Sharp Drop Fueled by Derivatives’ Liquidations

Bitcoin (BTC) and Ethereum (ETH) suffered a drop of over 10%, their steepest since Nov 2022’s FTX downfall. Unlike last time, no specific trigger for this decline stands out, despite various news stories attempting to shed light.

Notably, over $1 billion was liquidated in the wake of this fall, echoing the Three Arrows Capital debacle from June 2022. A significant portion of this can be traced back to gamma-related perp liquidations of BTC and ETH on Deribit and OKX. Together, these exchanges oversaw a staggering 50% of all liquidations during this period, dwarfing their 17% combined open interest. On Deribit, it seems a major player might’ve taken a hit, especially considering the pronounced ETH liquidation.

The slide might have been accelerated by a Wall Street Journal piece revisiting SpaceX’s Bitcoin markdowns from 2021. This sparked chatter around whether Tesla had followed suit, fuelling rumours of Musk cutting ties with crypto. This feels like a throwback to 2021 and 2022, when the market was swayed by Musk’s crypto sentiments – quite absurd!

There’s also talk that this downturn was influenced by the SEC’s hesitation over a US-based spot BTC ETF and the delayed decision on Grayscale’s lawsuit against the SEC.

It’s worth noting that macro events and market conditions might also be at play acting as a drag for cryptos. US 10-year yields made a new 16-year high and there’s a notable uptick in USD buying. We’re all eyes and ears for Powell’s speech at Jackson Hole this Friday.

Volatility Back In Full Swing

Crypto volatility increased sharply last week, with Bitcoin dropping below 28k and Ethereum breaching the 1800 mark. This led to significant liquidations, notably on Deribit and OKX.

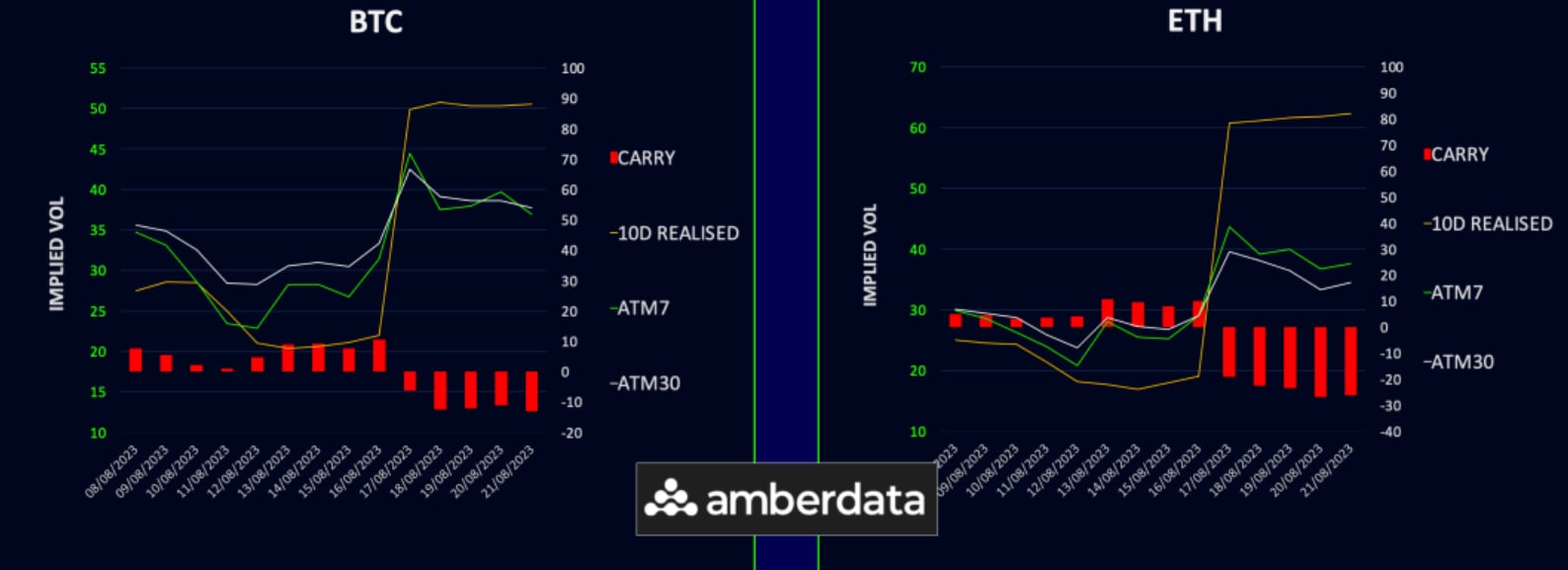

Implied volatility rose but has begun to normalize after the weekend’s more stable market movements.

Carry is now deeply negative as realised vol has spiked far beyond implied vol. It may take a while for this to recover even if the market finds a new range in the forthcoming weeks as some of the vol selling appetite may have waned, especially on the front end.

Term Structure Backwardation Returns

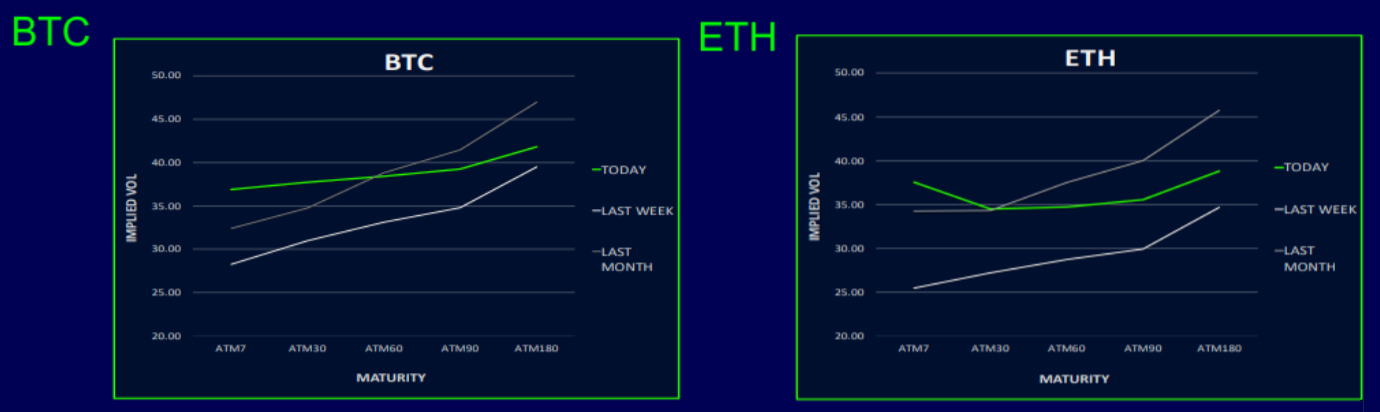

Bitcoin’s term structure briefly flipped into backwardation but has now reverted to a slight contango again. This week, front-end volatility increased by 5 points, while the back-end rose just 1 point. For those thinking this volatility won’t last, long calendar strategies might appeal.

Ethereum’s term structure showed a greater spike than Bitcoin’s and is currently in backwardation. Front-end weekly volatility surged by 10 points, with the back end gaining 3-4 points. Holding a long volatility position paid off, but it required a delta-neutral stance, which many lacked.

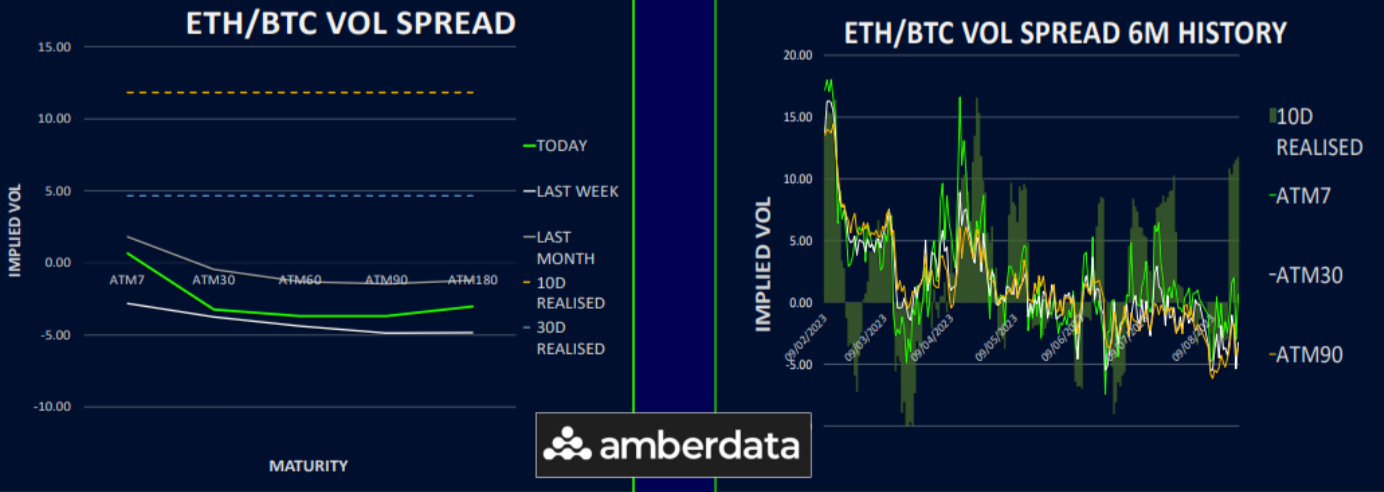

ETH/BTC Vol Spread Pokes Its Head Above Zero

The ETH/BTC volatility spread has seen a minor recovery. The front end now favours ETH, particularly as ETH’s recent performance outstripped by over 10 vols. The long end, however, remains wary due to past underwhelming ETH results and significant overwriting flows.

Should the downturn in the crypto market persist, we’d anticipate ETH to exhibit greater movements than in recent times, potentially pushing the vol spread above zero. Conversely, if the market rallies, there’s a strong chance we’ll see an excess supply of ETH volatility. This could suppress ETH’s realized volatility, keeping the spread negative for an extended period.

Major Shifts In Front-End Skew

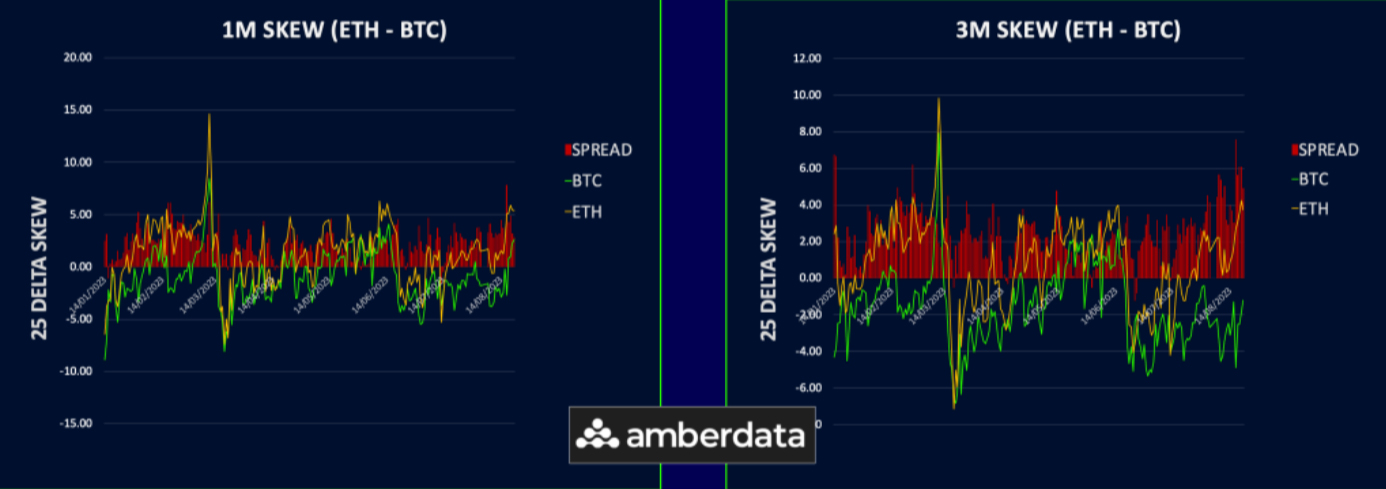

Skew faced significant adjustments this week as markets trended downwards, pushing the front-end BTC skew to a 4 vol put premium. The mid-curve settled around neutral, while the back-end retained its call premium close to 3.5 vols.

ETH skew, already leaning towards a put premium, intensified, with most timelines presenting a 4-5 vol put skew. The far back end stayed at roughly 2 vols in favour of puts.

Even though ETH momentarily dipped below 1500 on Deribit futures last week, it rebounded, marginally outdoing BTC. This counters the skew trend suggesting a more pessimistic view of ETH.

We reckon ETH might face resistance above 1900 without a solid trigger. If the price remains under 1700, overwriters might adjust their short-call positions and roll them down.

Option Flows And Dealer Gamma Positioning

BTC options volumes surged on 17th August, marking Deribit’s second-largest notional liquidation. There was notable put-buying activity for 25th August and 29th September, along with interest in both the purchase and sale of various call options.

ETH’s options activity increased, though not as starkly. With the price drop, we observed heightened interest in August to October 2023 puts between 1600-1500. Gamma sellers took a hit with the liquidations; they’d likely want stability before re-entering.

BTC dealer gamma turned negative due to short-term put buying, exacerbating the decline. This recent activity makes it challenging for BTC to regain its footing.

ETH dealer gamma, on the other hand, has levelled out around zero, mainly because we've distanced from the heavily sold 1900 area. Here, dealers have a more balanced position, short on local strikes but long on the wings.

Strategy Compass: Where Does The Opportunity Lie?

As BTC broke below the key 28k support, we re-entered some 29Sep23 bearish risk reversal hedges which were near zero cost (paid subscribers were alerted in real-time). We have not monetised them yet as they are protecting our holdings from further spot weakness.

For upside, we see some value in 29Sep call ratio structures on ETH as above 1800 would likely get sticky again so it’s probably safe to sell the upside tail to cheapen up close to the money calls.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)