Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

A strong week in the spot prices of both majors is reflected in the movement of the vol smile skew towards a more balanced smile. Volatility has risen at all tenors, with a sharper rally in short-optionality compressing the vol term structure without resulting in a meaningful inversion. ETH future-implied spot-yields have risen too, but continue to underperform BTC’s. Of the two, ETH’s funding rate reached slightly higher as both reached rates paid from long to short not seen since October 2021.

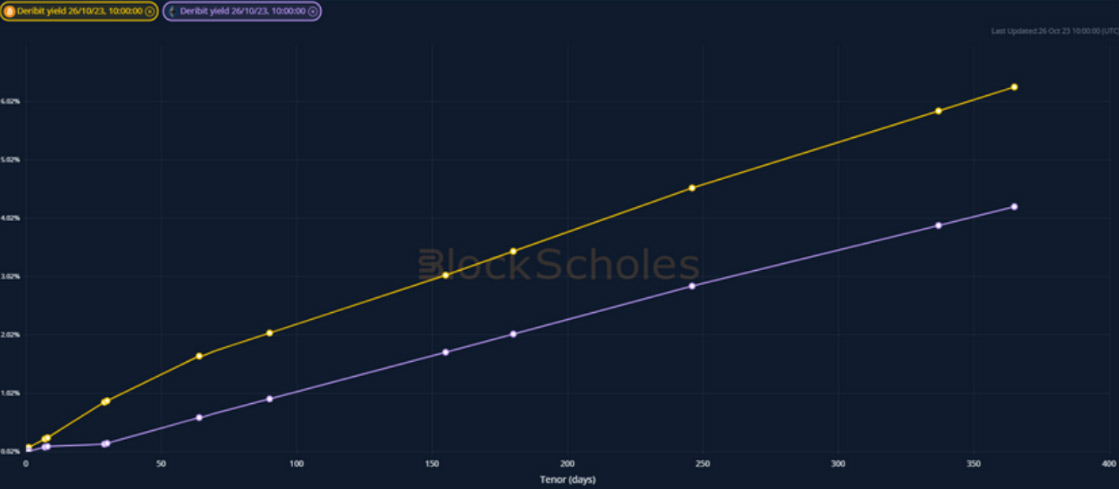

Futures implied yield term structure

Volatility Surface Metrics

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

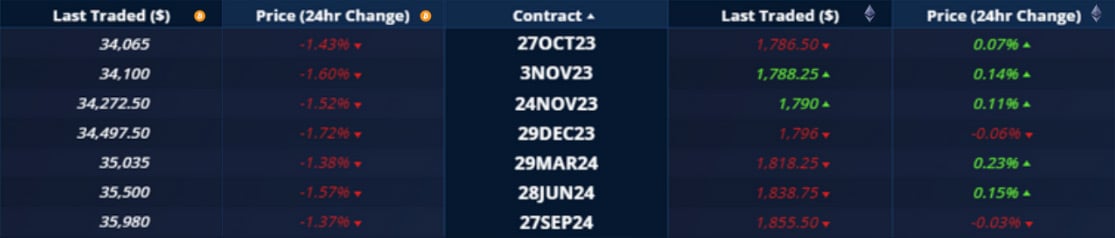

Futures

BTC ANNUALISED YIELDS – soard as high as 20% at a 1-week tenor, settling between 5% and 12% with an inverted term structure.

ETH ANNUALISED YIELDS – rose across the term structure during the spot rally, but remain noticeably below those of BTC’s at equivalent tenors.

Perpetual Swap Funding Rate

BTC FUNDING RATE – spiked to their highest levels since Oct 2021 and have remained elevated for contracts margined in both USD and USDC.

ETH FUNDING RATE – spiked higher than BTC’s funding rates after a month of relatively subdued action.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has risen most strongly at short tenors, compressing the term structure without fully inverting.

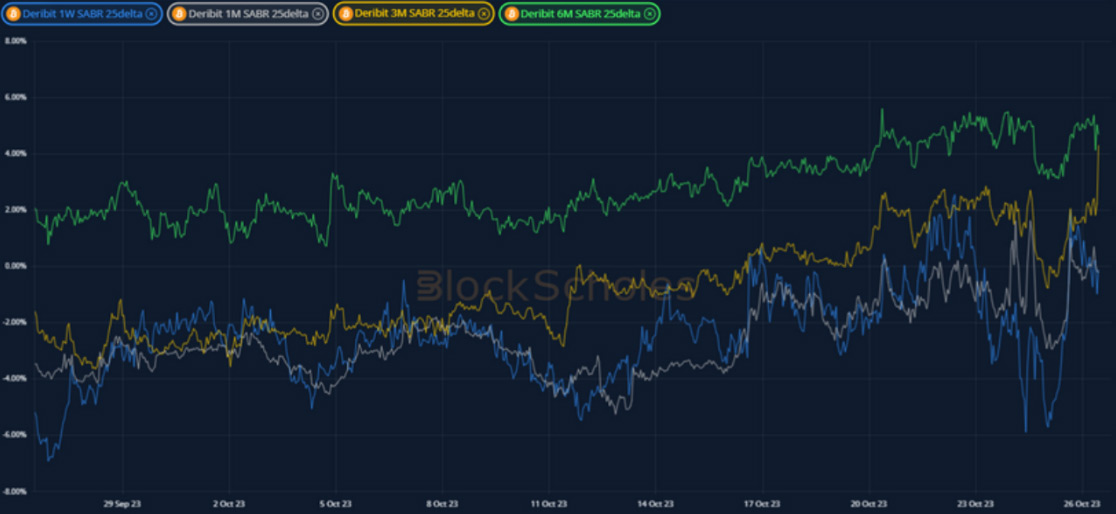

BTC 25-Delta Risk Reversal – shows the volatile moves in OTM puts relative to OTM calls as sentiment shifts towards a more bullish postioning.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – is at a similar level to BTC’s with the same compression resulting from the out-performance of short tenors.

ETH 25-Delta Risk Reversal – the skew at all tenors has shifted towards a more neutral smile, with less volatile trends than in BTC’s skew.

Volatility Surface

BTC IMPLIED VOL SURFACE – reports a significant increase at all points on the volatility surface.

ETH IMPLIED VOL SURFACE – volatility has risen at all points on the volatility surface, with a slight out-performance in 1W tenor OTM calls.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

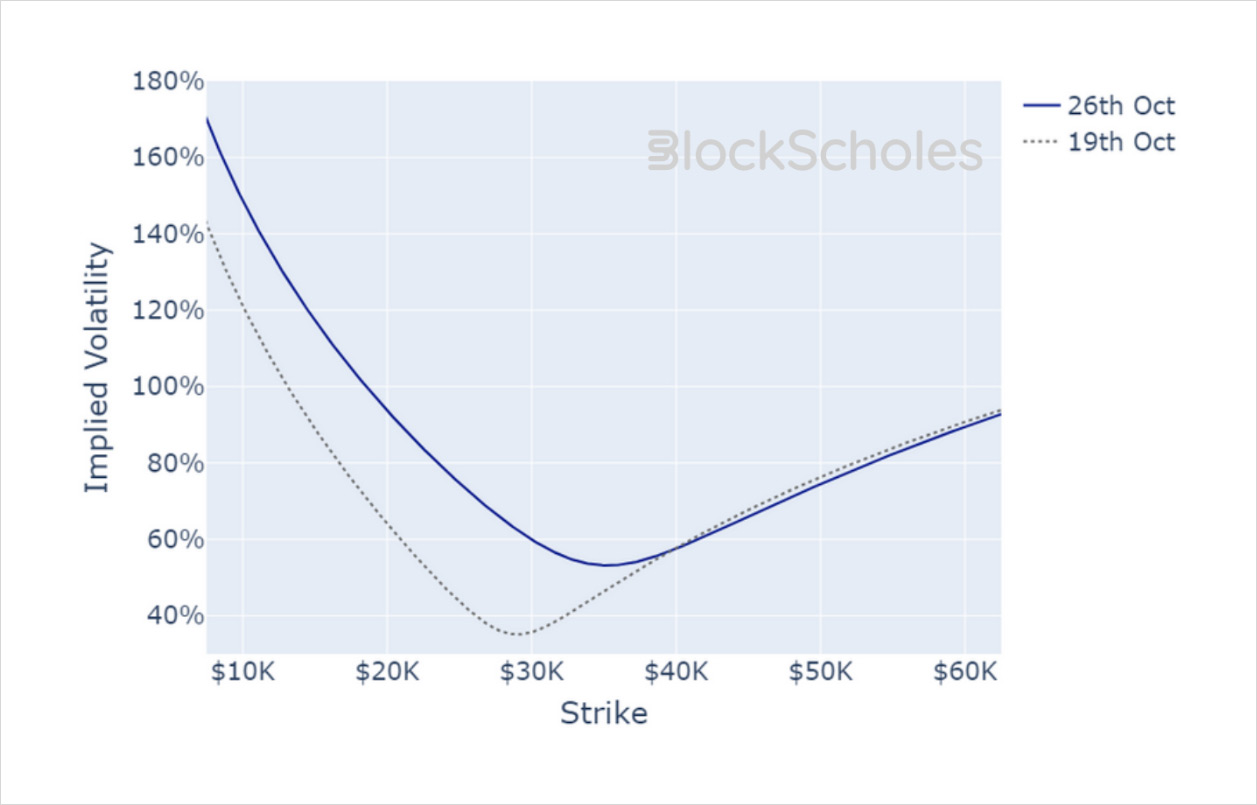

Volatility Smiles

BTC SMILE CALIBRATIONS – 24-Nov-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 24-Nov-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)