Compared to other asset classes, volatility is often misunderstood. Volatility refers to the frequency and extent of underlying movements over a specific period. In traditional finance (TradFi), volatility-as-an-asset is widely traded, with the Chicago Board Options Exchange (Cboe) VIX and its derivatives, including VIX futures, swaps, and options, being the most popular products. In the crypto world, on March 27, 2023, Deribit is set to introduce the first BTC DVOL futures, which is a derivative based on its BTC volatility index.

DVOL Index

The Deribit volatility (DVOL) index is the volatility index of cryptocurrency options made by Deribit, and it measures a 30-day forward-looking expected volatility (implied from options), not backward-looking realized volatility (computed from underlying price time series).

The DVOL is expressed as an annualized volatility expectation. As a rule of thumb, to get the expected daily move for BTC price, simply divide the DVOL value by 19 (the square root of 365). For example, DVOL with 57 gives an expected daily move of 3%.

Similar to the BTC index, BTC DVOL is a time series. However, unlike the BTC index, there are no tradable products available in the market that provide pure DVOL index exposure – at least not until March 27, 2023, when Deribit will introduce its first BTC DVOL futures contract.

BTC DVOL and Index. Source: Deribit

DVOL Futures

Prior to this, the volatility index is just a measurement tool and not a tradable product. To gain volatility exposure, traders need to use derivatives such as futures, swap or options which can transform the volatility index from a measurement tool to tradable asset class.

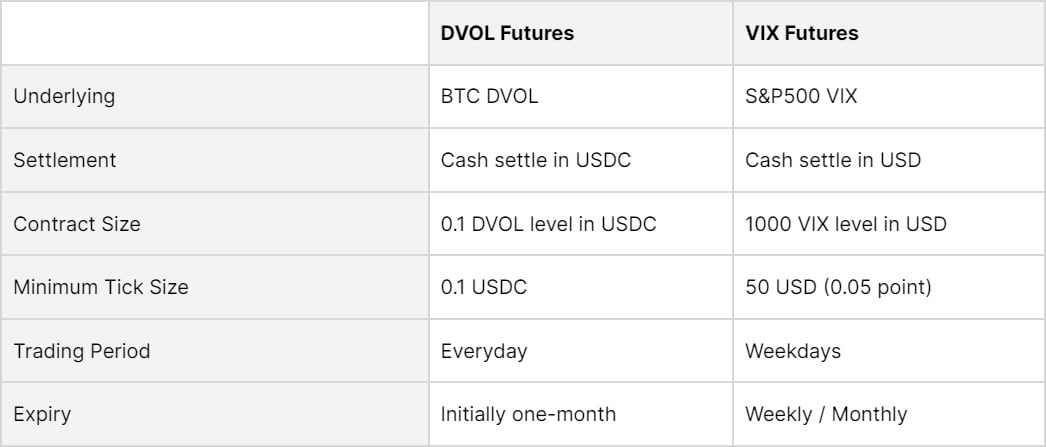

By and large, Deribit DVOL futures from crypto world and Cboe VIX futures from TradFi world are much alike. The following table summarizes the key differences between the two products.

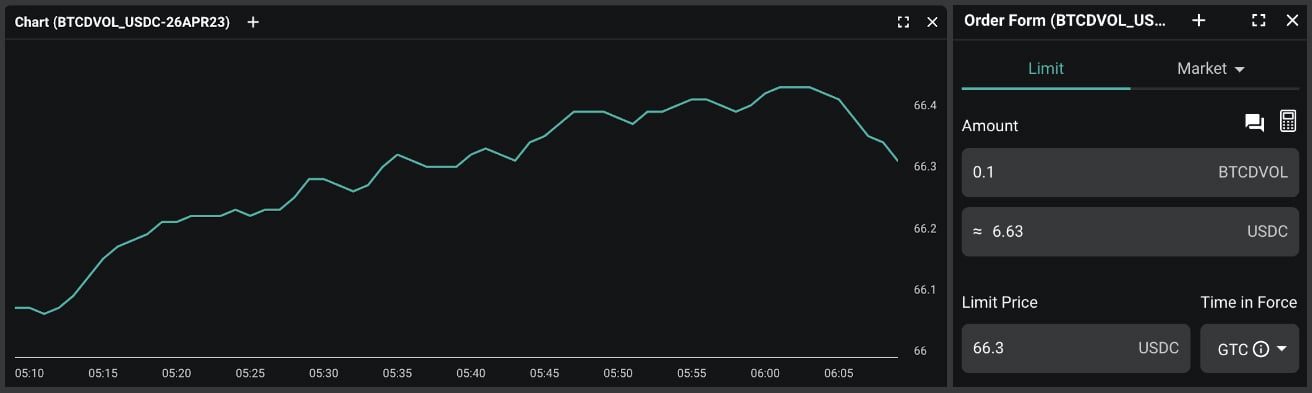

Let’s consider a specific example of 1-month BTC DVOL futures, launched on March 27, 2023, and set to expire on April 26, 2023. At present, the DVOL level is 66.3, and 0.1 of this value corresponds to a contract size of 6.63 USDC.

BTC DVOL Futures. Source: Deribit

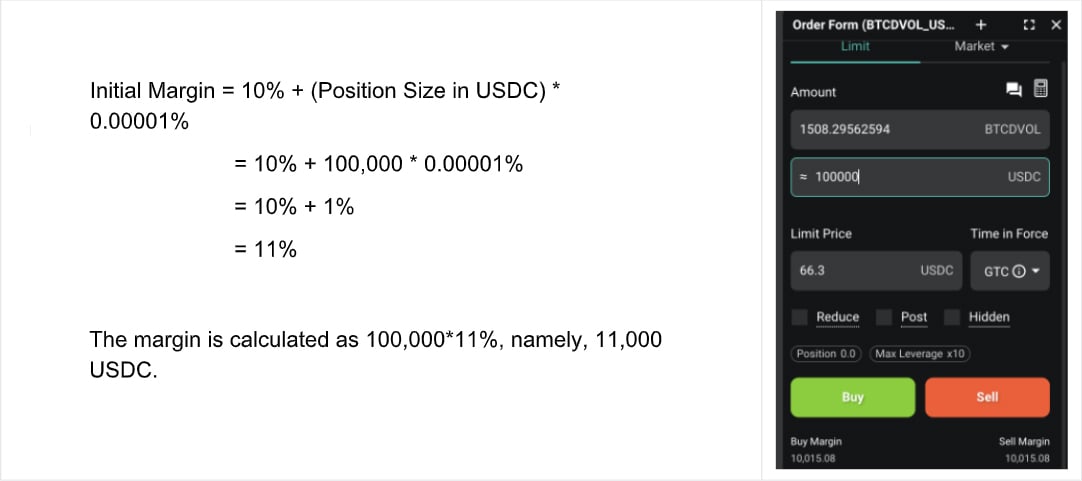

We use an example below to illustrate the Initial Margin calculation with the given formula.

BTC DVOL Futures. Source: Deribit

Use cases of DVOL Futures

Traders can utilize options strategies such as straddle and strangle to convey their opinion on volatility in the crypto market. However, a standalone option strategy does not give pure exposure to volatility. On the other hand, DVOL futures enable market participants to gain isolated exposure to market volatility, with payoffs based solely on changes in vol, and independent of underlying market direction.

On the following, we list out a few circumstances to have DVOL futures in the portfolio:

1. Speculation: This might be the main reason to trade on DVOL futures. Traders can long DVOL futures if they are bullish on realized volatility and short DVOL futures if otherwise.

2. Hedging: Traders can long DVOL futures as a hedge against potential upcoming turbulent market environment, or put another way – use it as a proxy hedge of Vega.

3. Calendar Spreads: Going forward, after DVOL futures with more expiries are created and there is a term-structure, this can open up opportunities to explore carry trades. Traders may:

a. Buy long-term DVOL futures and sell near-term DVOL futures in backwardation market.

b. Buy near-term DVOL futures and sell long-term DVOL futures in contango market.

4. Relative Value Trading: Down the line, with an introduction of ETH DVOL futures, trading on DVOL futures on different underlyings would be possible. For example, for the first time in nearly two years, ETH DVOL fell below BTC DVOL (see the negative spread – 0.22). In that case, traders may choose to long ETH DVOL futures and short BTC DVOL futures, anticipating that ETH DVOL will bounce back above BTC DVOL.

ETH/BTC DVOL Spread. Source: Amberdata

These are just a few examples of the many trading strategies that can be implemented using DVOL futures. It is important to note that trading futures involve risks and traders should thoroughly understand the risks and potential rewards before implementing any strategy.

Why use DVOL Futures for Risk Management?

If you are already trading DVOL futures, feel free to skip this section. Otherwise, we will give some technical illustrations below to explain why a trader should use DVOL futures to get pure volatility exposure.

Payoff and Risks

To fix the idea, suppose today is 27MAR23, the payoff of BTCDVOL_USDC-26APR23 contract on 26APR23 is

size * (DVOL on 27APR23 – DVOL on 26MAR23)

Here, size is positive for long futures and negative for short futures.

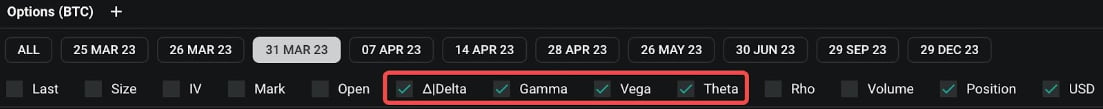

Unlike DVOL futures, vanilla option is not just about volatility. We typically break down the risks into Greeks, including Delta, Gamma, Theta, Vega, Rho and higher orders. The first four are the main focus in crypto options nowadays. In order to have Vega risk alone, without DVOL products, one will need to strip Vega risk out of vanilla options.

Four Types of Option Risks. Source: Deribit

Pure Vega without DVOL Futures

Approach 1 – Use ATM Option / Straddle + DDH:

To achieve pure Vega, the trick of dynamic Delta hedge (DDH) is utilized. However, it is quite challenging due to the fact that Delta exposure is minimized through DDH, and Theta and Gamma PnL can only balance each other out when the implied volatility (IV) is equal to realized volatility (RV). As demonstrated below, this is hardly the case in the current market.

BTC IV and RV were divergent in the past week. Source: SignalPlus

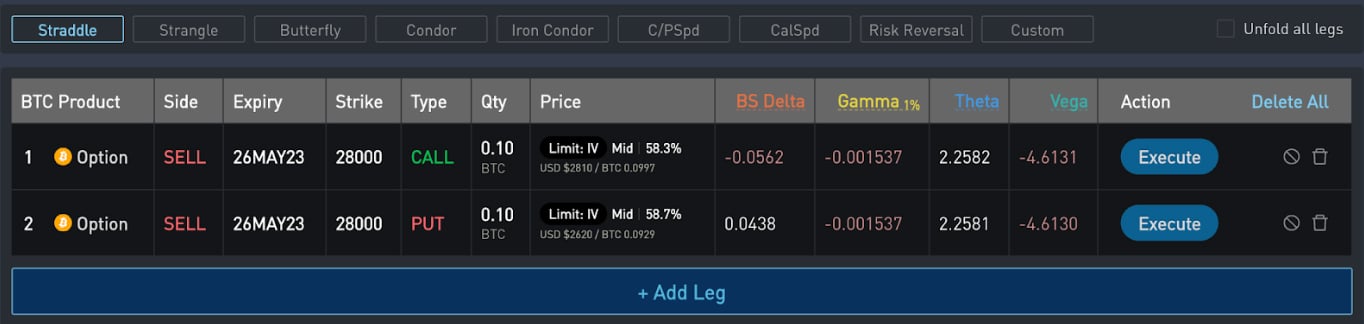

Moreover, we can use straddle which consists of an equal number of long ATM calls and put options. The Delta of ATM calls and puts can counterbalance each other, which helps to save some of the DDH cost–do note, DDH is still needed when the market fluctuates.

Risk analysis of Trading Straddles. Source: SignalPlus

In addition to DDH, both single option and straddle must be dynamically rolled to maintain their ATM status due to the existence of volatility smile. Since the DVOL index is heavily weighted on ATM volatilities, ATM options are optimal choices for replicating DVOL futures. However, when ATM options become ITM or OTM, the replicating result will be deviated.

Approach 2 – Use OTM Options:

The cost of hedging a financial instrument is typically equivalent to its value. The value of DVOL futures depends on a volatility quantity, rather than a variance quantity. As a result, there are two steps to hedge the volatility quantity:

1. Hedging the variance.

2. Adding a model-dependent convexity adjustment which is related to volatility of volatility.

To hedge variance, a construction methodology outlined in an article can be used. The article suggests replicating variance using OTM options that are weighted by the inverse of the strike-squared, multiplied by the interval of strikes.

But again, Approach 2 will face the same dilemma when underlying asset price changes, all the risk profile changes.

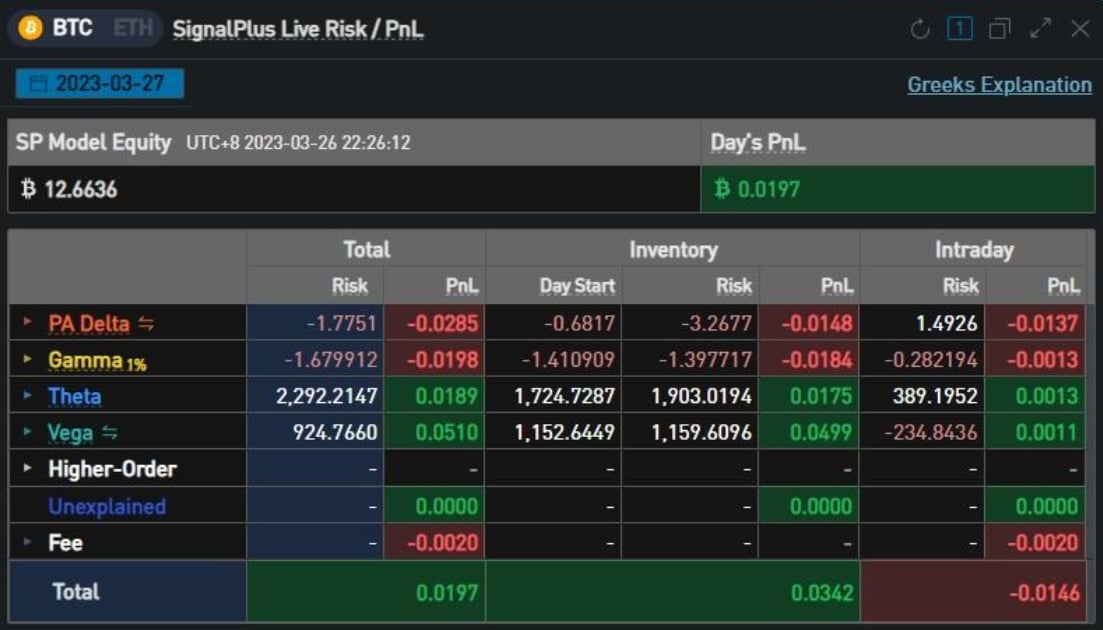

As we can see, either way of doing it, exposure to Delta, Gamma and Theta cannot be entirely eliminated. Gaining pure Vega exposure using only vanilla options can be a labor- intensive process, despite that we can monitor the desired level of exposure to various risks (refer to the screen below) with minimal Delta, Gamma, and Theta and a specific amount of Vega.

Risk Profile and PnL Analysis. Source: SignalPlus

In sum, the DVOL futures can only be replicated approximately, but it is still an exceptional instrument that has purely Vega risks by design. This makes DVOL futures an attractive instrument for traders who want to isolate and manage their exposure to Vega risk. But at the same time, since it is so complicated to replicate DVOL Futures through vanilla options, it is also sensible to manage the total exposure, especially when market liquidity is thin.

In Closing

DVOL futures represent an exciting new opportunity for traders to manage their positions and risks, benefit from market volatility, generate alpha, and diversify their portfolios. The launch of BTC DVOL futures on Deribit on March 27, 2023 marks a significant milestone for the crypto options market. We expect to see significant user interest in this product, and anticipate that follow-up instruments such as DVOL swaps and options will soon follow as the next logical evolution. Ultimately, users and traders will enjoy most of the benefits, as they can now better express their views on crypto volatility movements in a simpler and more precise fashion, further helping to foster crypto volatility as a tradable asset class in- line with what we see in TradFi markets.

AUTHOR(S)