The Fed Tightening Cycle Plateaus

The macro terrain continues to be rather murky to navigate. Even if the Fed tightening cycle may be behind us or primed for a long pause, as suggested by the outcome of the latest FOMC, pressing questions remain.

A pause in the tightening cycle does not necessarily imply the much-awaited Fed pivot, far from it.

What if the Fed maintains rates at high levels until something breaks? What if the banking crisis continues to snowball into the broader system? At what point will the market begin to price in the risk of a US economic recession more aggressively? One could argue that Oil is already sensing it but equities aren’t.

From this point forward, as we reach an inflection point in Fed rate hikes, their role will transition to being a more passive observer of measures on economic activity and inflation. Over the next few months, they must gather additional evidence to confirm that the current rate level of 5% is adequate to curb inflation.

The upcoming US nonfarm payrolls report this Friday will offer insight into the labour market and wage pressures, potentially influencing the Fed’s June meeting and impacting the USD and quite likely crypto.

BTC & ETH In A Phase Of Lethargy

The crypto market’s direction, particularly for Bitcoin (BTC) and Ethereum (ETH), remains unclear due to conflicting on-chain metrics and a far-from-ideal macro context.

The bullish technical aspects in both large caps are still saving the day for the large-cap assets. However, the market still faces a worrying trend of decreasing liquidity, volume constraints, stagnant stablecoin flows, no significant bridging activity, weak DeFi growth, uncertain regulatory environment (especially in the US), and flat to negative social traffic.

The bullish scenario for the crypto kings (BTC and ETH) depends on improving metrics, fresh institutional flows, an accelerated banking crisis (favouring BTC as “digital gold”), or an eventual ‘real’ Fed pivot, potentially boosting BTC and ETH.

Conversely, a bearish outcome could arise if declining liquidity negatively impacts technical aspects, in which case, one could argue the signs were written all over the wall. Despite recent intraday price volatility, in this dicey environment, Ethereum is still the weaker link, as it awaits much-needed liquidity rotation which didn’t persist after the recent upgrade.

Realized Volatility Within Familiar Ranges

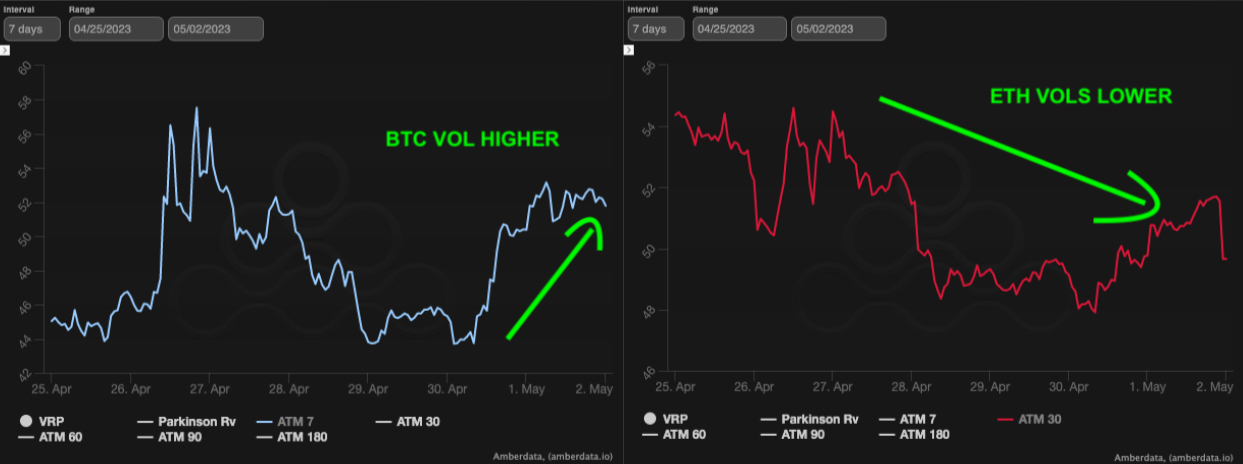

In the last week, BTC’s realized volatility climbed (10-day RV increasing by 8 points to 52.5%) due to the spot prices heightened fluctuations, despite staying within the 27k-30k range. On the other hand, ETH’s 10-day realized volatility has demonstrated more stability, ending the week marginally lower at 50%, once again positioned below BTC. The FOMC on Wednesday failed to inject much volatility in either BTC or ETH.

Diverging Implied Volatilities and Carry Challenges

Implied volatilities showed contrasting behaviour, with BTC experiencing gains (particularly in weeklies, up 5 points), while ETH’s 1-month expiry dropped by 5 points. As expected, earning carry proved challenging last week, with BTC carry turning marginally negative and ETH hovering close to zero.

Term Structures Show Waning Interest In ETH Vol

BTC’s term structure has flattened, with weekly vol increasing and long-end vol softening, pivoting around the 50-day expiry.

ETH’s term structure lowered, led by the back end as Vega was sold off due to ETH’s disappointing price action. Front-end ETH fared better due to realized vol.

The ETH/BTC vol spread narrowed to zero across the curve, as the 10-day realized spread shifted in favour of BTC, suggesting ETH’s volatility spike was temporary and unsustainable.

ETH/BTC couldnt maintain support, now in uncertain territory, which explains the vol markets waning interest in ETH vol. Its difficult to envision this spread improving on the upside given BTC’s dominance so far in 2023 and its superior safe-haven narrative.

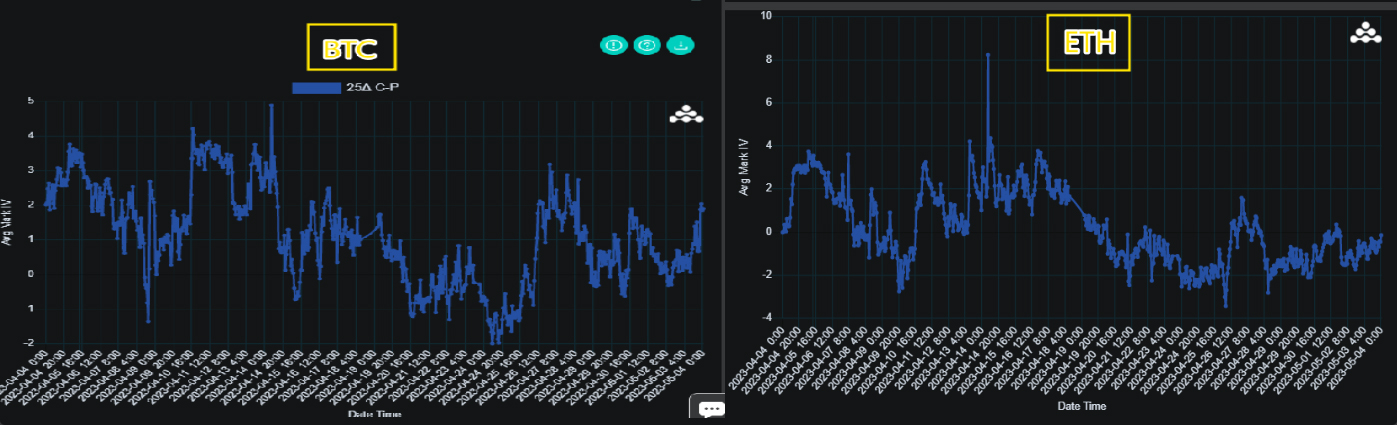

Skew Reveals BTC Optimism and ETH Downside Risk

BTC’s front-end skew remains highly volatile, tracking spot prices in both directions, while the long end is more stable, favouring call premium.

The BTC skew term structure shows put premium for weeklies, neutral for monthlies, and gradually increasing call premium for longer expiries, indicating short-term caution and long-term optimism.

ETH skew, in contrast, leans towards puts across the curve, reflecting more downside risk due to potential crypto regulation and a lack of safe-haven appeal compared to BTC during the recent banking crises.

The market seems to anticipate that if ETH volatility returns, it will be on the downside, whereas in a bullish crypto scenario, BTC is expected to lead and maintain dominance.

Option Flows And Dealer Gamma Positioning

Last week’s volumes were below average, but we suspect they will increase due to the upcoming FOMC and NFP events this week. In BTC, as the market remained in the 27-31k range we saw vol seller sell short-dated downside and strangles. Directional upside was bought in May calls and call spreads. Limited hedging flows appeared in June risk reversals.

Despite ETH’s underperformance, flows remained mainly bullish. Notable transactions included calls, call spreads and bullish risk reversals. Some chunky put hedges were acquired in 05May and 30Jun puts.

BTC dealer gamma experienced a sharp increase as BTC shifted away from the 28k strike towards Friday’s expiry, with fresh ATM gamma supplied in the 28-29k range. BTC dealers turn short again if the price rises above 30k or drops below 27k. ETH positioning temporarily turned negative when the spot price exceeded 1900 last week but couldn’t sustain it, reverting to long as dealers held the 1800 strike across multiple expiries. A move above 2000 would be required for a substantial shift towards a shorter position.

Strategy Compass: Where The Opportunity Lies?

We anticipate lower liquidity and are raising our hedge ratio. Remember, ETH is closer to breaking key support than BTC, so added hedges here makes more sense. We expect ETH to exhibit a higher risk asset beta than BTC, which is evident in the skew.

Outright June puts in ETH look attractive from a hedging perspective with ETH vol being relatively cheap and volatility carry neutral. We also have non-farm payrolls as a potential catalyst for volatility this Friday.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)