Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

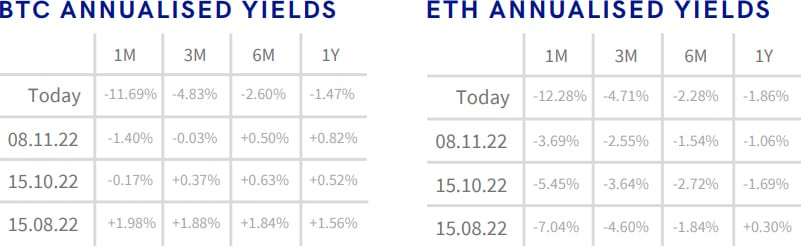

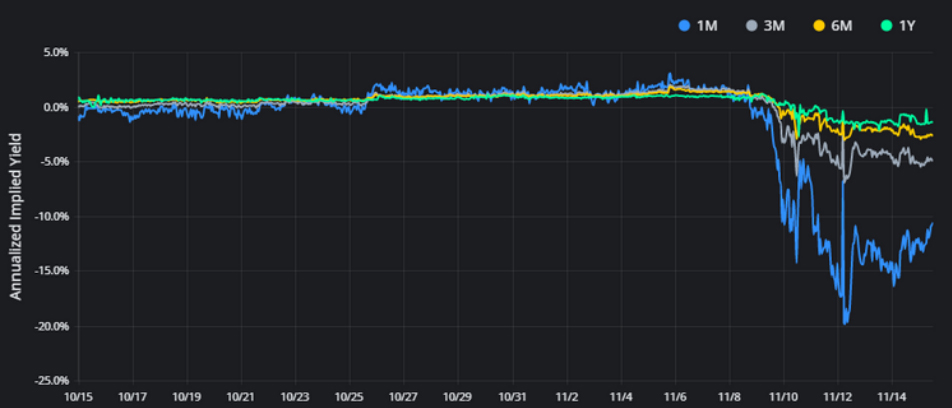

- BTC ANNUALISED YIELDS – fall far below zero at all tenors following this week’s dramatic uncertainty.

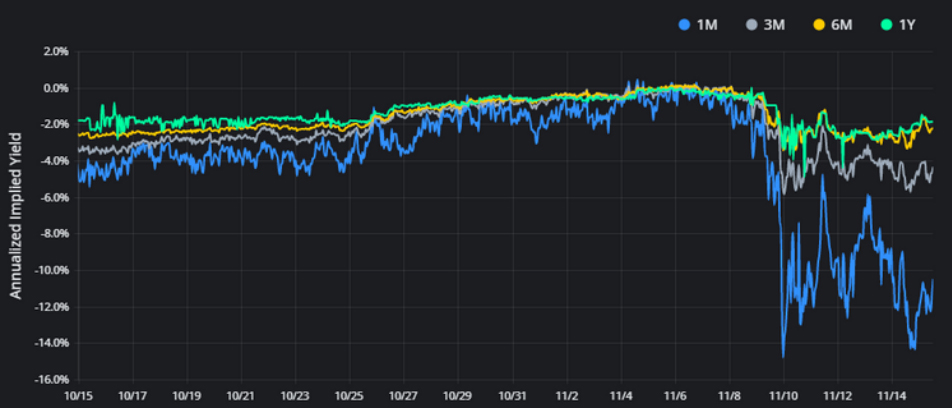

- ETH ANNUALISED YIELDS – collapse to far below zero but less severely than BTC.

- BTC SABR ATM IMPLIED VOLATILITY – spiked sharply following a period of uncharacteristic calm in its derivatives markets, and remains elevated.

- ETH SABR ATM IMPLIED VOLATILITY – spiked to a higher level than BTC, maintaining its comparatively higher volatility.

- BTC IMPLIED VOL SURFACE – at highest levels for shortest tenors, with strong skew along the term structure.

- ETH IMPLIED VOL SURFACE – at highest levels for shortest tenors, with similar strong skew to BTC.

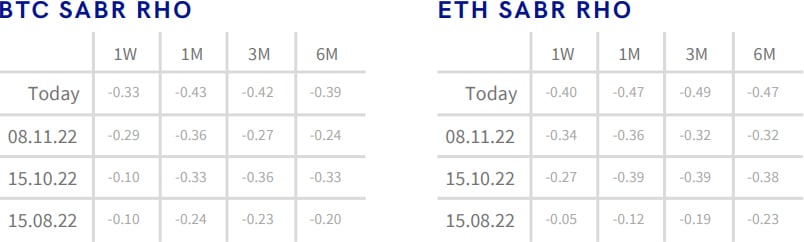

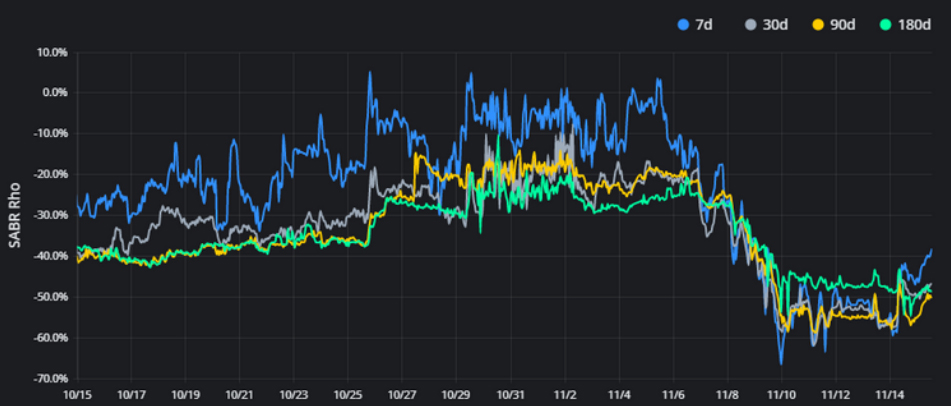

- BTC SABR RHO – returns to a strong skew towards OTM puts following a prolonged period of low skew.

- ETH SABR RHO – has skewed back towards OTM puts with similar levels to BTC.

The period of unusual calm in crypto-asset derivatives markets was brought to a swift end following the collapse of the second largest exchange, FTX, this week. The aftermath sees implied volatility remain elevated in both BTC and ETH derivatives, despite falling from their sharp spike early last week. The skew of both assets volatility smiles is now steeper and skewed further towards OTM puts than it has been in several months.

Futures

BTC ANNUALISED YIELDS – fall far below zero at all tenors following this week’s dramatic uncertainty.

ETH ANNUALISED YIELDS – collapse to far below zero but less severely than BTC.

Options

BTC SABR ATM IMPLIED VOLATILITY – spiked sharply following a period of uncharacteristic calm in its derivatives markets, and remains elevated.

ETH SABR ATM IMPLIED VOLATILITY – spiked to a higher level than BTC, maintaining its comparatively higher volatility.

Volatility Surface

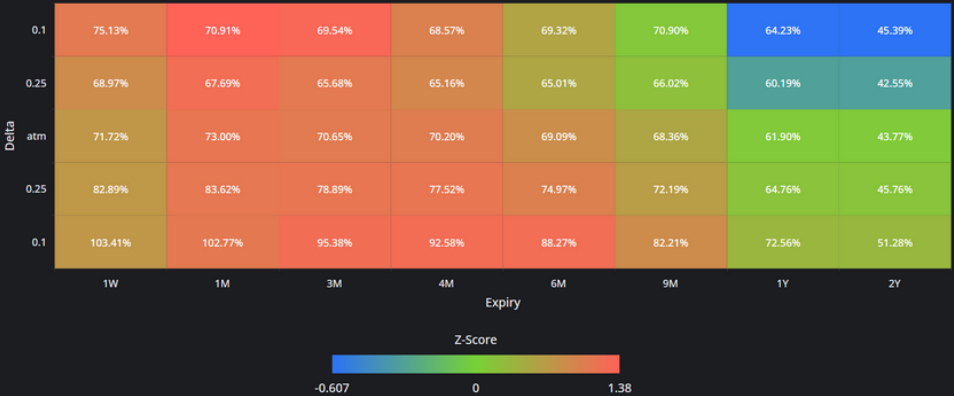

BTC IMPLIED VOL SURFACE – at highest levels for shortest tenors, with strong skew along the term structure.

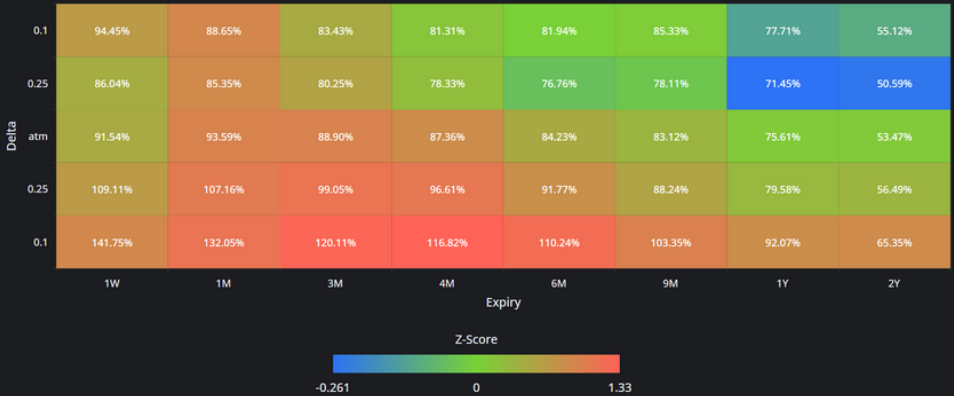

ETH IMPLIED VOL SURFACE – at highest levels for shortest tenors, with similar strong skew to BTC.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

SABR Rho

BTC SABR RHO – returns to a strong skew towards OTM puts following a prolonged period of low skew.

ETH SABR RHO – has skewed back towards OTM puts with similar levels to BTC.

Volatility Smiles

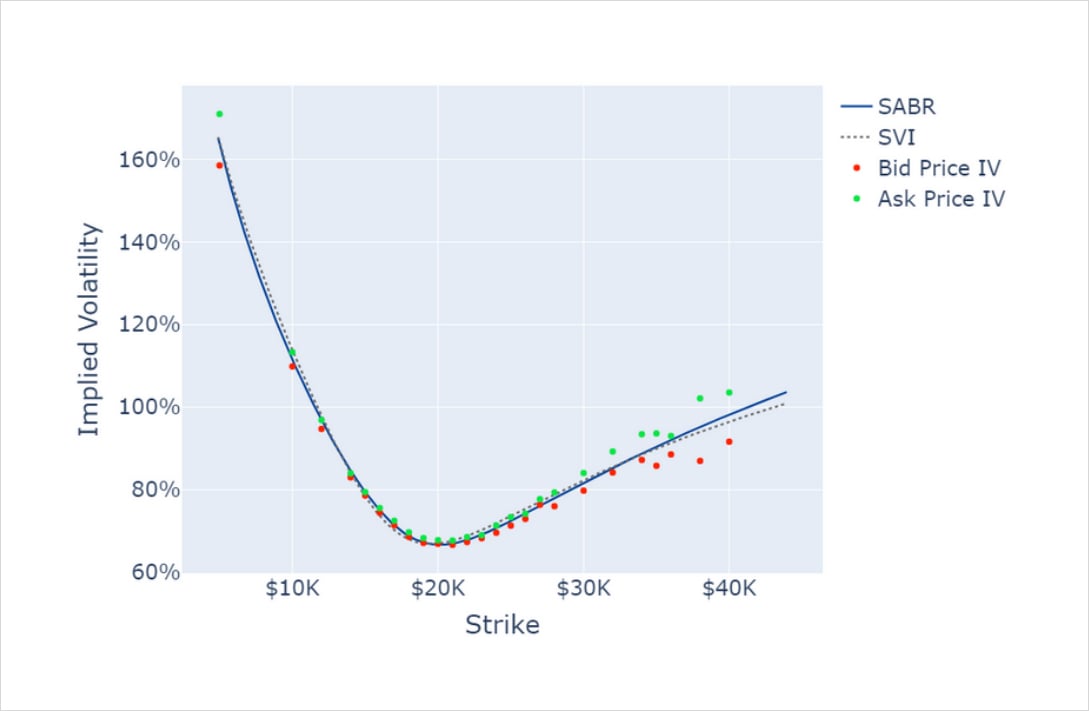

BTC SMILE CALIBRATIONS – 30-Dec-2022 Expiry, 14:00 UTC Snapshot.

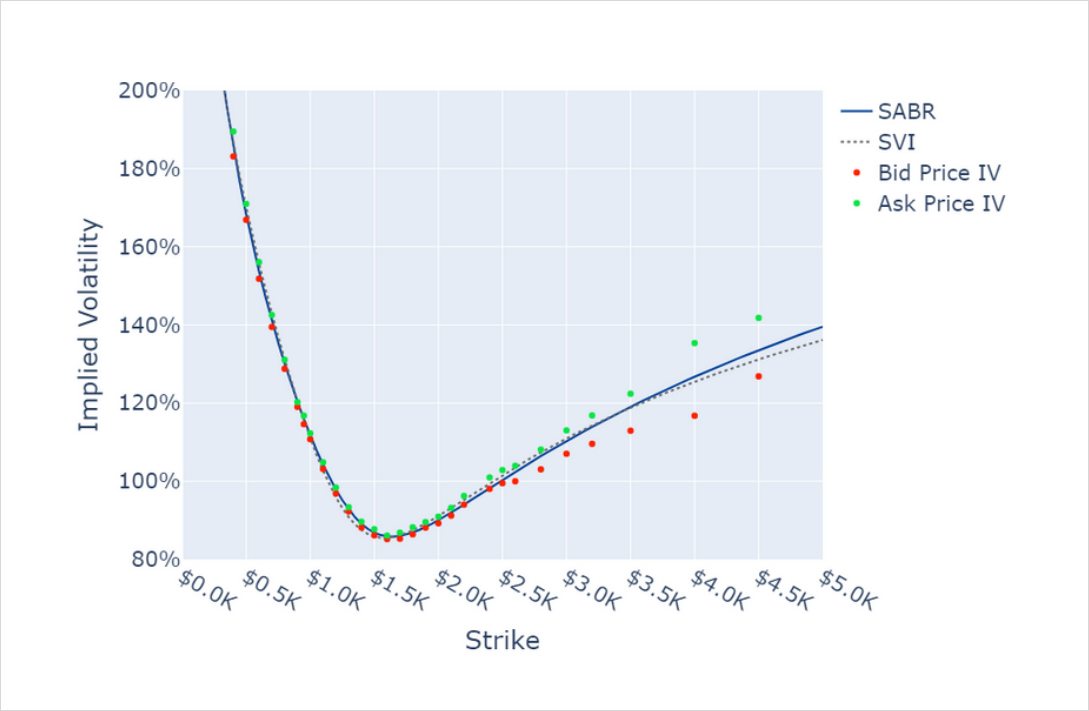

ETH SMILE CALIBRATIONS – 30-Dec-2022 Expiry, 14:00 UTC Snapshot.

Historical SABR Volatility Smiles

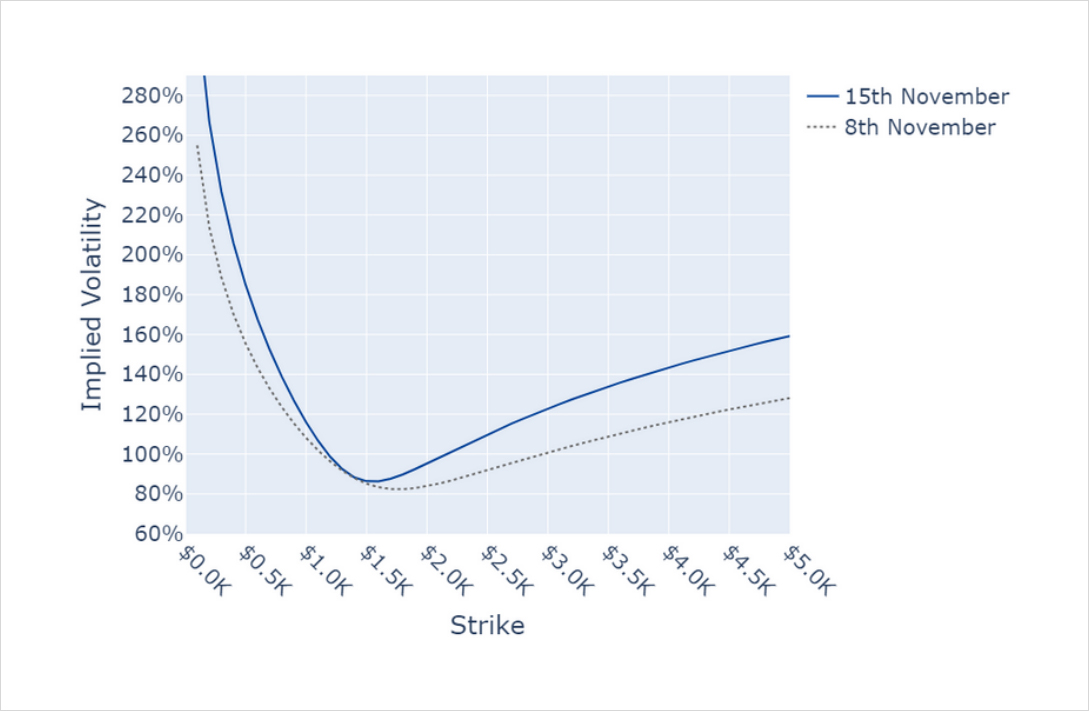

BTC SABR CALIBRATION – 30 Day Tenor, 14:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 14:00 UTC Snapshot.

AUTHOR(S)