Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The risk premium demand above the recently delivered level of volatility remains high in expiries later than the expected deadline for ETF applications and has caused a sharp kink in the term structures of volatility for both major crypto-assets. The weaker skew towards calls that we observed in the 1-week tenor has been echoed across the term structure. However, while the 1-week tenor saw an increase in vols for OTM puts, longer tenors instead reported a weaker volatility assigned to OTM calls.

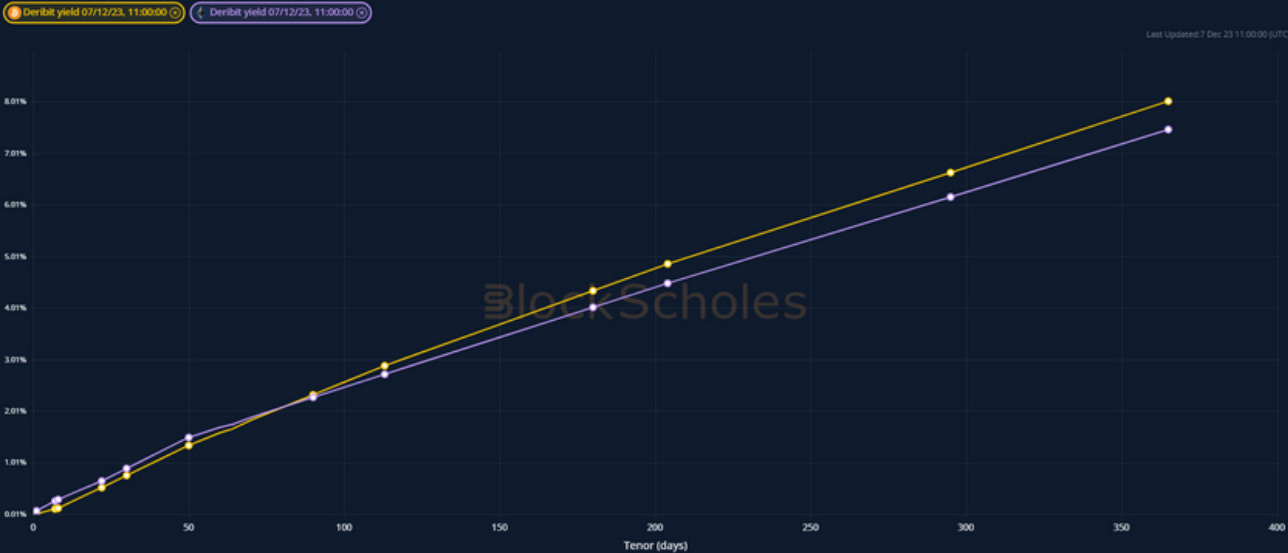

Futures implied yield term structure.

Volatility Surface Metrics.

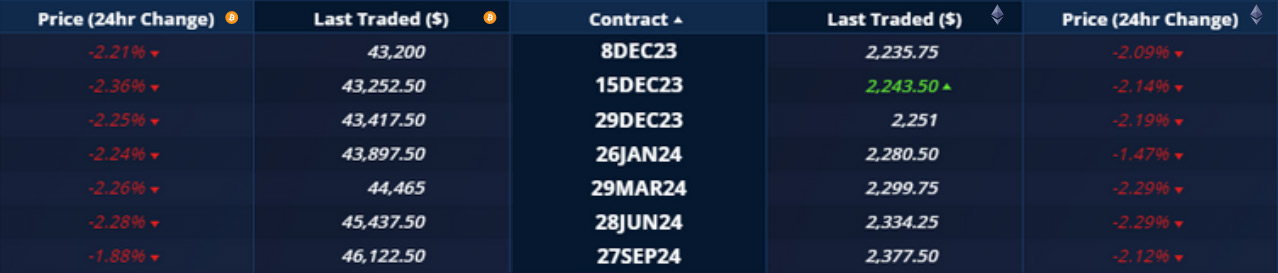

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – fall strongly in the 1 week tenor, with futures pries at longer tenors moving closer to spot in the last 24 hours.

ETH ANNUALISED YIELDS – the futures price term structure has compressed, but not as drastically as BTC’s at the 1-week tenor.

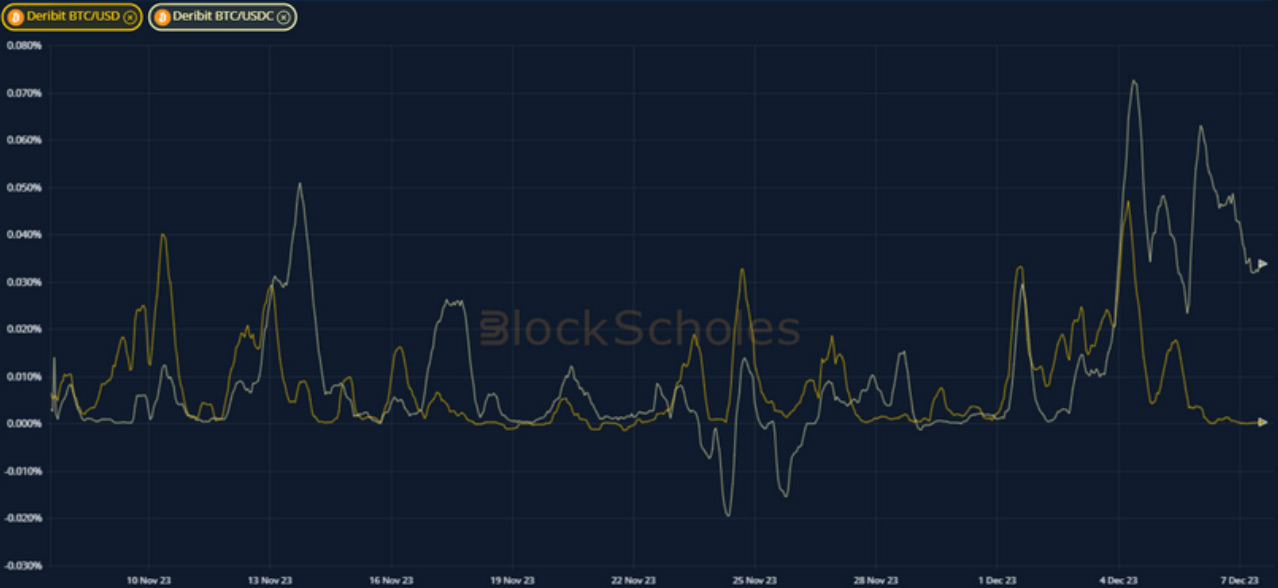

Perpetual Swap Funding Rate

BTC FUNDING RATE – has returned this week to high and positive rates paid by traders looking for leveraged long positions in the derivative.

ETH FUNDING RATE – shows that the willingness to pay for long exposure is not limited to BTC traders, particularly over the last three days.

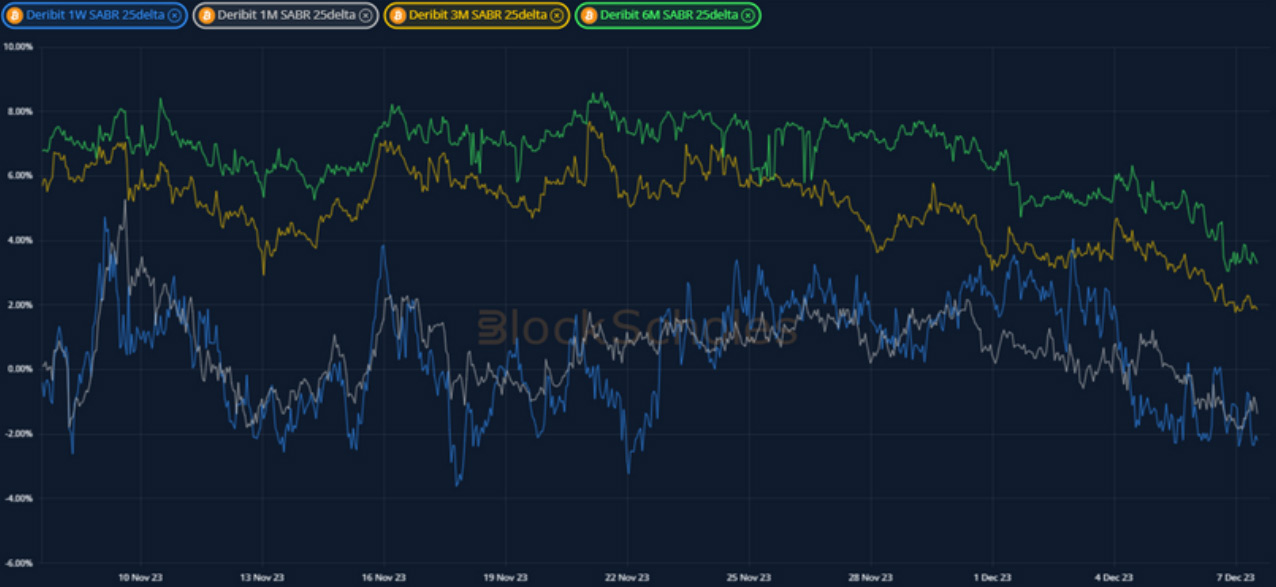

BTC Options

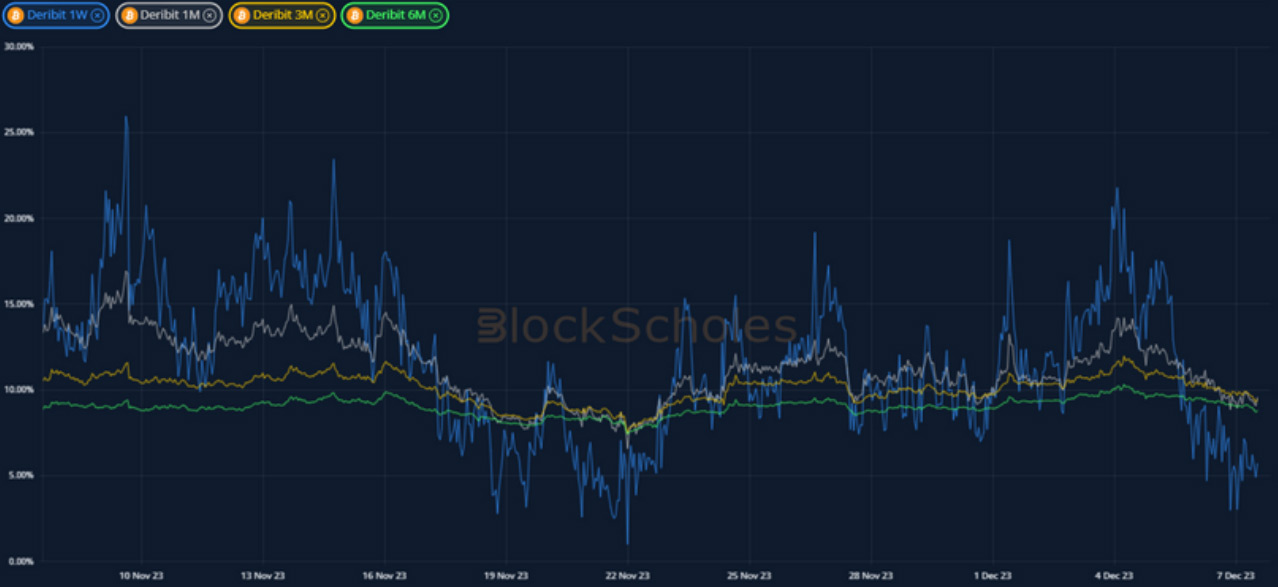

BTC SABR ATM IMPLIED VOLATILITY – short tenors trade close to delivered vol, while tenors longer than 1M price a significant risk premium.

BTC 25-Delta Risk Reversal – the bullish sentiment express throughout the last month has faded slightly as each smile skews less towards OTM calls.

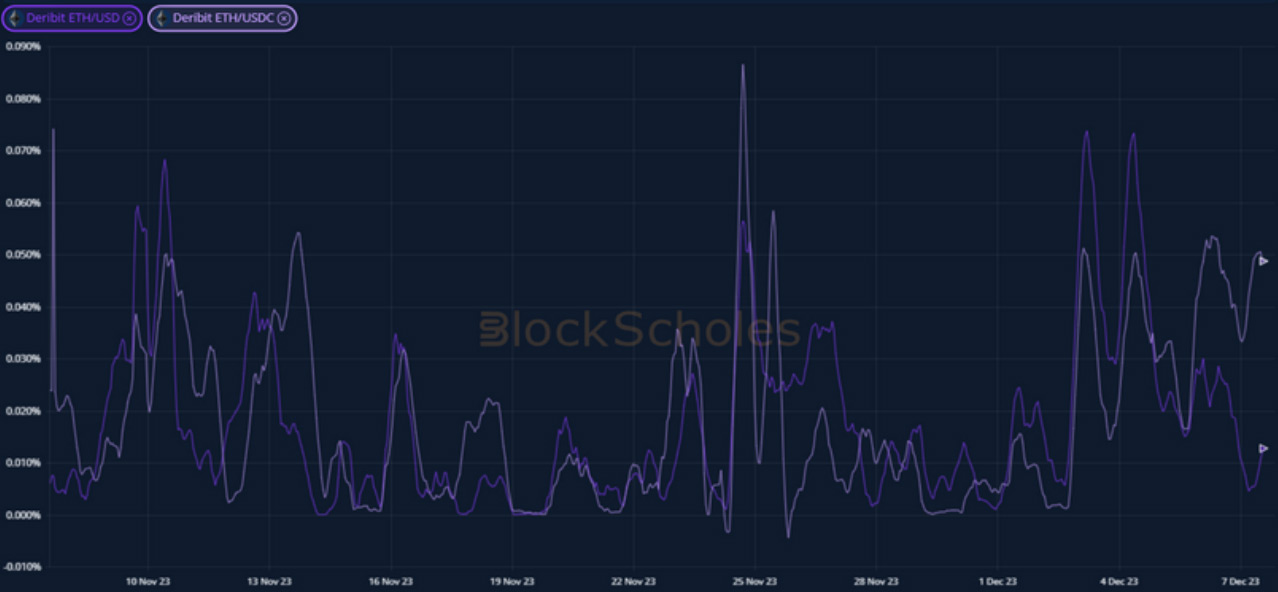

ETH Options

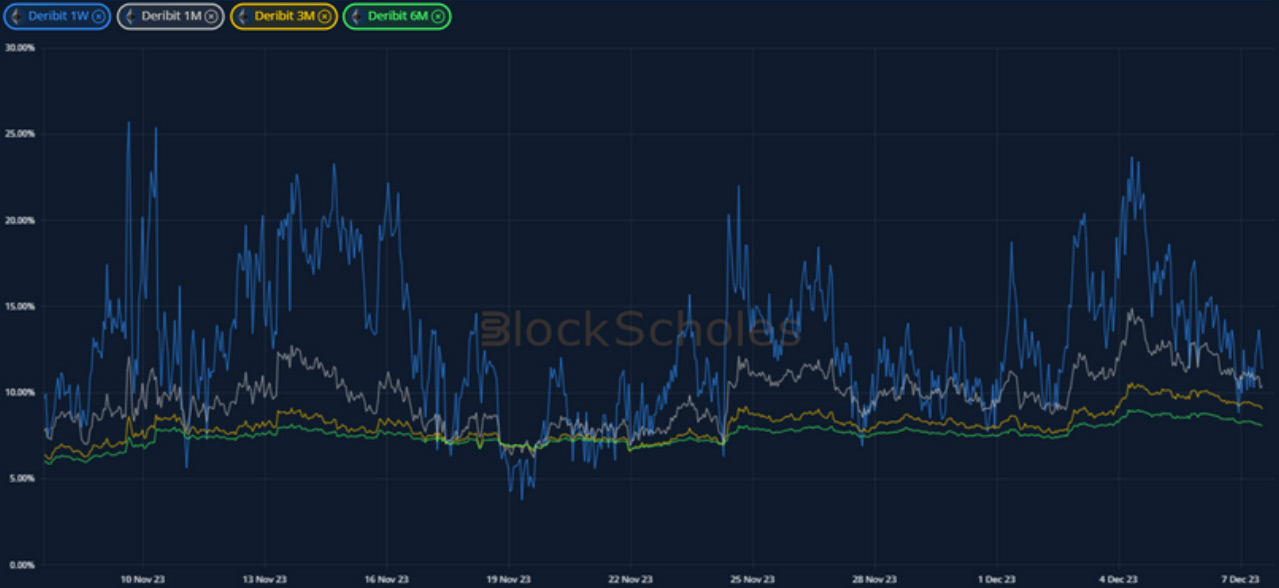

ETH SABR ATM IMPLIED VOLATILITY – trends sideways with a similar volatility risk premium targeting the end of January tenors.

ETH 25-Delta Risk Reversal – does not show the same slip in bullish sentiment, albeit starting from a less bullish skew than BTC’s smiles.

Volatility Surface

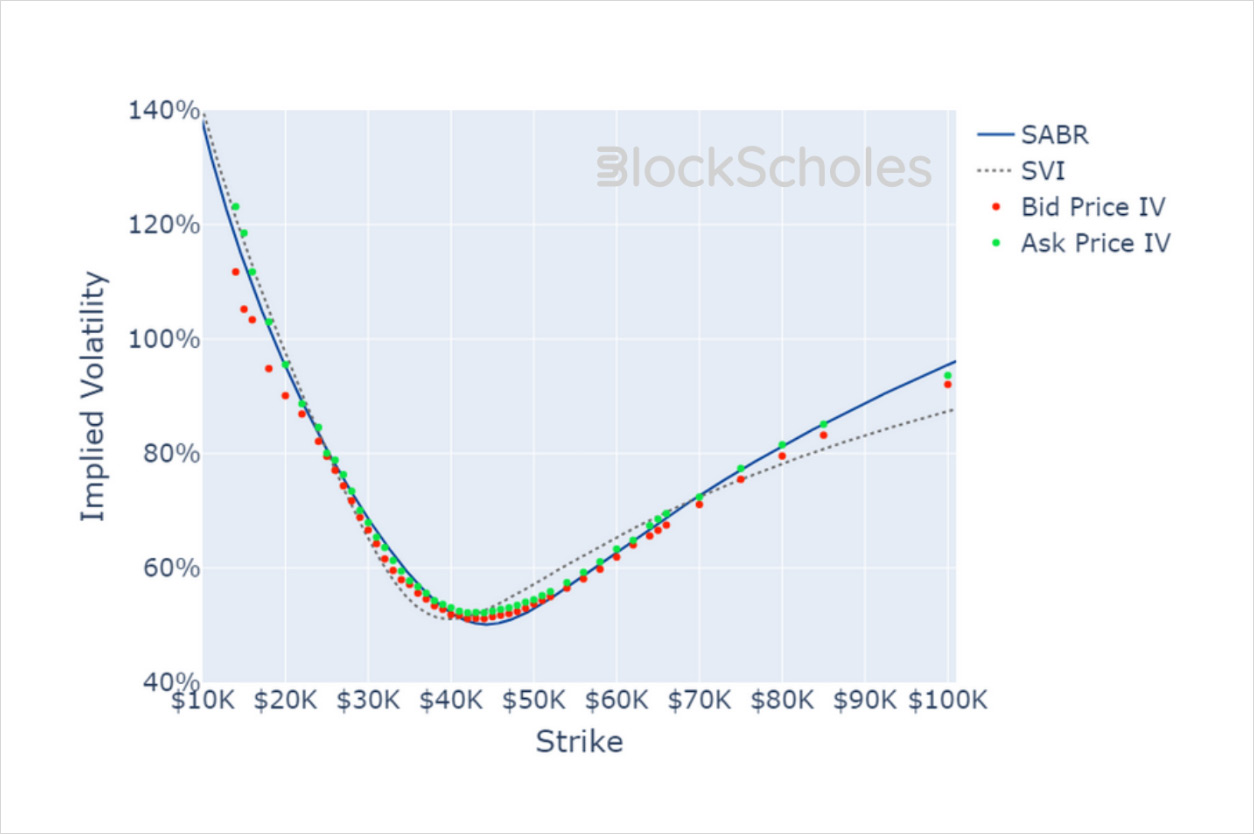

BTC IMPLIED VOL SURFACE – a weaker skew towards calls at longer is attributed to falling call volatility, rather than a strong demand for puts.

ETH IMPLIED VOL SURFACE – mid-tenor, ATM options report the sharpest cooling in implied volatility over the last 30 days of hourly snapshots.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

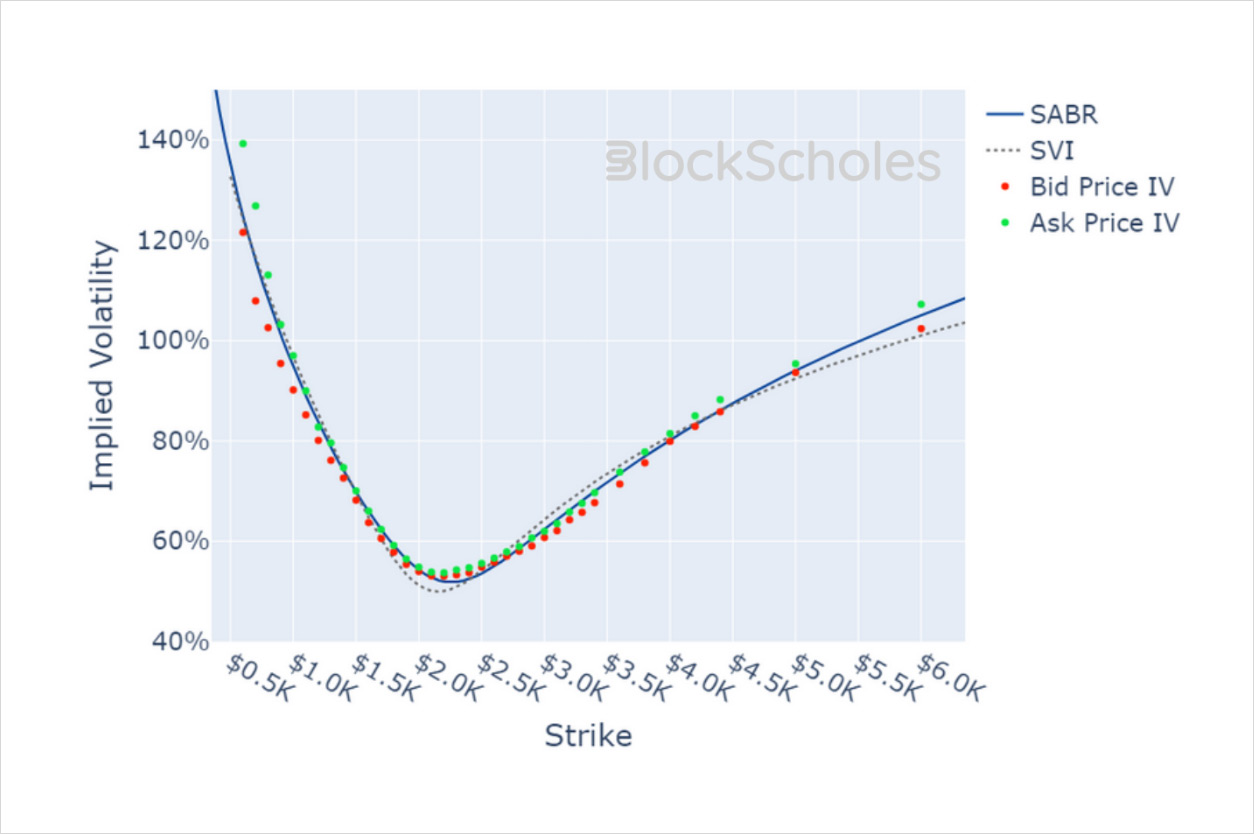

BTC SMILE CALIBRATIONS – 26-Jan-2024 Expiry, 11:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 26-Jan-2024 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

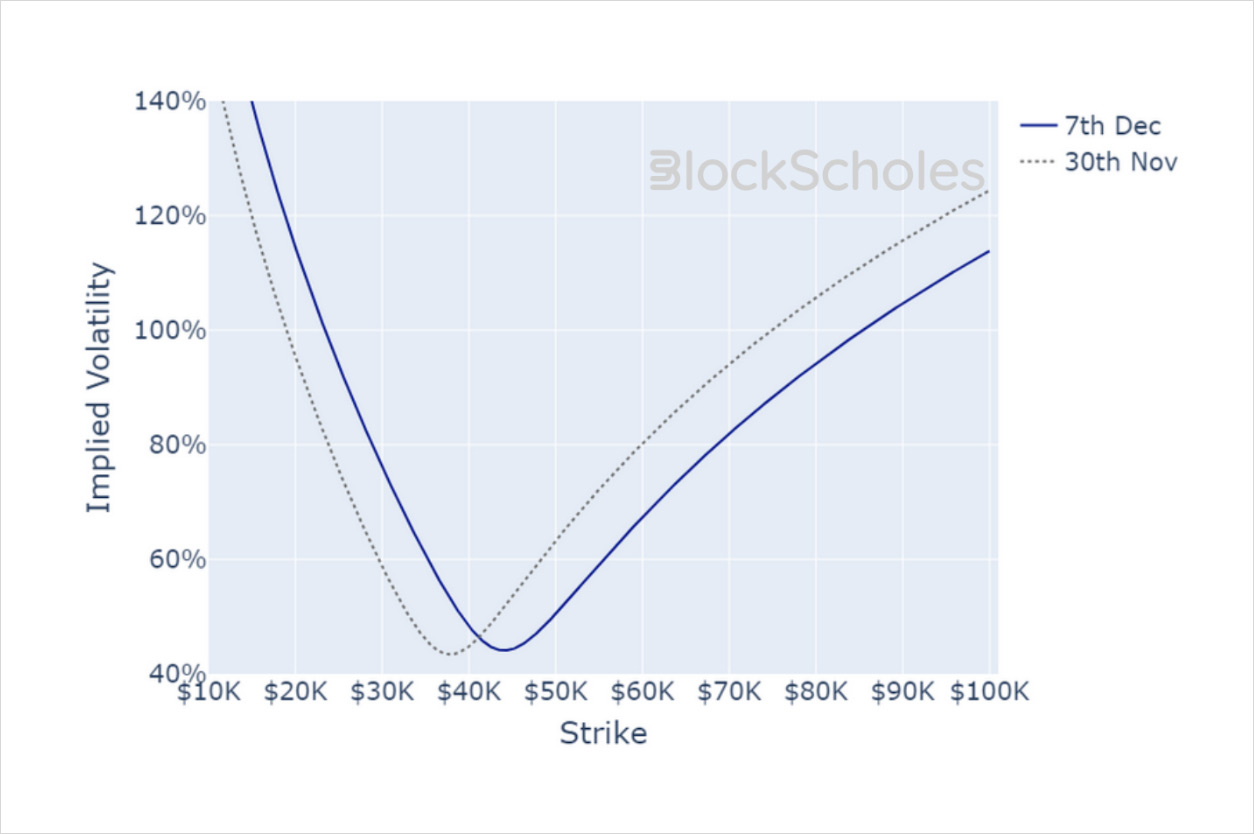

BTC SABR CALIBRATION – 30 Day Tenor, 11:00 UTC Snapshot.

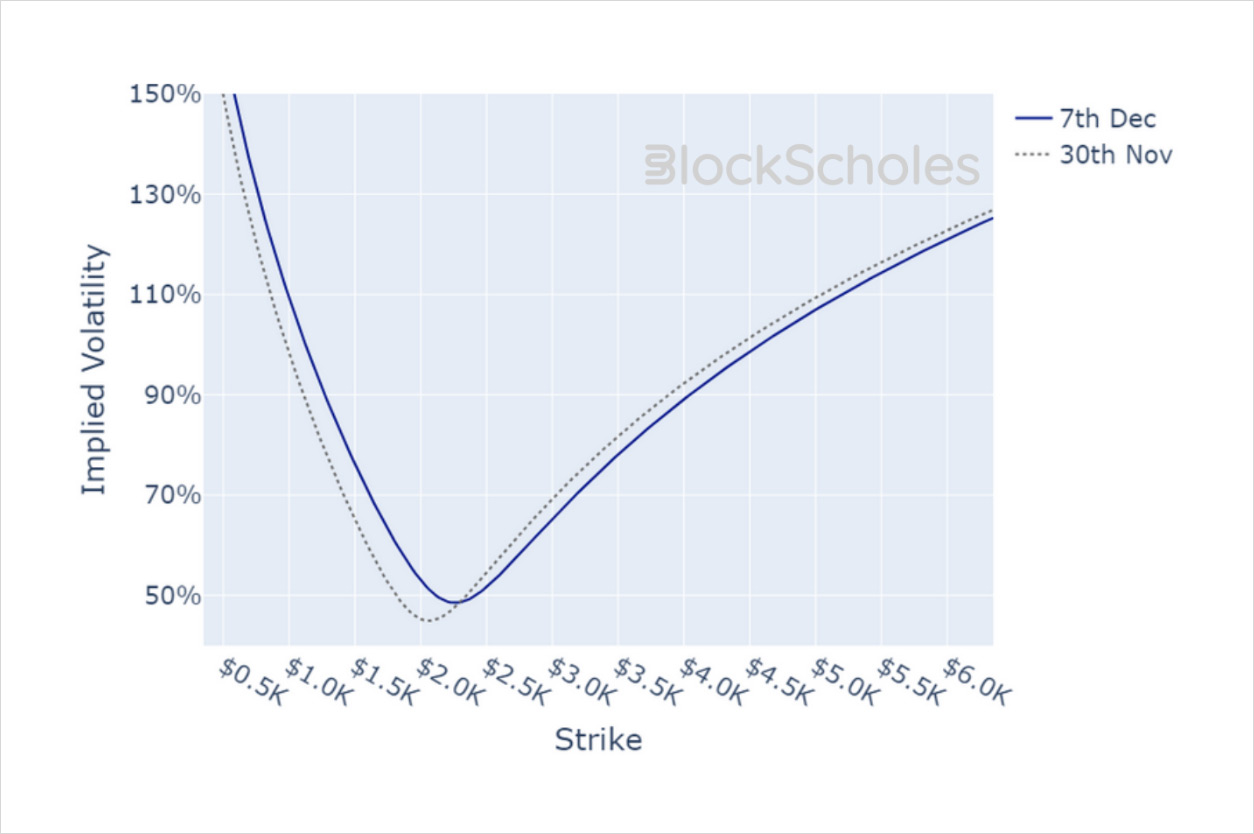

ETH SABR CALIBRATION – 30 Day Tenor, 11:00 UTC Snapshot.

AUTHOR(S)