Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

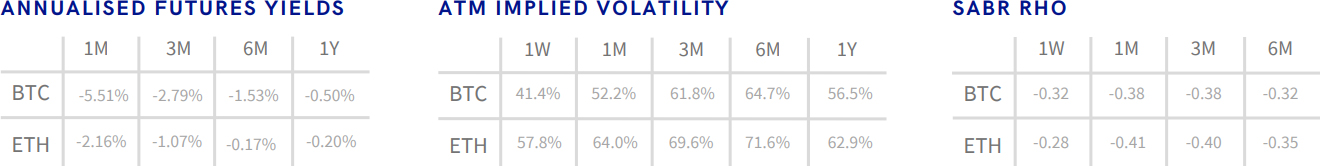

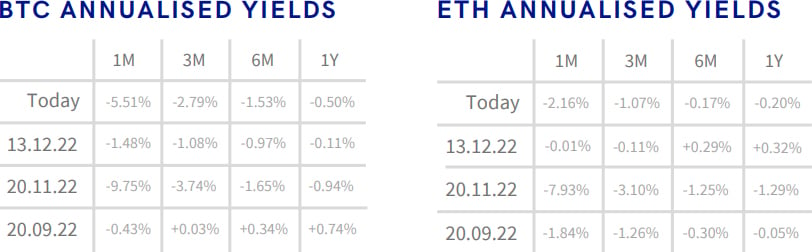

- BTC ANNUALISED YIELDS – the upside move teased last week did not materialise, with futures prices falling further below spot.

- ETH ANNUALISED YIELDS – fall back below zero at all tenors up to 1Y, returning to the bottom of their tight range since the beginning of December.

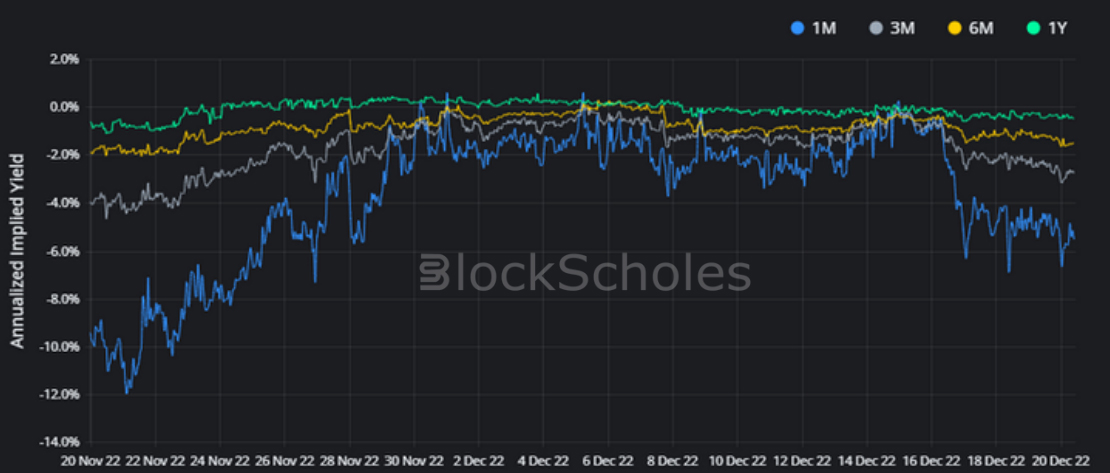

- BTC SABR ATM IMPLIED VOLATILITY – is still at Nov 2020 lows, despite spiking mid-week at shorterdated tenors.

- ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s movements as it returns to the bottom of its monthly range.

- BTC IMPLIED VOL SURFACE – shorter-dated calls underperform whilst 3M, 4M, and 6M puts outperform their recent values.

- ETH IMPLIED VOL SURFACE – cools across the surface, with 6M and 9M, 25-delta calls seeing the biggest drop in implied volatility.

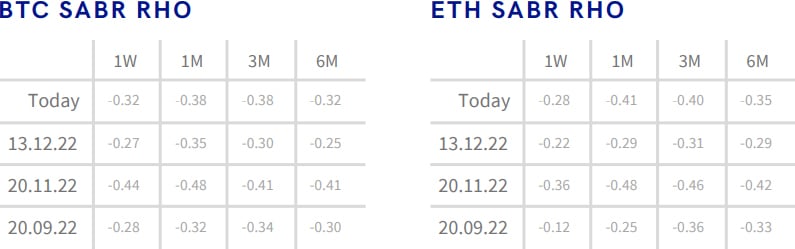

- BTC SABR RHO – the trend towards a neutral skew in the volatility smile is reversed, as rho plunges further negative.

- ETH SABR RHO – the aggressive move in shorter expiries towards a neutral skew in the volatility smile has been slowly reverse over the past week, skewing back towards OTM puts.

The tentative signs of market recovery observed last week have been reversed. This week, futures-implied yields and volatility smile skew both indicate a slight return to pessimistic sentiment in both BTC’s and ETH’s derivatives markets, whilst the volatility implied by ATM options continues to stagnate.

Futures

BTC ANNUALISED YIELDS – the upside move teased last week did not materialise, with futures prices falling further below spot.

ETH ANNUALISED YIELDS – fall back below zero at all tenors up to 1Y, returning to the bottom of their range since the beginning of December.

Options

BTC SABR ATM IMPLIED VOLATILITY – is still at Nov 2020 lows, despite spiking mid-week at shorter-dated tenors.

ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s movements as it returns to the bottom of its monthly range.

Volatility Surface

BTC IMPLIED VOL SURFACE – shorter-dated calls underperform whilst 3M, 4M, and 6M puts outperform their recent values.

ETH IMPLIED VOL SURFACE – cools across the surface, with 6M and 9M, 25-delta calls seeing the biggest drop in implied volatility.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

SABR Rho

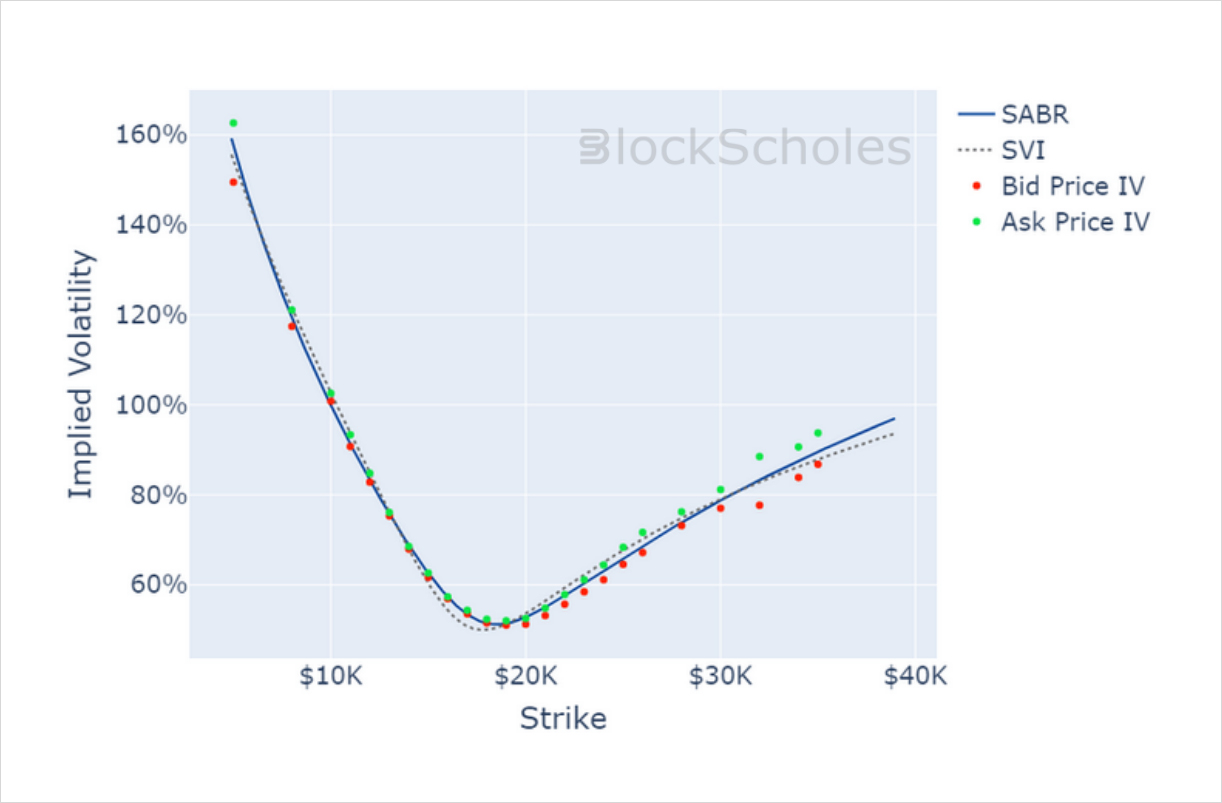

BTC SABR RHO – the trend towards a neutral skew in the volatility smile is reversed, as rho plunges further negative.

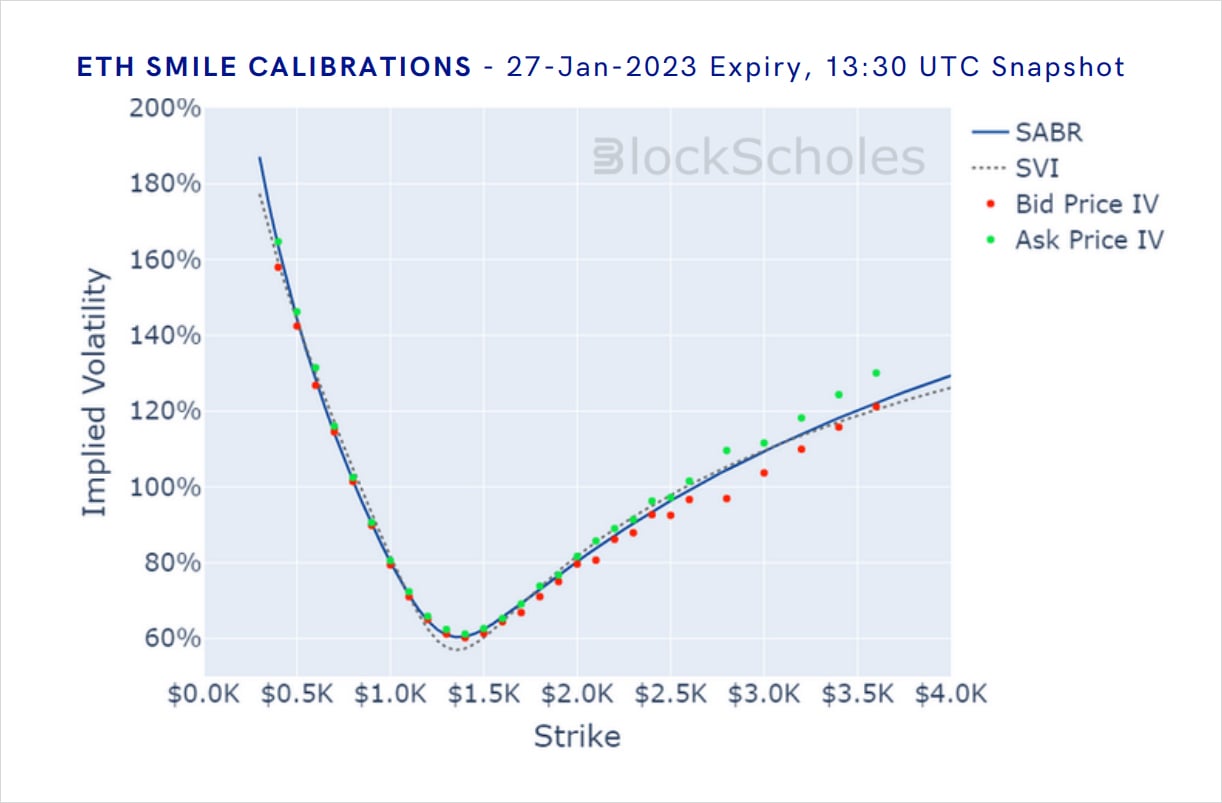

ETH SABR RHO – the aggressive move in shorter expiries towards a neutral skew in the volatility smile has been slowly reversed over the past week, skewing back towards OTM puts.

Volatility Smiles

BTC SMILE CALIBRATIONS – 27-Jan-2023 Expiry, 13:30 UTC Snapshot.

ETH SMILE CALIBRATIONS – 27-Jan-2023 Expiry, 13:30 UTC Snapshot.

Historical SABR Volatility Smiles

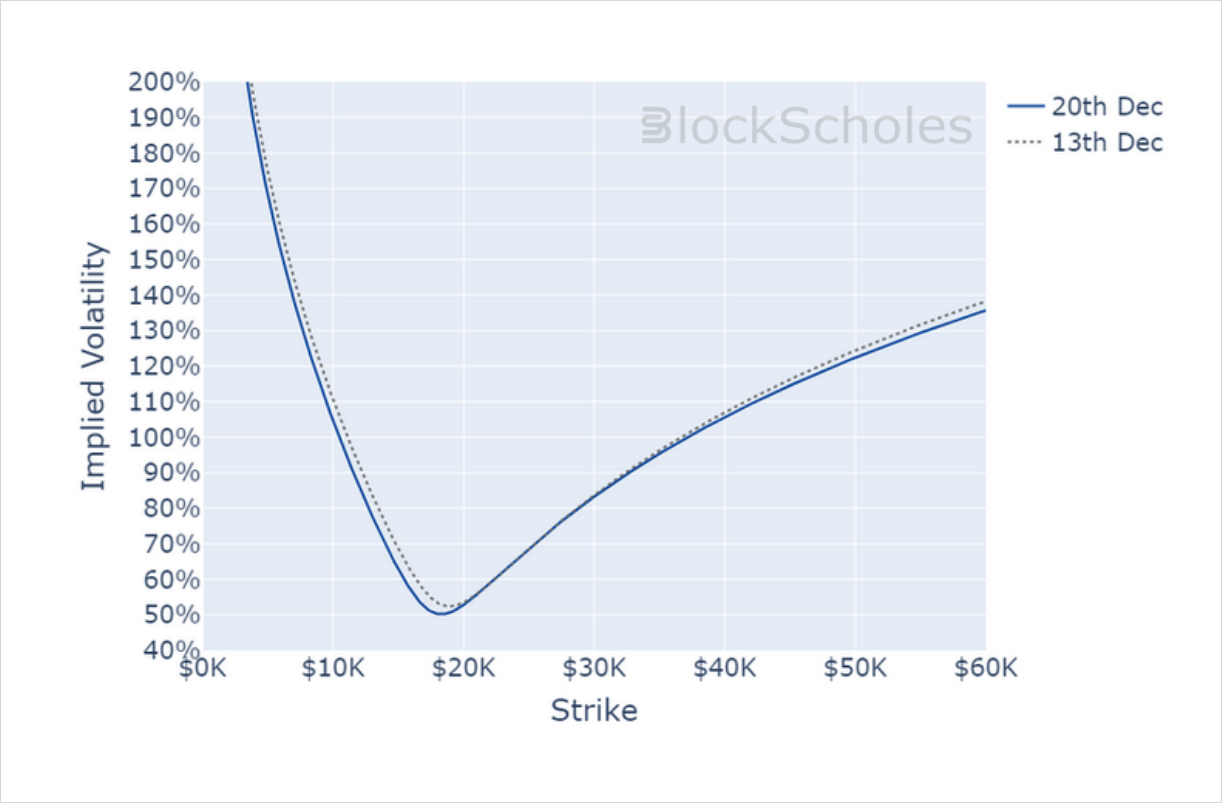

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

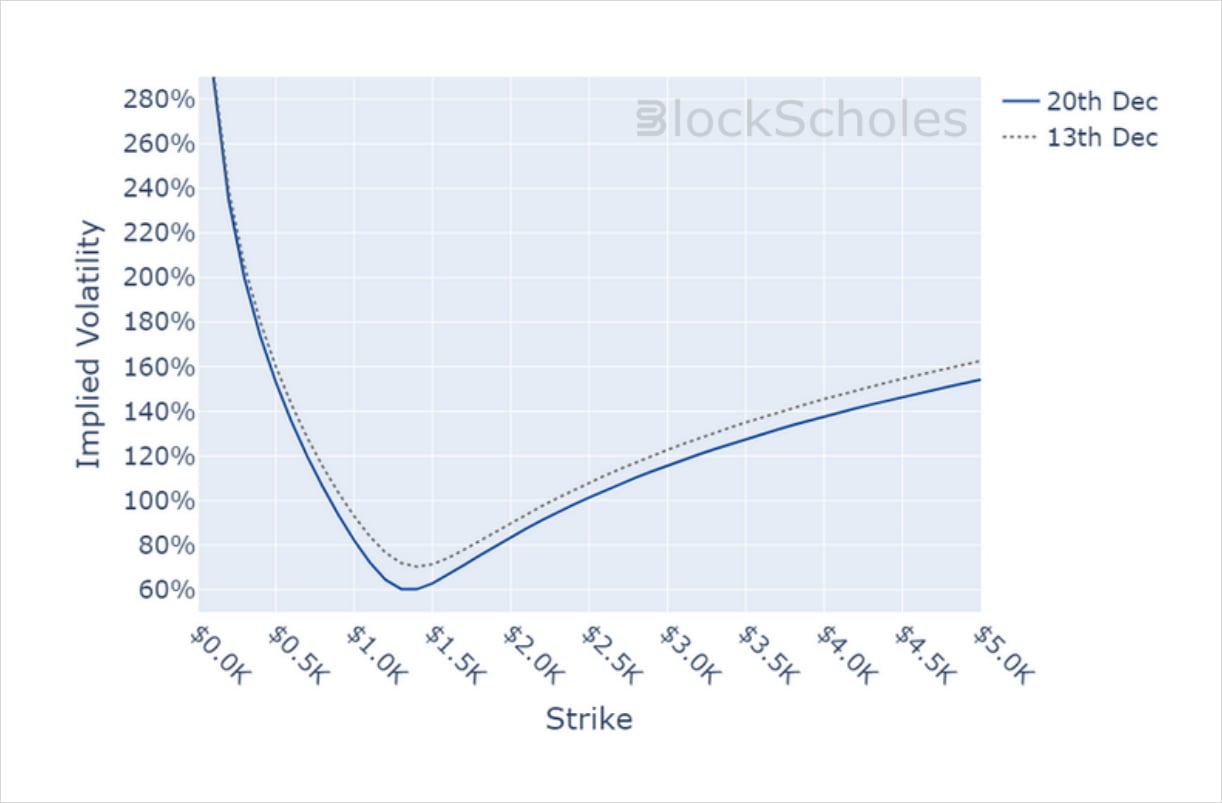

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)