Smart traders will use the calmness of the Bitcoin options markets to position themselves for a potentially volatile October and an explosive end of the year. While the market is focused on the $2bn of calls and $1.2bn of puts (in notional US$) end-of-the-quarter expiry this week, several cataclysmic events could impact the direction of Bitcoin prices.

Bitcoin’s implied volatility percentile (IV Percentile), an indicator that shows the percentage of time when implied volatility has been lower than the current level, shows that volatility was only lower in 11% of the observations. As volatility is crucial in evaluating option values, a lower level shows that option prices are cheap, relative to history. The IV Percentile for Ether is even lower at 6%, which usually trades 30-40% above Bitcoin’s.

Either market makers do not appear to expect significant price moves, or traders have been lured into the range-trading market structure and are willing to sell short-dated options to collect some extra premium. Either way, this could be a misjudgment and an opportunity that smart traders could take advantage of.

The probability that Bitcoin will break out or break down from its $26,000/$27,000 trading range is relatively high during the next few weeks. The potential catalysts for a breakout are a US-listed Bitcoin ETF approval that the US Securities and Exchange Commission (SEC) has to approve or postpone until January, and the SEC will also have to address the Grayscale Investments request to convert the Grayscale Bitcoin Trust into an ETF in October as was ordered by a court ruling.

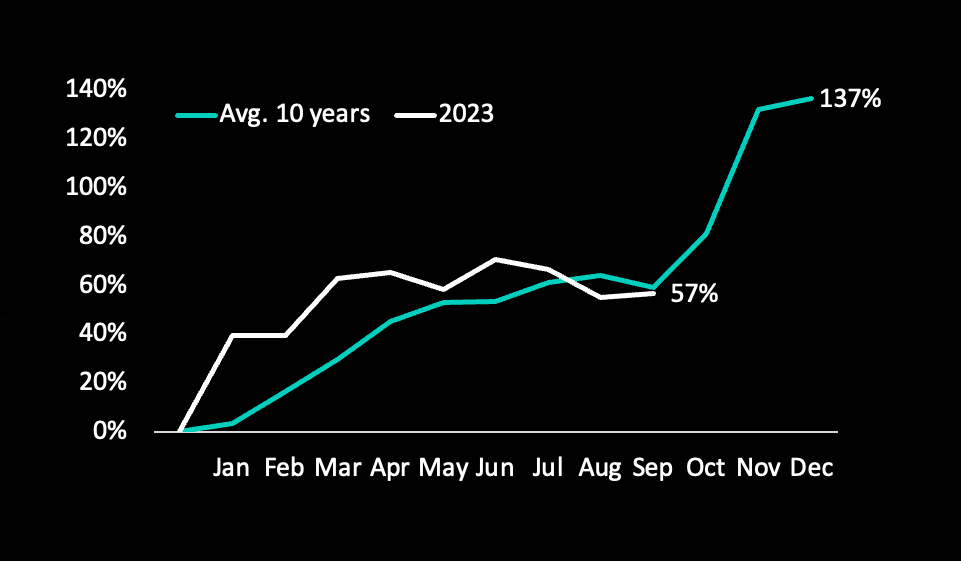

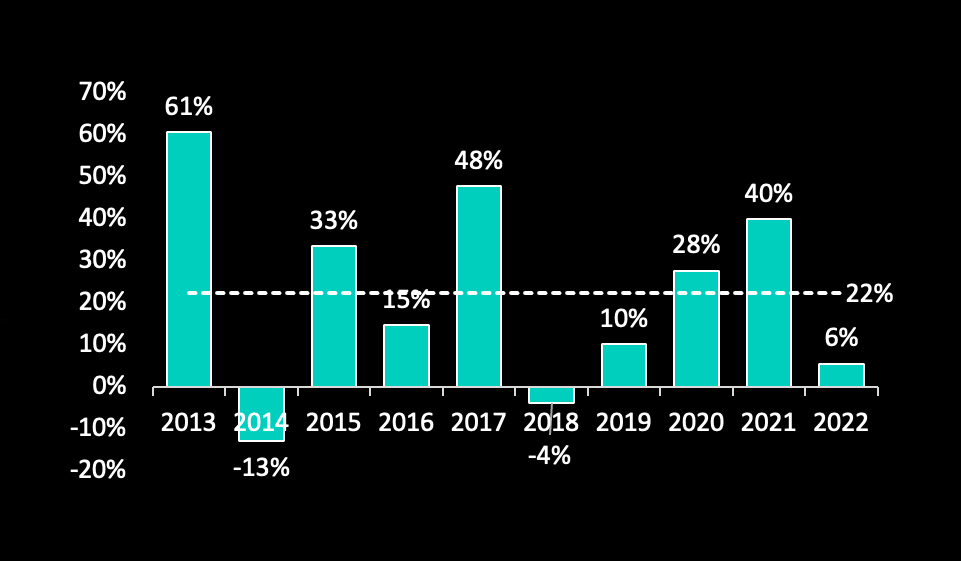

During the last ten years, the average return for Bitcoin in October has been +22%, with only 2014 (-13%) and 2018 (-4%) registering negative returns. This shows that Bitcoin has an 80% hit ratio (8 out of 10) to generate positive returns in October. Bitcoin returned +6%, +40%, +28%, and +10% during the last four years in October.

These potential catalysts could cause a material re-pricing higher for Bitcoin, considering the low implied volatility (36%) of a $28,000 Bitcoin call expiring on October 27, 2023, valued at $535 or 2.0% of the notional amount. The two percent cost for a call option vs. twenty-two percent average returns in October appears exciting.

On the flip side, the strength of the US dollar and rising US bond yields are damaging US corporate margins and the ability to attract capital at competitive rates. This could cause an economic recession, as predicted by the inversion of the 2-10-year Treasury Yield curve. As a result, US stocks have gradually declined from their July highs, and this year’s highflyers (Nvidia, Apple, etc.) are no longer carrying the equity market to new highs. There could be a spill-over effect into crypto, with prices breaking the $25,000/$26,000 support level.

A $24,000 strike put option expiring on October 27, 2023, costs $340 or 1.3% of the notional amount with an implied volatility of 40%. Pairing puts, and calls (buying a strangle – as the strike prices are different) would, therefore, cost 3.3% (2.0% for calls and 1.3% for puts), and as long as Bitcoin trades outside of these ranges (plus the option costs), then an investor could make money.

These odds seem in traders’ favor, considering the upside and downside catalysts that Bitcoin faces in October.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)