Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

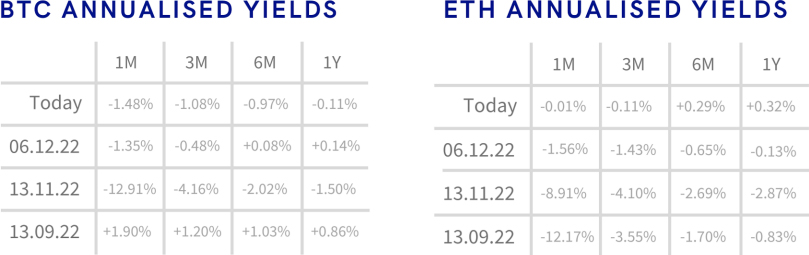

- BTC ANNUALISED YIELDS – continue trading flat while beginning to tease an upside move.

- ETH ANNUALISED YIELDS – trading flat near zero, as they exit periods of high volatility early on in December.

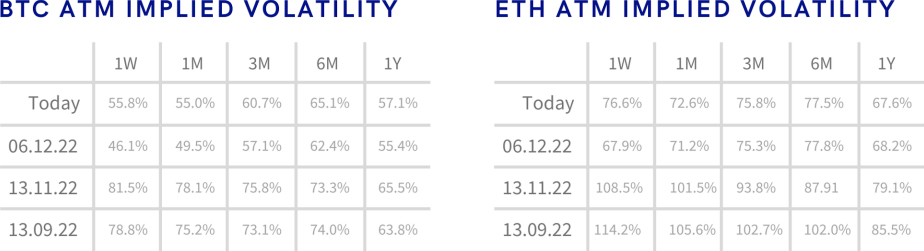

- BTC SABR ATM IMPLIED VOLATILITY – trading mostly flat following its recent slump to Nov 2020 lows.

- ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s movements as it maintains low levels visited last week.

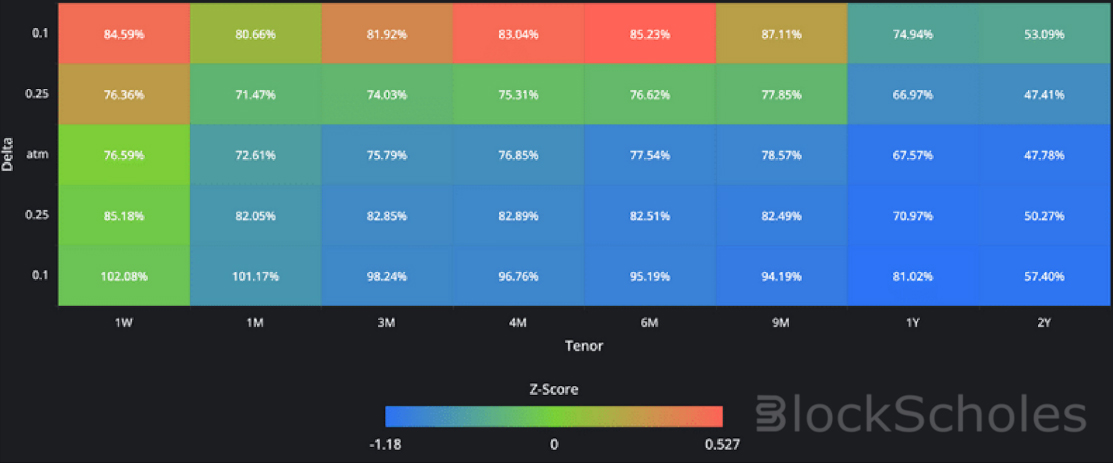

- BTC IMPLIED VOL SURFACE – cooling across nearly the whole surface with 4M, 6M, and 9M 0.1 delta calls recorded to outperform recent values.

- ETH IMPLIED VOL SURFACE – more robust performance across 0.1 delta calls with continued cooling across the whole surface.

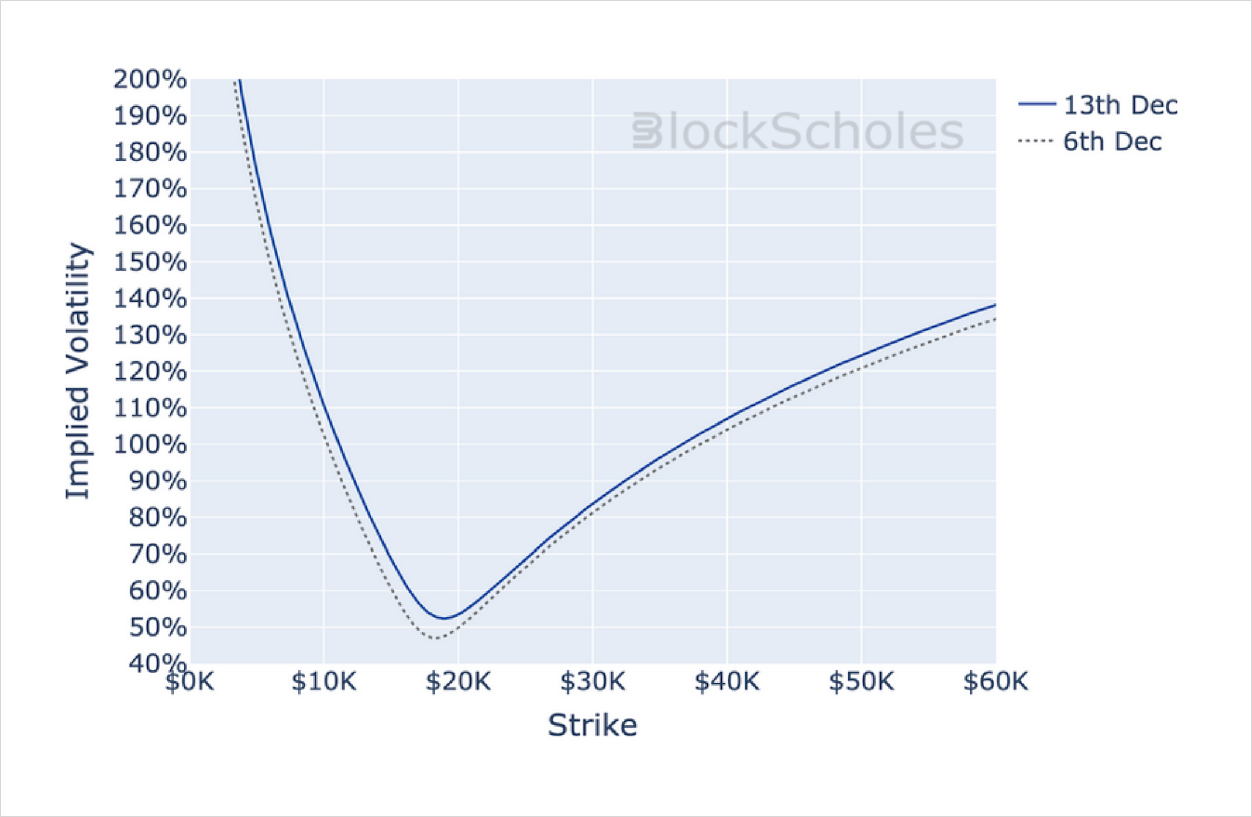

- BTC SABR RHO – a slowdown in the recent trend towards a neutral skew in the volatility smile.

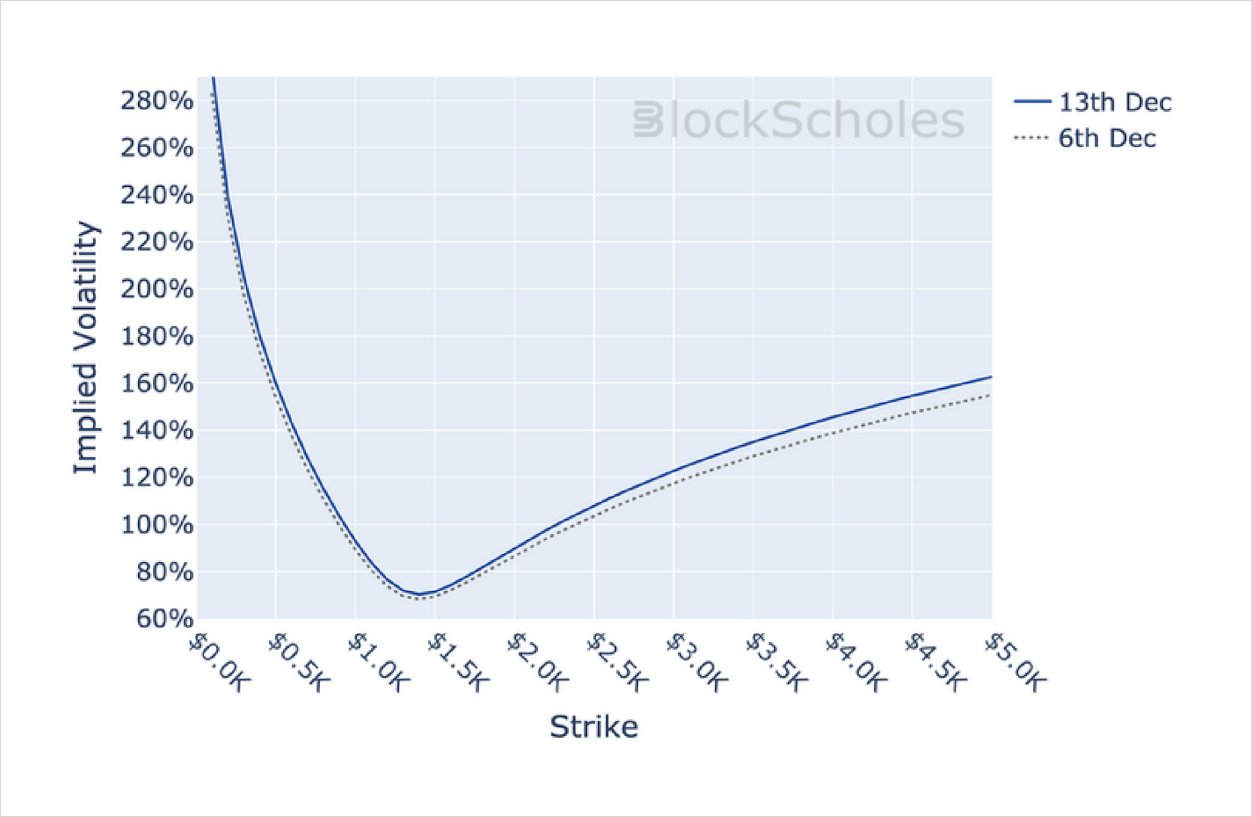

- ETH SABR RHO – even though smiles continue to be skewed towards OTM puts, there was an aggressive move in shorter expiries towards a neutral skew in the volatility smile.

The ATM volatilities of both BTC and ETH remain low following their recent slumps. Though their volatility smiles continue to contrast this by their continued skew towards OTM calls, a sharp skew towards a neutral skew in the volatility smile in ETH is observed.

Futures

BTC ANNUALISED YIELDS – continue trading flat while beginning to tease an upside move.

ETH ANNUALISED YIELDS – trading flat near zero, as they exit periods of high volatility early on in December.

Options

BTC SABR ATM IMPLIED VOLATILITY – trading mostly flat following its recent slump to Nov 2020 lows.

ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s movements as it maintains low levels visited last week.

Volatility Surface

BTC IMPLIED VOL SURFACE – cooling across nearly the whole surface with 4M 6M and 9M 0.1 delta calls recorded to outperform recent values.

ETH IMPLIED VOL SURFACE – more robust performance across 0.1 delta calls with continued cooling across the whole surface.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

SABR Rho

BTC SABR RHO – a slowdown in the recent trend towards a neutral skew in the volatility smile.

ETH SABR RHO – even though smiles continue to be skewed towards OTM puts, there was an aggressive move in shorter expiries towards a neutral skew in the volatility smile.

Volatility Smiles

BTC SMILE CALIBRATIONS – 30-Dec-2022 Expiry, 10:00 UTC Snapshot.

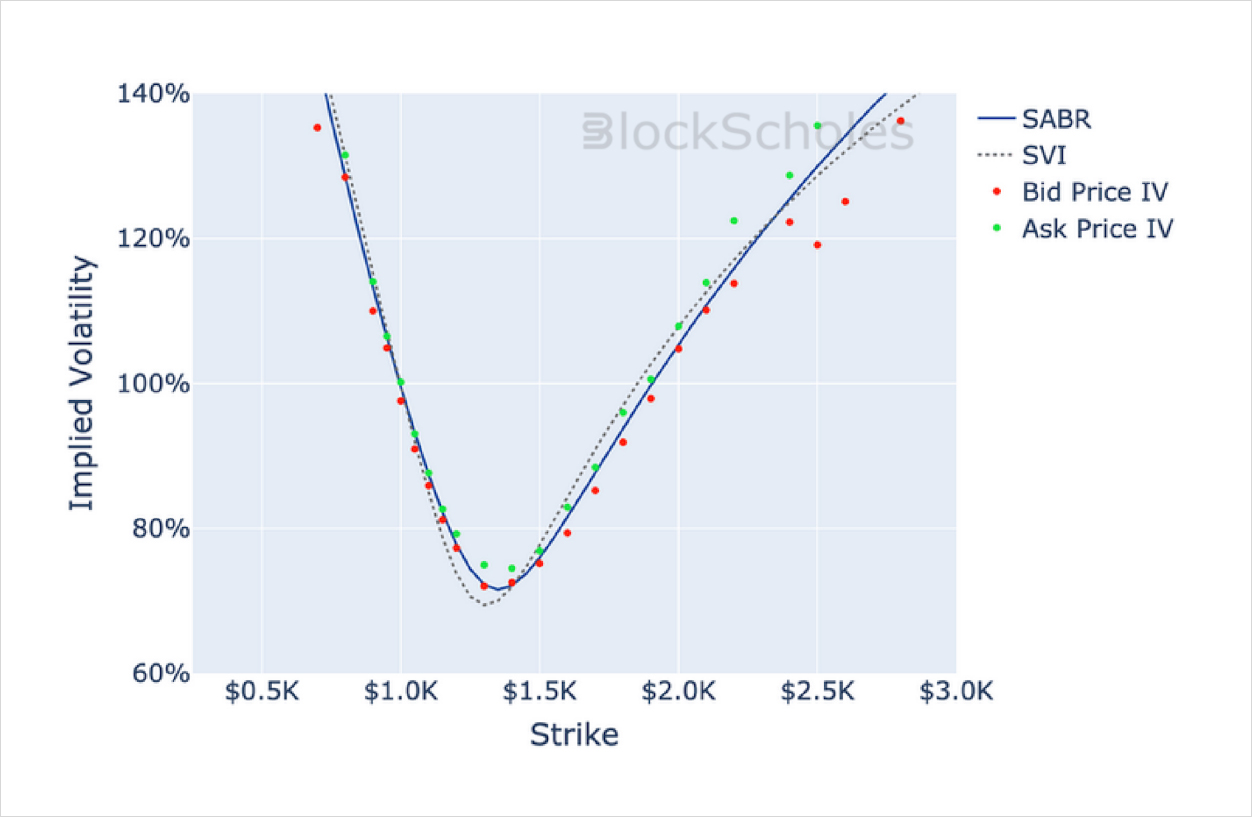

ETH SMILE CALIBRATIONS – 30-Dec-2022 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)