Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The skews of both major assets’ volatility smiles reflect bullish sentiment across the term structure, albeit with more conviction in BTC’s markets. The same difference is observed in their future-implied spot-yields as ETH lags BTC’s despite following the latter’s upwards trend. There is lesser divergence, however, in ATM vol levels and perpetual swap funding rates. Both assets report a strong, persistent willingness for long positions to pay shorts for their exposure through the derivative contract.

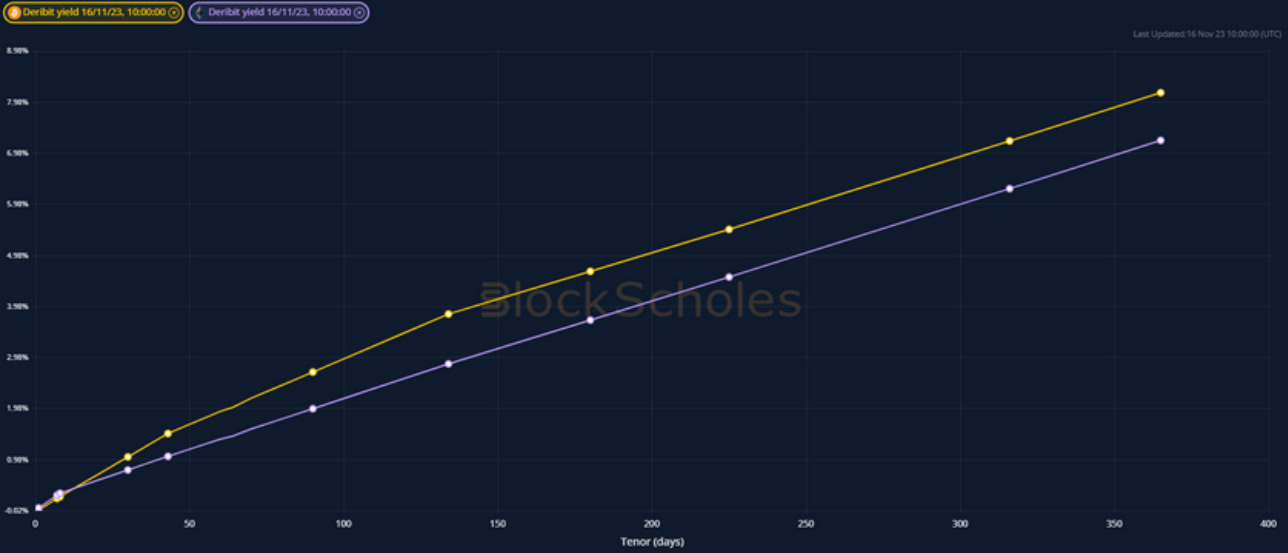

Futures implied yield term structure.

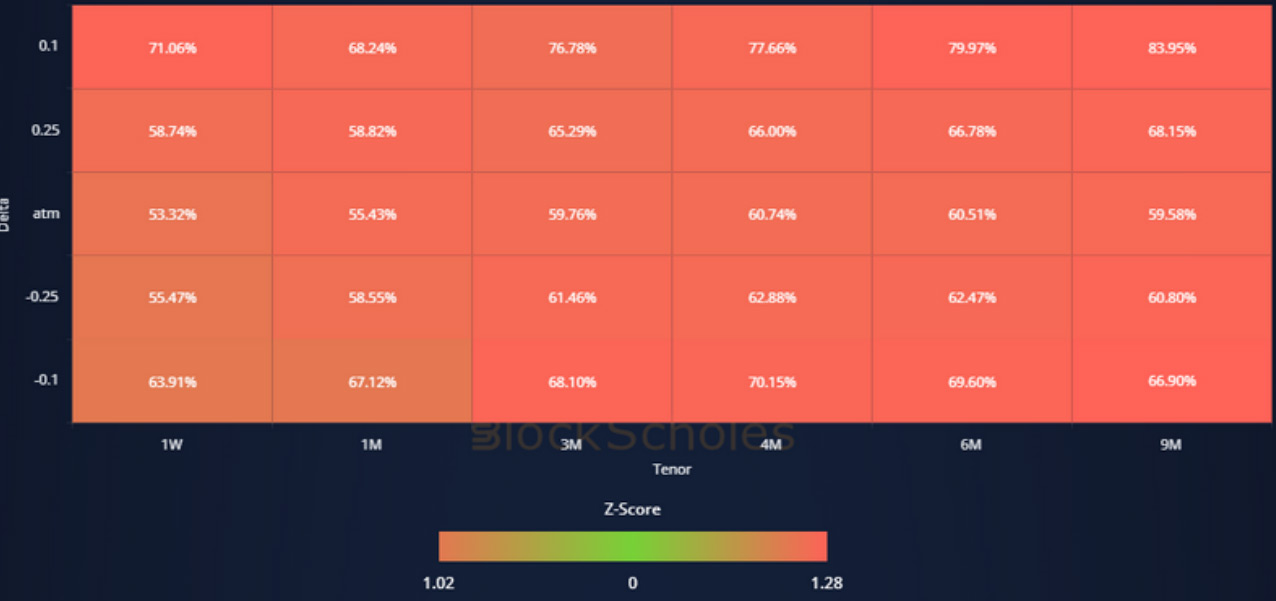

Volatility Surface Metrics.

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – remain at elevated levels with only the 6M tenor future trading less than 10% above spot an an annualised rate.

ETH ANNUALISED YIELDS – are strong and positive, but still below BTC’s at each tenor on the term structure.

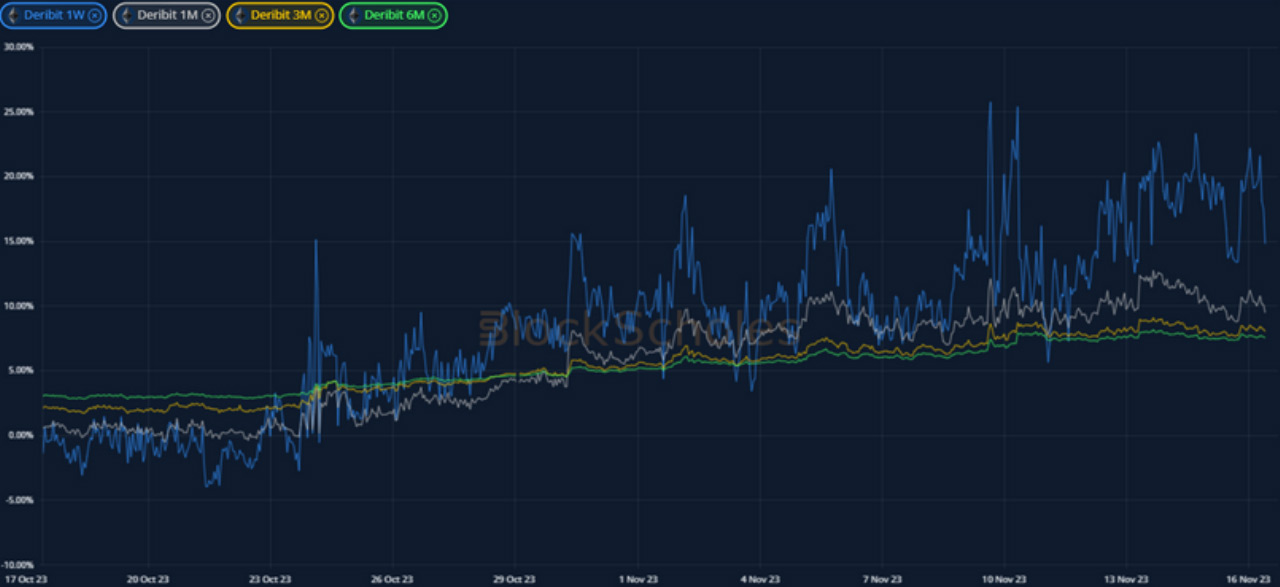

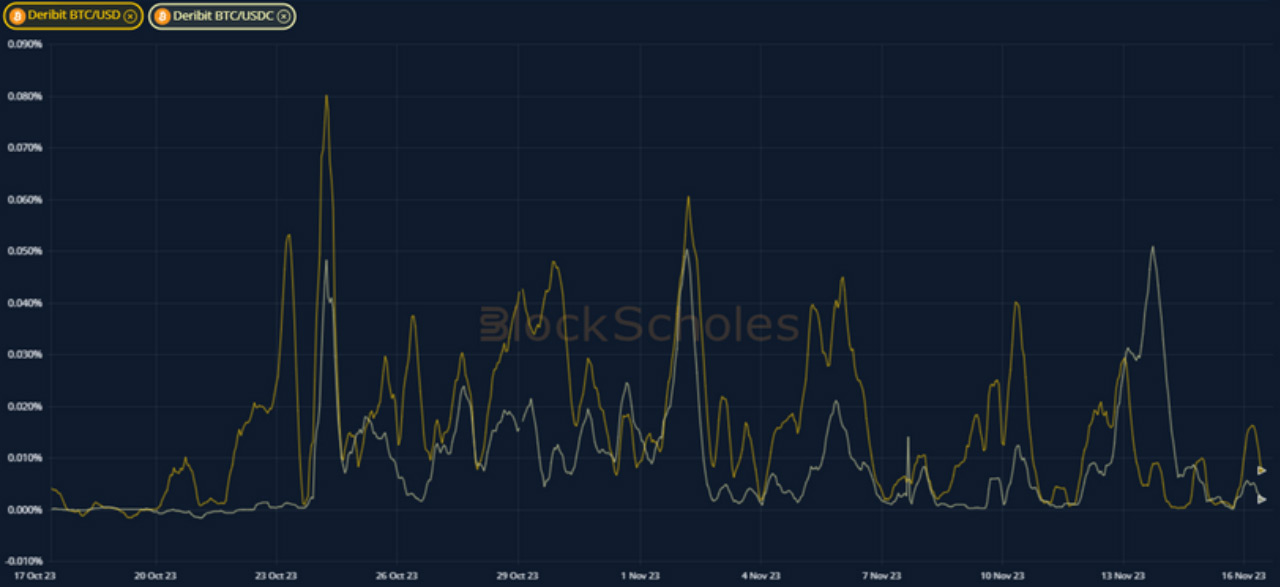

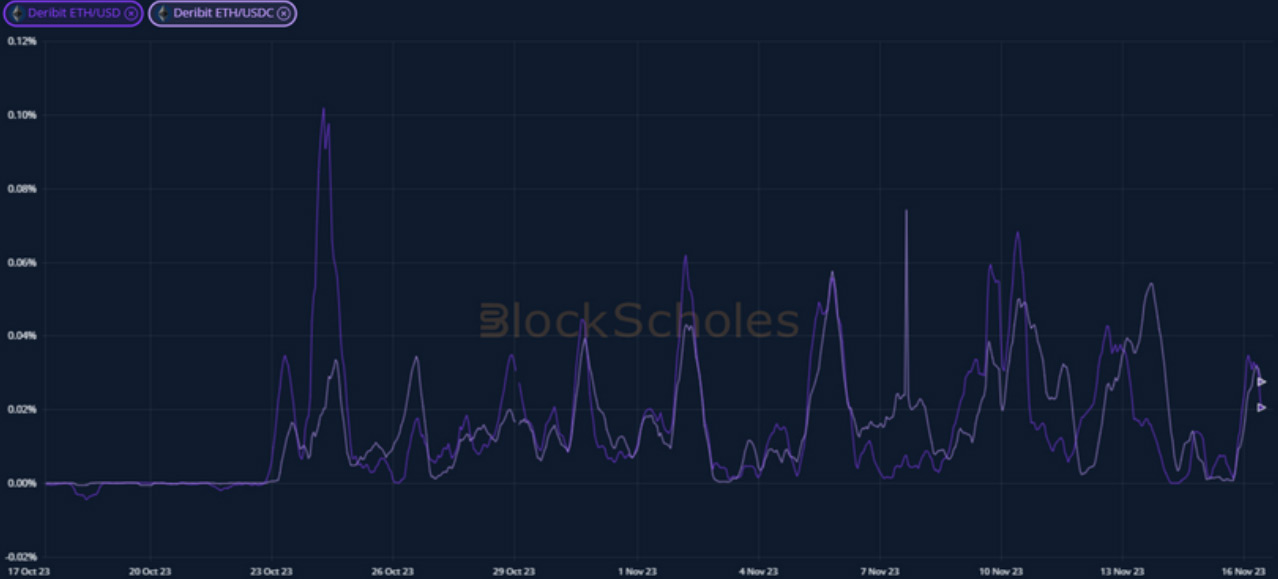

Perpetual Swap Funding Rate

BTC FUNDING RATE – shows continued demand for leveraged long exposure that out-strips any other period we have seen this year.

ETH FUNDING RATE – reflects similar bullish levels to BTC’s, with consistent payments collected by short positions since the 23rd October.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – trades between 50% and 60% across the term structure without any spikes or inversions in the last week.

BTC 25-Delta Risk Reversal – smiles at each tenor are pricing OTM upside optionality at a higher volatility than similarly OTM puts.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – is at similar levels to BTC’s across the term structure, having trended upwards since late October.

ETH 25-Delta Risk Reversal – paints less of a clearly bullish picture than BTC’s, with short tenor optionalities oscillating around a neutral smile.

Volatility Surface

BTC IMPLIED VOL SURFACE – the surface wide increase in implied volatility has been strongest in longer-dated OTM calls.

ETH IMPLIED VOL SURFACE – highlights the upwards trend in ETH volatility across each smile and each tenor.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

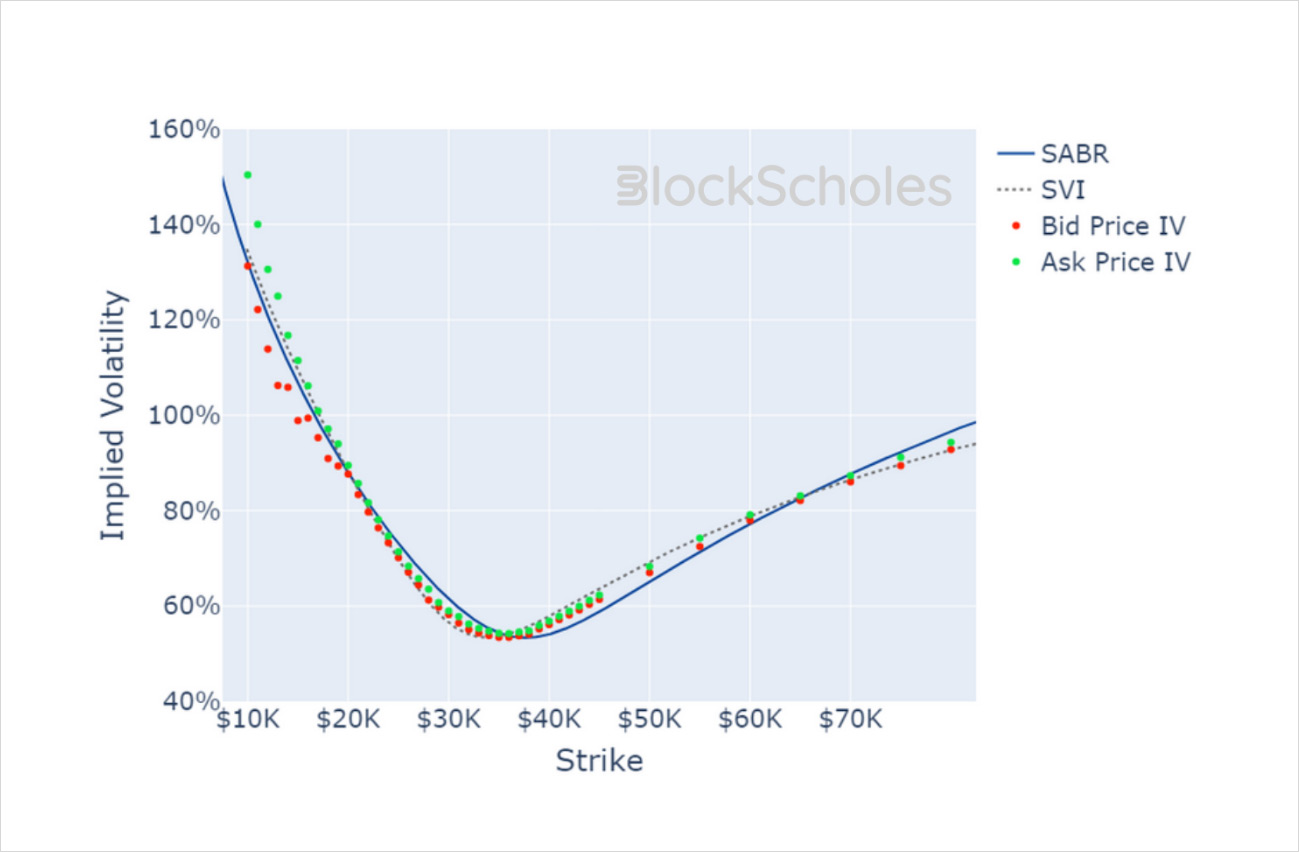

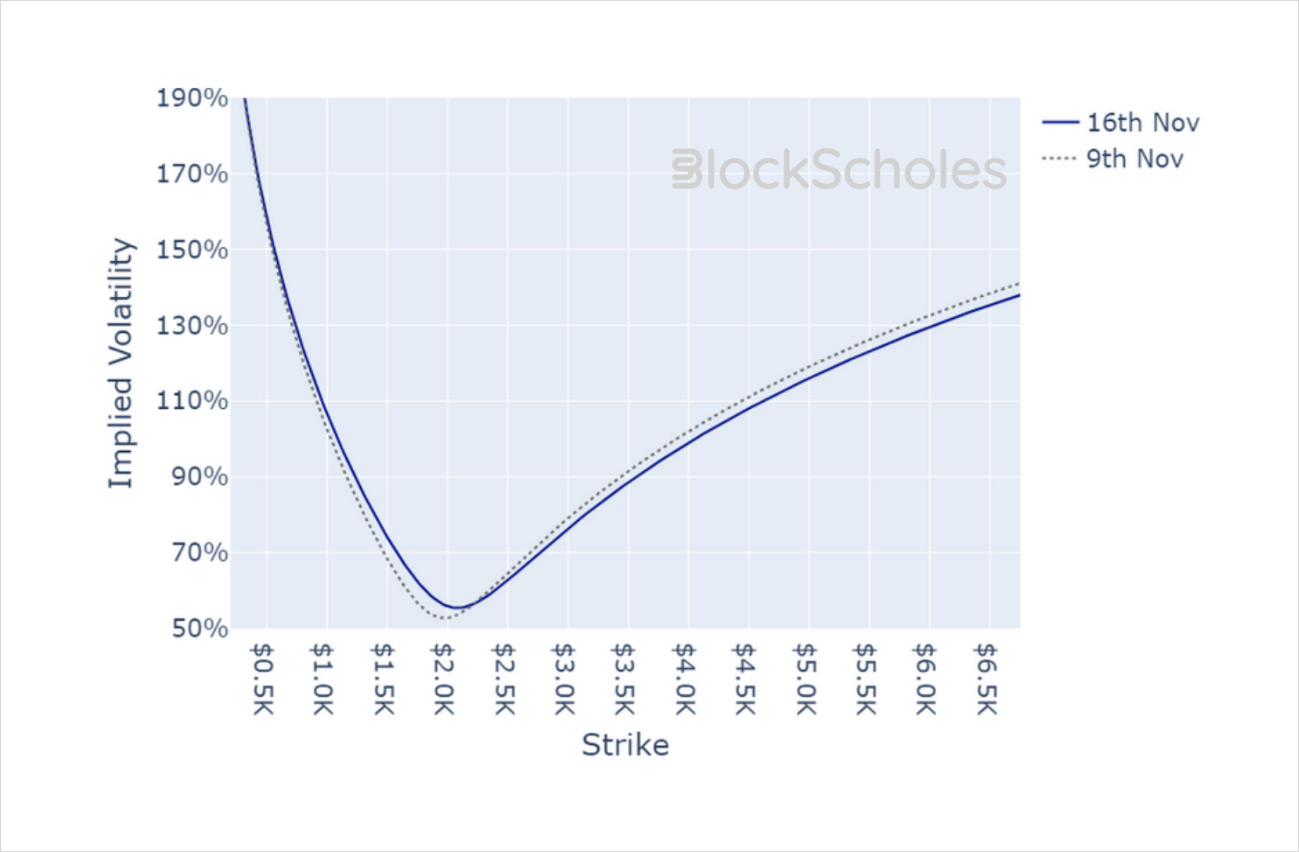

Volatility Smiles

BTC SMILE CALIBRATIONS – 29-Dec-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 29-Dec-2023 Expiry, 10:00 UTC Snapshot.

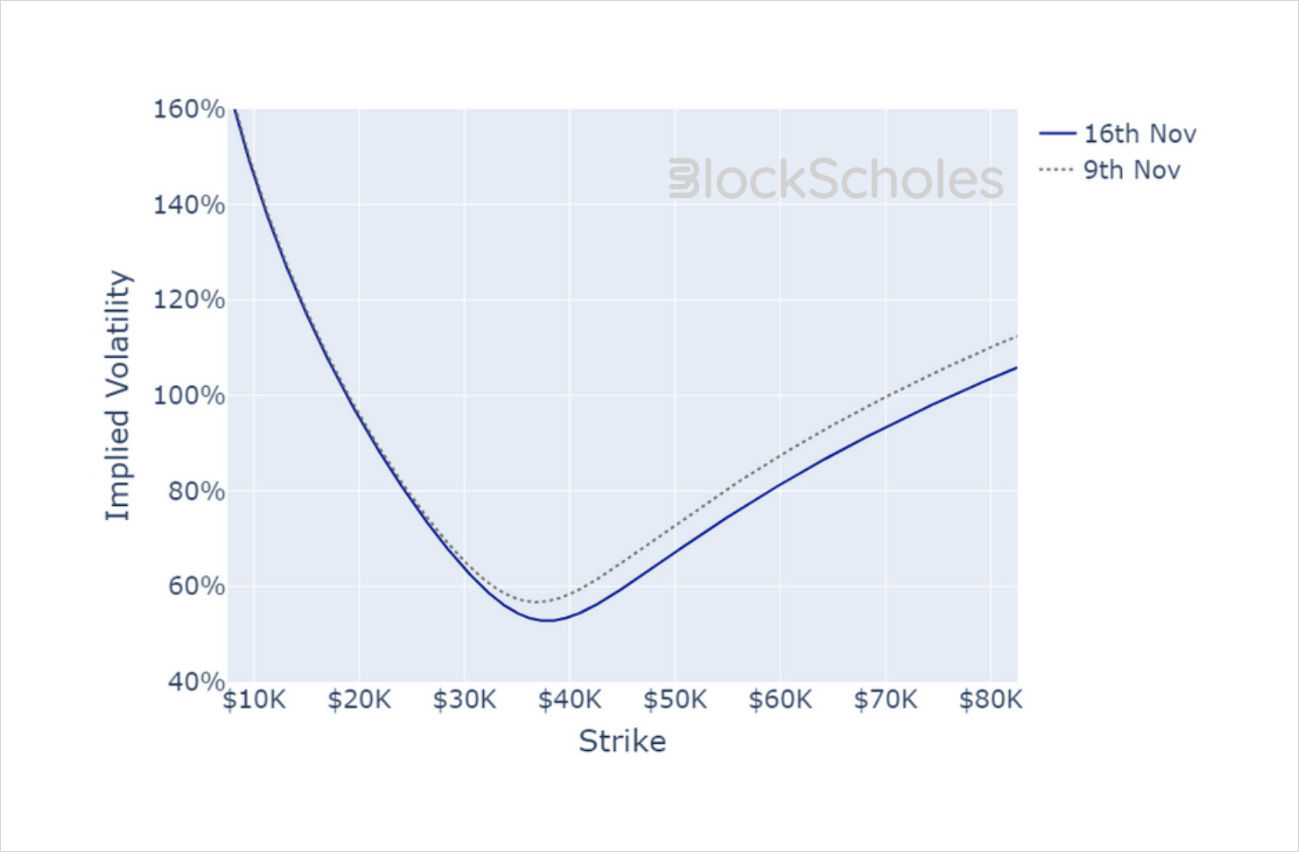

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)