Summary: This week’s price action revealed that there will be enormous buying power of $8-24 billion unleashed into Bitcoin once the ETF is approved. For every $2 billion of inflows – as measured by the change in market cap for the stablecoin Tether, we see a statistical relationship of a +4% rally in the price of Bitcoin. BlackRock is not waiting for anybody else to eat their (Bitcoin) lunch – neither should you.

Analysis

BlackRock lost the fight for the most valuable Gold ETF years ago, and they are doing everything to make sure this will not happen to the next digital Gold – Bitcoin – as it becomes inevitable that the US Securities and Exchange Commission (SEC) will approve an exchange-traded-fund (ETF) based on Bitcoin spot prices.

State Street Advisors launched the SPDR Gold Shares ETF (GLD) on November 18, 2004, when an ounce of Gold exchanged hands for $400. Today, an ounce of Gold is worth $1,930. BlackRock launched the iShares Gold Trust ETF (IAU) two months later, on January 21, 2005. But despite iShares offering a competitive product with a meager expense ratio of just 0.25% (vs. SPDR’s 0.4%), the iShares Gold Trust ETF has only a market capitalization of $25bn vs. SPDR Gold Shares ETF of $56bn.

Those two ETFs have captured a combined value of $81bn. That number is critical. It doesn’t matter who wins the Bitcoin ETF race. Instead, we care about how much inflows we see in Bitcoin.

As Bitcoin offers a hedge against excessive money printing, especially as the US government appears to be somewhat on the loose fiscal side, we can assume that Bitcoin as an asset will continue gaining ground. Notably, a macroeconomic distinction exists between an inflationary hedge (Gold) and a monetary investment (Bitcoin). As a recession looms in Europe and US inflation appears to be in check, the money printing machines will eventually be switched on again, which is when Bitcoin will thrive. No matter where you stand on this inflation/deflation question, having exposure to both might be a worthy hedge.

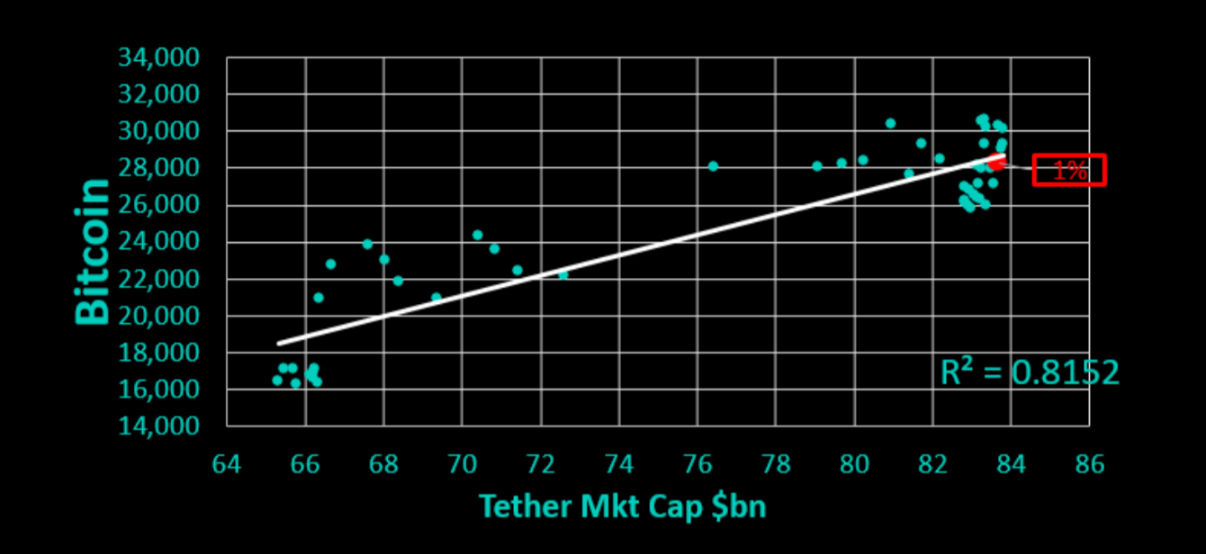

It is fair to assume that 10-20% of those Gold ETF holdings would be switched to Bitcoin – which has been a monetary hedge since its existence fourteen years ago. Those potential $8-16 billion inflows into Bitcoin could significantly impact Bitcoin. When we compare the change in market capitalization of the largest stablecoin, Tether, with the price of Bitcoin, we can see robust statistical relevance. For every $2 billion of inflows – as measured by the change in market cap for the stablecoin Tether, we see a statistical relationship of a +4% rally in the price of Bitcoin.

Based on Tether’s market cap, Bitcoin is precisely at the level where it should be (28,664). Adding $8 billion (through potential ETF flows) would lift our fair value to 33,100, while adding $16 billion could see Bitcoin prices rallying to 37,500. According to our model, the bullish scenario would see 30% of those Gold ETF holdings move over to Bitcoin, and the digital gold would then be worth 42,000.

Monday’s ‘false alarm’ that the SEC had approved BlackRock’s Bitcoin ETF temporarily sent Bitcoin prices +10% higher. The 28,000 strike calls with expiry for October 27, 2023, which we recommended a few weeks ago, rocketed from $220 with an implied volatility of 29% on Friday to an intraday high of $2,400 as implied volatility reached 52%, and those calls found themselves suddenly ‘in-the-money’.

As the example shows, Bitcoin rallied +10% without an official statement by the SEC, based on an unconfirmed news source. In that case, the actual approval can have a more pronounced impact, and a +20-30% rally appears to be a reasonable assumption – which would imply $16-24 billion of Bitcoin ETF inflows.

One thing is for sure: no trader can remain short into the announcement of a Bitcoin ETF approval and manage his / her risk appropriately, and Monday’s wild price action has shown that buying call options is the correct way to trade this event.

The genie is out of the bottle. Bitcoin calls are a ‘must-have’ weapon in every crypto warrior’s armor arsenal.

Another critical data point is that – expectedly – Ethereum massively underperformed. ETH volume underwhelmed with a spike in volumes of just +67%.

On the other hand, BTC volumes skyrocketed with a +180% increase to $28 billion. This is just short of $1 billion on August 30, 2023, when a US federal appeals court ruled that the SEC must review its rejection of Grayscale Investments’ attempt to convert its Grayscale Bitcoin Trust (GBTC) into an ETF. A few days ago, on October 14, 2023, news was released that the SEC would not appeal the court’s decision. These developments increase the odds that the SEC will approve a US-listed spot Bitcoin ETF within the next three months.

It’s been four months since BlackRock filed for approval, and the probability is increasing that their application will be approved. This week’s price action revealed that there will be enormous buying power of $8-24 billion unleashed into Bitcoin once the ETF is approved. BlackRock is not waiting for anybody else to eat their (Bitcoin) lunch – neither should you.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)