Summary: We remain bullish on BTC, but acknowledge the weakness around the Ethereum ecosystem – technically, ETH prices could drop to 1,200 – if the 1,550 level breaks. ETH puts are cheap, especially relative to BTC puts. Stubbornly high US CPI, an increase in oil prices, and another military conflict are dampening sentiment but should have less of an impact on crypto prices. This is the time when trade construction will be critical.

Analysis

US inflation has printed higher for two consecutive months, and the market is anxiously awaiting the next inflation print this Wednesday. Expectations are for a month-on-month flat reading. Interestingly, crypto prices were slightly negatively impacted on the days when US CPI data was released, but it would be sensationalist to claim that the last few CPI prints mattered. Understandably, nobody appears to be concerned about this week’s inflation print.

Instead, geopolitical risk is picking up, and this could have a negative impact on sentiment. With the Russia / Ukraine war still lingering on, suddenly, a new war ignited in the Middle East. While markets have shown only a muted reaction, a more pronounced effect might still occur in the next few days when we see which nations might be drawn into this conflict.

The common denominator of both wars is energy prices. Energy prices are a leading indicator for inflation but have a relatively weak statistical relevance in the day-to-day trading landscape for crypto traders.

When the Russia / Ukraine war started on February 24, 2022, BTC was up +15% one week later, ETH also rallied by +14% while Crude Oil prices were up +19%. Therefore, geopolitical risk might not be substantially negative for crypto unless we see a significant escalation.

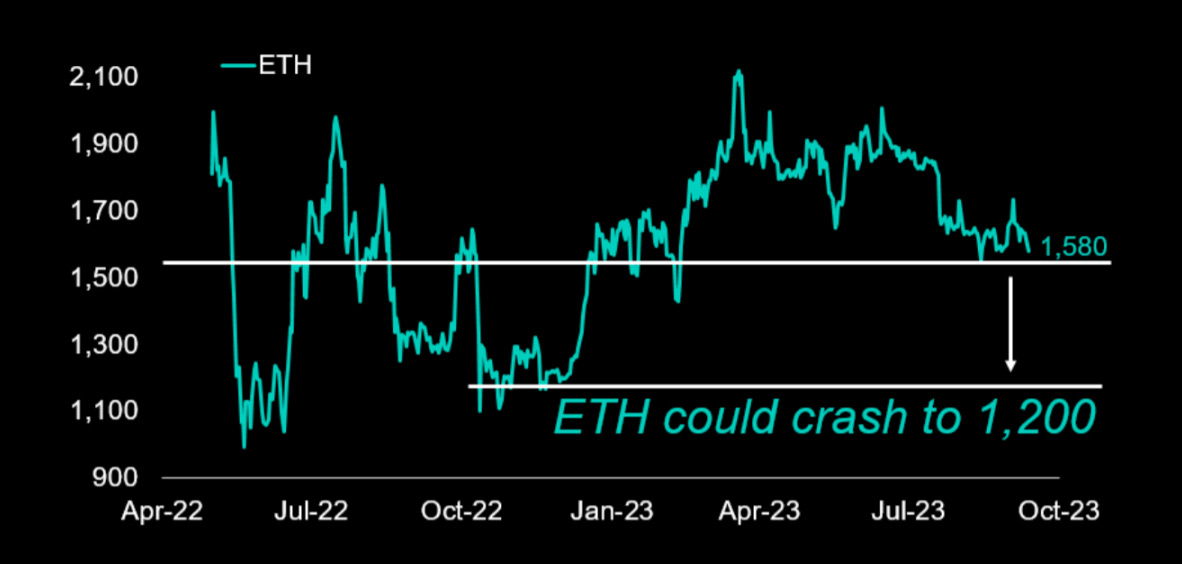

But what matters is that ETH is trading close to its multi-month support level at 1,550. This 1,550 support level might be the last line of defense before a steeping sell-off occurs. Technical support levels below this level are 1,440 and 1,200. Any ETH weakness could set off cascading liquidations and lower prices to the bigger support level at 1,200. This would catch many traders off guard, as the low implied volatility levels indicate. Traders only expect ETH prices to move by +/-3.8% until the end of the month based on option prices. During the last week, ETH prices declined by -5% while BTC prices remained flat. If the 1,550 level breaks, ETH puts could become very valuable.

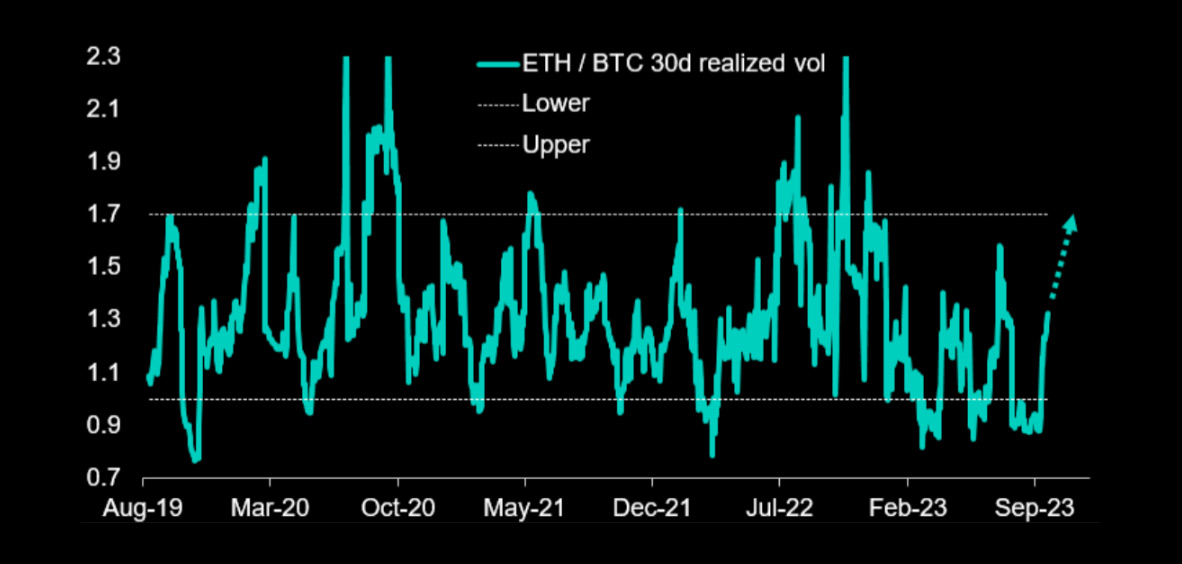

We have noticed a pick-up in realized volatility for Ethereum relative to Bitcoin. Implied levels still indicate that at-the-money volatility for Ethereum is cheaper – or similar – to Bitcoin. Historically, Ethereum’s realized volatility has averaged 40% higher than Bitcoin’s. For the October 27, 2023 expiry, the at-the-money calls and puts for BTC trade at 32.8% implied vol, while similar ETH calls and puts trade roughly at 31% implied vol. ETH vol is cheap.

Selling an at-the-money BTC put for month-end expiry to finance an ETH put makes statistical sense if markets enter a higher beta environment. Arguably, with the potential for a broader military conflict, this trade appears attractive from various risk/reward standpoints.

ETH rallied last week on expectations of the Futures-based Ethereum ETFs in the US, but disappointing trading volumes during their first week of trading show that Ethereum does not have much going for itself right now. ETH issuance is higher than the burn, implying that ETH has become inflationary again. Revenues for the Ethereum blockchain continue to be minuscule. At least Bitcoin has the ‘Blackrock’ spot Bitcoin ETF application going for itself, and relative performance speaks volumes as the BTC / ETH ratio continues to climb higher.

When geopolitical risk becomes challenging to quantify, traders are well advised to trade ‘relative value’ – matching longs against shorts, instead of running with outright exposure. While ETH has not yet broken its 1,550 technical level – and might not do so – traders could finance the ETH put by selling a put on BTC for near zero cost currently, while historically, ETH realized vol was, on average, 40% higher than BTC vol.

To clarify, we remain bullish on BTC but acknowledge the weakness around the Ethereum ecosystem – technically, ETH prices could drop to 1,200 – if the 1,550 level breaks. ETH puts are cheap, especially relative to BTC puts. Stubbornly high US CPI, an increase in oil prices, and another military conflict are dampening sentiment but should have less impact on crypto prices. This is the time when trade construction will be critical.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)