Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Crypto-assets have enjoyed yet another rally in spot prices following a brief fade of the strong January performance. However, whilst implied yields and funding rates both reflect this positive sentiment, implied volatility has not exceeded its (relatively muted) recent range. The skew of both BTC’s and ETH’s volatility smiles has remained skewed towards OTM puts, with OTM calls not seeing the same increase in demand that they have during previous spot rallies this year.

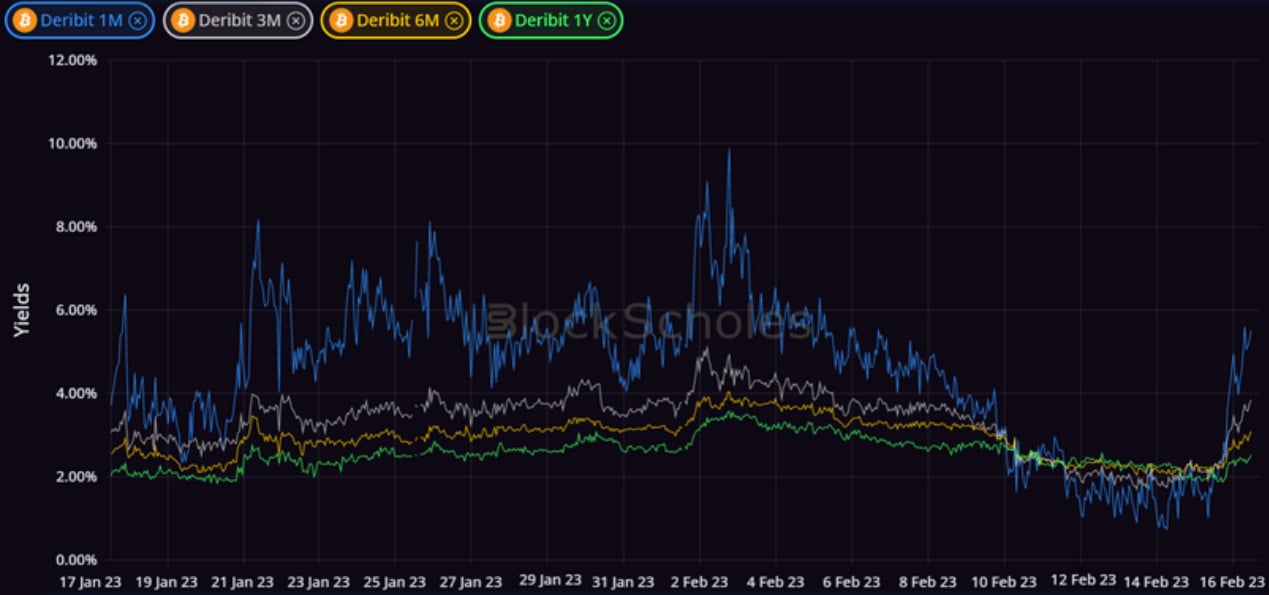

Futures

BTC ANNUALISED YIELDS – downwards trend towards zero is interrupted by a spike in response to the most recent rally in spot price.

ETH ANNUALISED YIELDS – similarly show a positive spike as ETH’s spot price enjoys the same rally as BTC’s.

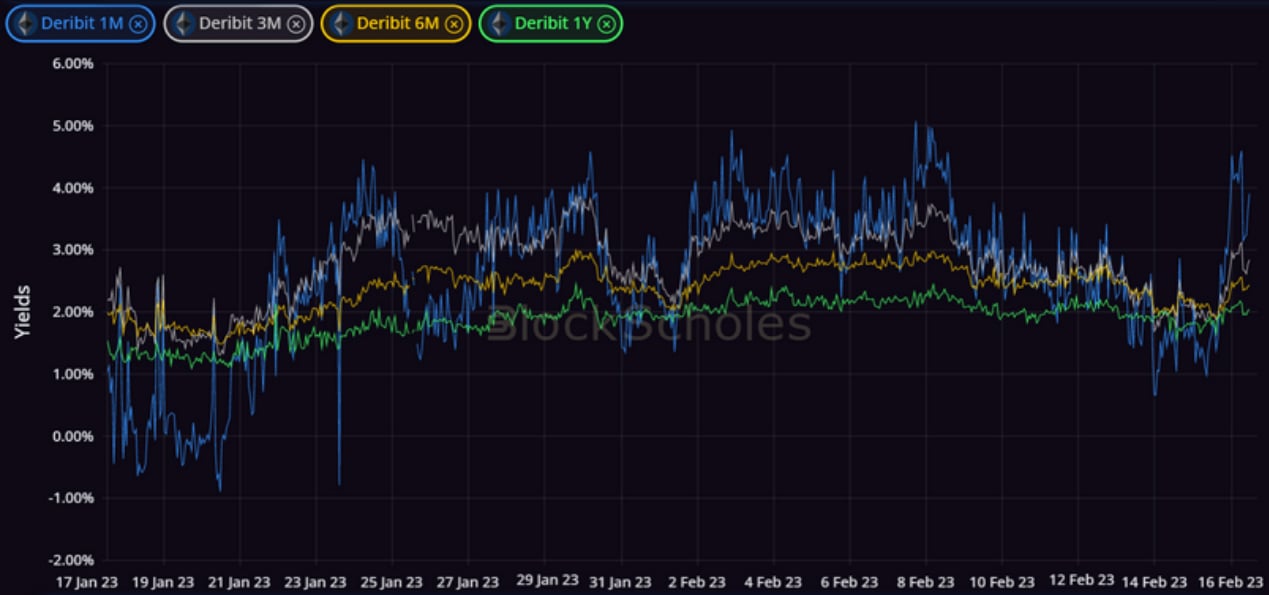

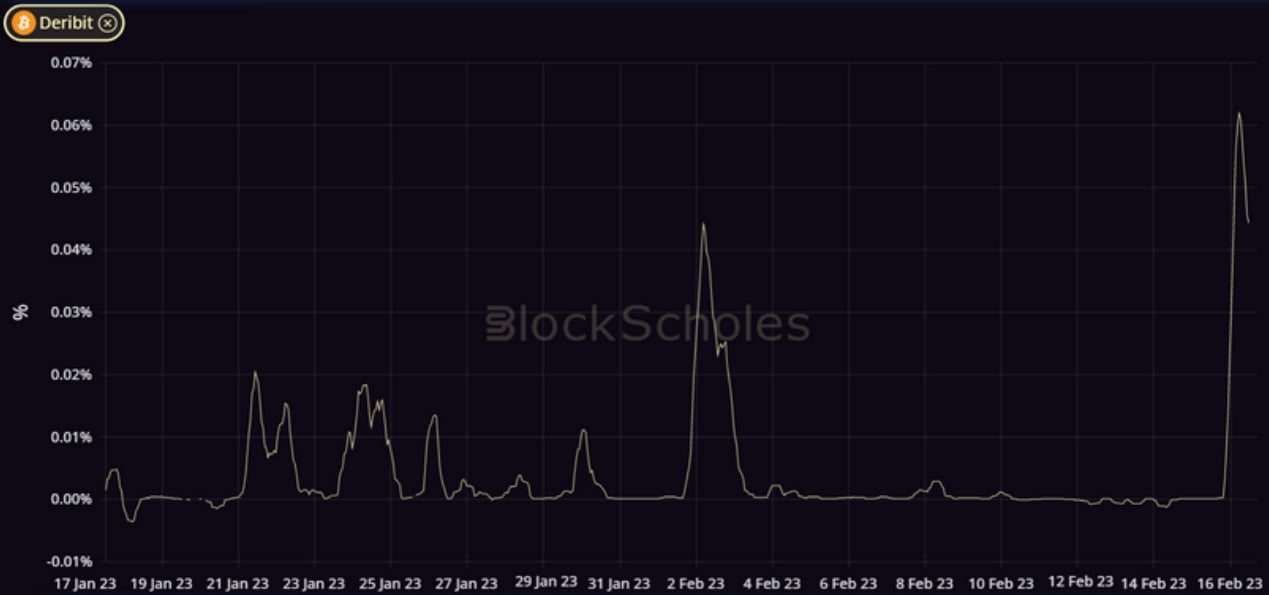

Perpetual Swap Funding Rate

BTC FUNDING RATE – spikes positively in response to the rally, indicating that BTC’s perpetual is trading slightly above its spot price.

ETH FUNDING RATE – reverses an initial negative value to reflect the behaviour of BTC’s perpetual swap contracty.

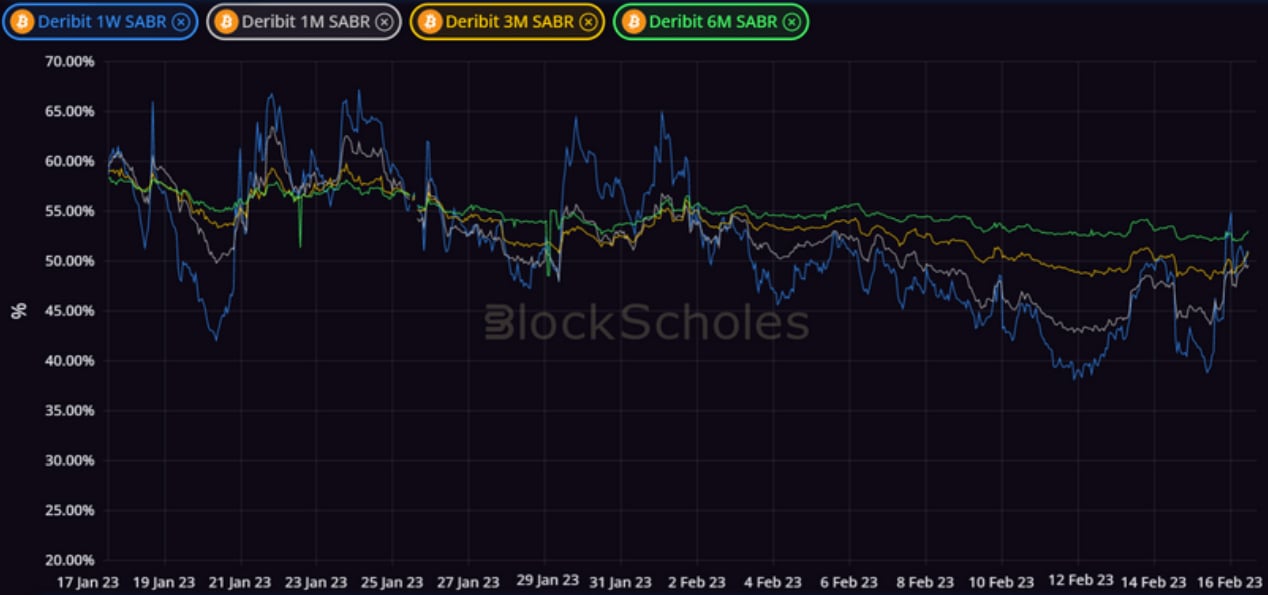

Options

BTC SABR ATM IMPLIED VOLATILITY – rises slightly following the upside move in spot, with shorter tenors seeing the sharpest increases.

ETH SABR ATM IMPLIED VOLATILITY – trades within its recent historical range despite ETH spot price spiking strongly in the last 24 hours.

Volatility Surface

BTC IMPLIED VOL SURFACE – 10-delta puts see the biggest increase in implied volatility compared to its recent history, despite a rally in spot price.

ETH IMPLIED VOL SURFACE – rises most in OTM puts, with the rest of the surface reflecting BTC’s cooling, especially at longer dated tenors.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

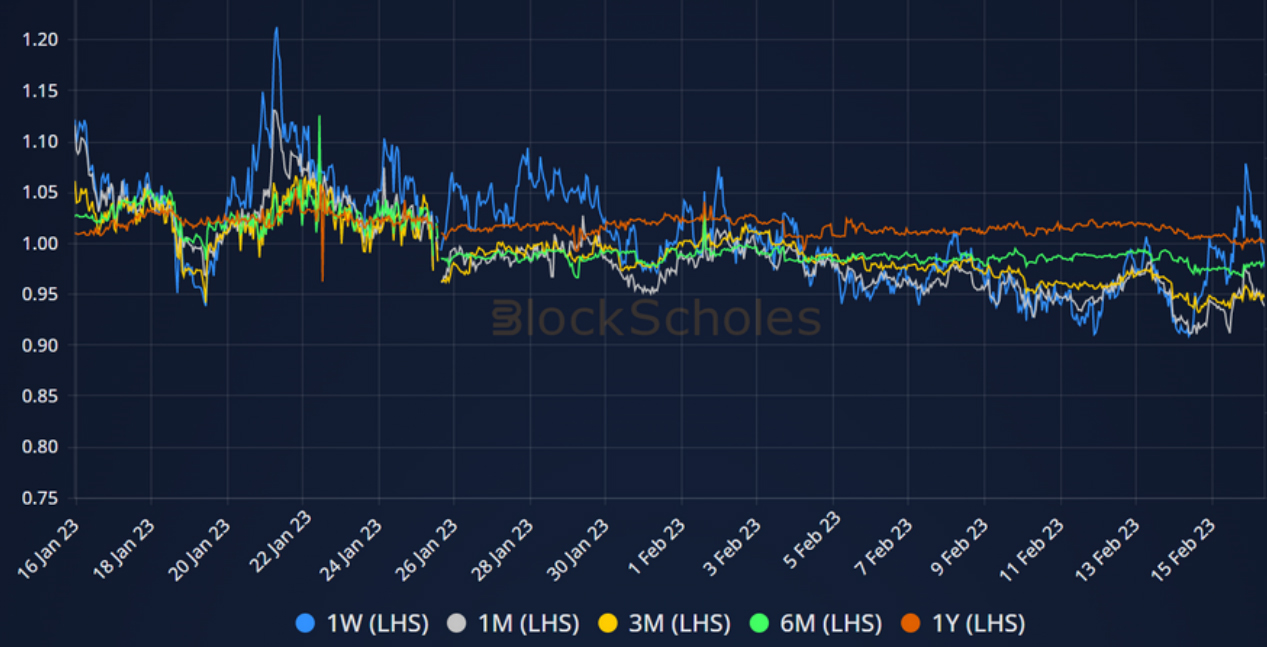

Put-Call Skew

BTC 25 DELTA PC SKEW – oscillates near to 1 at short tenors, reflecting a more neutral smile than the longer-dated skew towards OTM puts.

ETH 25 DELTA PC SKEW – reflects the relative richness in OTM puts compared to similarly OTM puts at nearly all tenors.

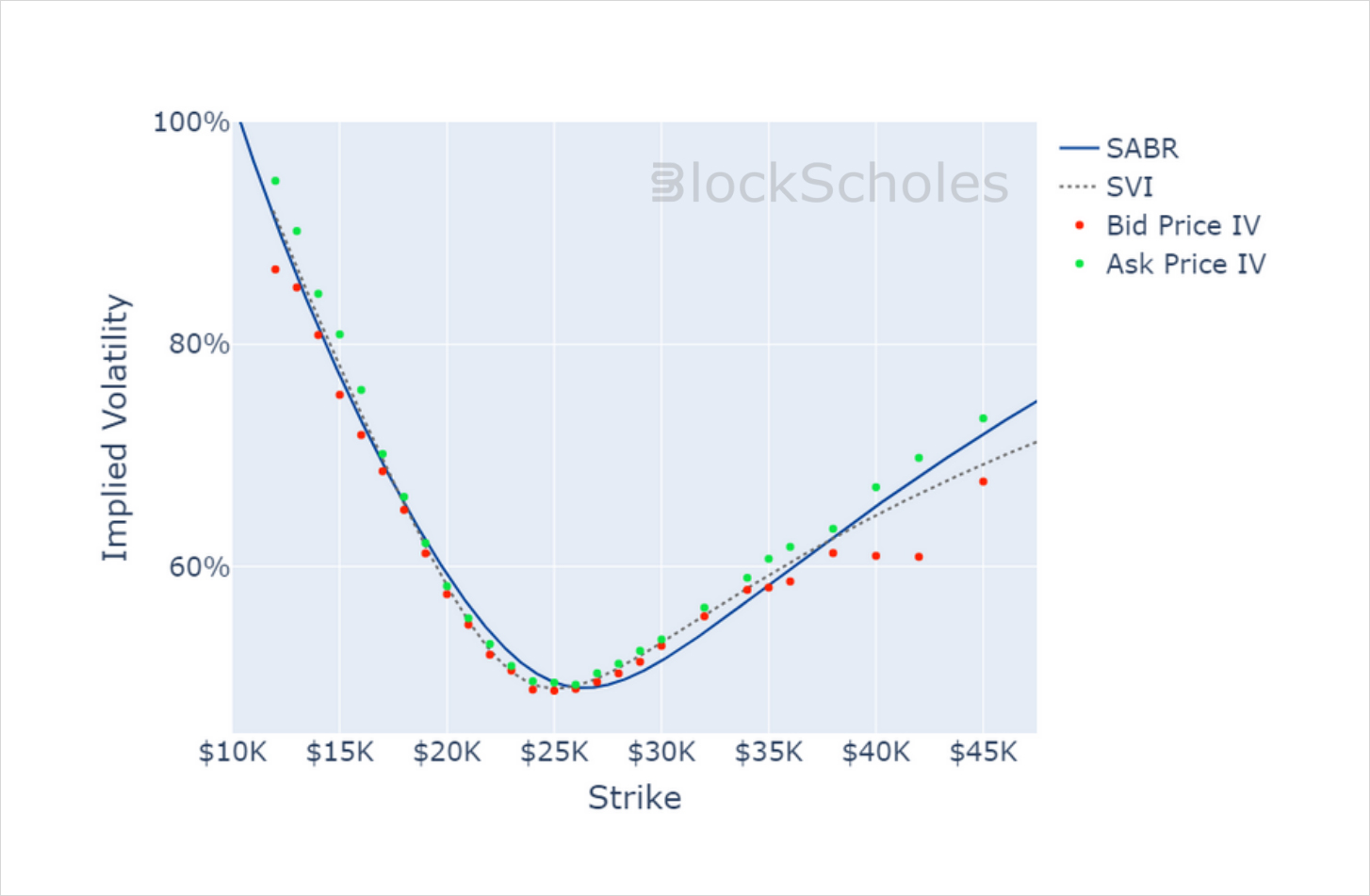

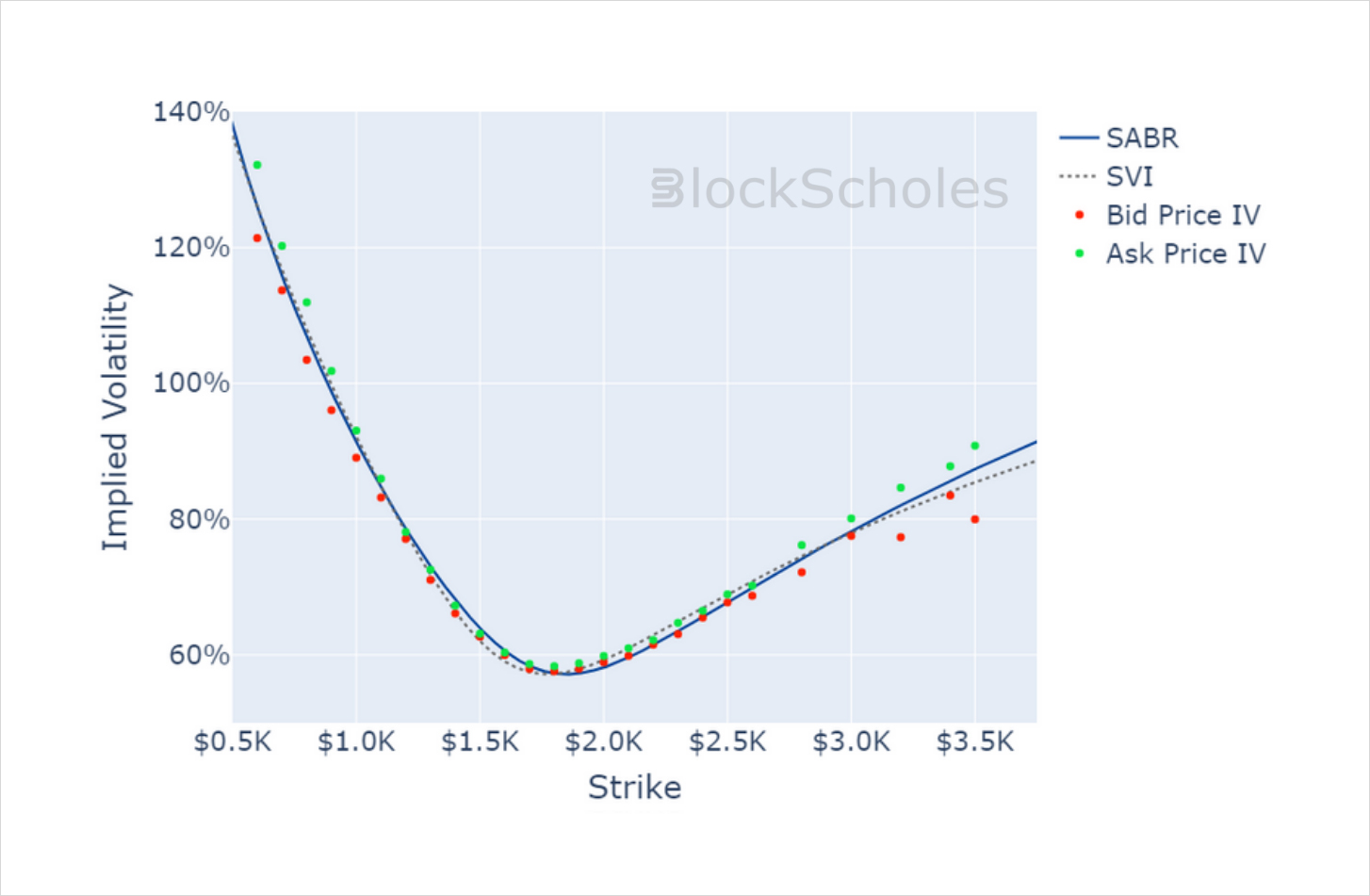

Volatility Smiles

BTC SMILE CALIBRATIONS – 31-Mar-2023 Expiry, 10:00 UTC Snapshot.

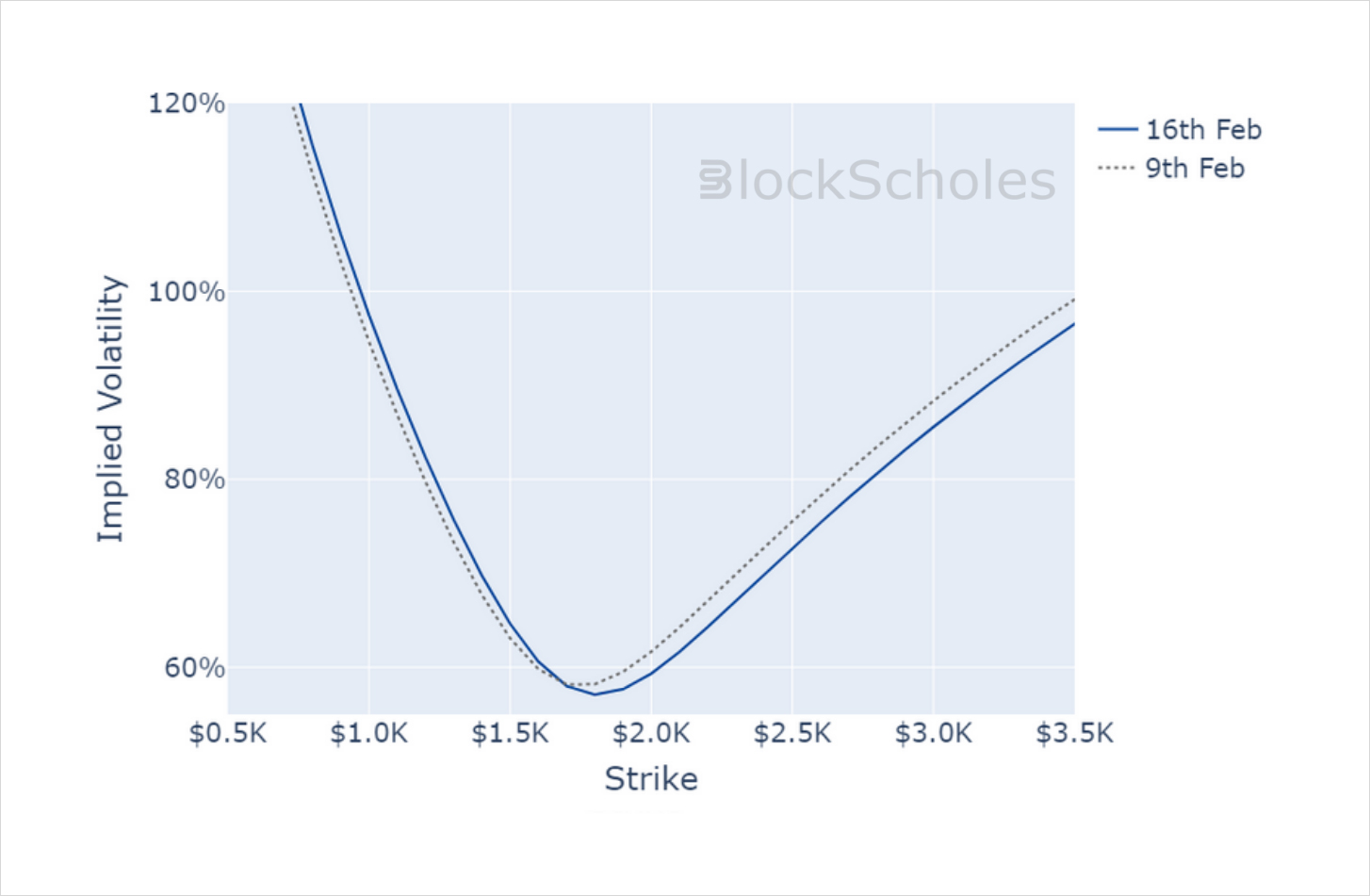

ETH SMILE CALIBRATIONS – 31-Mar-2023 Expiry, 10:00 UTC Snapshot.

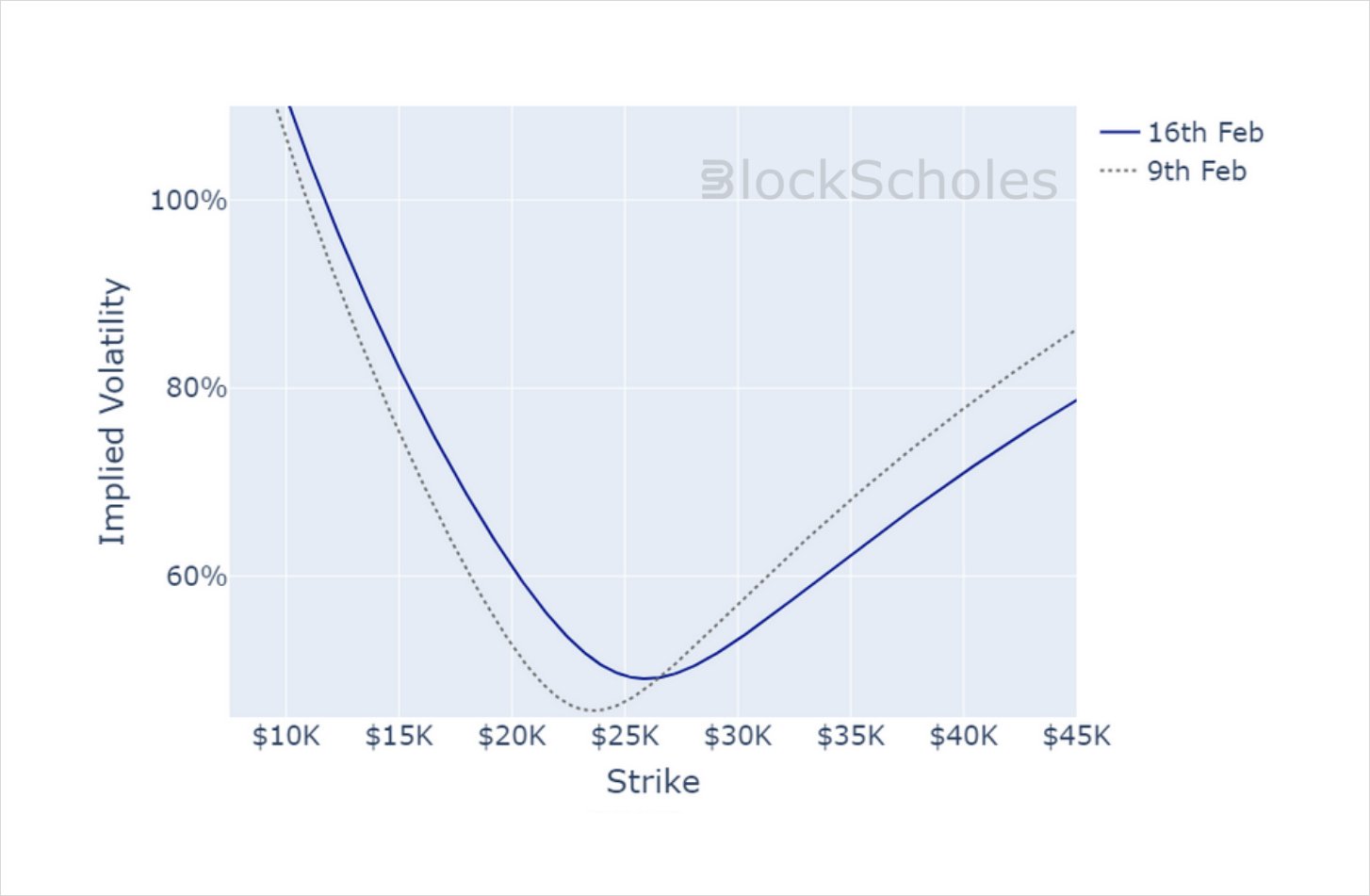

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)