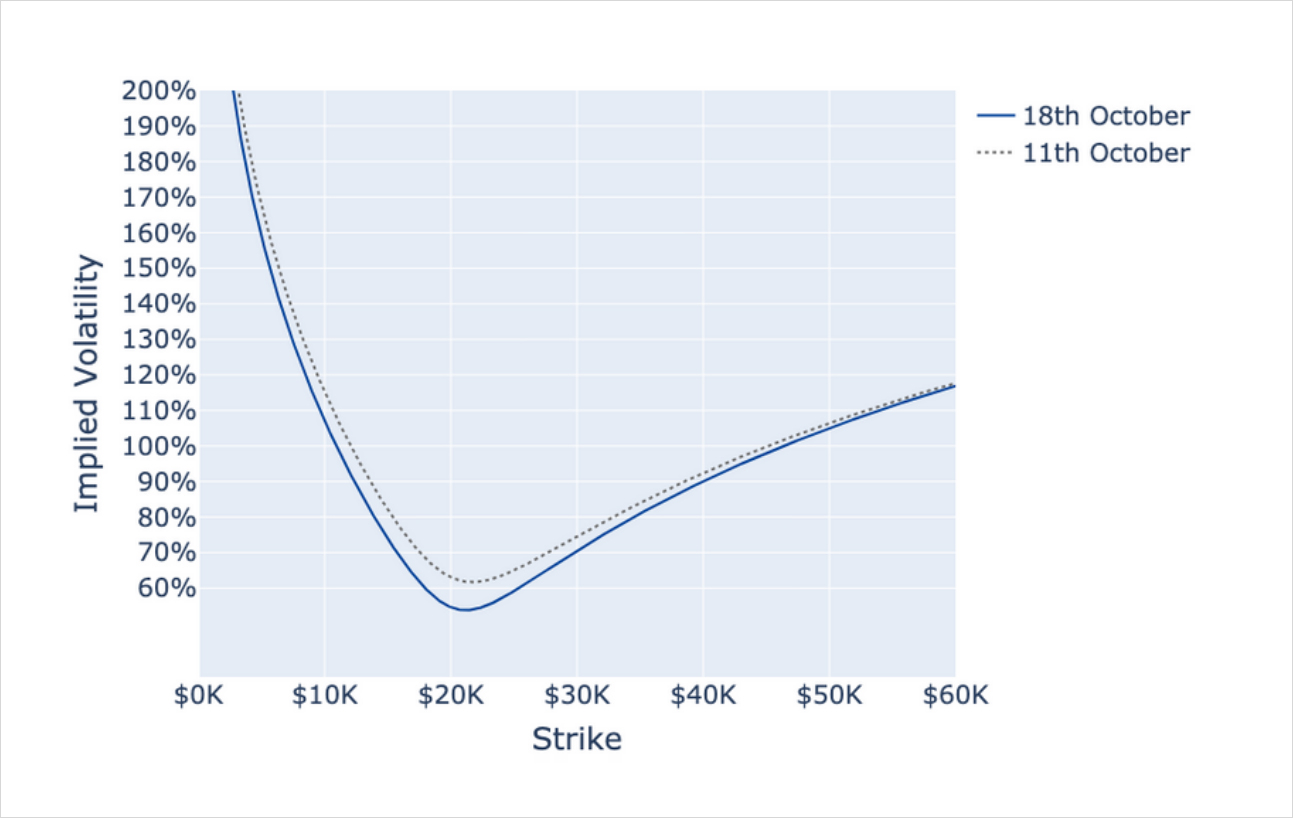

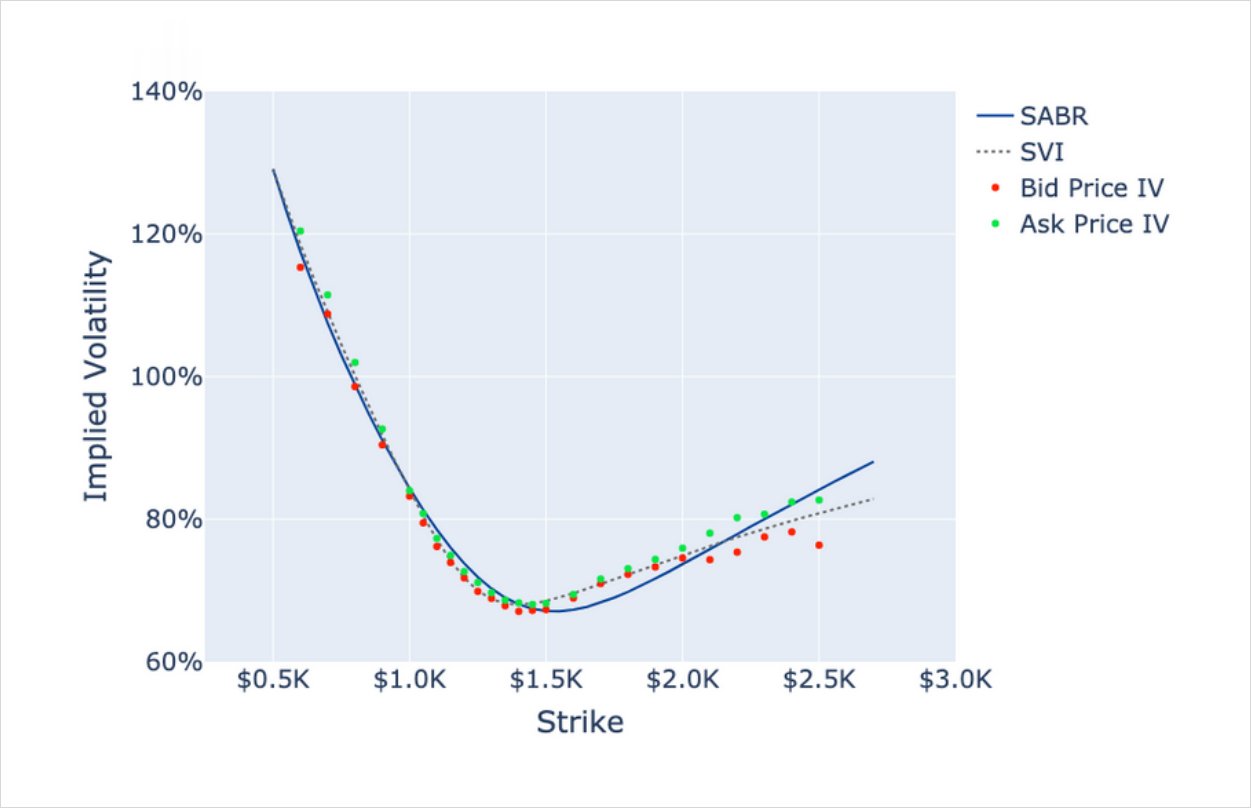

ETH SABR, SVI Smile Calibrations – 25th November Expiry

ETH 30d Tenor Vol Smile – has fallen slightly compared to last week’s vol smile, particularly in OTM puts

ETH 1 Month SABR Implied Vol Smile.

AUTHOR(S)