Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Volatility levels have continued to fall in both majors, continuing the trend they picked up following the resolution of the ETF event risk in early January. An out-performance in OTM calls for both assets has seen their implied volatility fall by a lower amount that of OTM puts, leading to the shift in volatility smiles towards a slight tilt towards OTM calls that is stronger at longer-dated tenors. Futures yields are up again, following an extended period of stable-but-high rates. As are funding rates paid by long positions, indicating a resumption of the bullish sentiment it last expressed in late Janaury.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – short tenor future prices have risen over the last 24H, after languishing between 5% and 10% for much of the week.

ETH ANNUALISED YIELDS – show a more dramatic recovery in short-tenor yields that had reached far closer to 0% mid-week.

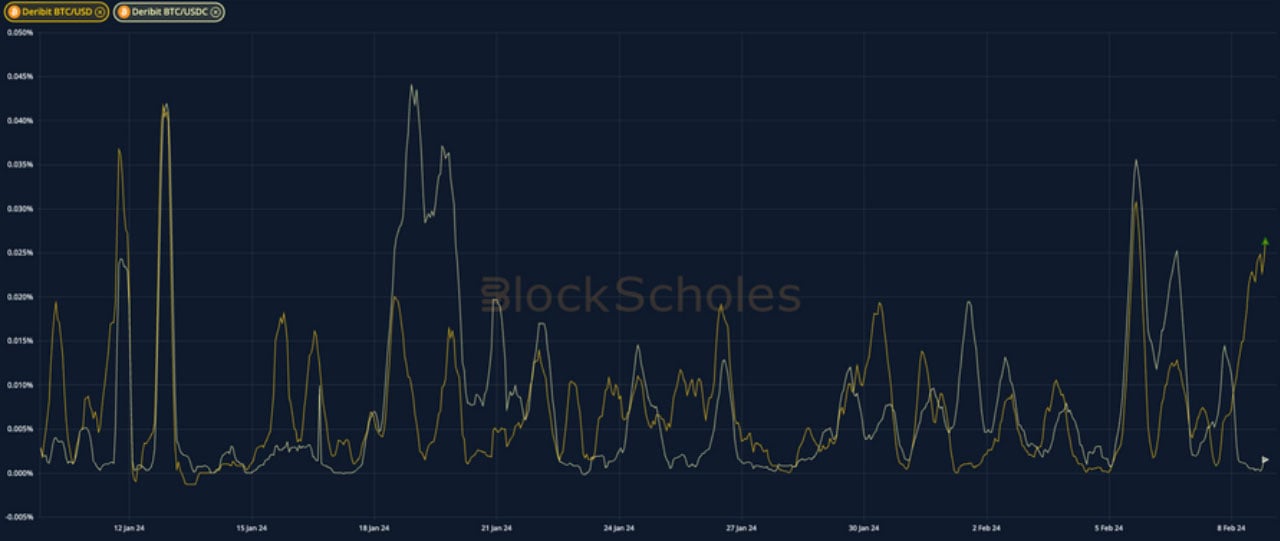

Perpetual Swap Funding Rate

BTC FUNDING RATE – has risen monotonically over the last 24H, showing a decisive increase in demand for long exposure in the USD contract.

ETH FUNDING RATE – reports an elevated rate paid from long positions to shorts alongside the rally in spot price.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – Implied vol continues to trade sideways, despite a sharp move higher in BTC spot over the last 24H.

BTC 25-Delta Risk Reversal – the bearish skew towards puts that we observed following the ETF has now resolved across the term structure.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – has traded at similar levels to BTC over the last week, including during today’s spot market action.

ETH 25-Delta Risk Reversal – reports a neutral shape to the volatility smiles at 1-week and 1-month tenors, with a more bullish tilt at 3-months.

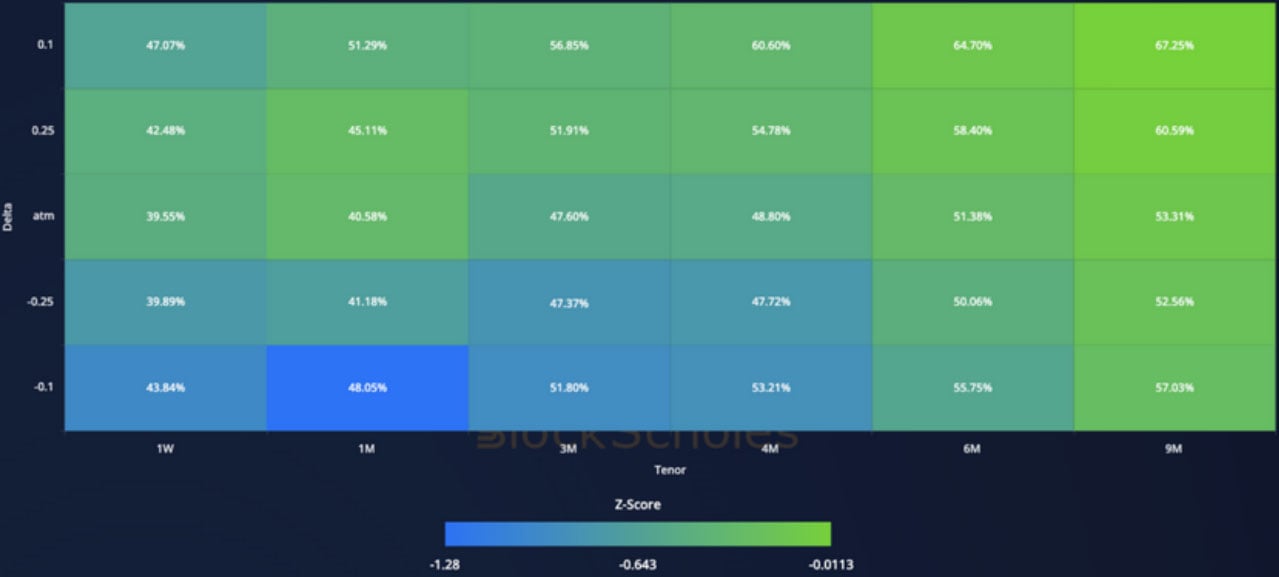

Volatility Surface

BTC IMPLIED VOL SURFACE – shows that over the last month volatility has cooled across the surface, with out-performance in OTM calls.

ETH IMPLIED VOL SURFACE – similarly shows that OTM call vols have out- performed puts as both have fallen, resulting in the bullish shift in skew.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

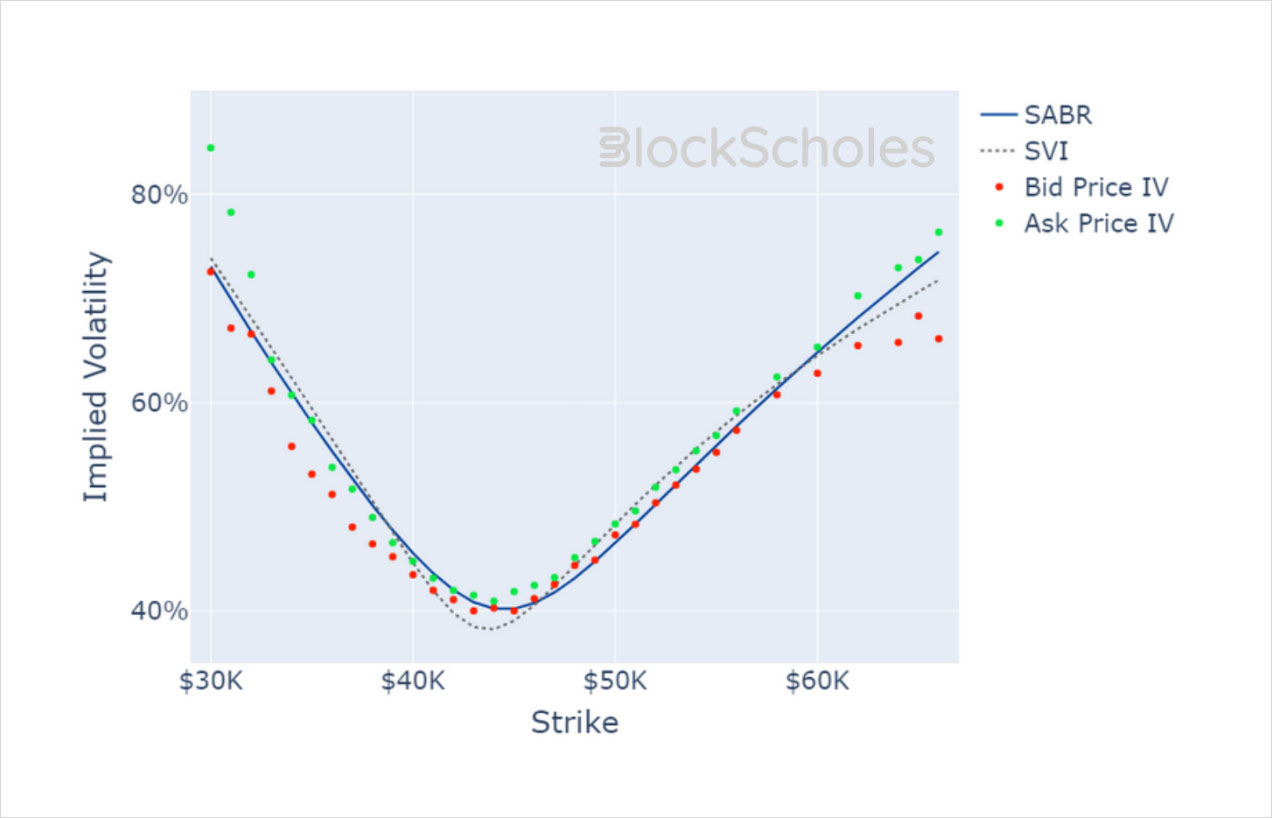

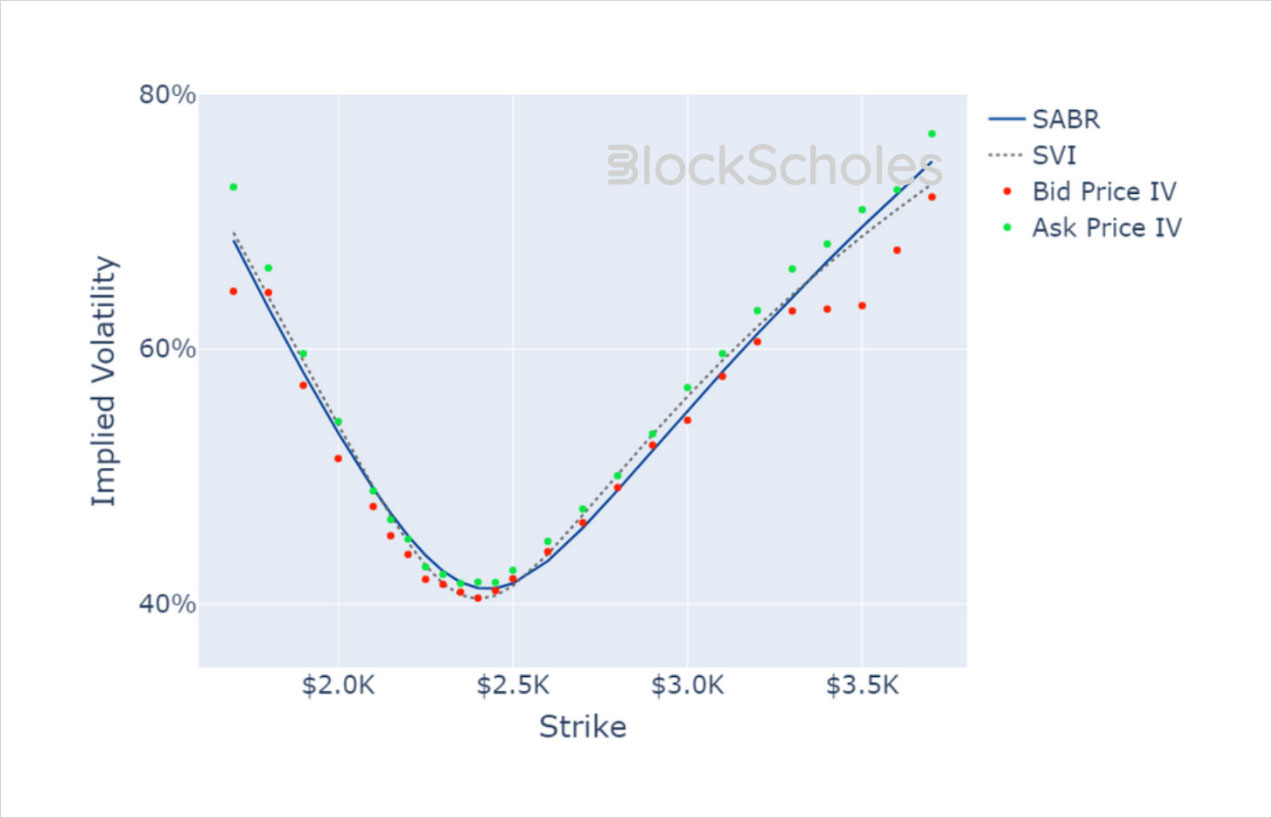

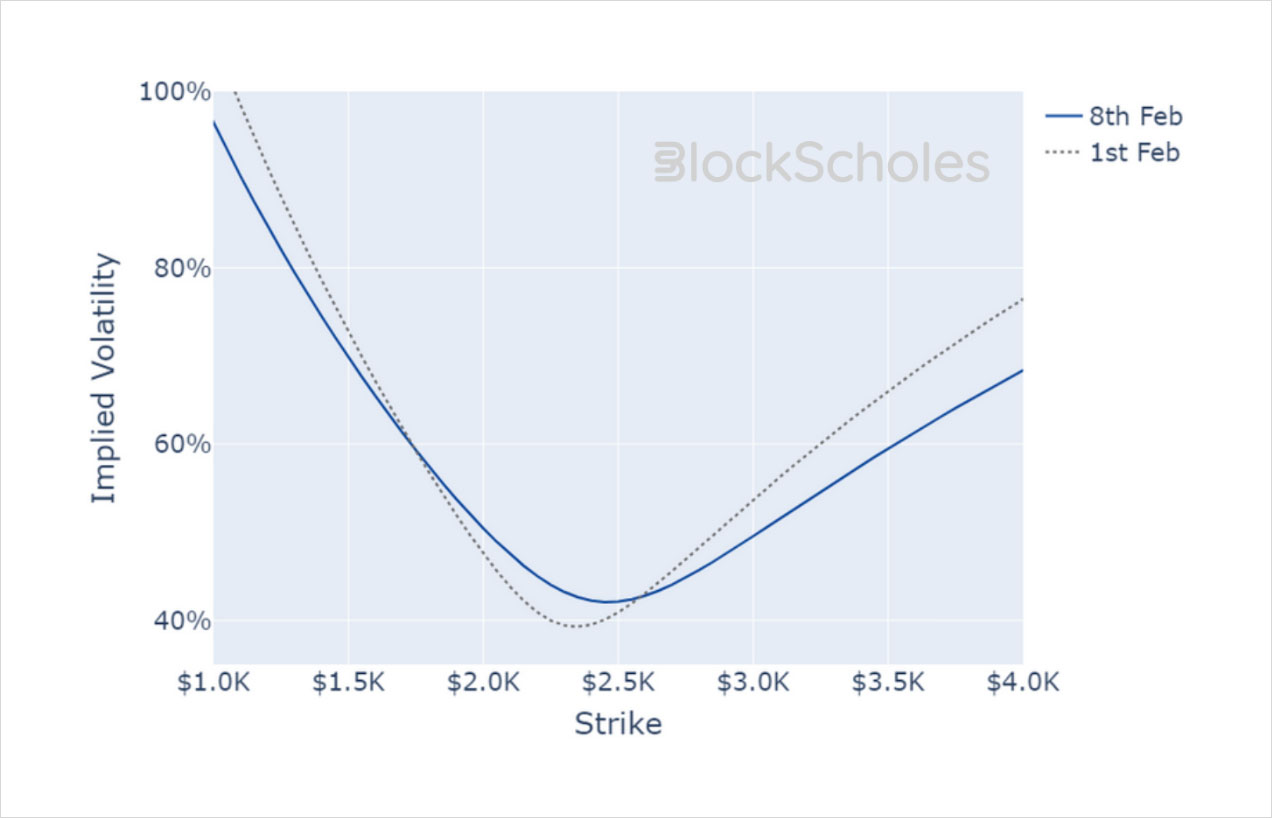

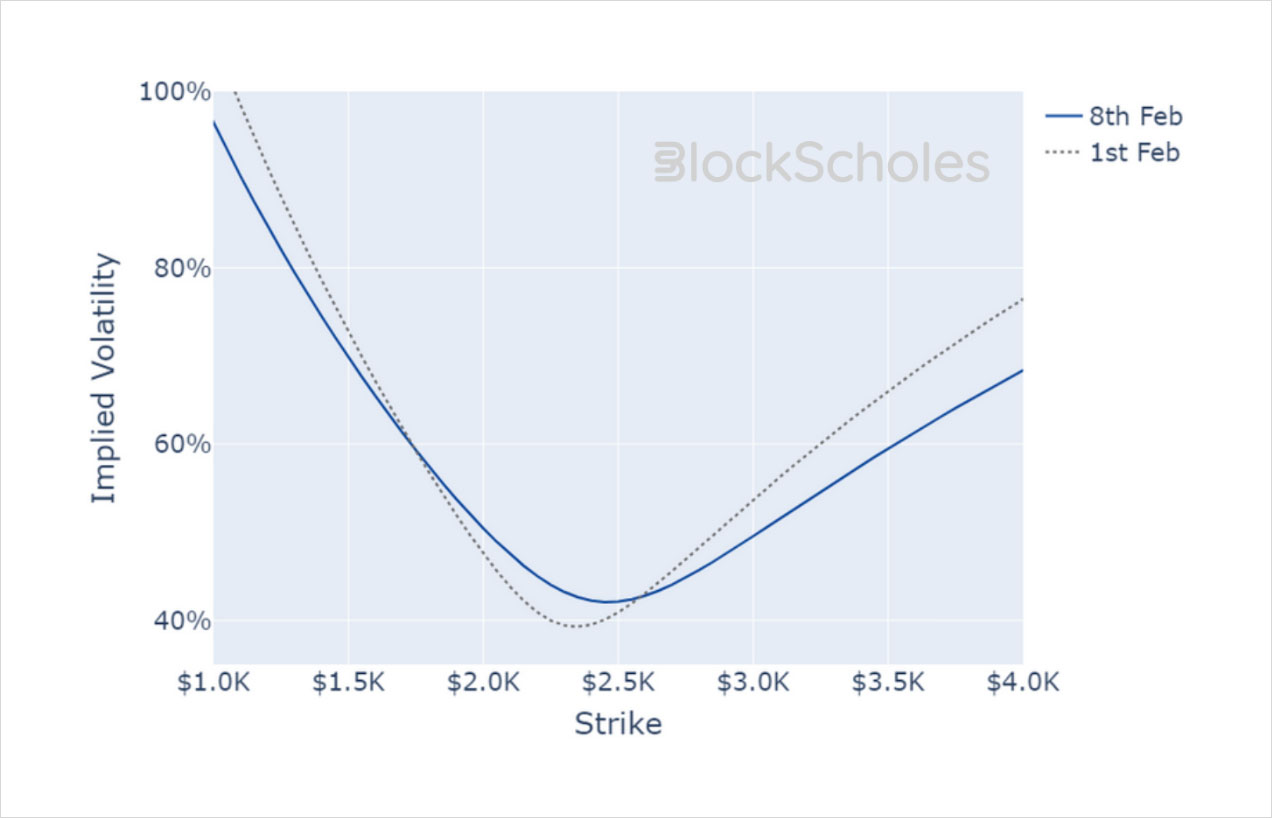

Volatility Smiles

BTC SMILE CALIBRATIONS – 23-Feb-2024 Expiry, 11:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 23-Feb-2024 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 11:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 11:00 UTC Snapshot.

AUTHOR(S)