Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

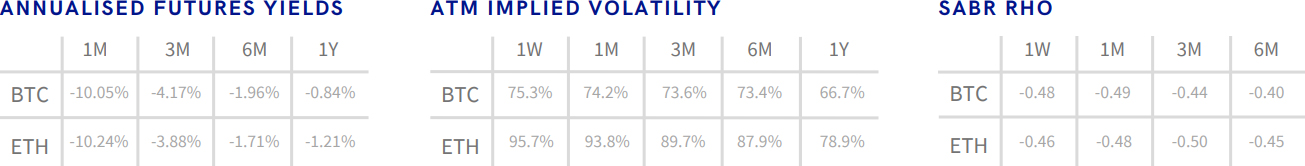

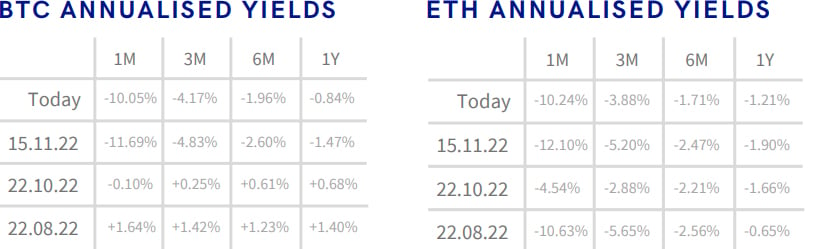

- BTC ANNUALISED YIELDS – continue significantly below zero as the fallout from FTX’s collapse continues.

- ETH ANNUALISED YIELDS – behave similarly to BTC’s, trading below zero in a slightly tighter range.

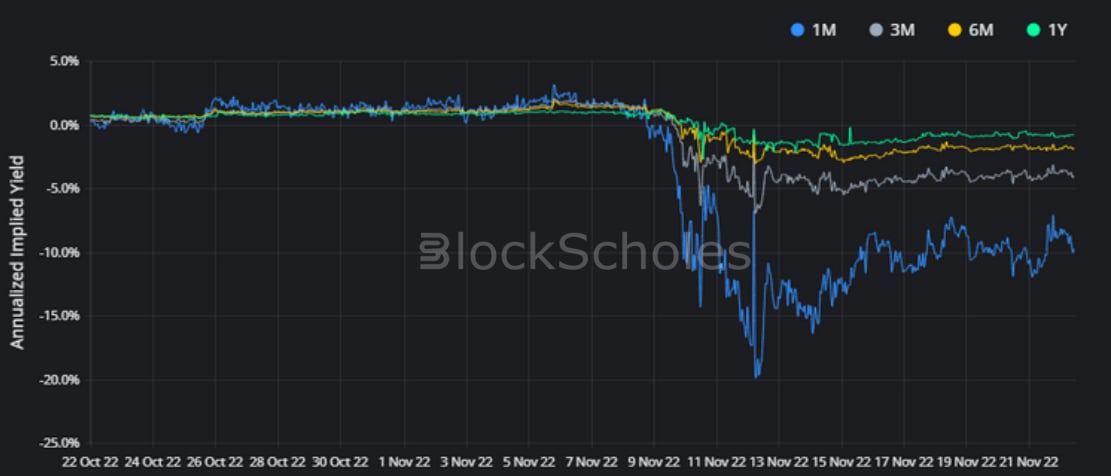

- BTC SABR ATM IMPLIED VOLATILITY – remains above the pre-collapse levels, and continues to rise slowly.

- ETH SABR ATM IMPLIED VOLATILITY – remains stable and elevated, still 20 vol points above BTC’s implied vol.

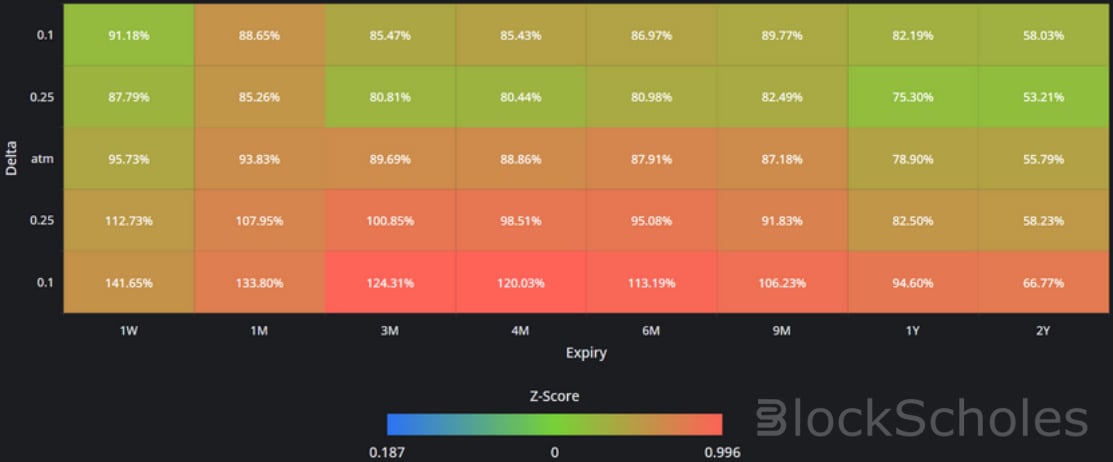

- BTC IMPLIED VOL SURFACE – both long dated OTM puts and calls are above their 30-day average.

- ETH IMPLIED VOL SURFACE – does not see the same richness in 6M OTM calls that BTC does.

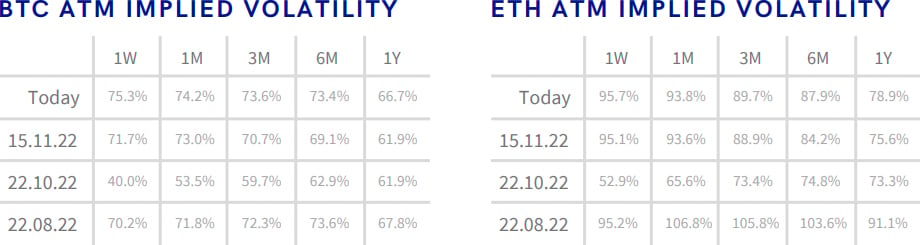

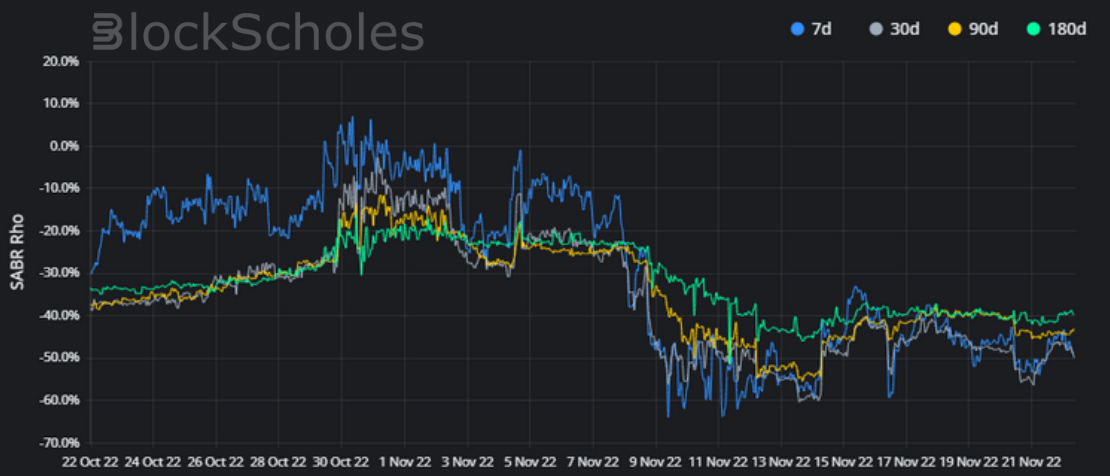

- BTC SABR RHO – maintains a strong skew towards OTM puts with little to assuage market concerns about further downside price action.

- ETH SABR RHO – reached its lowest levels since June, recovering slightly before the end of the week.

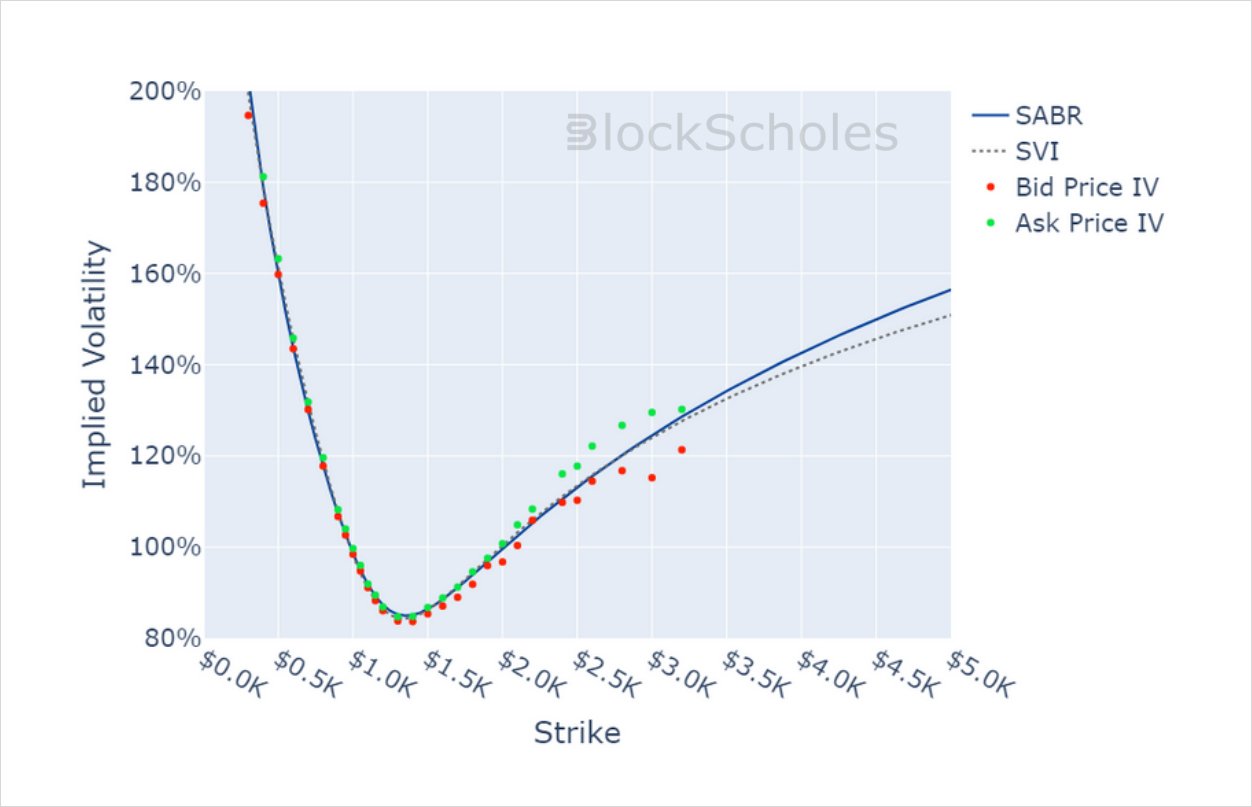

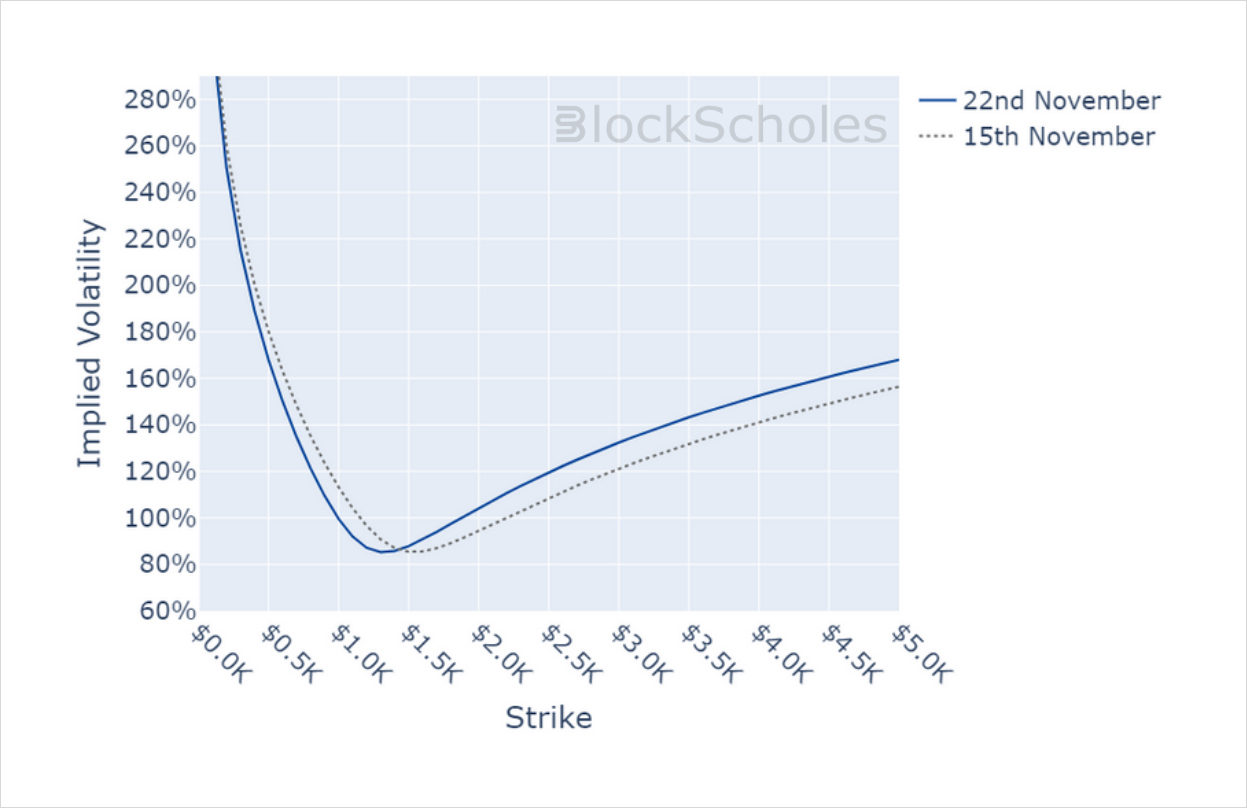

The fear, uncertainty, and doubt that dominated crypto’s derivatives markets last week continues into this week, with no reprieve yet offered to traders following FTX’s dramatic collapse. Many will be concerned about the market impact of the funds stolen from the platform and potential further contagion. The volatility smiles of both BTC and ETH reflect the continuing high preference for downside protection, holding their shape at a new, lower ATM level.

Futures

BTC ANNUALISED YIELDS – continue significantly below zero as the fallout from FTX’s collapse continues.

ETH ANNUALISED YIELDS – behave similarly to BTC’s, trading below zero in a slightly tighter range.

Options

BTC SABR ATM IMPLIED VOLATILITY – remains above the pre-collapse levels, and continues to rise slowly.

ETH SABR ATM IMPLIED VOLATILITY – remains stable and elevated, still 20 vol points above BTC’s implied vol.

Volatility Surface

BTC IMPLIED VOL SURFACE – both long dated OTM puts and calls are above their 30-day average.

ETH IMPLIED VOL SURFACE – does not see the same richness in 6M OTM calls that BTC does.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

SABR Rho

BTC SABR RHO – maintains a strong skew towards OTM puts with little to assuage market concerns about further downside price action.

ETH SABR RHO – reached its lowest levels since June, recovering slightly before the end of the week.

Volatility Smiles

BTC SMILE CALIBRATIONS – 30-Dec-2022 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 30-Dec-2022 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)