Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

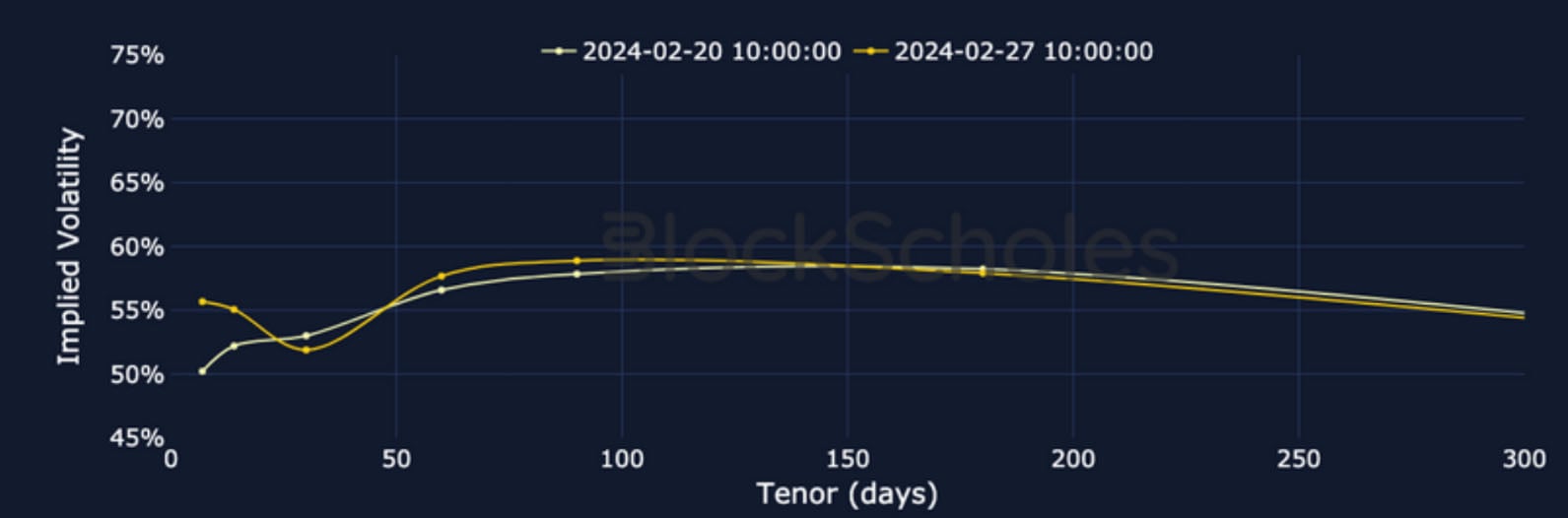

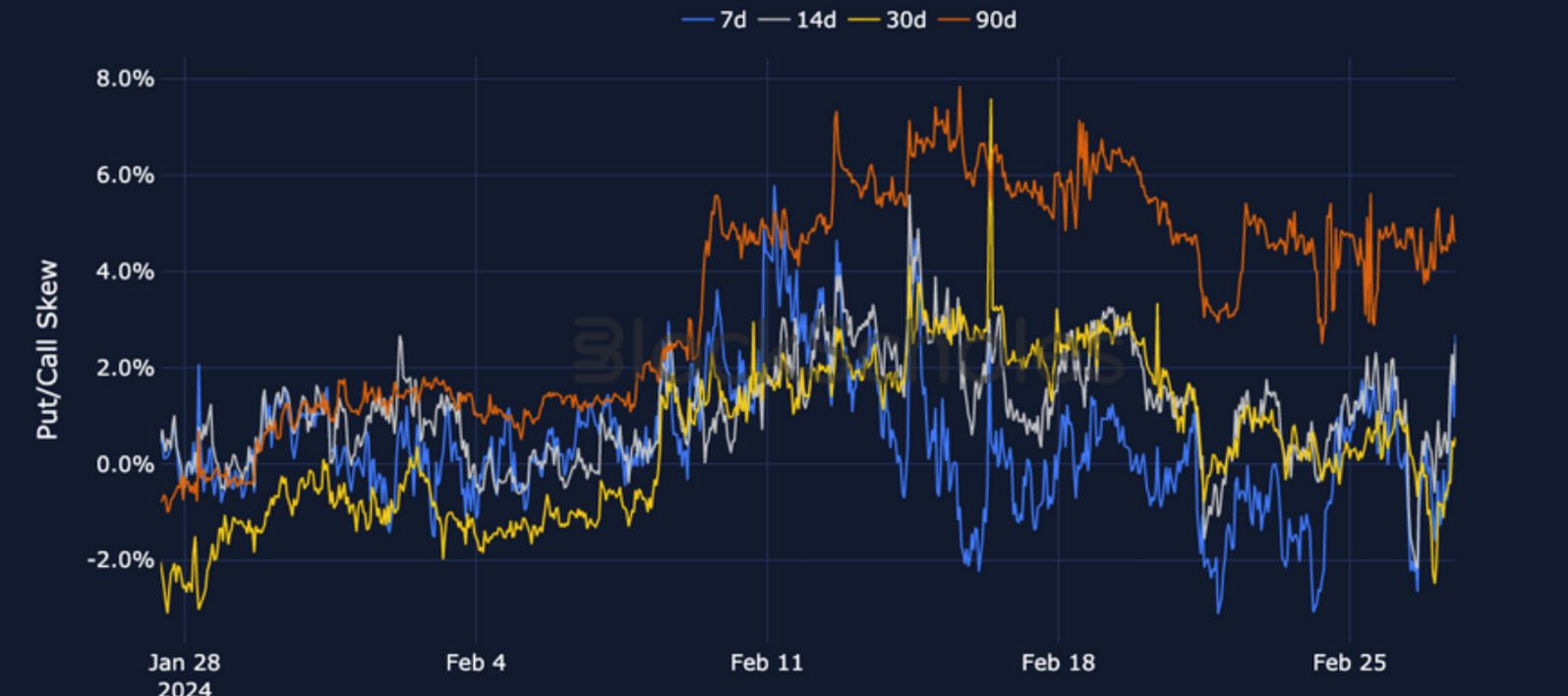

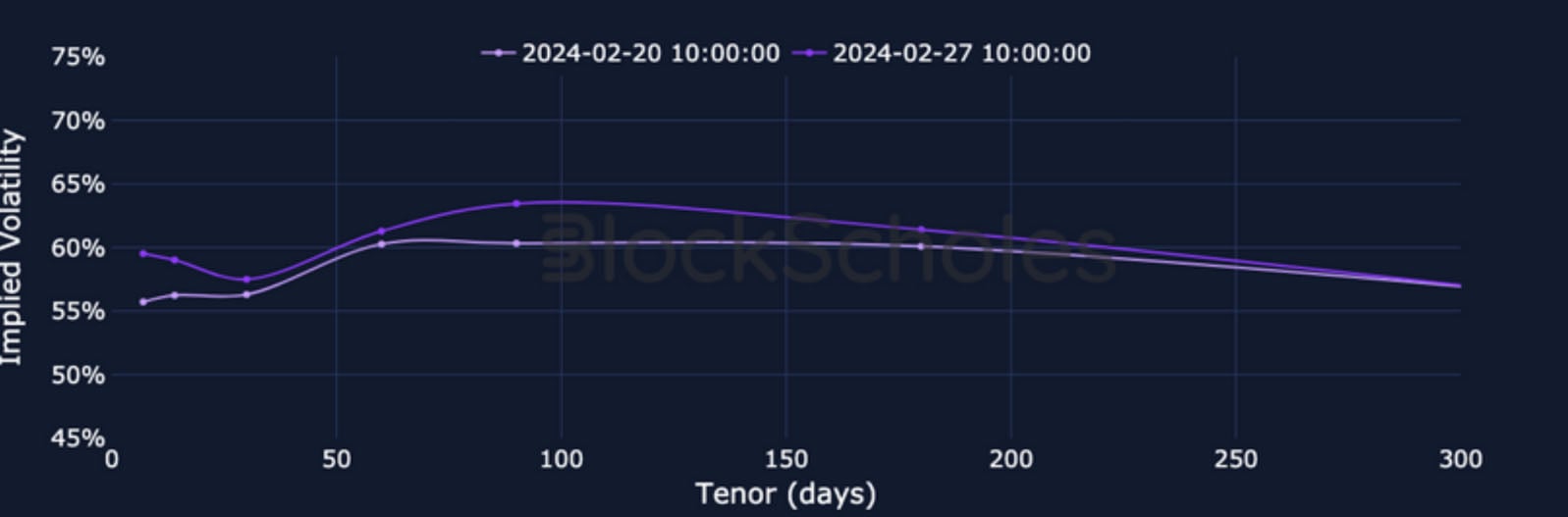

Futures-implied yields and perpetual swap funding rates have risen strongly, to levels that we saw last just before the flush out of leverage ahead of the ETF announcement in early January. We also note that both majors are pricing for higher levels of volatility, with a stronger rise at the front end of the term structure that, while not leading to an inversion, drastically compresses volatility levels across the term structure. The rally that has seen futures leverage and volatility climb higher has not had as strong an effect on the skew towards OTM puts, which for both BTC and ETH remain either neutral or put-skewed at short tenors.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

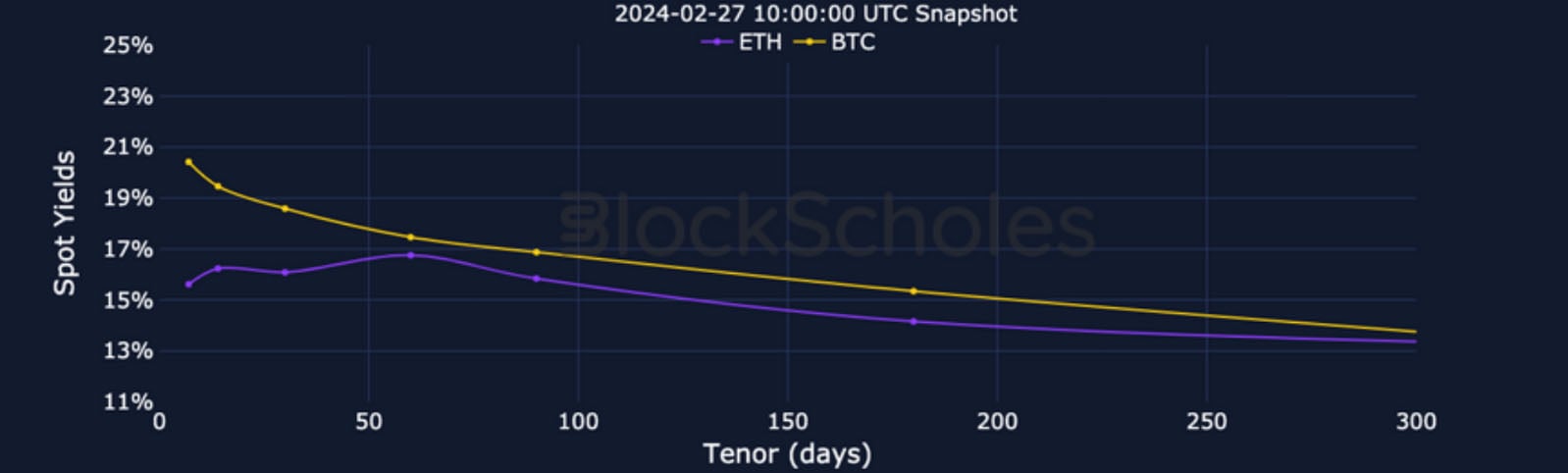

BTC ANNUALISED YIELDS – yields are at their highest values in over a month, trading at 20% at an annualised rate for 1-week tenors.

ETH ANNUALISED YIELDS – ETH’s yields have not spiked as high, but nonetheless trade at historically elevated levels.

Perpetual Swap Funding Rate

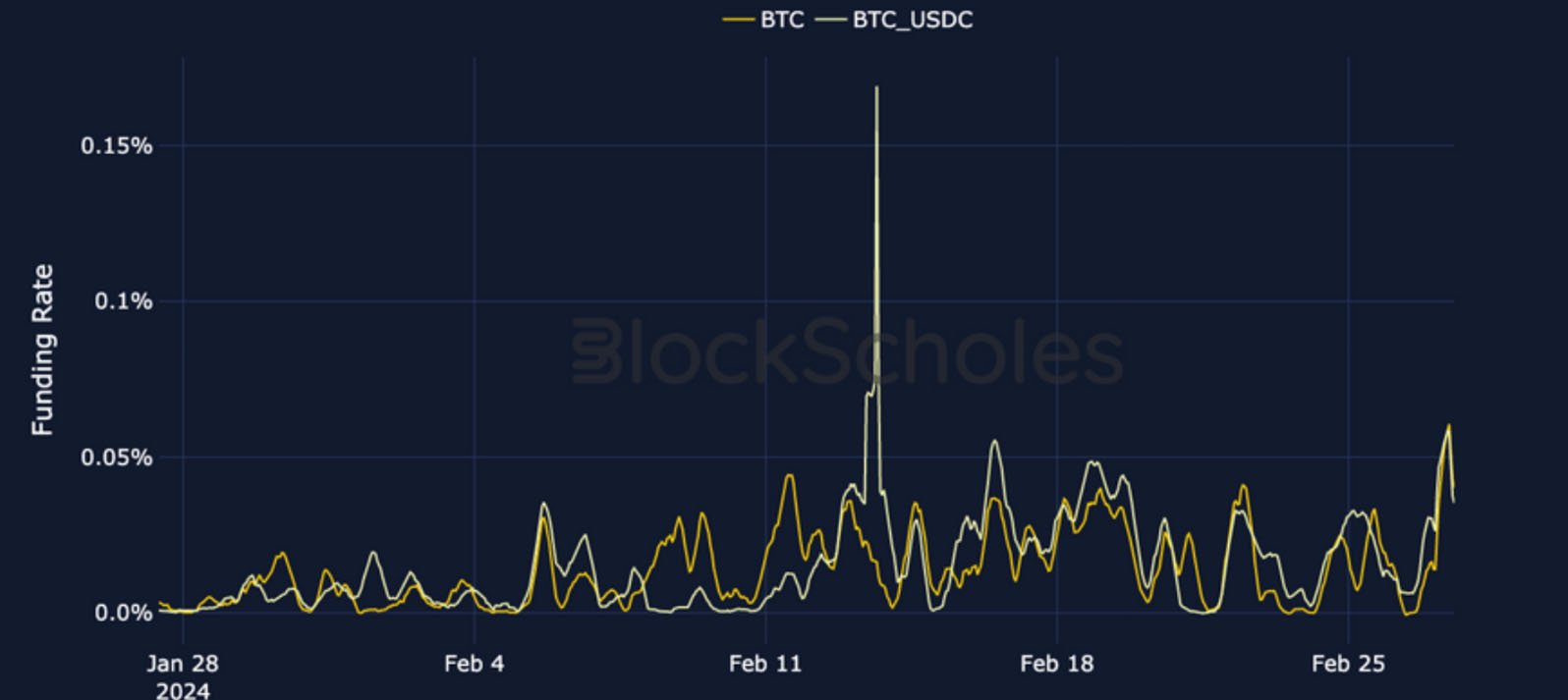

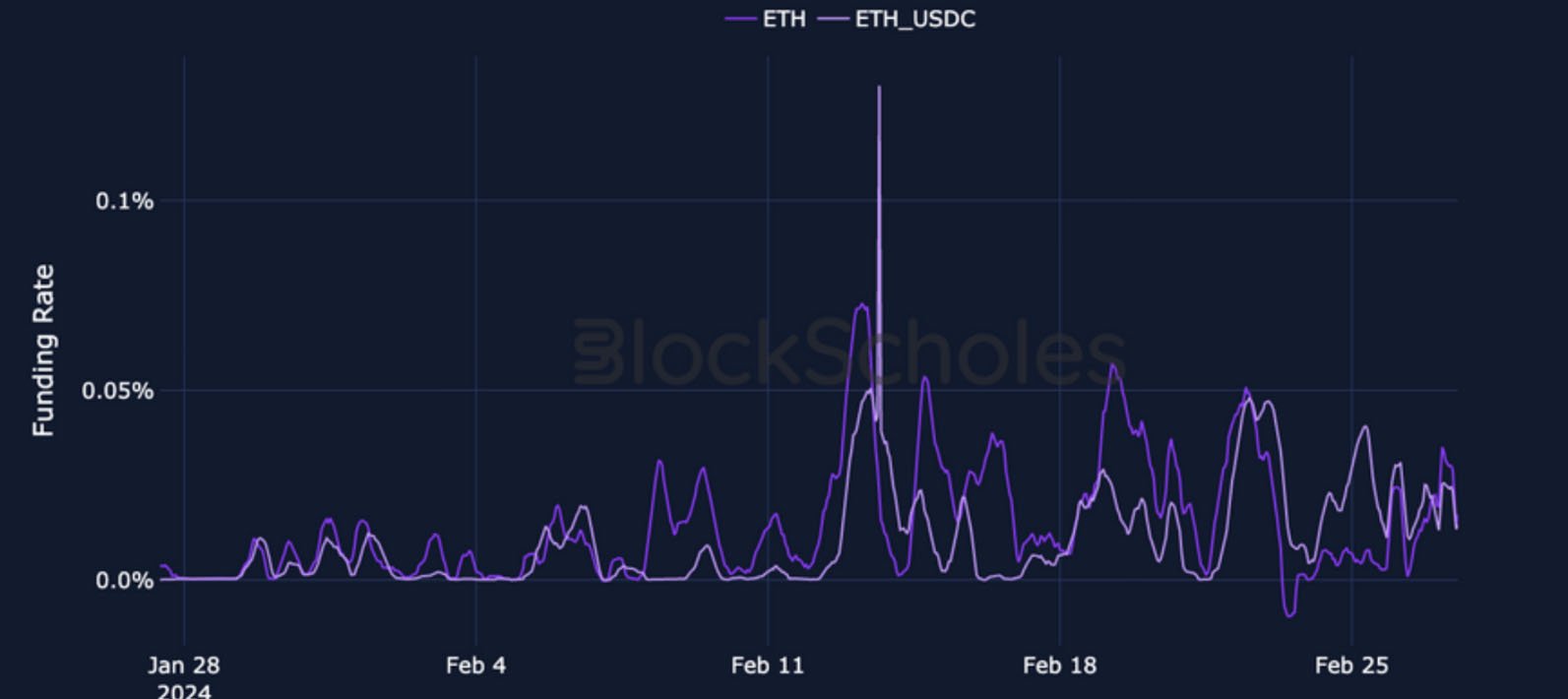

BTC FUNDING RATE – funding rates now trade close to the persistently high levels that saw a flush out of leverage in January.

ETH FUNDING RATE – funding rates have remained at consistently high levels, indicating continued strong demand for leveraged long exposure.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – the volatility term structure has compressed as short-tenor vols have led the rise to levels above 60%.

BTC 25-Delta Risk Reversal – the skew of BTC’s vol smiles remains towards OTM calls at a 3 M tenor only, with shorter tenors neutral.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – ETH’s ATM vols have risen near- monotonically, with vols across the term structure trading at similat levels.

ETH 25-Delta Risk Reversal – Volatility smiles remain slightly put-skewed at shorter tenors, with the 3M tenor pricing more decisively bullish.

Volatility Surface

BTC IMPLIED VOL SURFACE – the red at shorter-tenors in the volatility surface highlights the compression of the term structure over the last 24H.

ETH IMPLIED VOL SURFACE – ETH’s surface remains higher than BTC’s, rising most strongly in 3M and 4M tenor OTM puts over the last month.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

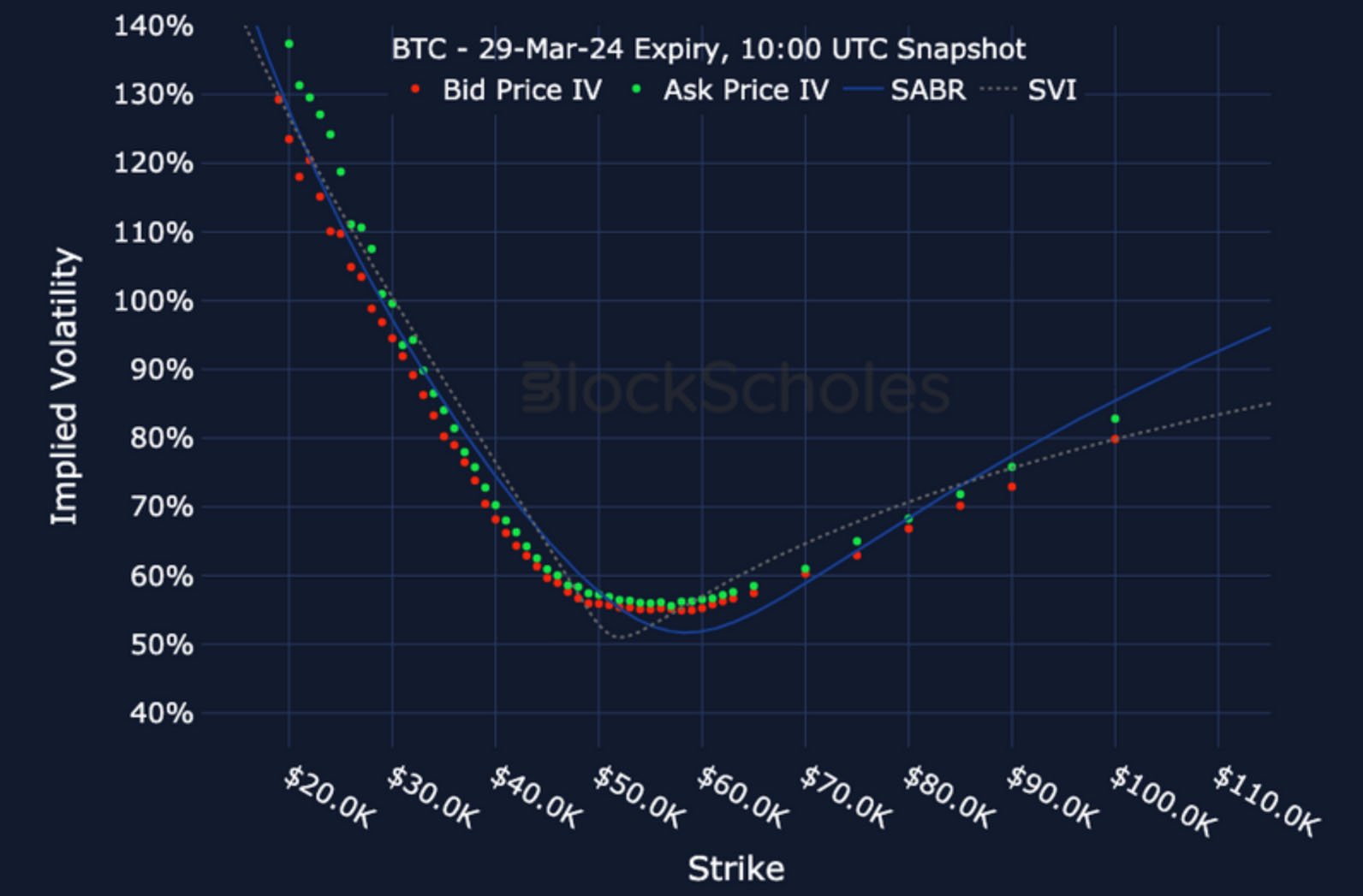

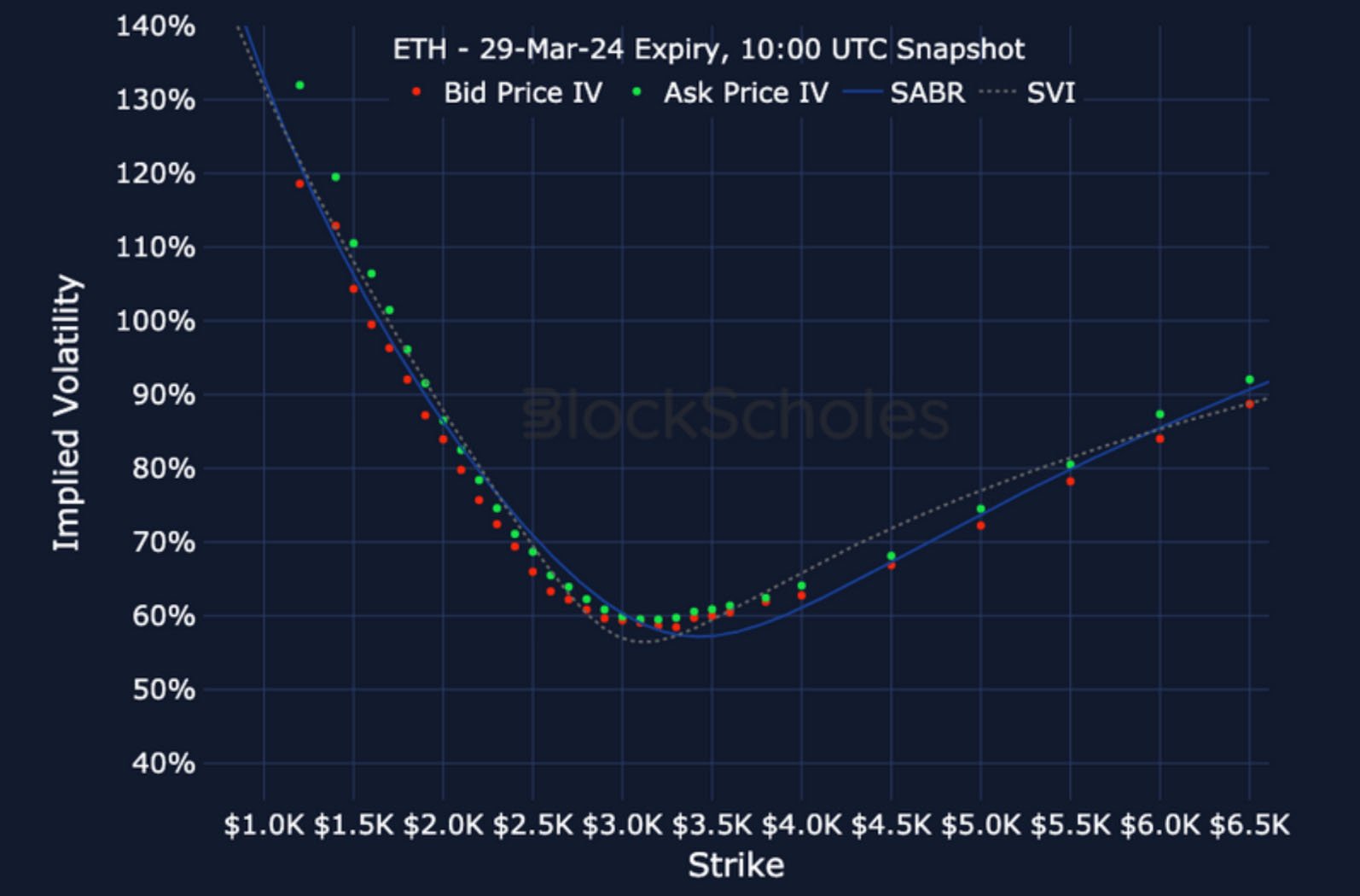

Volatility Smiles

BTC SMILE CALIBRATIONS – 29-Mar-2024 Expiry, 11:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 29-Mar-2024 Expiry, 11:00 UTC Snapshot.

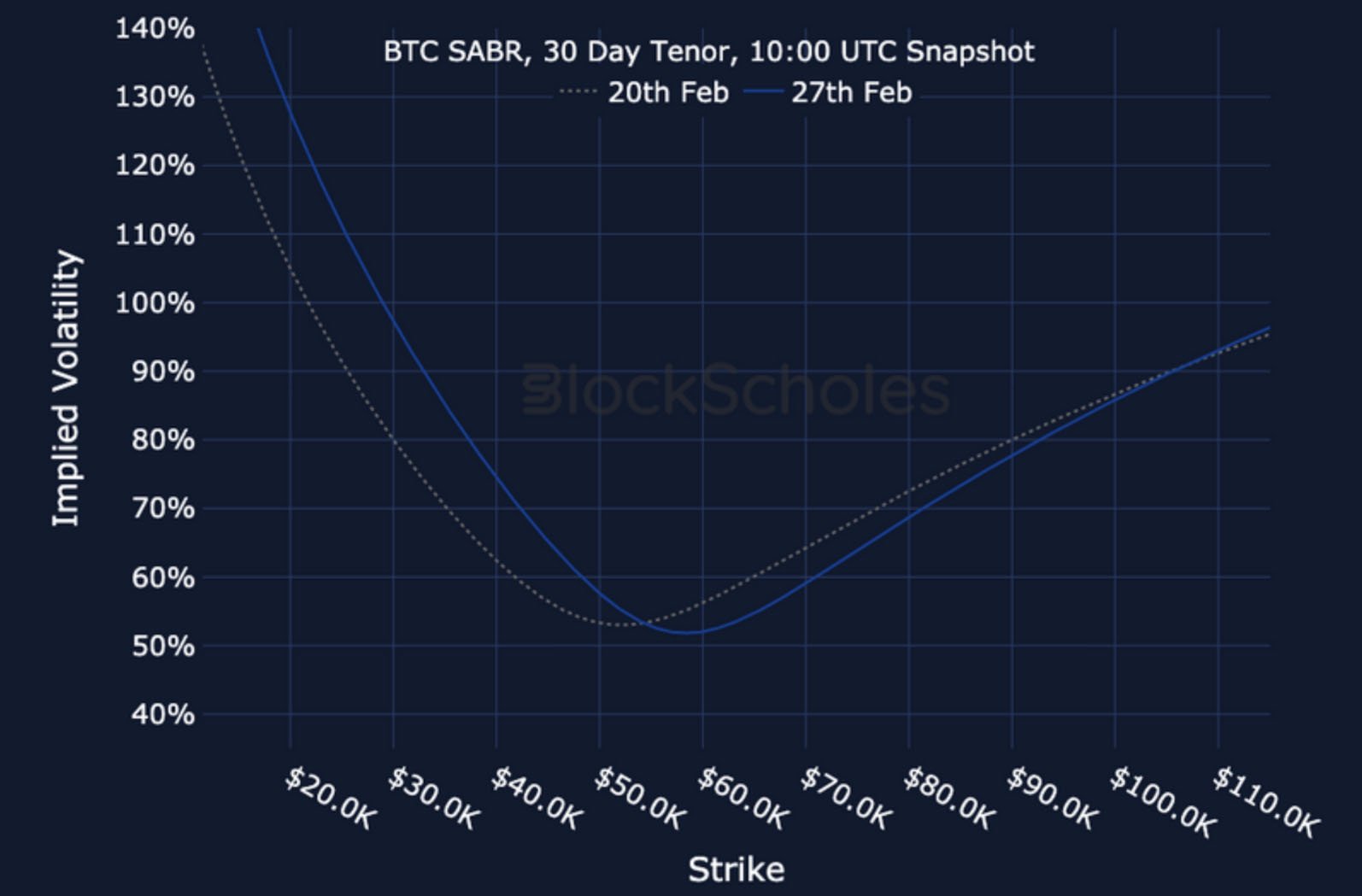

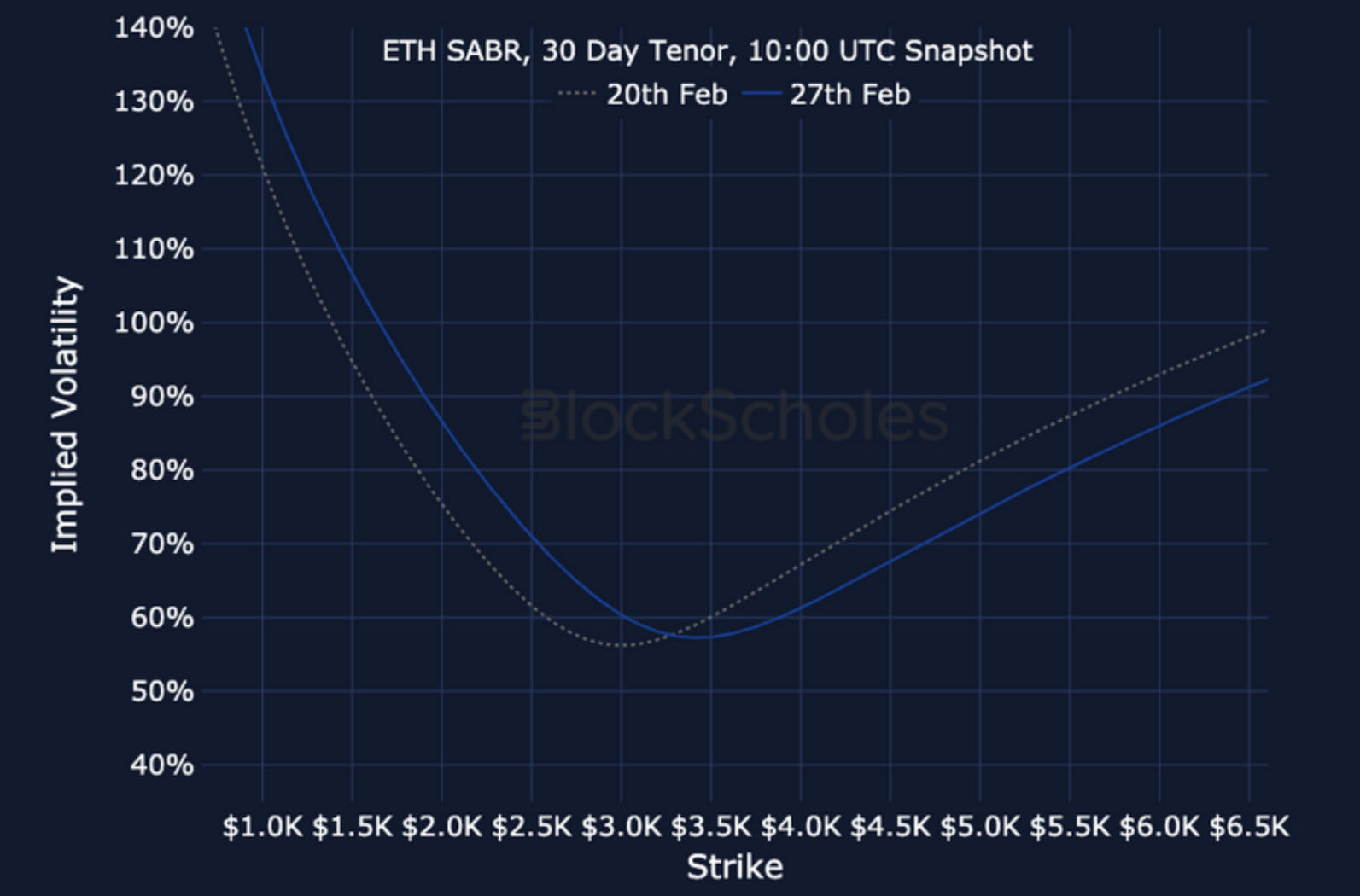

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)