Stability in BTC Fortified by ETF Narrative

Blackrock, a globally recognised investment management titan, has recently dipped its toes into the realm of digital assets by lodging an application for a Bitcoin spot ETF. Despite the SEC’s reservations and their call for further information, this move has sparked renewed interest in BTC.

The ETF speculation is helping BTC maintain a steady position, trading above 30k, an indication of persistent optimism in the cryptocurrency. Blackrock’s CEO, Larry Fink, fanned these flames in a recent chat with Fox Business, wherein he elaborated on the firm’s Bitcoin ETF application, even likening Bitcoin to “digital gold”.

Should Blackrock’s Bitcoin ETF, or indeed any other Bitcoin ETF application, secure approval, it’s expected to enhance public trust and accessibility in relation to Bitcoin investments. It’s noteworthy that the launch of the inaugural Gold ETF in 2003, catalyzed a significant uptick in gold prices due to amplified investment activity in the sector. The market is expecting a similar behavior if/when the ETF becomes a reality, let alone the historically bullish effects of the halving, due next year.

Pivoting to a wider economic view, looking forward, this week’s macro spotlight is on US inflation figures. The consensus doesn’t anticipate any major market impact. Instead, Bitcoin’s trajectory is predicted to continue to be molded by unfolding developments in the ETF applications and regulatory news. Specifically, there’s an air of anticipation surrounding the promise of clearer regulatory direction on stablecoins and market structures, with votes on these issues slated for this summer.

Implied Vols Plummet As Realized Subdued

The past week has seen a roughly 10-point drop in realised volatility across the two main crypto assets, as price boundaries have held firm without any breakout. With realised volatility now standing around 30%, this indicates that markets are, on average, moving about 1.6% per day.

Implied volatility also took a hit, dropping about 5 points, especially at the front end, but it hasn’t been able to keep up with realised volatility and has settled around 40%.

As a result, the Volatility Risk Premium (VRP), or volatility carry, has increased to about 10 vols, making it an attractive prospect for gamma sellers.

Following the US Consumer Price Index (CPI) report, we anticipate a further recalibration downward in implied vols, as the VRP is expected to be diminished, unless there’s a substantial breakout from the current spot range.

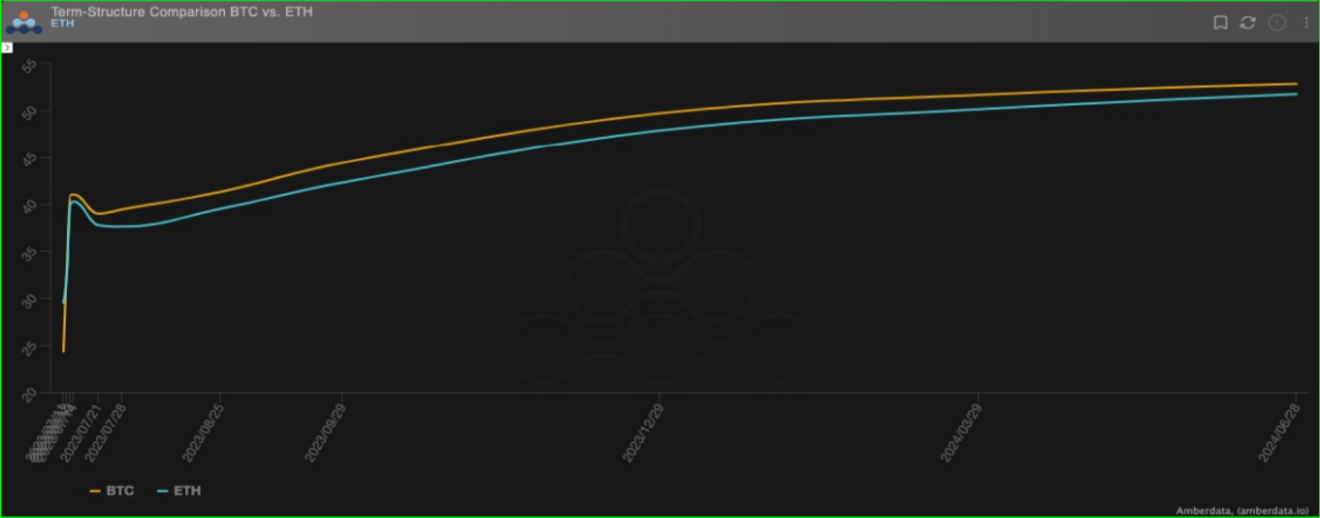

BTC Term Structure In Contango

BTC’s term structure is reverting back into contango, buoyed by low realisation, which encourages gamma sellers. This week’s implied volatility retains a premium for the forthcoming CPI data. Long- term volatility, associated with 2024 expiries, is faring better and even marking an uptick on the week.

ETH’s term structure is likewise shifting around year-end expiries. Its front end took a hit of about 7 vols as realised plummeted, but the back end received a modest boost of roughly 2 vols in 2024 expiries. This motion echoes the shift in BTC’s curve, though it’s somewhat amplified.

Volatility Spread Reverts To More Neutral Levels

ETH/BTC volatility spreads are returning to 2 vols (BTC leading) across the curve as ETH’s front end bid diminished when ETH failed to break out following last week’s strong performance.

We previously stated that persistent realised outperformance would be necessary to uphold a positive spread for ETH after BTC’s dominating run this year. It now seems that it may not be ETH’s moment to shine just yet, particularly as the ETH/BTC chart is still demonstrating a weekly downtrend.

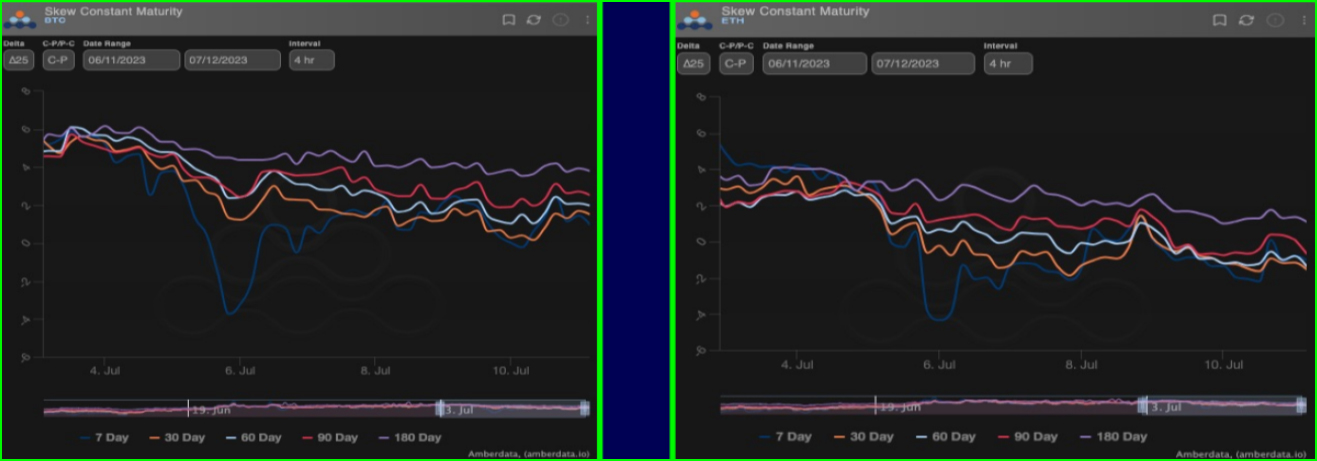

Back-End Skew Stable In Favor Of Calls

This week, skew has seen significant fluctuation, particularly the front end, which momentarily dipped into a put premium on BTC last week. However, a swift recovery ensued as the spot price once again bounced back from the near 30k mark.

As we indicated last week, the short-dated skew was likely to swiftly flip into puts if the spot price fell, and this was precisely the scenario that unfolded, while the back-end skew maintains relative stability in calls.

ETH skew experienced an even steeper decline and fell rather uniformly across the term structure. There’s still a minor call premium at the long end but absent of the halving or an ETF narrative to support ETH, demand for the upside tail is diminished. We’ve returned to a put premium at the front end, a condition that’s been more typical for ETH throughout the year.

Option Flows And Dealer Gamma Positioning

Last week saw a decline in BTC volumes due to a scarcity of volatility, yet some significant trades still took place. Buyers shelled out a premium of $5m for 29th Dec 40k calls. Also, the purchase of 29th Sep 38k calls and Mar24 35k/50k call spreads conveyed bullish sentiments.

Also, bullish tendencies were once more observed in ETH flows, particularly in the longer portion of the curve. Outright calls were bought at the 29th Dec 2200, 2400 & 3000 strikes.

BTC dealer gamma slid lower for the majority of the previous week, then bounced back near flat as some local gamma was sold over the weekend. ETH gamma positioning ticked higher as the spot failed to break and settled near the 1900 long strike accumulating in July expiries.

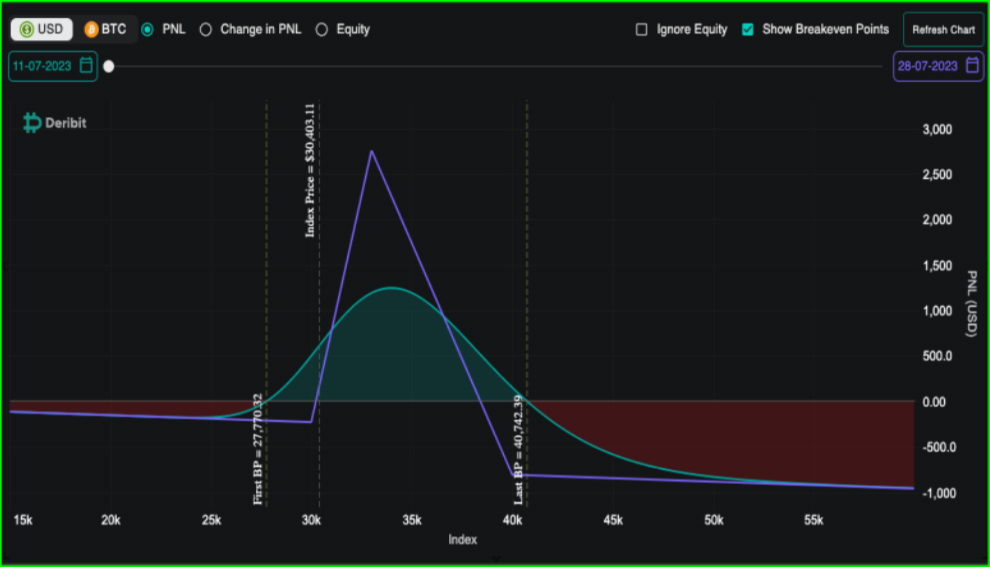

Strategy Compass: Where Does The Opportunity Lie?

We still favour the bullish scenario, particularly in BTC, but are not convinced that it need to happen that quickly. Using call fly structures allows you to gain some leverage to a gradual rally in price toward targets of around 33k over the next month or two.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)